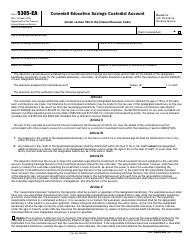

This version of the form is not currently in use and is provided for reference only. Download this version of

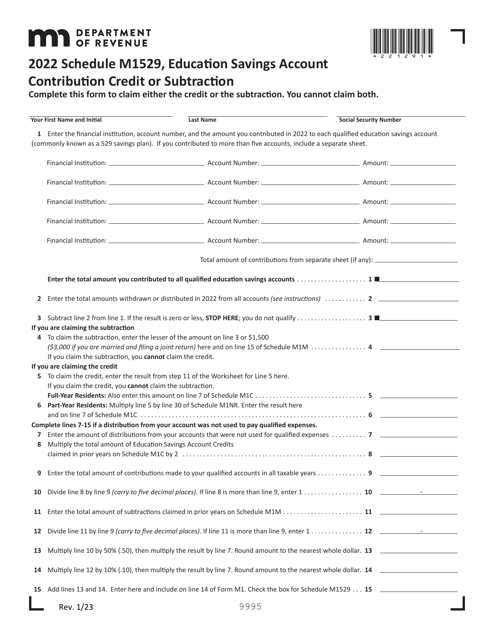

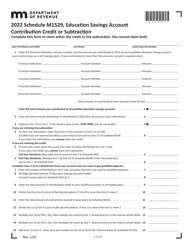

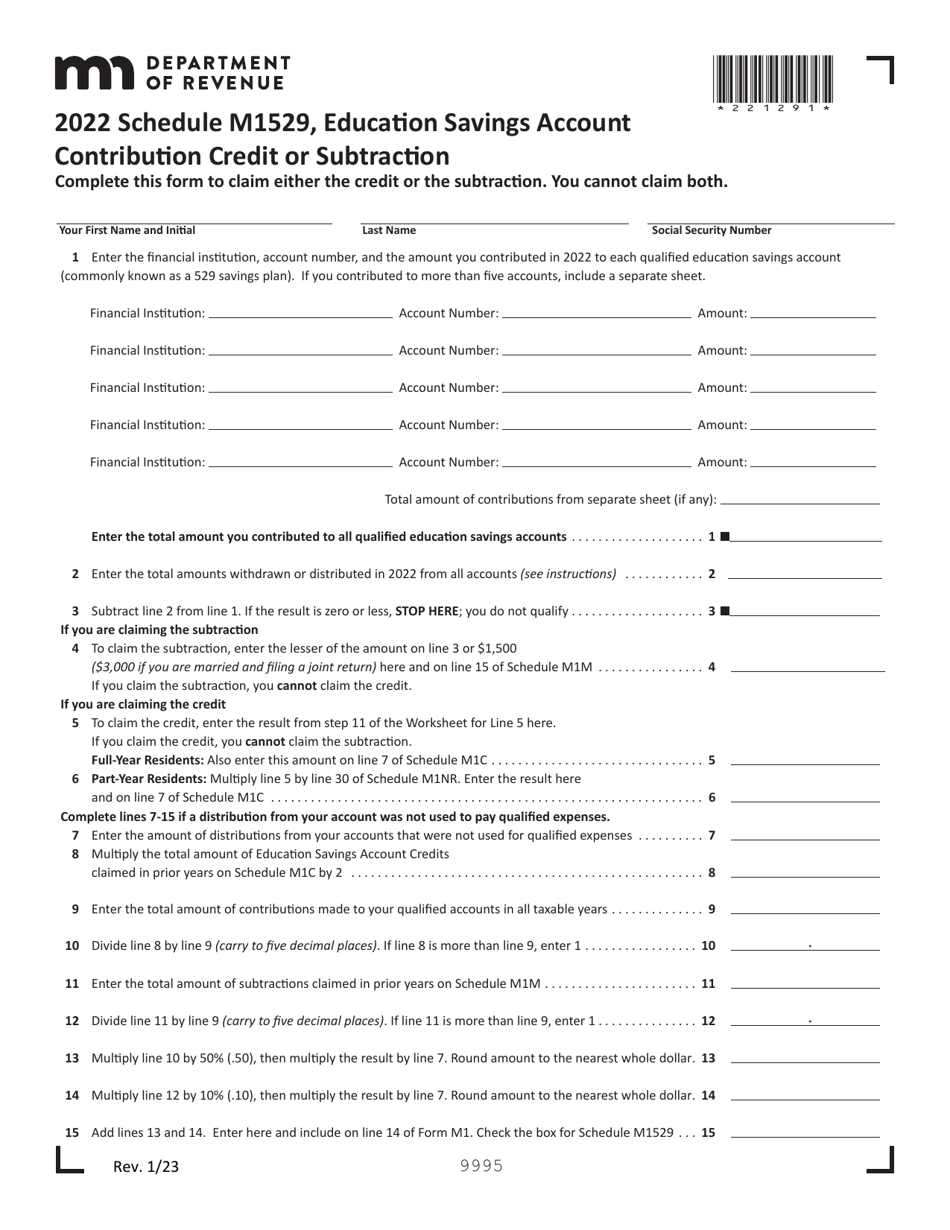

Schedule M1529

for the current year.

