This version of the form is not currently in use and is provided for reference only. Download this version of

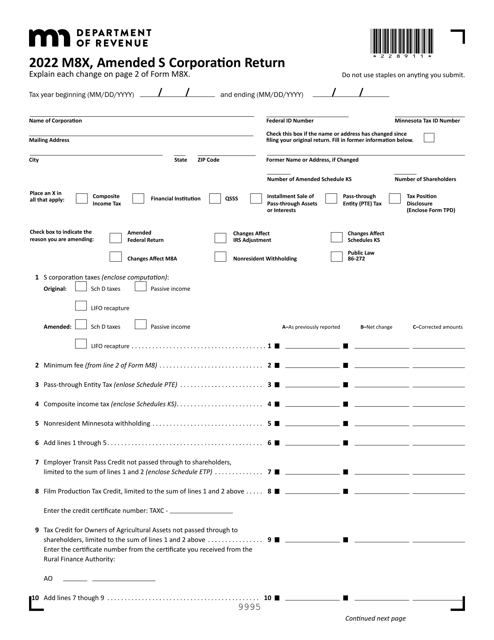

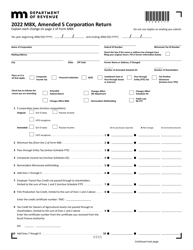

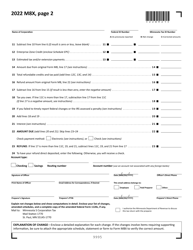

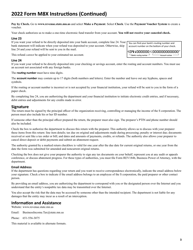

