This version of the form is not currently in use and is provided for reference only. Download this version of

Form M2X

for the current year.

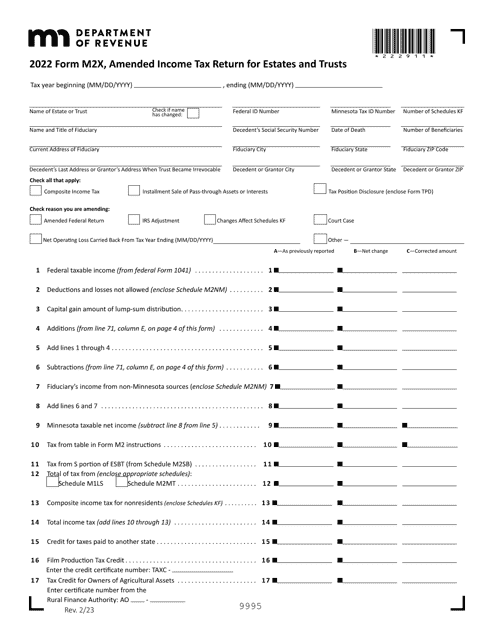

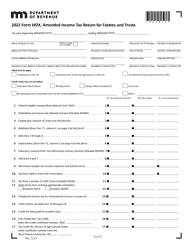

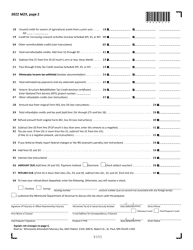

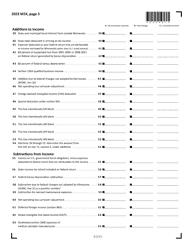

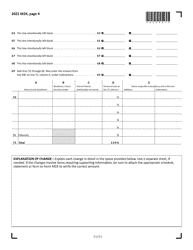

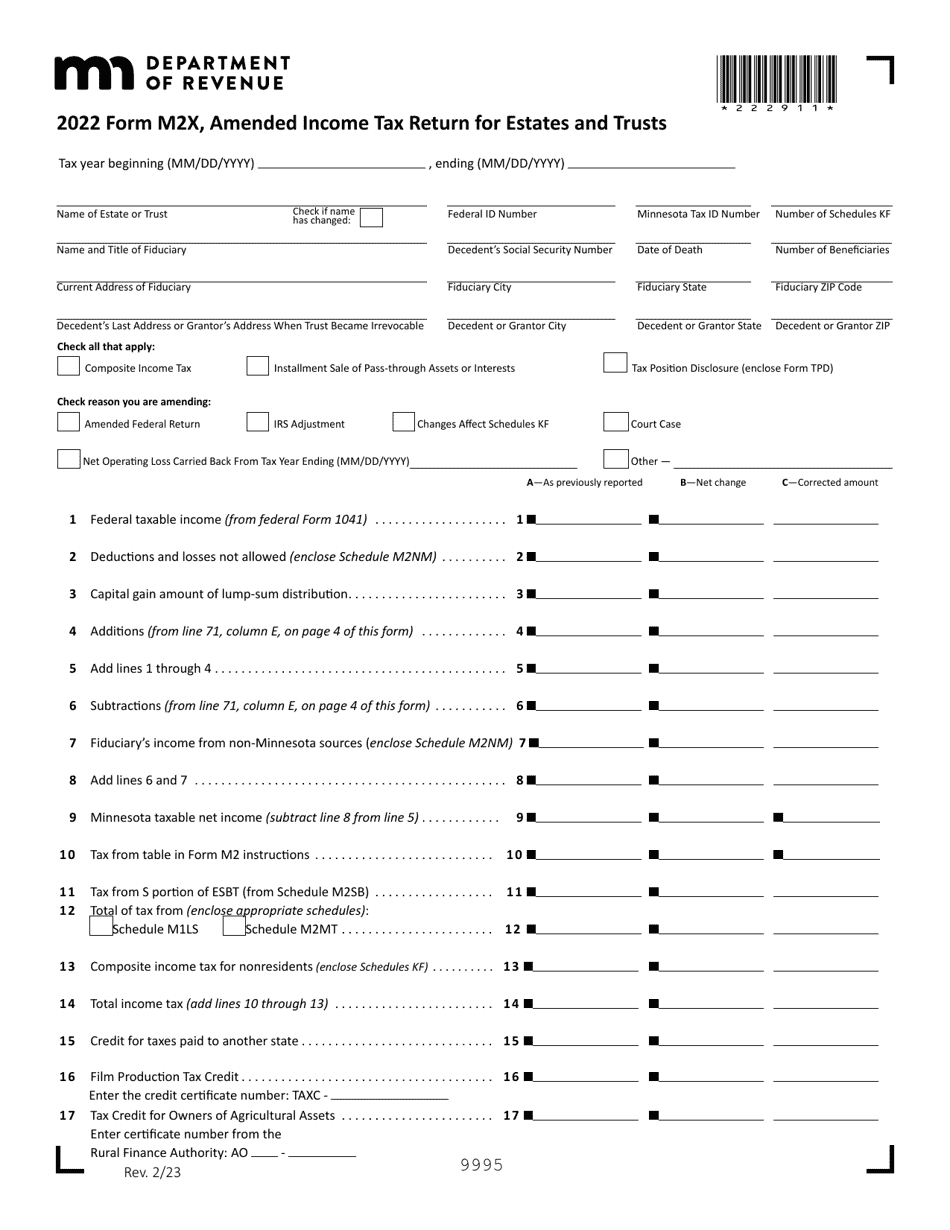

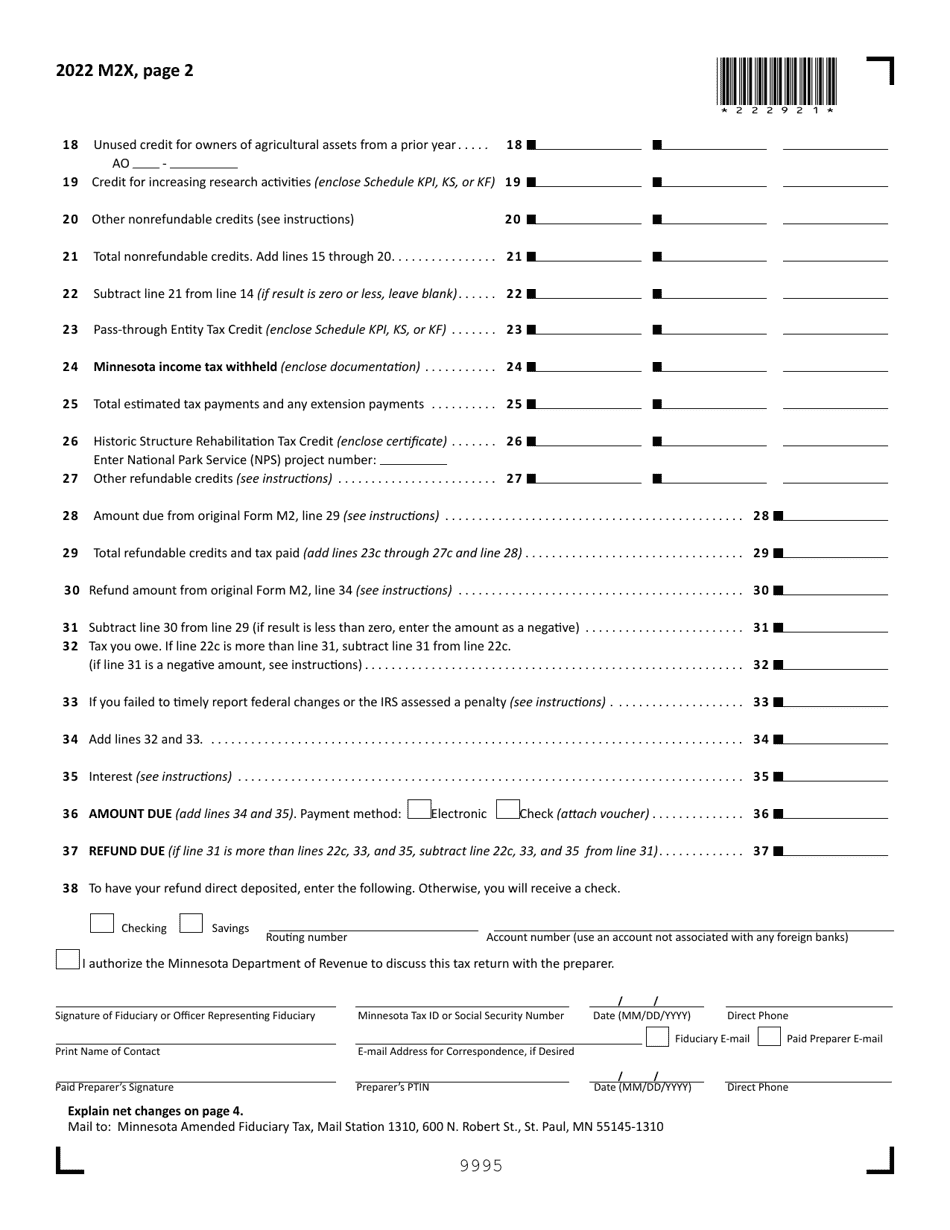

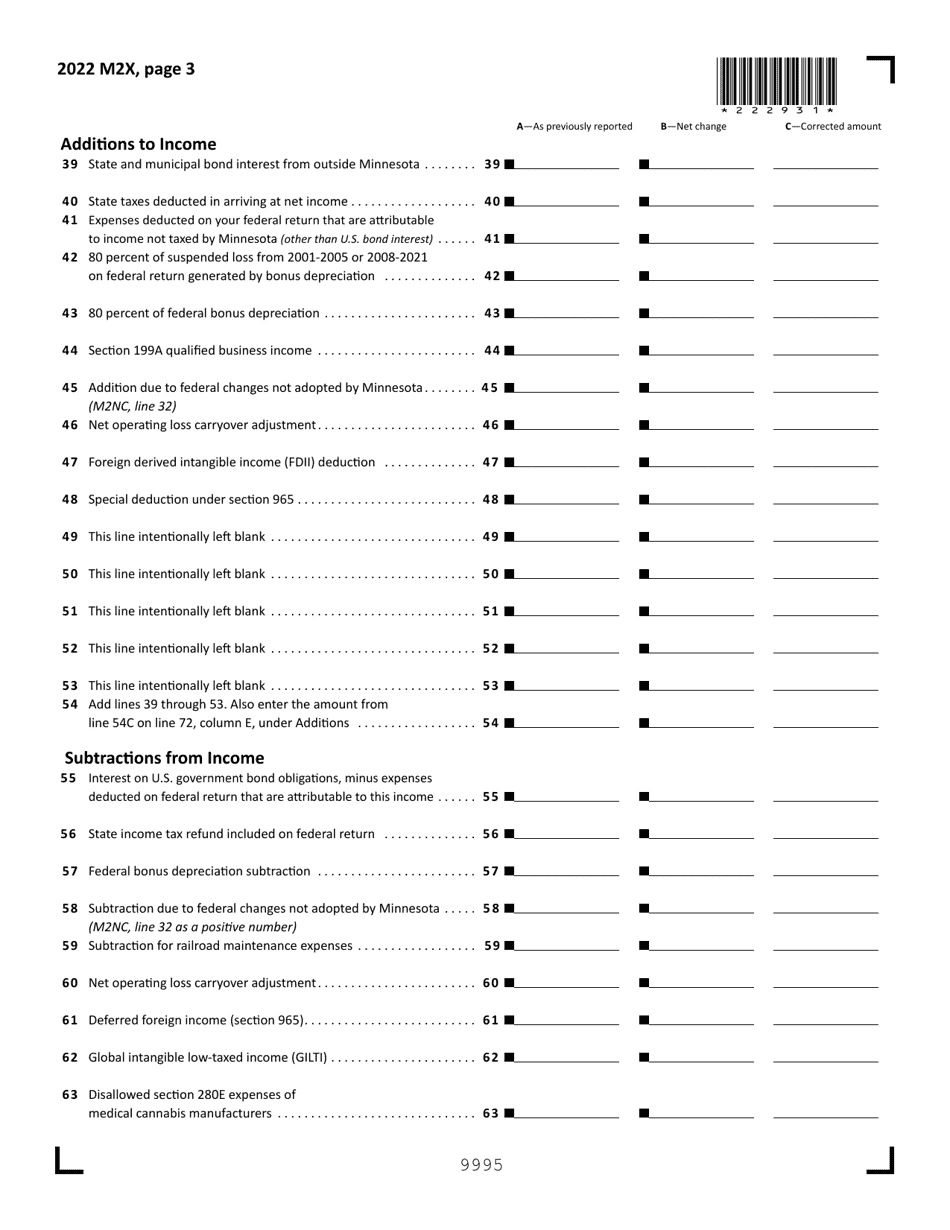

