This version of the form is not currently in use and is provided for reference only. Download this version of

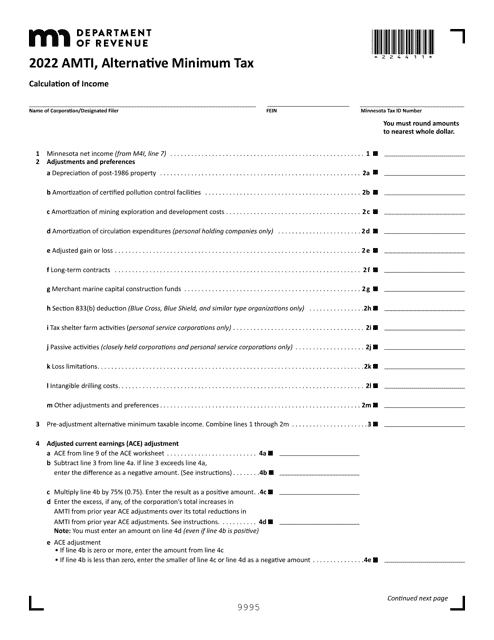

Form AMTI

for the current year.

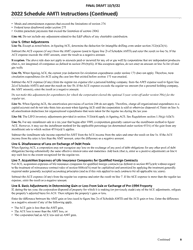

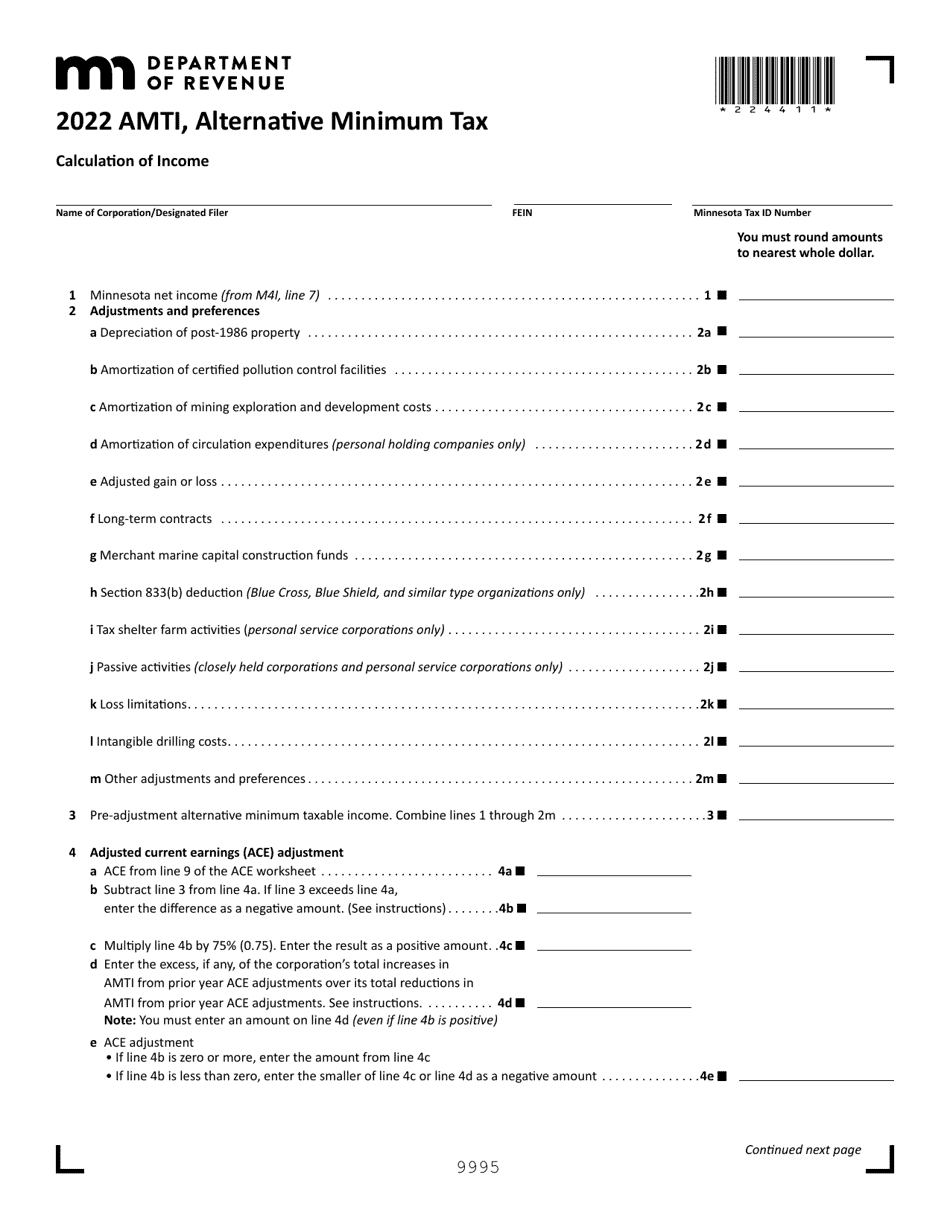