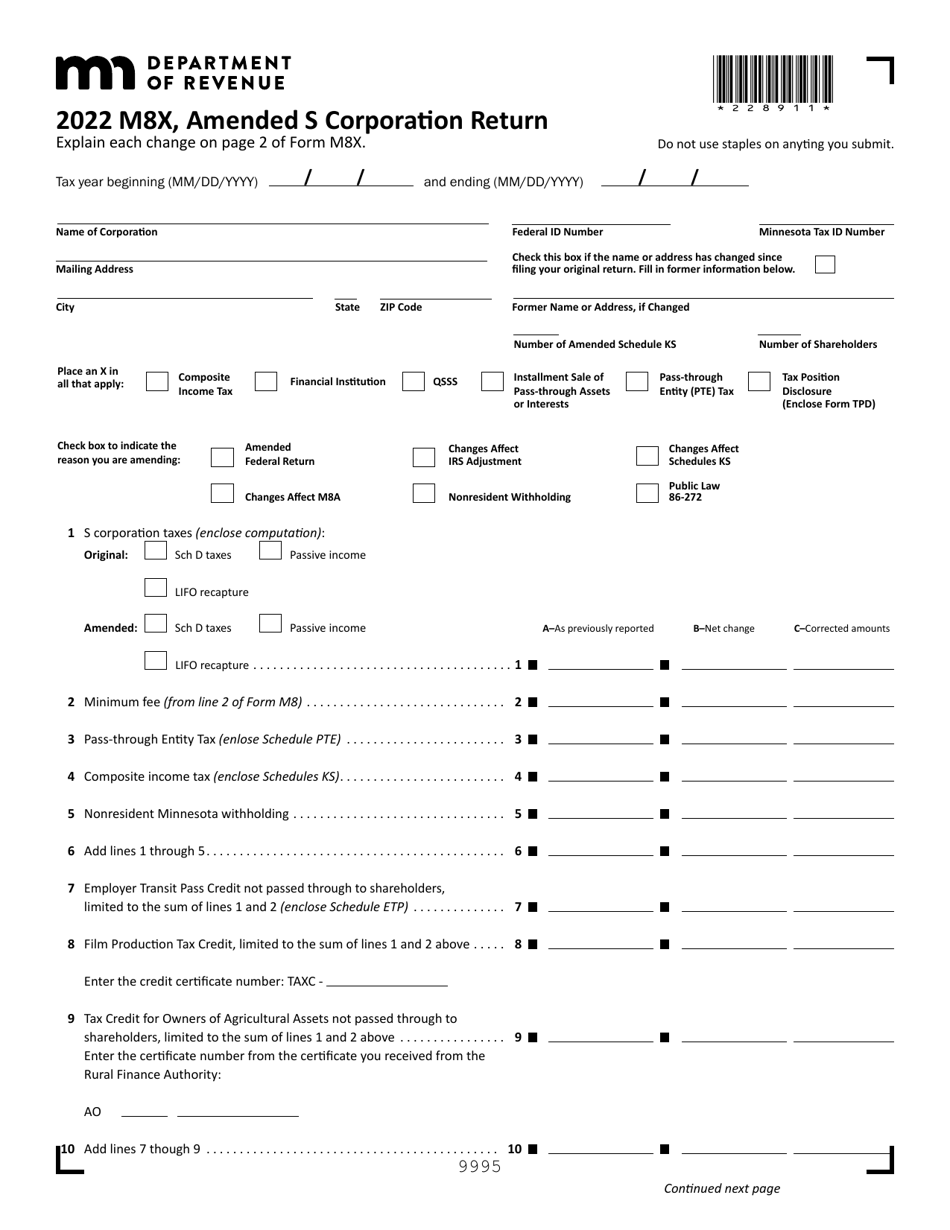

Form M8X

for the current year.

Form M8X Amended S Corporation Return - Minnesota

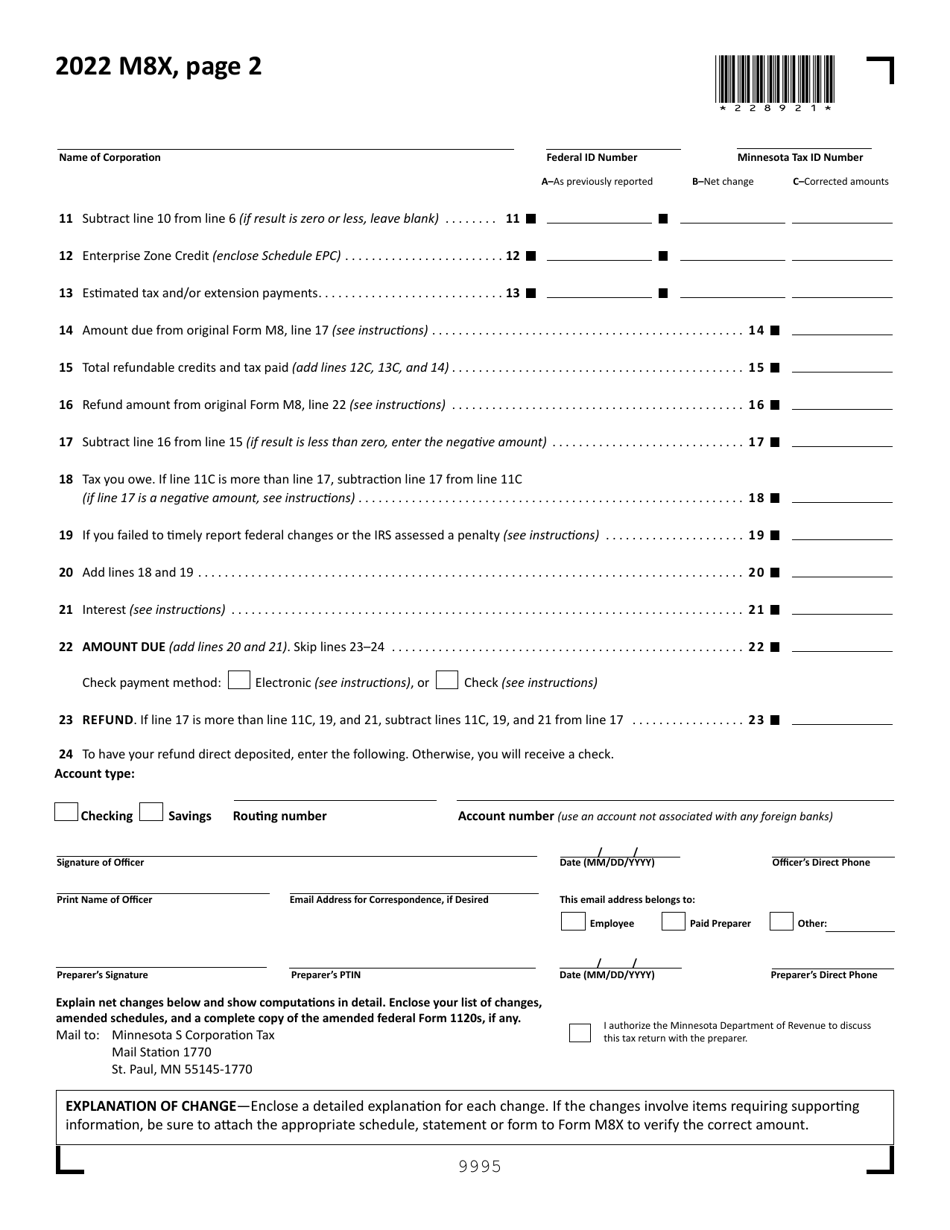

What Is Form M8X?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M8X?

