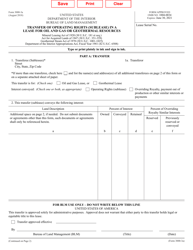

This version of the form is not currently in use and is provided for reference only. Download this version of

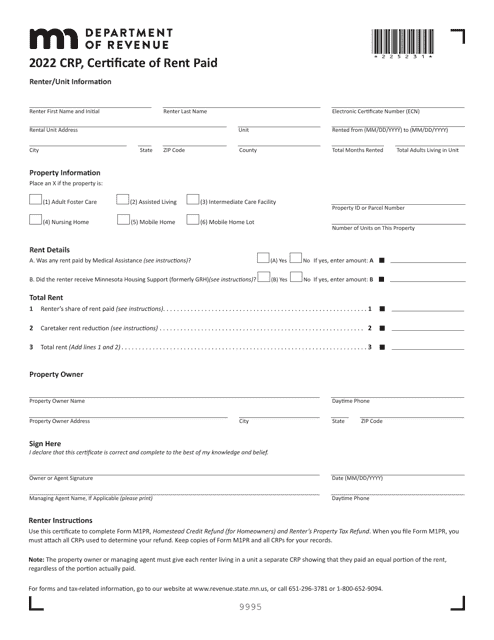

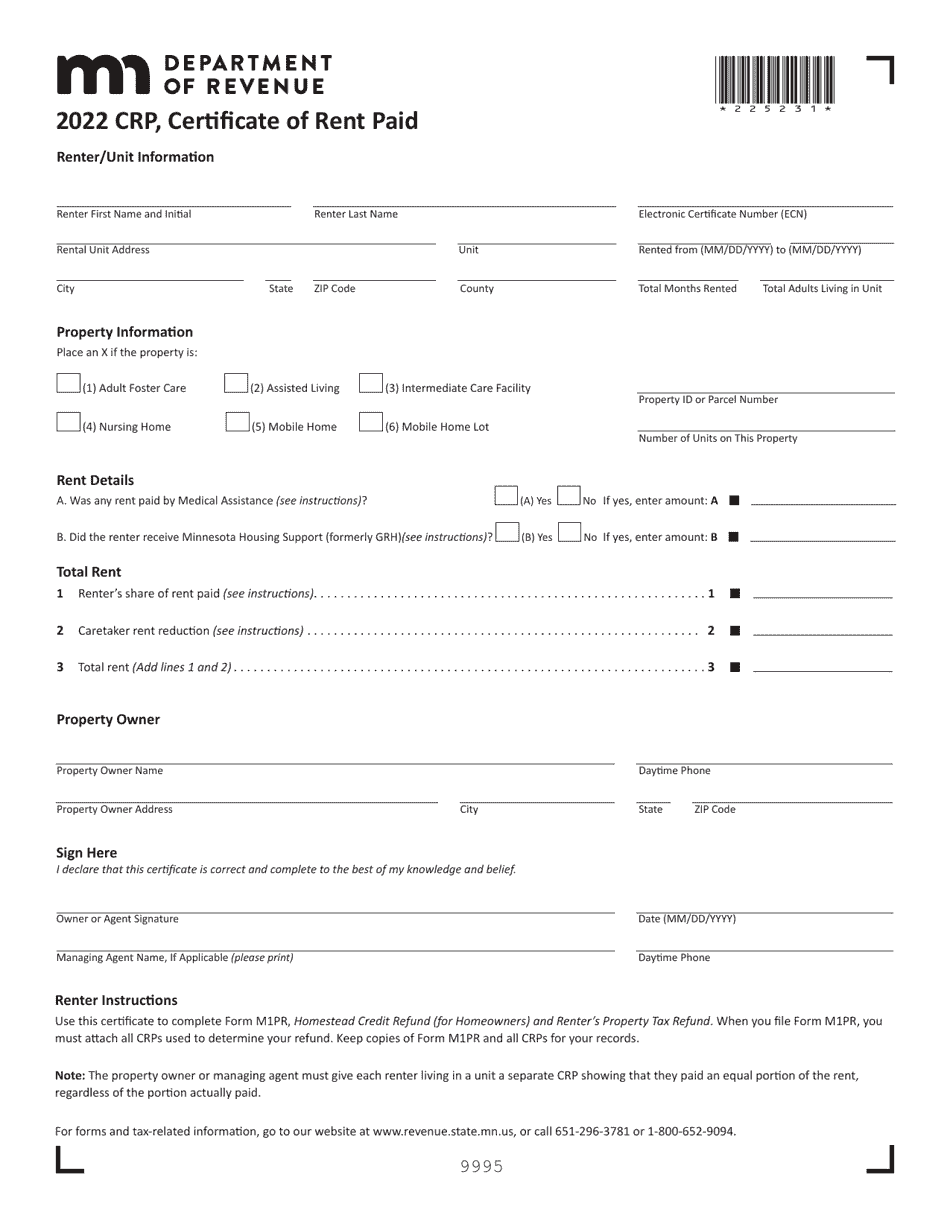

Form CRP

for the current year.

Form CRP Certificate of Rent Paid - Minnesota

What Is Form CRP?

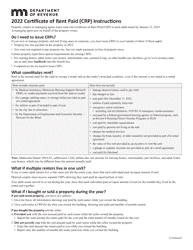

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a CRP?

A: A CRP is a Certificate of Rent Paid.

Q: What is the purpose of a CRP?

A: The purpose of a CRP is to report the amount of rent you paid for Minnesota property in a specific year.

Q: Who needs to file a CRP?

A: Landlords are required to file a CRP for each tenant who paid them rent during the year.

Q: Do I need a CRP if I'm a tenant?

A: No, as a tenant, you do not need to file a CRP. Your landlord is responsible for providing it to you.

Q: What information does a CRP include?

A: A CRP includes your name, address, the property address, the total amount of rent paid during the year, and the landlord's contact information.

Q: When should I receive my CRP?

A: Landlords are required to provide CRPs to tenants by January 31st of the year following the year they received rent payments.

Q: What should I do with my CRP?

A: Keep your CRP for your records and provide it to your tax preparer when filing your state income taxes.

Q: Is the CRP used for federal tax purposes?

A: No, the CRP is only used for Minnesota state income tax purposes.

Q: Are there any penalties for not filing a CRP?

A: Yes, landlords who fail to provide CRPs to tenants may be subject to penalties.

Q: Can I request a duplicate CRP if I lost mine?

A: Yes, you can request a duplicate CRP from your landlord if you have lost yours.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CRP by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.