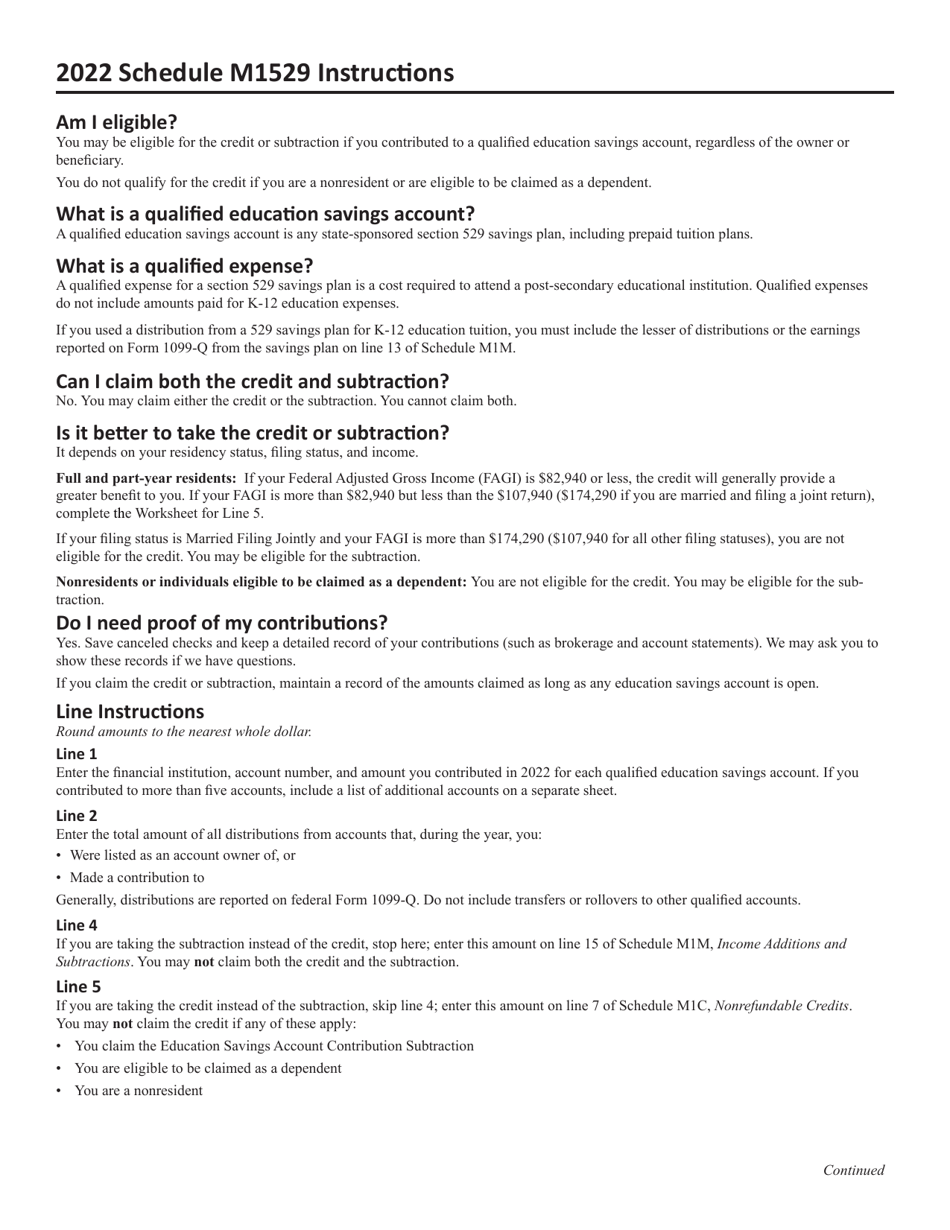

Schedule M1529 Education Savings Account Contribution Credit or Subtraction - Minnesota

What Is Schedule M1529?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M1529?

A: Schedule M1529 is a form used to claim the Education Savings Account Contribution Credit or Subtraction in the state of Minnesota.

Q: What is the Education Savings Account Contribution Credit?

A: The Education Savings Account Contribution Credit is a tax credit that allows Minnesota residents to claim a credit for contributions made to an education savings account.

Q: What is the Education Savings Account Contribution Subtraction?

A: The Education Savings Account Contribution Subtraction is a tax deduction that allows Minnesota residents to subtract contributions made to an education savings account from their taxable income.

Q: Who is eligible to claim the Education Savings Account Contribution Credit or Subtraction?

A: Minnesota residents who made contributions to an education savings account are eligible to claim the credit or subtraction, subject to certain income limits and other requirements.

Q: What is the purpose of the Education Savings Account Contribution Credit or Subtraction?