A: Form M8X is the Amended S Corporation Return for the state of Minnesota.

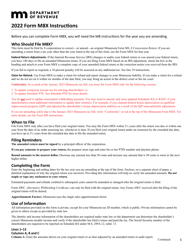

Q: Who needs to file Form M8X?

A: S corporations that need to make changes or correct errors on their original Minnesota S Corporation Return.

Q: When should Form M8X be filed?

A: Form M8X should be filed when there are changes or errors in the original Minnesota S Corporation Return.

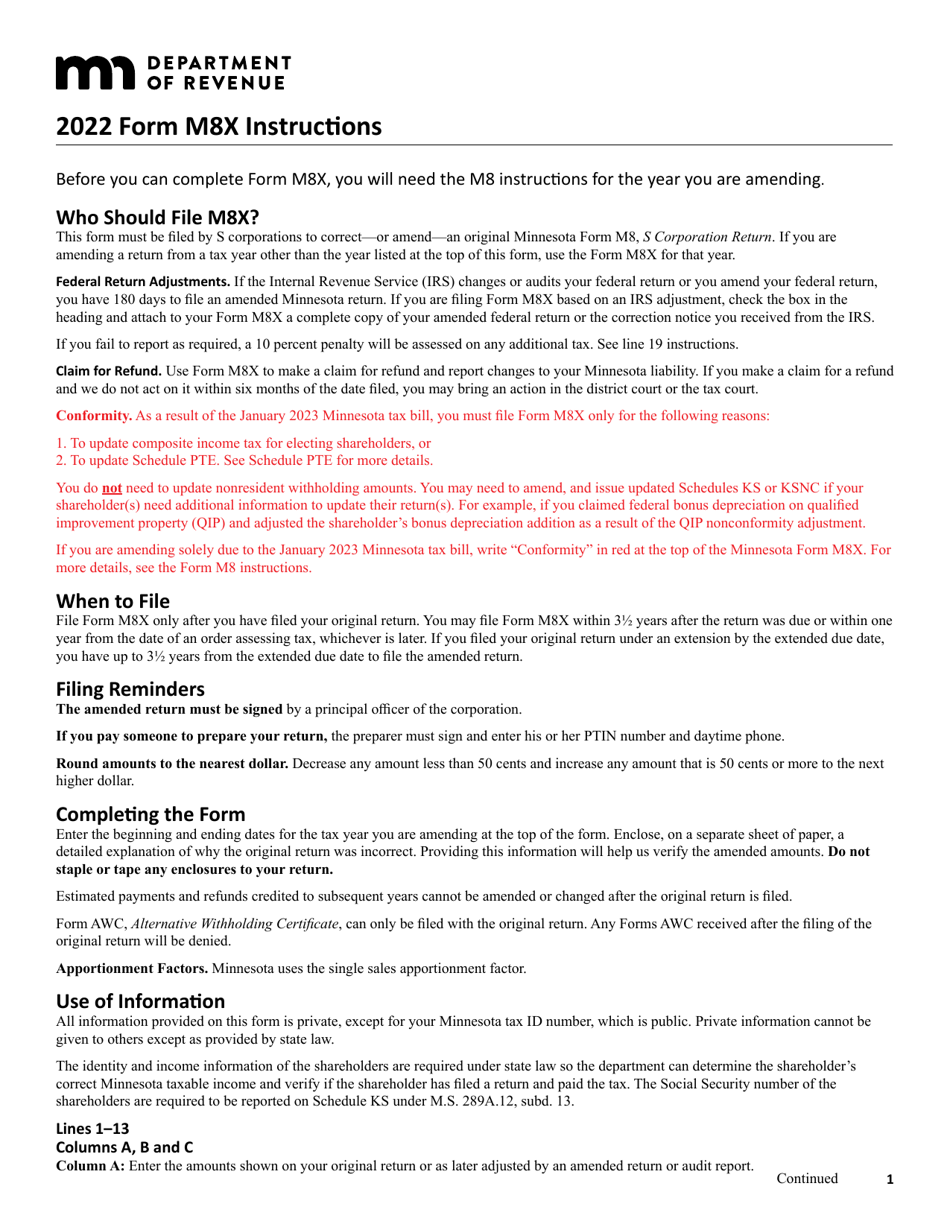

Q: What information is required on Form M8X?

A: Form M8X requires information about the S corporation's original return, as well as the changes or corrections being made.

Q: Are there any filing fees for Form M8X?

A: No, there are no filing fees for Form M8X.

Q: Can Form M8X be e-filed?

A: Yes, Form M8X can be e-filed through the Minnesota Department of Revenue's e-Services system.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M8X by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.