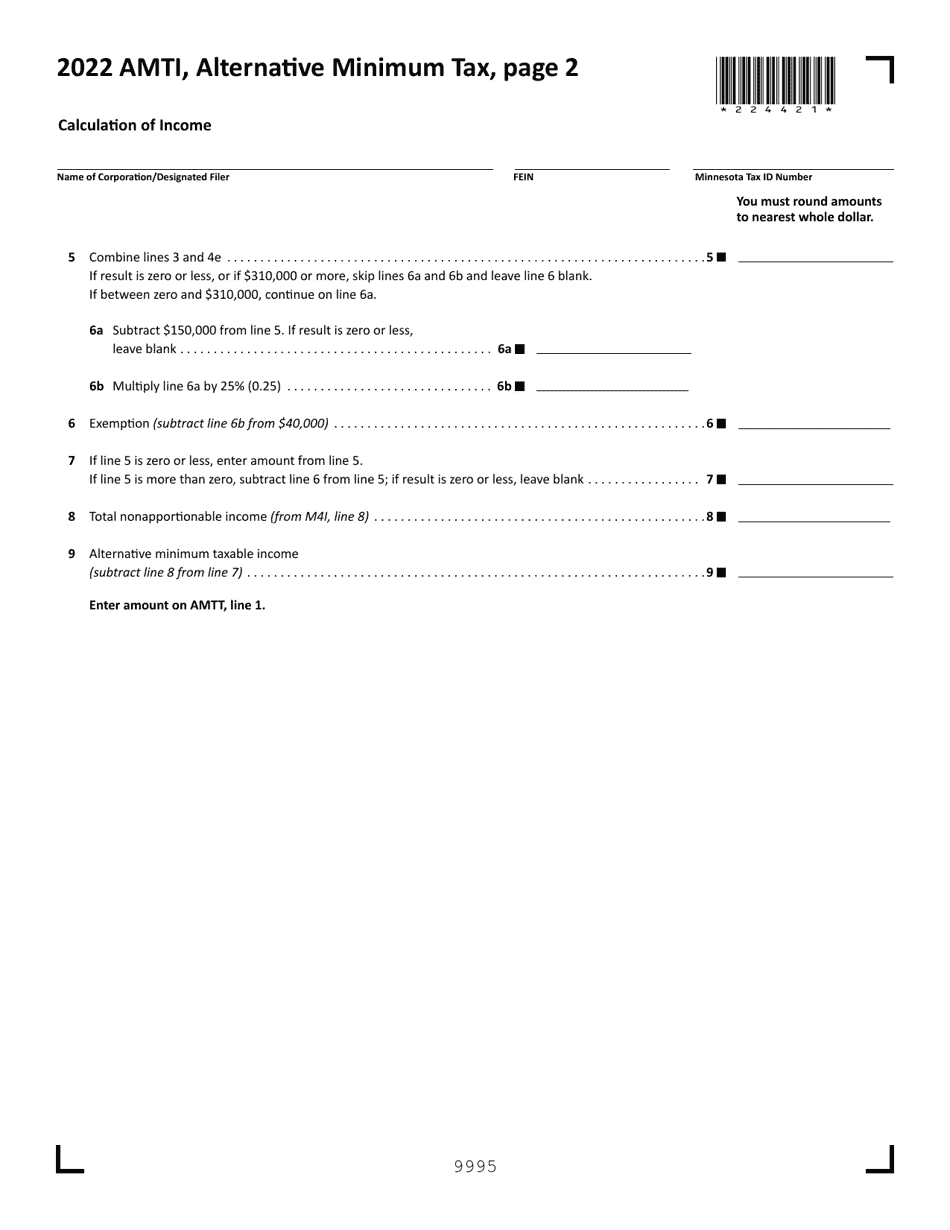

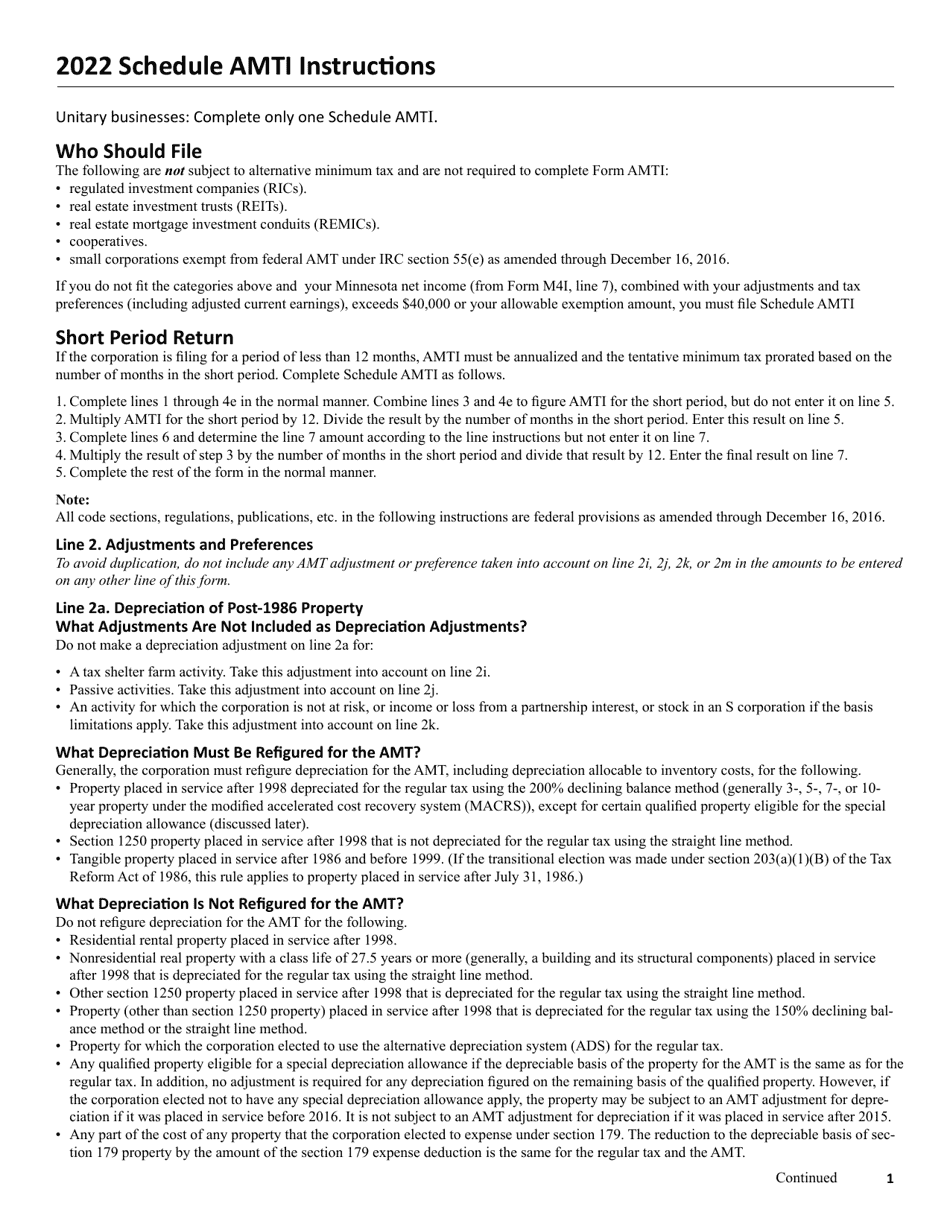

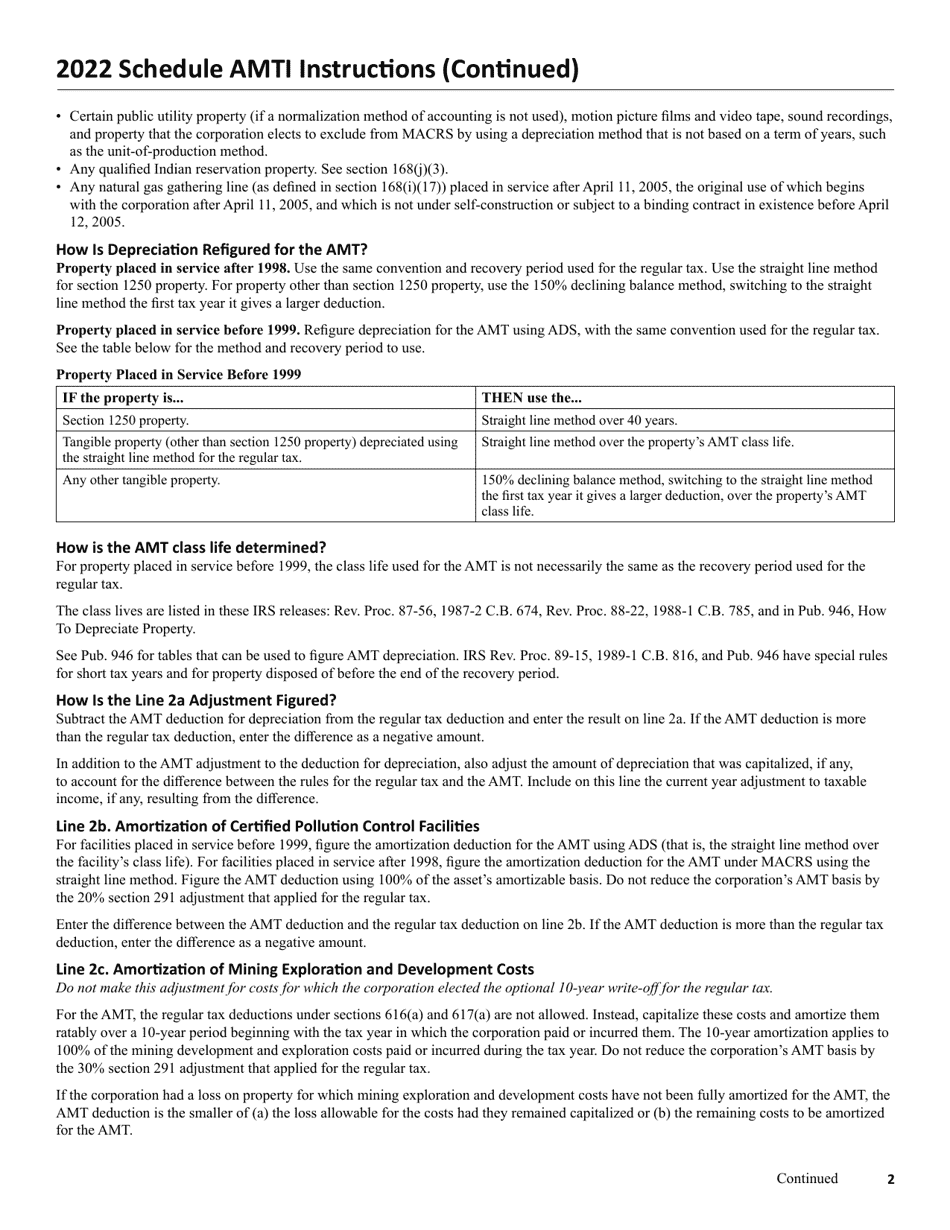

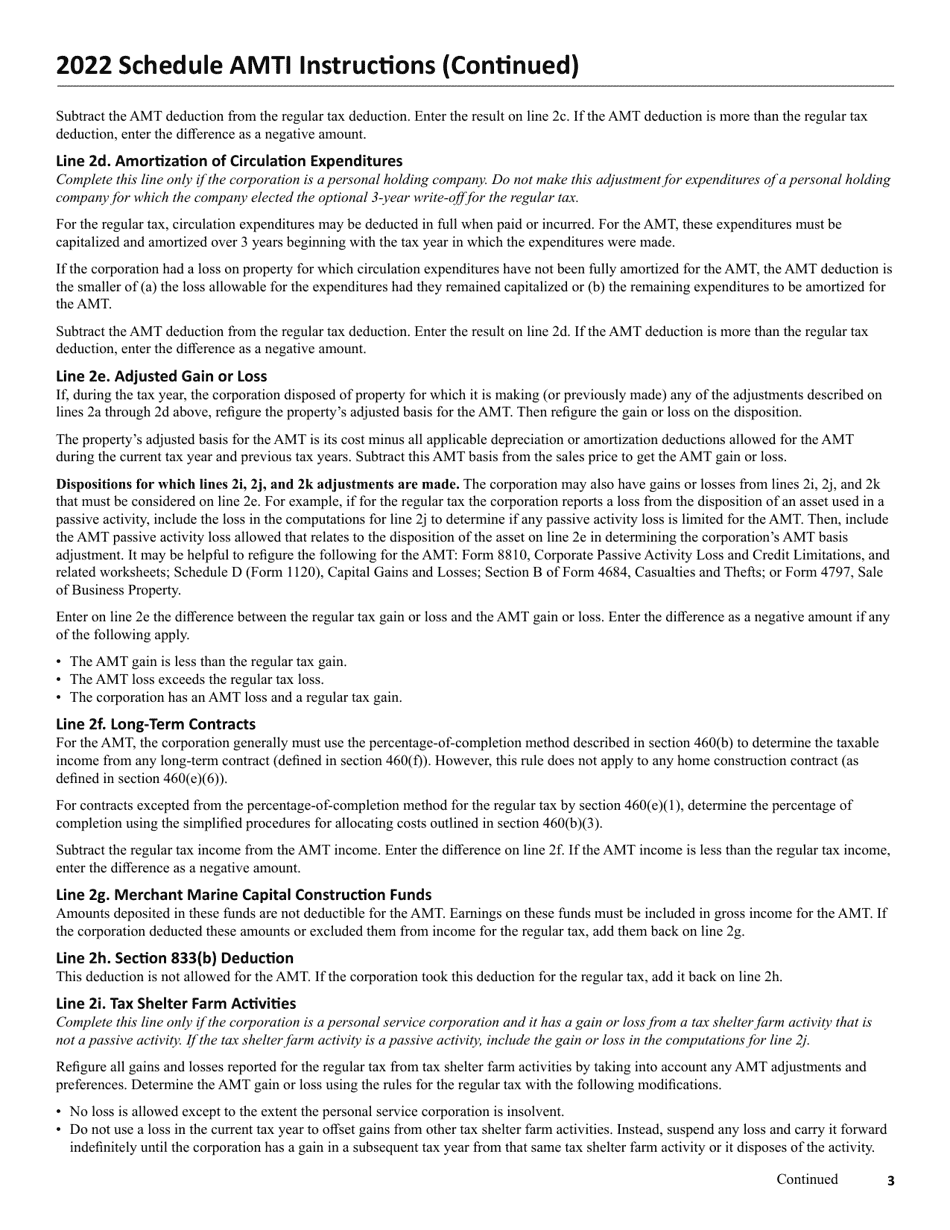

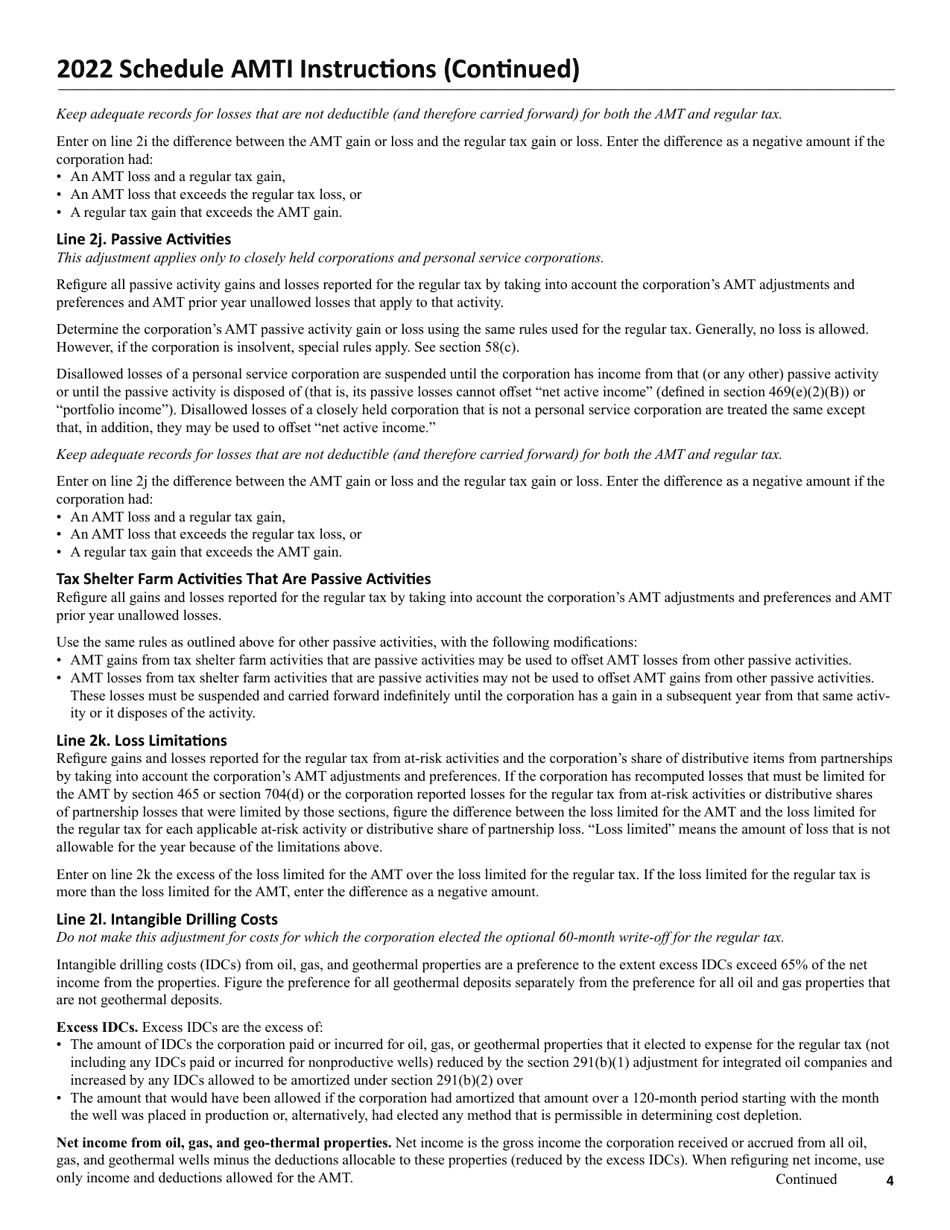

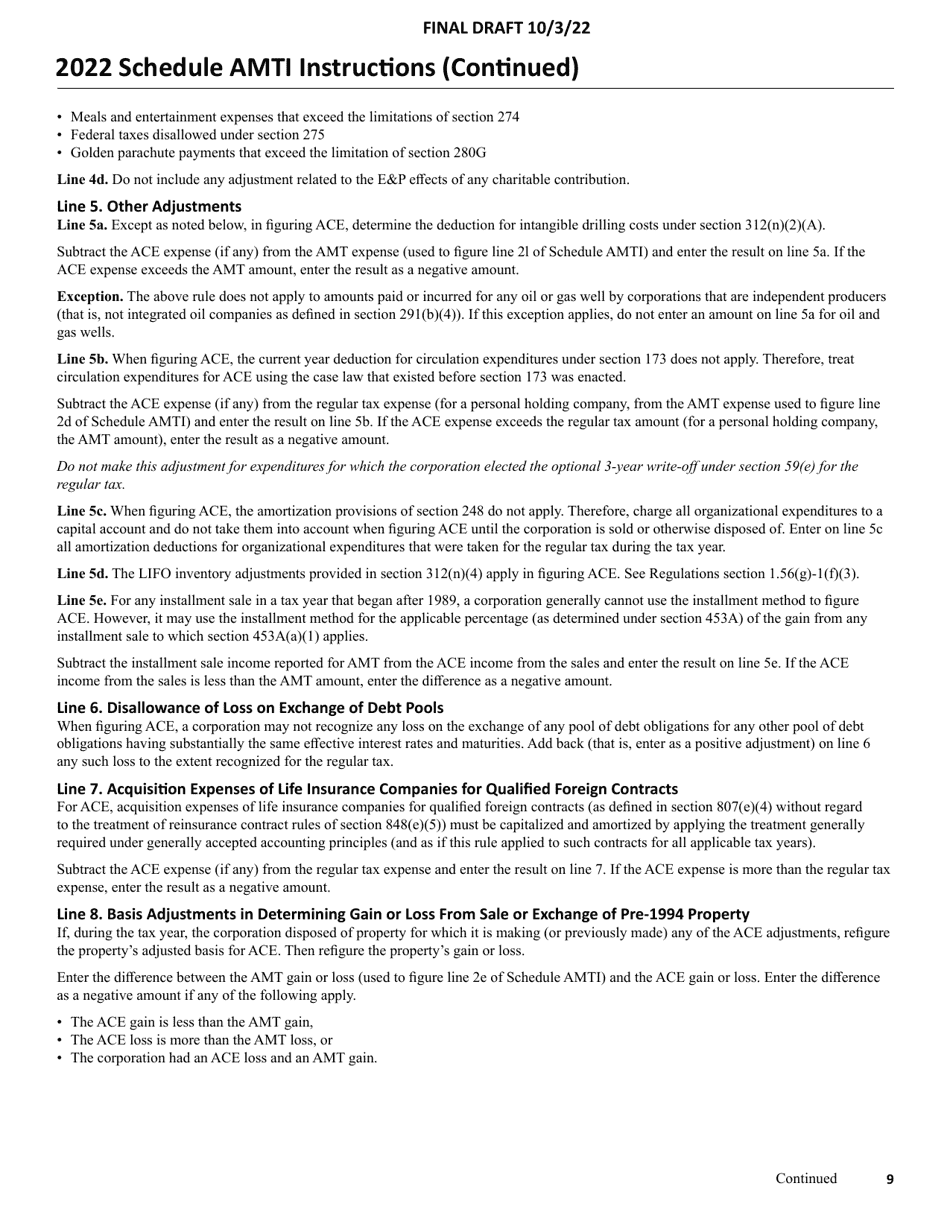

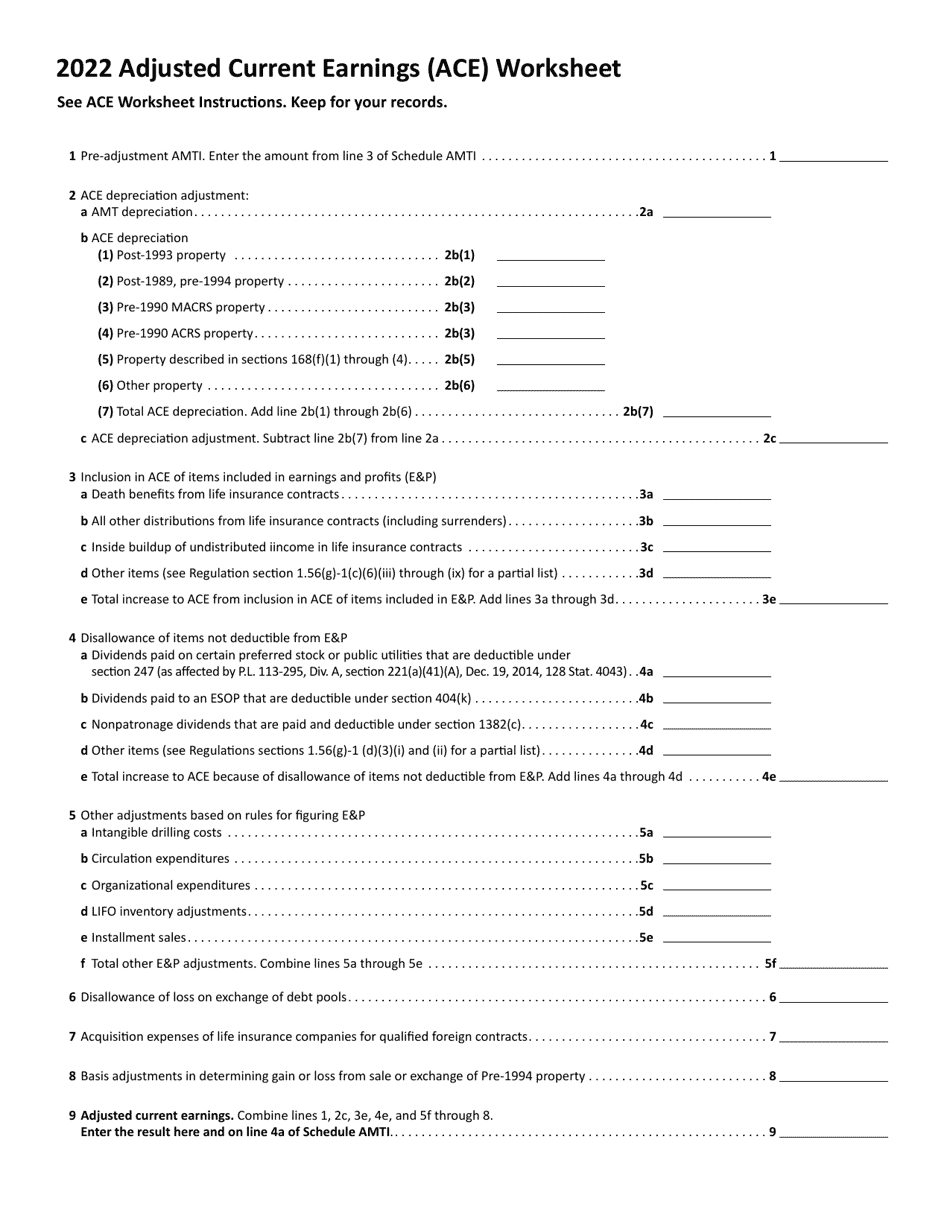