A: The purpose of the credit or subtraction is to provide tax benefits to Minnesota residents who are saving for higher education expenses for themselves or their dependents.

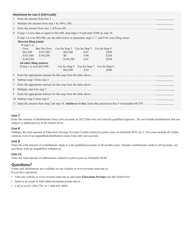

Q: How do I claim the Education Savings Account Contribution Credit or Subtraction?

A: To claim the credit or subtraction, you need to complete Schedule M1529 and include it with your Minnesota state tax return. Make sure to follow the instructions provided on the form.

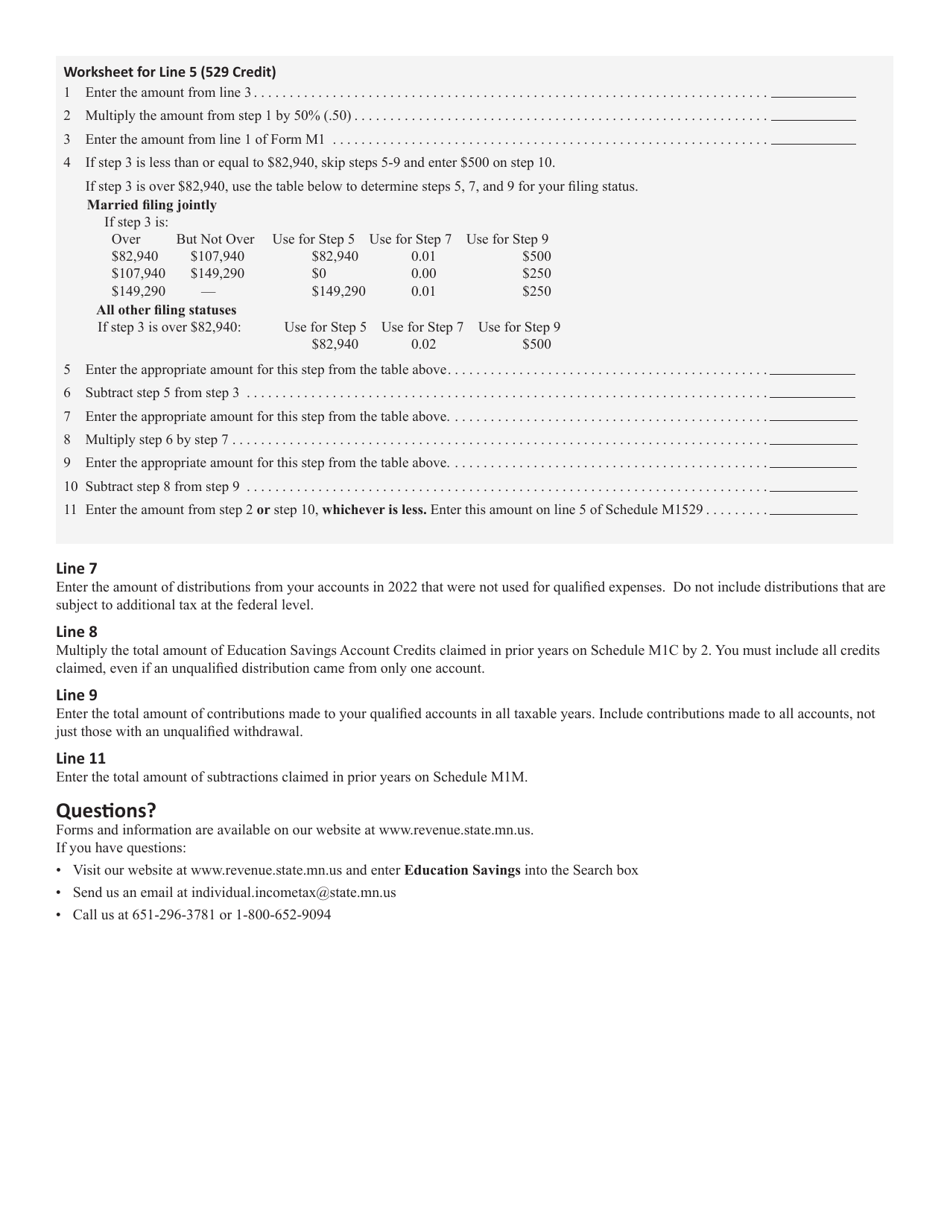

Q: Are there any limits to the Education Savings Account Contribution Credit or Subtraction?

A: Yes, there are income limits and contribution limits that apply to the credit or subtraction. These limits are specified on Schedule M1529.

Q: Are there any other education-related tax benefits in Minnesota?

A: Yes, in addition to the Education Savings Account Contribution Credit or Subtraction, Minnesota residents may be eligible for other education-related tax benefits such as the K-12 Education Subtraction or Credit, the College Savings Plan Credit, or the Student Loan Credit. Consult the Minnesota Department of Revenue for more information.

Q: Is the Education Savings Account Contribution Credit or Subtraction available in other states?

A: The specific credit or deduction for education savings account contributions varies by state. Other states may have similar or different provisions. Consult the tax laws of your state for more information.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M1529 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.