This version of the form is not currently in use and is provided for reference only. Download this version of

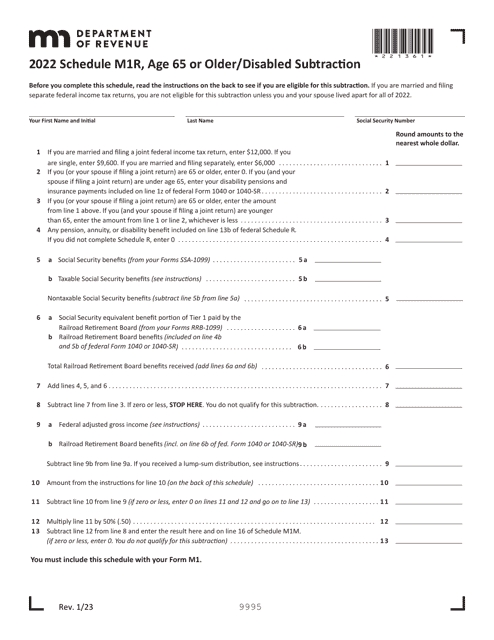

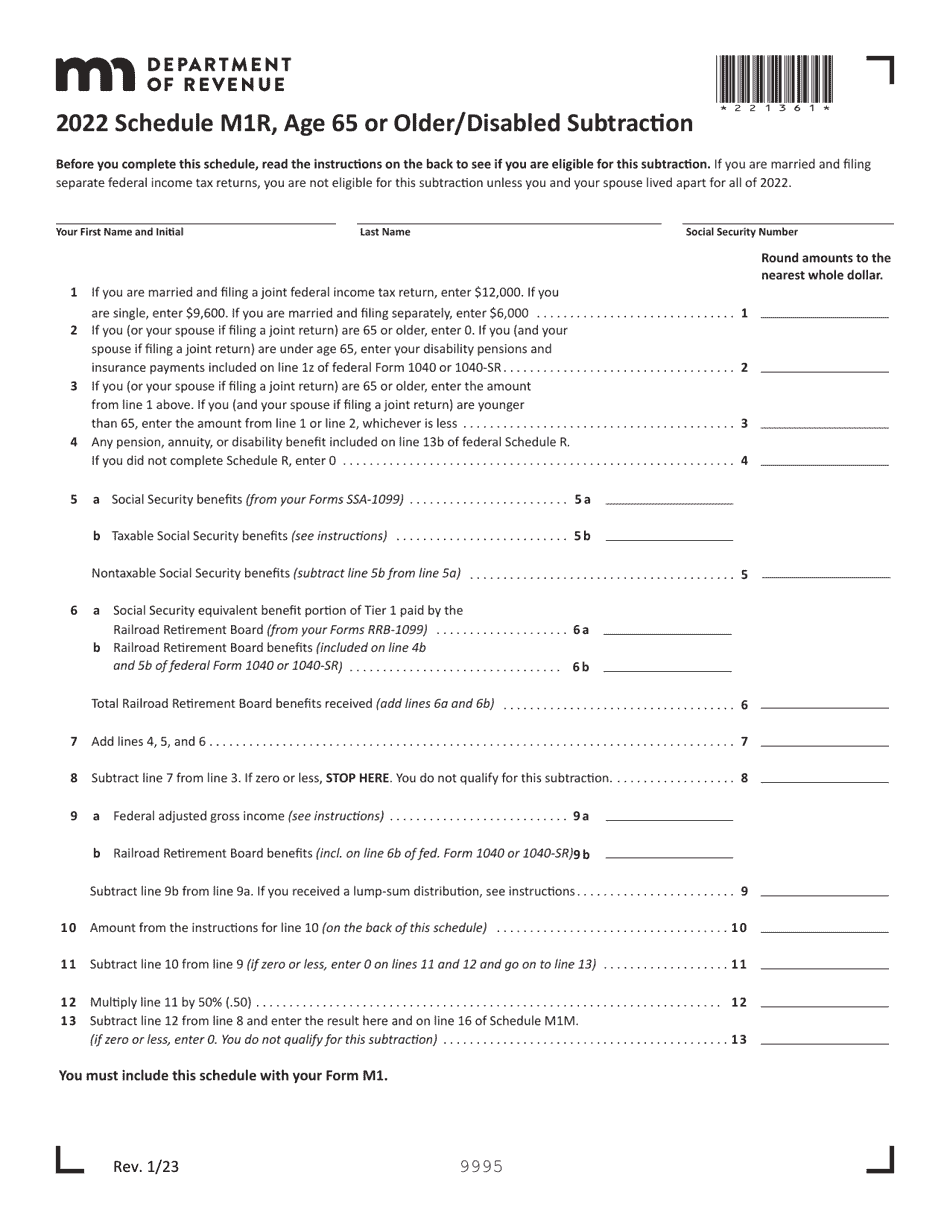

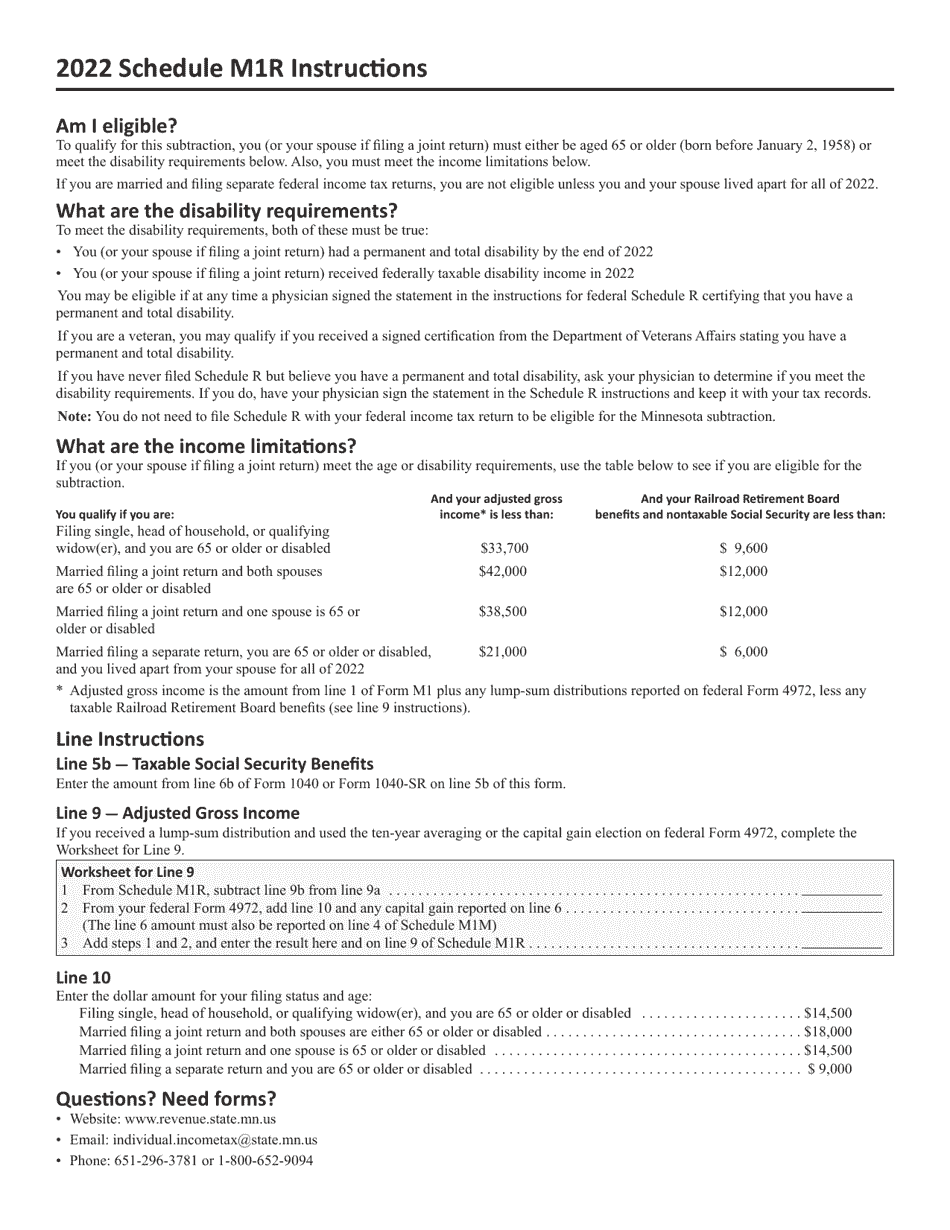

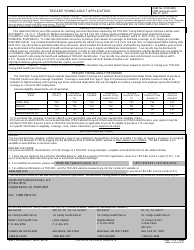

Schedule M1R

for the current year.

Schedule M1R Age 65 or Older / Disabled Subtraction - Minnesota

What Is Schedule M1R?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

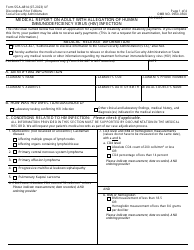

Q: What is Schedule M1R?

A: Schedule M1R is a tax form in Minnesota.

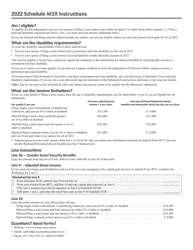

Q: Who is eligible for the Age 65 or Older/Disabled Subtraction?

A: Individuals who are 65 years or older or disabled may be eligible for this subtraction.

Q: What is the purpose of the Age 65 or Older/Disabled Subtraction?

A: The subtraction is used to reduce taxable income for individuals who meet the age or disability requirements.

Q: How do I claim the Age 65 or Older/Disabled Subtraction?

A: You need to complete Schedule M1R and include it with your Minnesota tax return.

Q: Are there any income limits to qualify for the subtraction?

A: Yes, there are income limits based on your filing status. You should refer to the instructions on Schedule M1R for the specific limits.

Q: Can I claim other deductions or credits in addition to the Age 65 or Older/Disabled Subtraction?

A: Yes, you may be eligible for other deductions or credits. You should review the instructions for Schedule M1R and consult a tax professional for guidance.

Q: Do I need to provide documentation to support my eligibility for the Age 65 or Older/Disabled Subtraction?

A: You should retain any documentation that supports your eligibility for the subtraction, but you are not required to submit it with your tax return. However, the Minnesota Department of Revenue may request documentation for verification purposes.

Q: What if I have questions or need assistance with Schedule M1R?

A: You can contact the Minnesota Department of Revenue or seek assistance from a qualified tax professional to help you with any questions or concerns regarding Schedule M1R.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M1R by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.