Form AMTI Alternative Minimum Tax - Minnesota

What Is Form AMTI?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AMTI?

A: AMTI stands for Alternative Minimum Taxable Income.

Q: What is the purpose of the AMTI?

A: The purpose of AMTI is to ensure that high-income taxpayers pay a minimum amount of tax, regardless of the deductions and credits they are eligible for.

Q: Do I have to pay AMTI in Minnesota?

A: No, Minnesota does not have an alternative minimum tax.

Q: Is there a federal AMT?

A: Yes, the federal government has an alternative minimum tax system that applies to certain taxpayers.

Q: Who typically pays AMT?

A: High-income individuals who have a significant amount of deductions and credits may be subject to paying AMT.

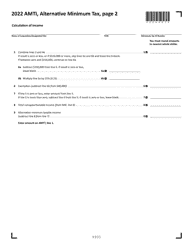

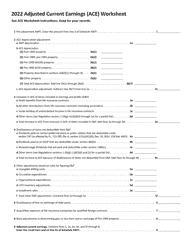

Q: How is AMTI calculated?

A: AMTI is calculated by starting with regular taxable income and making certain adjustments and additions.

Q: What are some common adjustments made to AMTI?

A: Some common adjustments made to AMTI include adding back certain deductions and credits.

Q: Is AMTI the same as regular taxable income?

A: No, AMTI is different from regular taxable income as it includes certain adjustments and additions.

Q: Are there exemptions or deductions available for AMTI?

A: Yes, there are exemptions and deductions available for certain taxpayers subject to AMTI.

Q: Can I avoid paying AMTI?

A: It depends on your income level and the deductions and credits you are eligible for. Consulting a tax professional can help you determine if you can avoid paying AMTI.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AMTI by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.