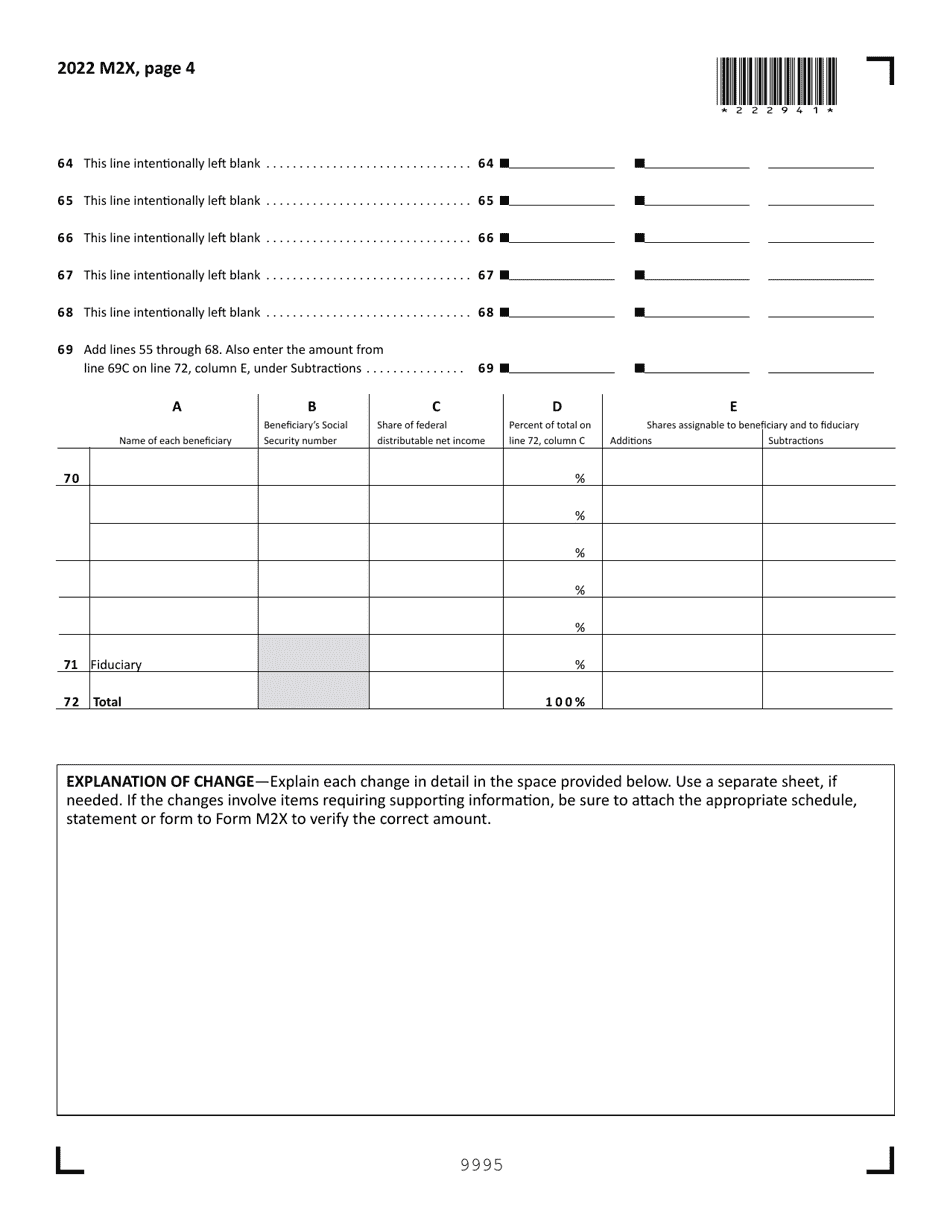

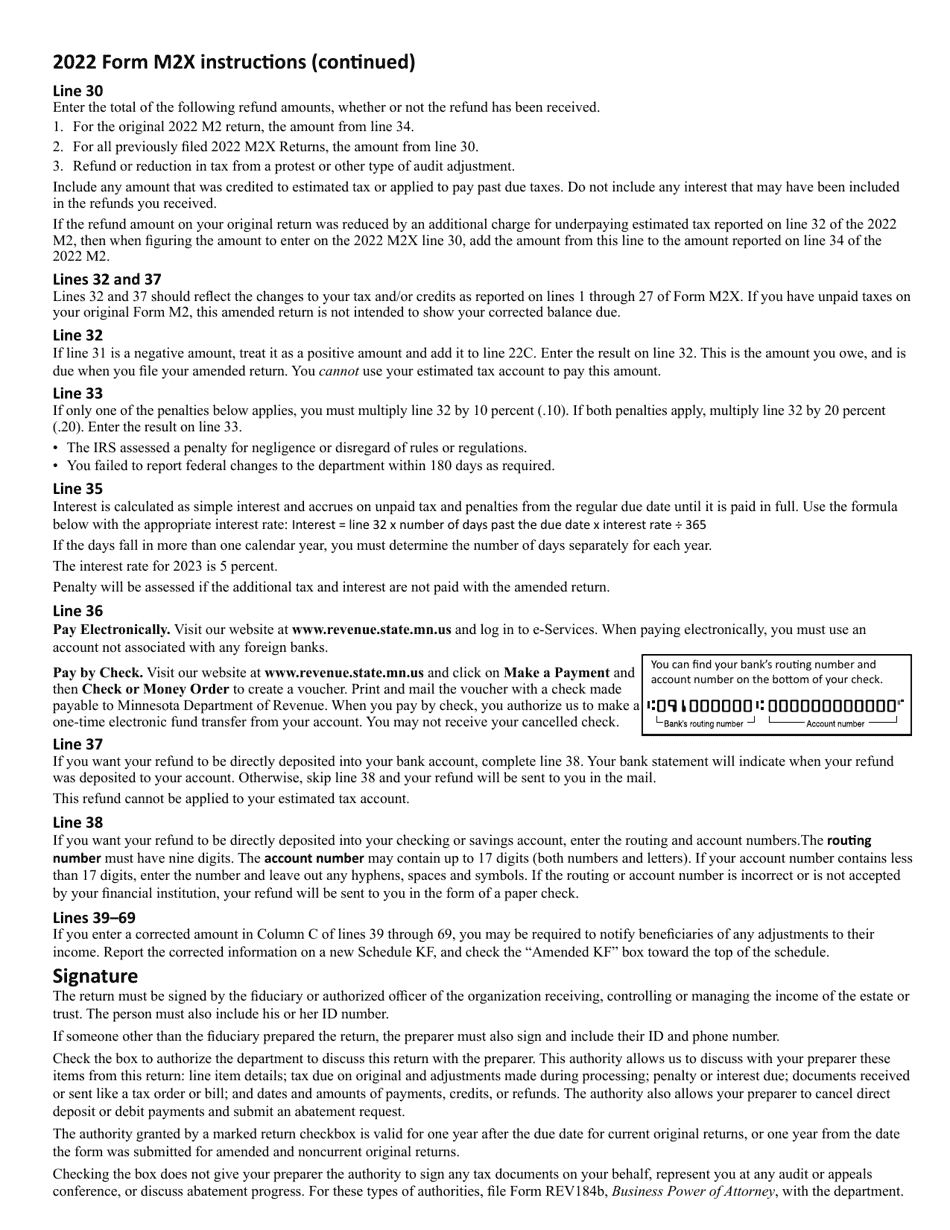

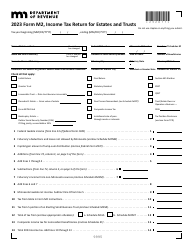

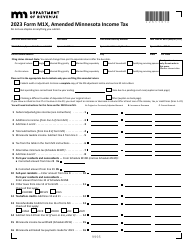

Form M2X Amended Income Tax Return for Estates and Trusts - Minnesota

What Is Form M2X?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M2X?

A: Form M2X is the Amended Income Tax Return for Estates and Trusts in Minnesota.

Q: Who should file Form M2X?

A: Estates and trusts in Minnesota that need to make changes or corrections to their previously filed income tax return should file Form M2X.

