This version of the form is not currently in use and is provided for reference only. Download this version of

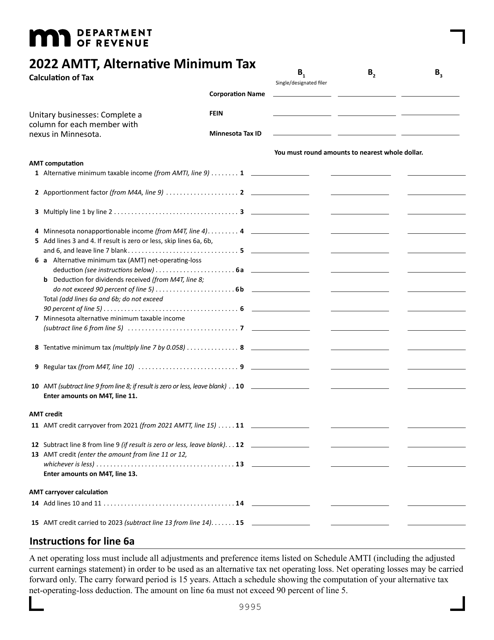

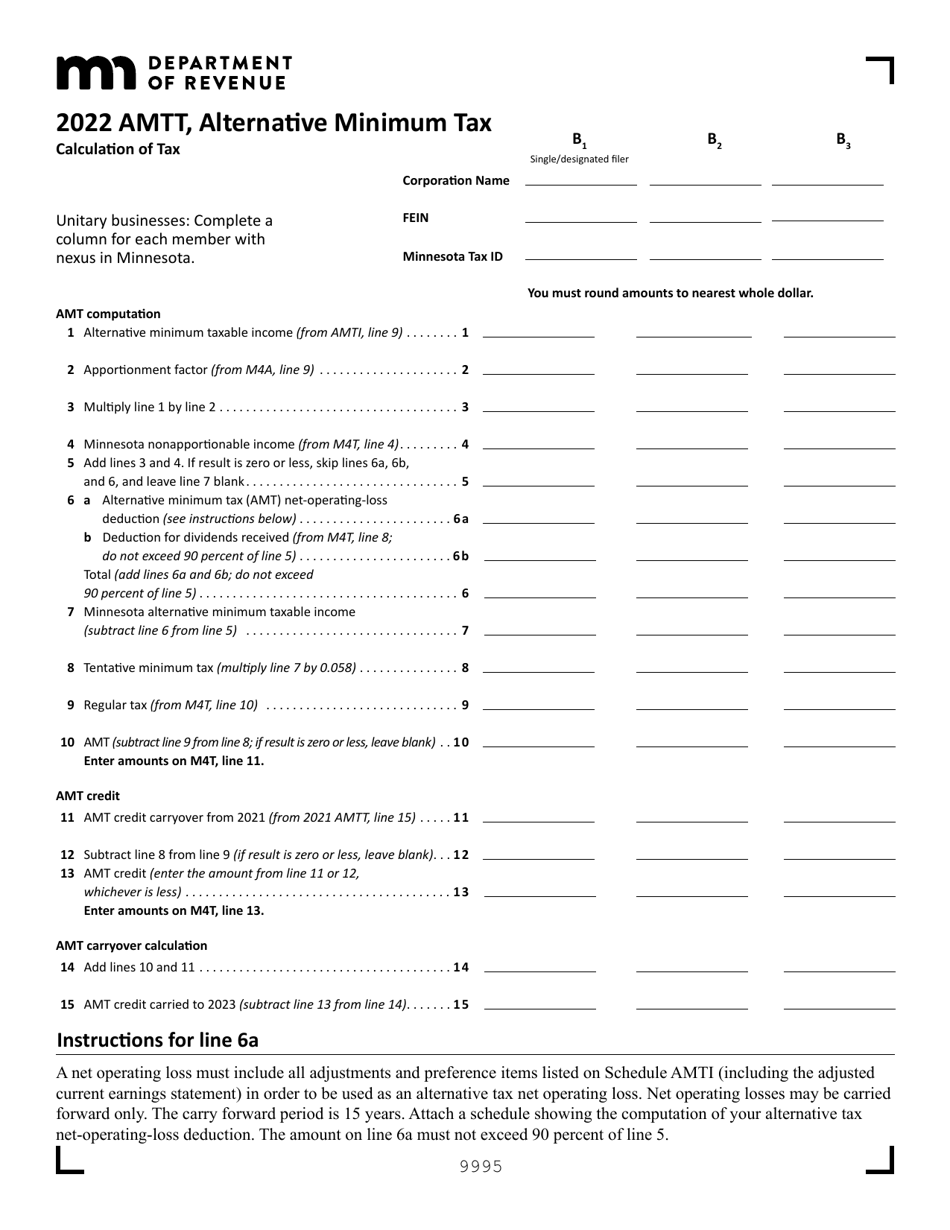

Form AMTT

for the current year.

Form AMTT Alternative Minimum Tax - Minnesota

What Is Form AMTT?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AMTT?

A: AMTT stands for Alternative Minimum Tax.

Q: Who does the AMTT apply to?

A: The AMTT applies to individuals and corporations in Minnesota.

Q: What is the purpose of the AMTT?

A: The purpose of the AMTT is to ensure that individuals and corporations with high incomes or certain tax benefits pay a minimum amount of tax.

Q: How is the AMTT calculated?

A: The calculation of the AMTT involves adding back certain tax preferences and exemptions to the taxpayer's income.

Q: What are some common items added back for AMTT calculation?

A: Common items added back for AMTT calculation include certain deductions and exclusions, such as the deduction for state and local taxes.

Q: Is the AMTT the same as the federal Alternative Minimum Tax?

A: No, the AMTT is specific to Minnesota and may have different rules and thresholds than the federal AMT.

Q: Do I need to file a separate form for the AMTT?

A: Yes, you need to file Form AMTT to calculate your Minnesota Alternative Minimum Tax.

Q: Is the AMTT refundable?

A: No, the AMTT is not refundable. Any excess AMTT paid can be carried forward to future tax years.

Q: Are there any exemptions or credits available for the AMTT?

A: Yes, there are certain exemptions and credits available to reduce the AMTT liability, such as the small business exemption and the research credit.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AMTT by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.