This version of the form is not currently in use and is provided for reference only. Download this version of

Form M3

for the current year.

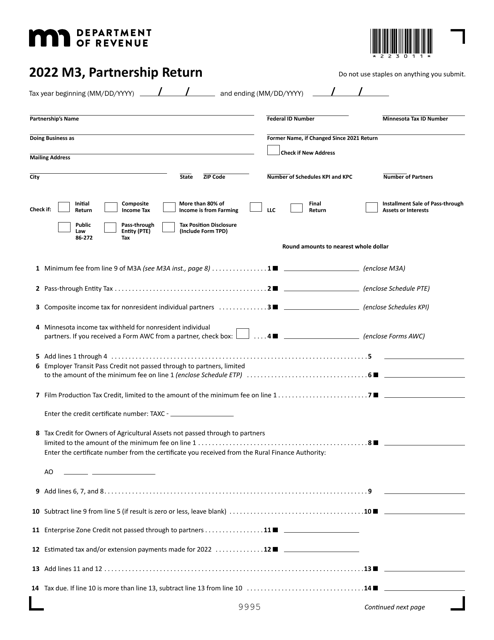

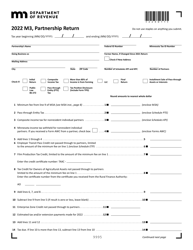

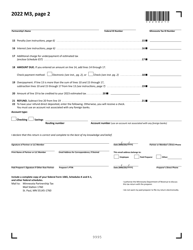

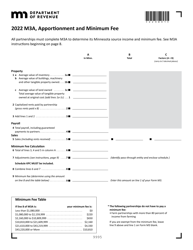

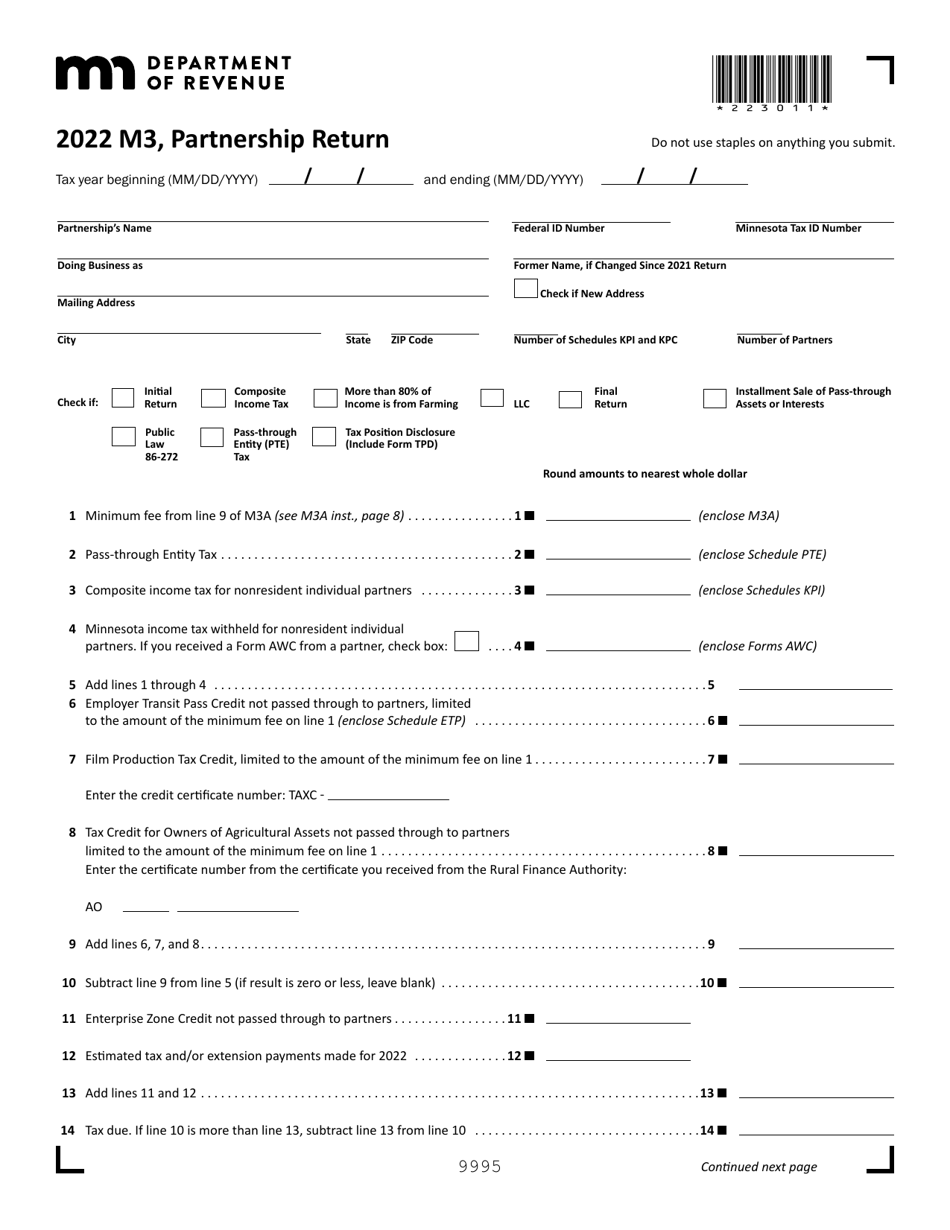

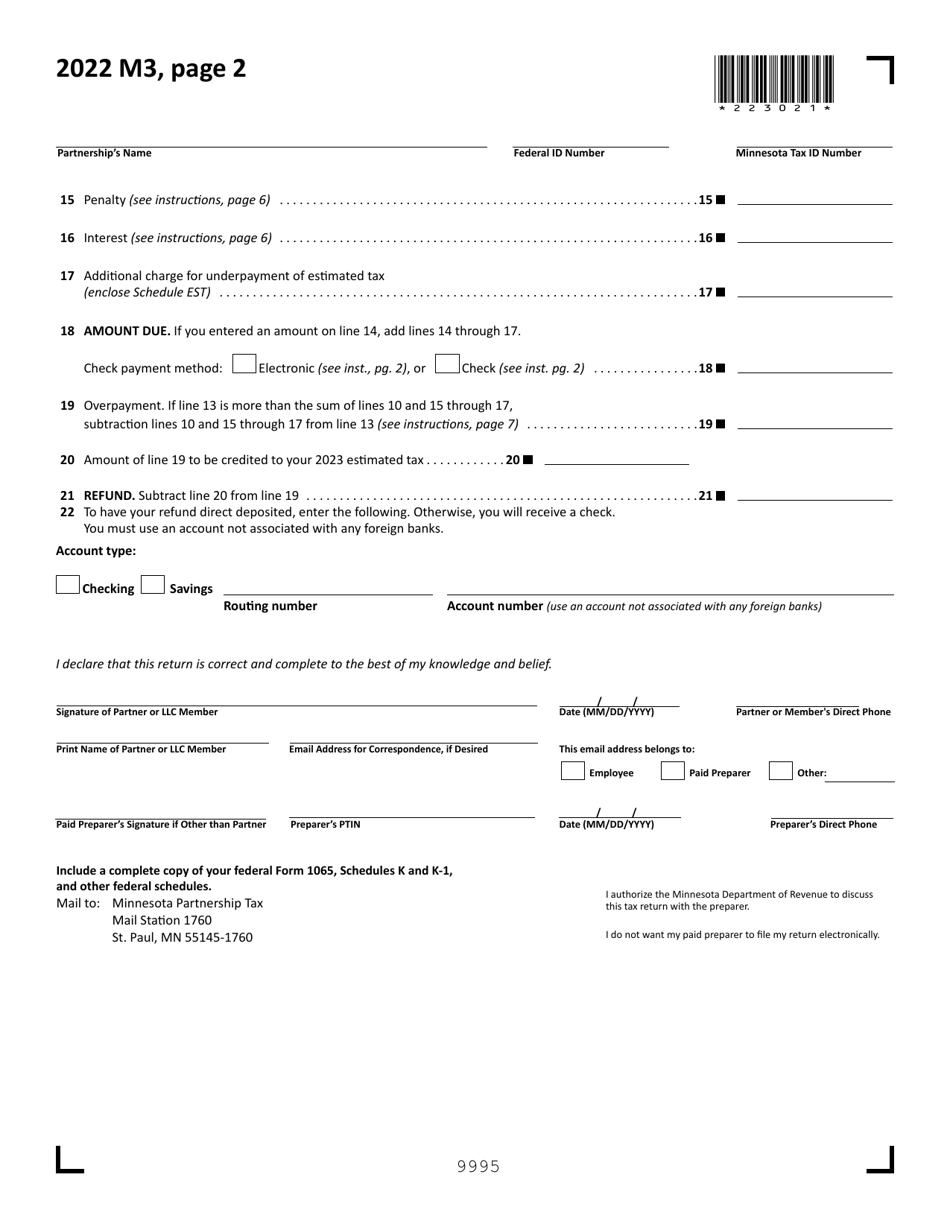

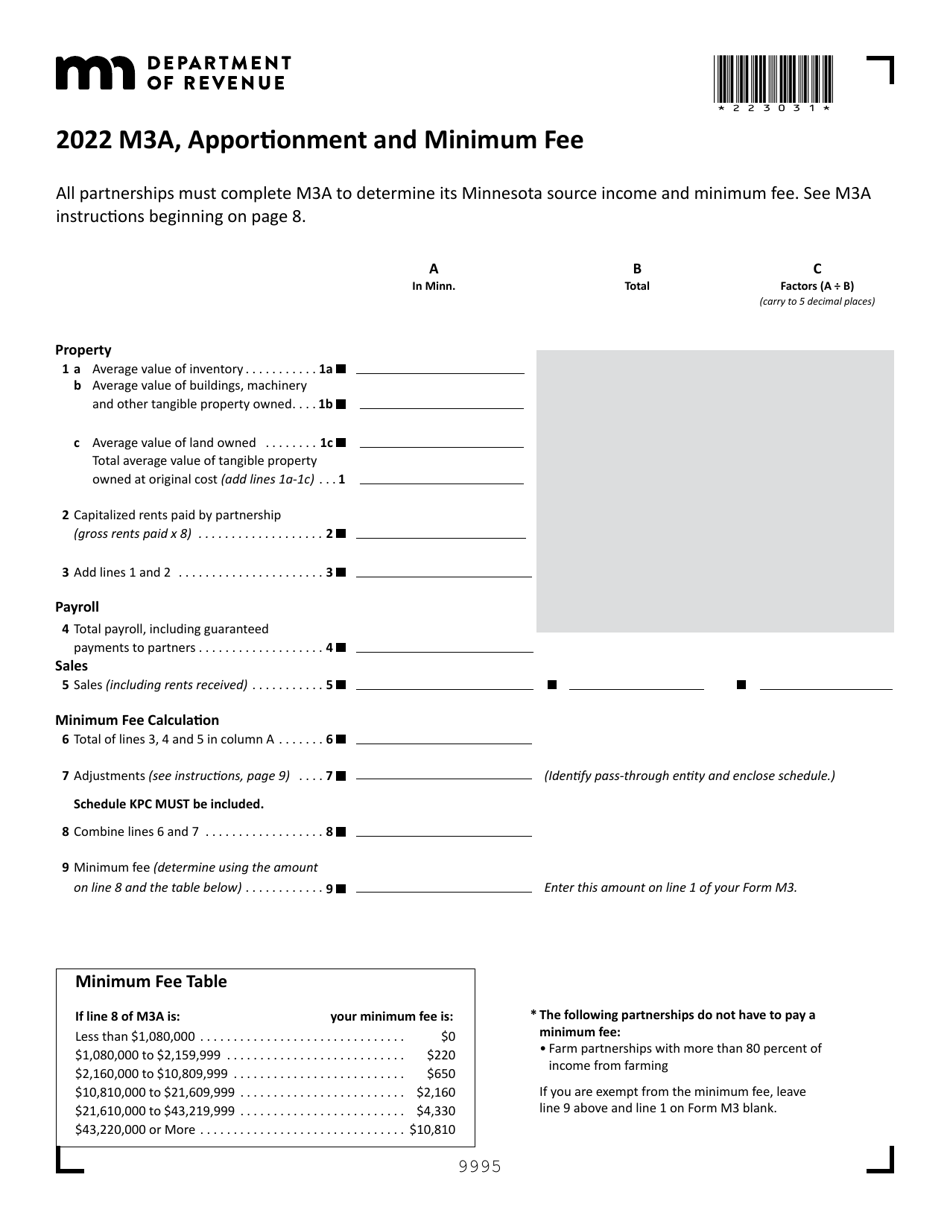

Form M3 Partnership Return - Minnesota

What Is Form M3?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M3 Partnership Return?

A: Form M3 Partnership Return is a tax form used by partnerships in Minnesota to report their income, deductions, and credits.

Q: Who needs to file Form M3 Partnership Return?

A: Any partnership that earns income or does business in Minnesota is required to file Form M3 Partnership Return.

Q: When is the deadline to file Form M3 Partnership Return?

A: Form M3 Partnership Return is due on or before the 15th day of the fourth month following the end of the partnership's tax year.

Q: How can I file Form M3 Partnership Return?

A: Form M3 Partnership Return can be filed electronically using the Minnesota Department of Revenue's e-Services system or by mail.

Q: Are there any penalties for late filing of Form M3 Partnership Return?

A: Yes, there are penalties for late filing or failure to file Form M3 Partnership Return. It is important to file the form on time to avoid these penalties.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M3 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.