This version of the form is not currently in use and is provided for reference only. Download this version of

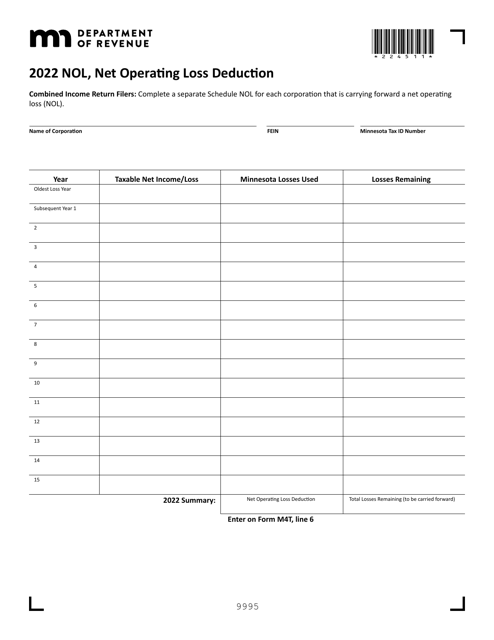

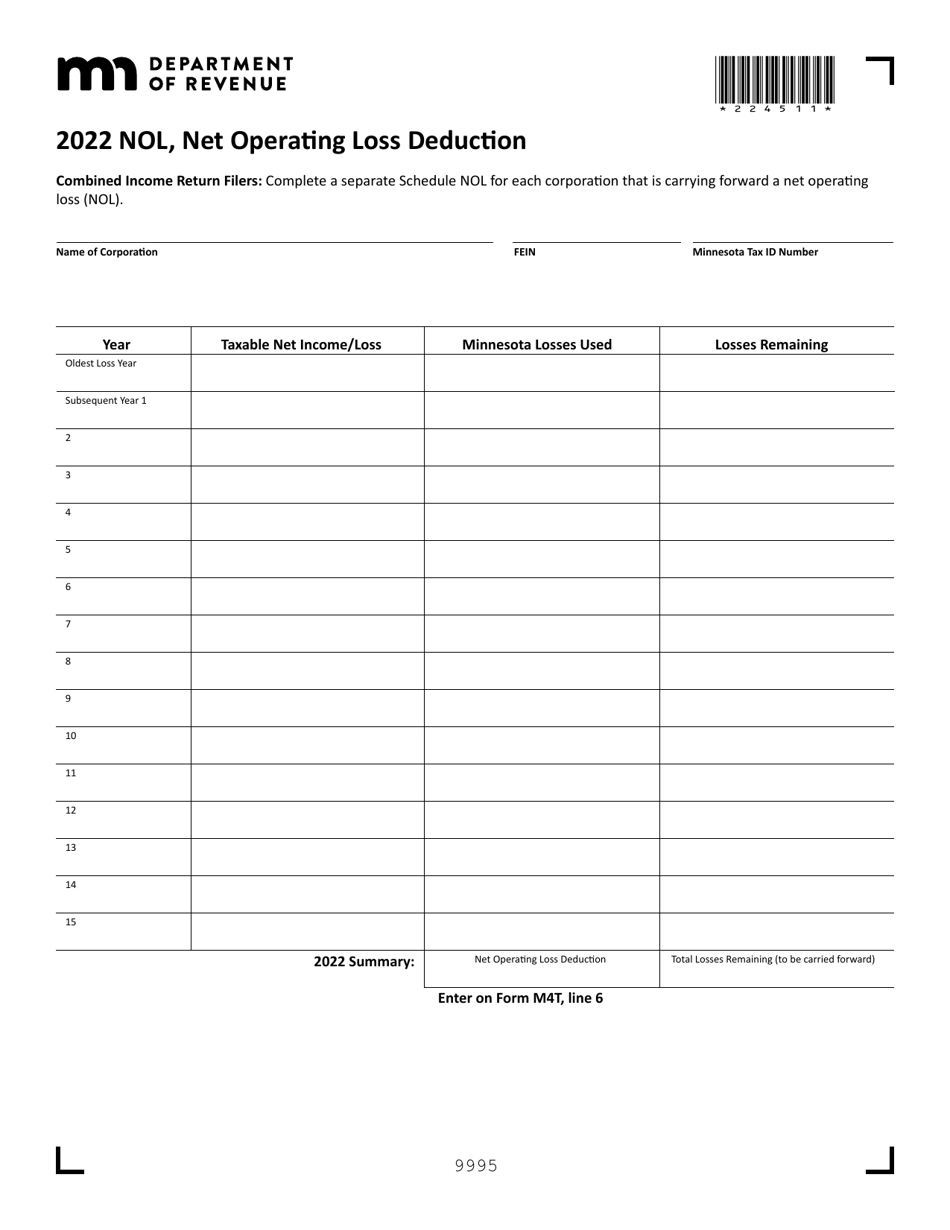

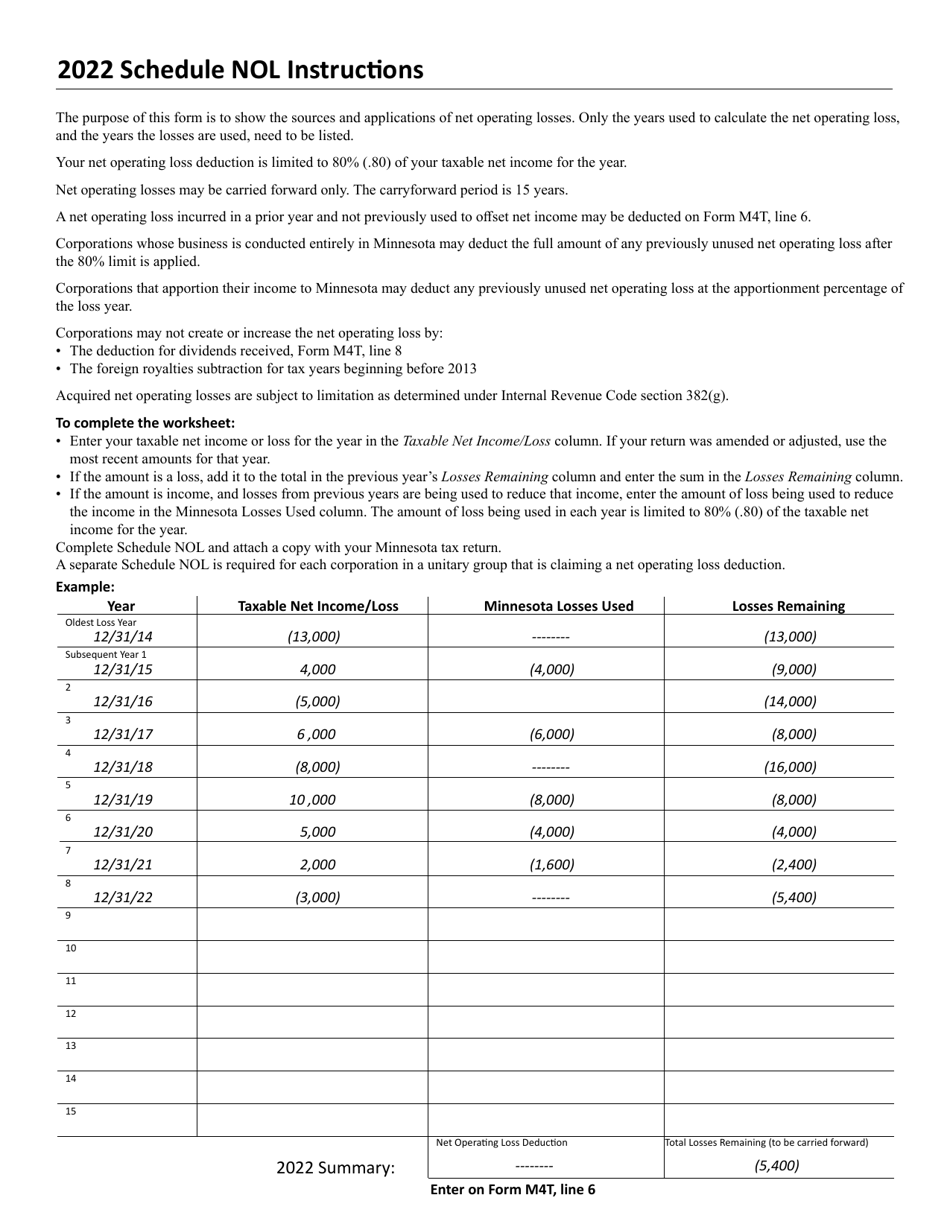

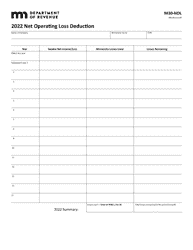

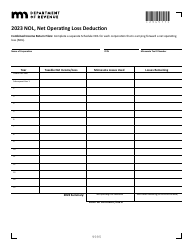

Form NOL

for the current year.

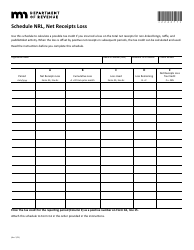

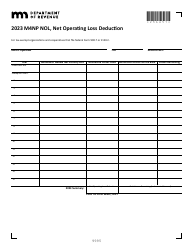

Form NOL Net Operating Loss Deduction - Minnesota

What Is Form NOL?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NOL?

A: Form NOL is a tax form used in Minnesota to claim a Net Operating Loss Deduction.

Q: What is a Net Operating Loss Deduction?

A: A Net Operating Loss Deduction is a deduction that allows businesses to offset their income by deducting losses from previous years.

Q: Who can file Form NOL?

A: Businesses in Minnesota that have incurred a net operating loss can file Form NOL.

Q: What is the purpose of filing Form NOL?

A: The purpose of filing Form NOL is to carry forward or carry back the net operating loss and apply it to future or previous tax years.

Q: Are there any eligibility requirements to claim the Net Operating Loss Deduction?

A: Yes, there are certain eligibility requirements that must be met to claim the Net Operating Loss Deduction. It is recommended to consult the instructions and guidelines provided by the Minnesota Department of Revenue for more details.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NOL by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.