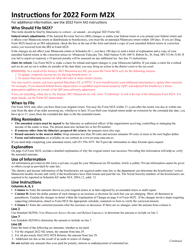

Q: When should Form M2X be filed?

A: Form M2X should be filed within the time allowed for filing an original return, which is generally within 6 months after the due date of the return.

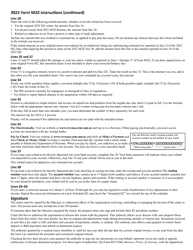

Q: What information is required when filing Form M2X?

A: When filing Form M2X, you'll need to provide information such as the taxpayer identification number, tax year, and details of the changes or corrections being made.

Q: Are there any fees associated with filing Form M2X?

A: No, there are no fees associated with filing Form M2X.

Q: Can Form M2X be filed electronically?

A: No, Form M2X cannot be filed electronically. It must be filed by mail.

Q: What should I do if I made a mistake on my previously filed income tax return?

A: If you made a mistake on your previously filed income tax return, you should file Form M2X to make the necessary changes or corrections.

Q: Is there a deadline for filing Form M2X?

A: Yes, Form M2X should be filed within the time allowed for filing an original return, which is generally within 6 months after the due date of the return.

Q: What if I need help with filing Form M2X?

A: If you need help with filing Form M2X, you can contact the Minnesota Department of Revenue for assistance.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M2X by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.