This version of the form is not currently in use and is provided for reference only. Download this version of

Form KPC

for the current year.

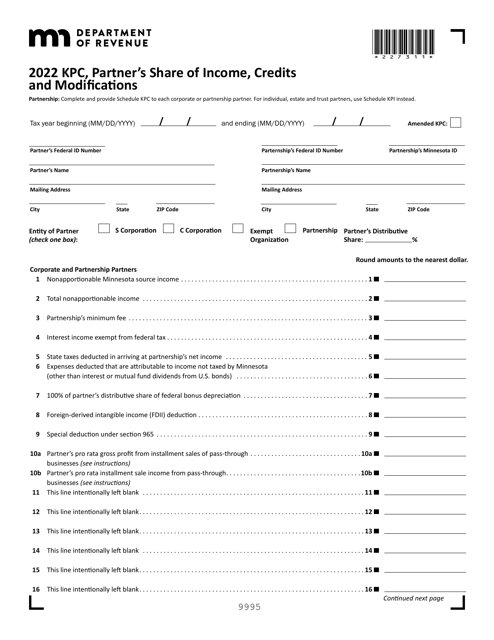

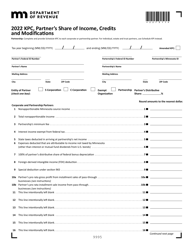

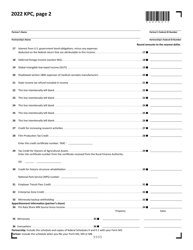

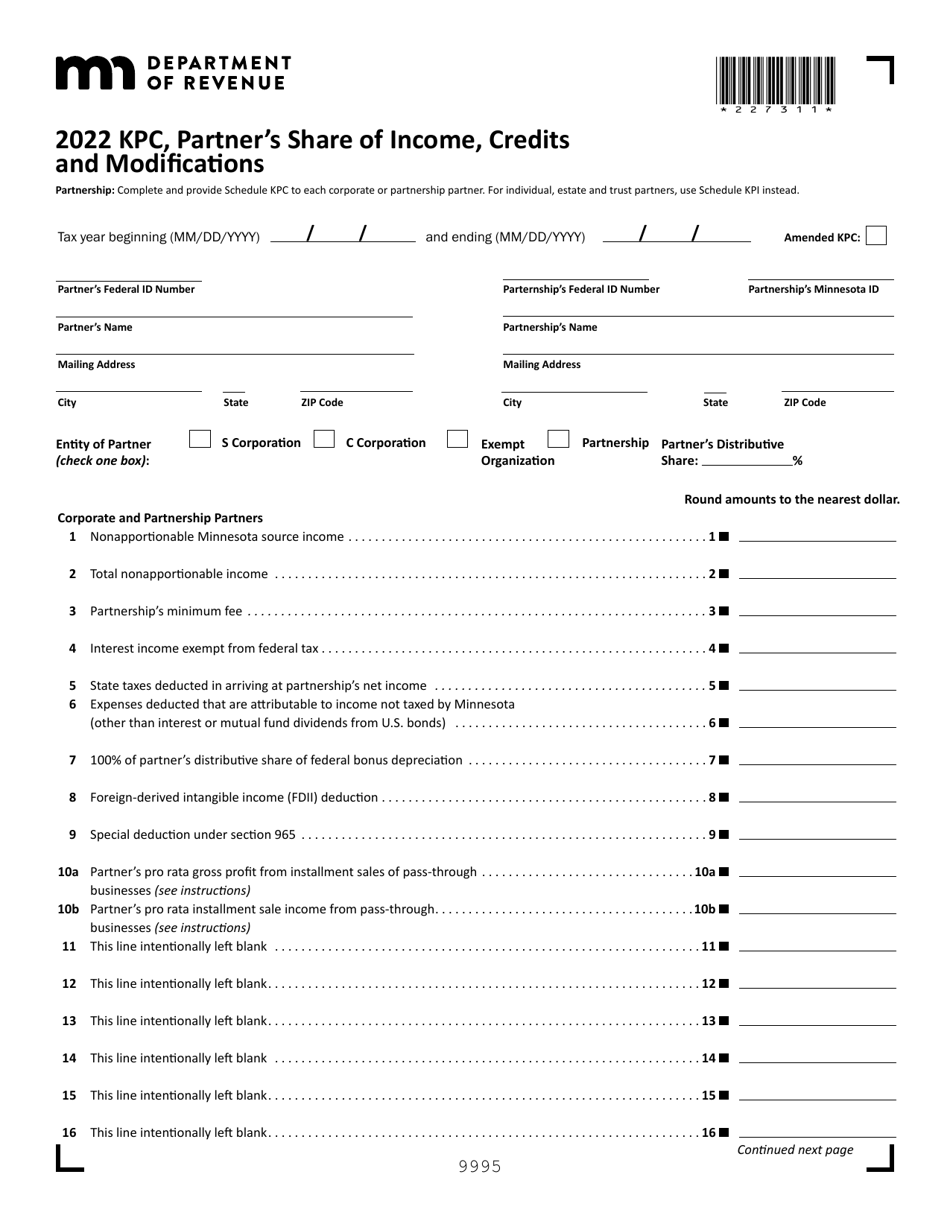

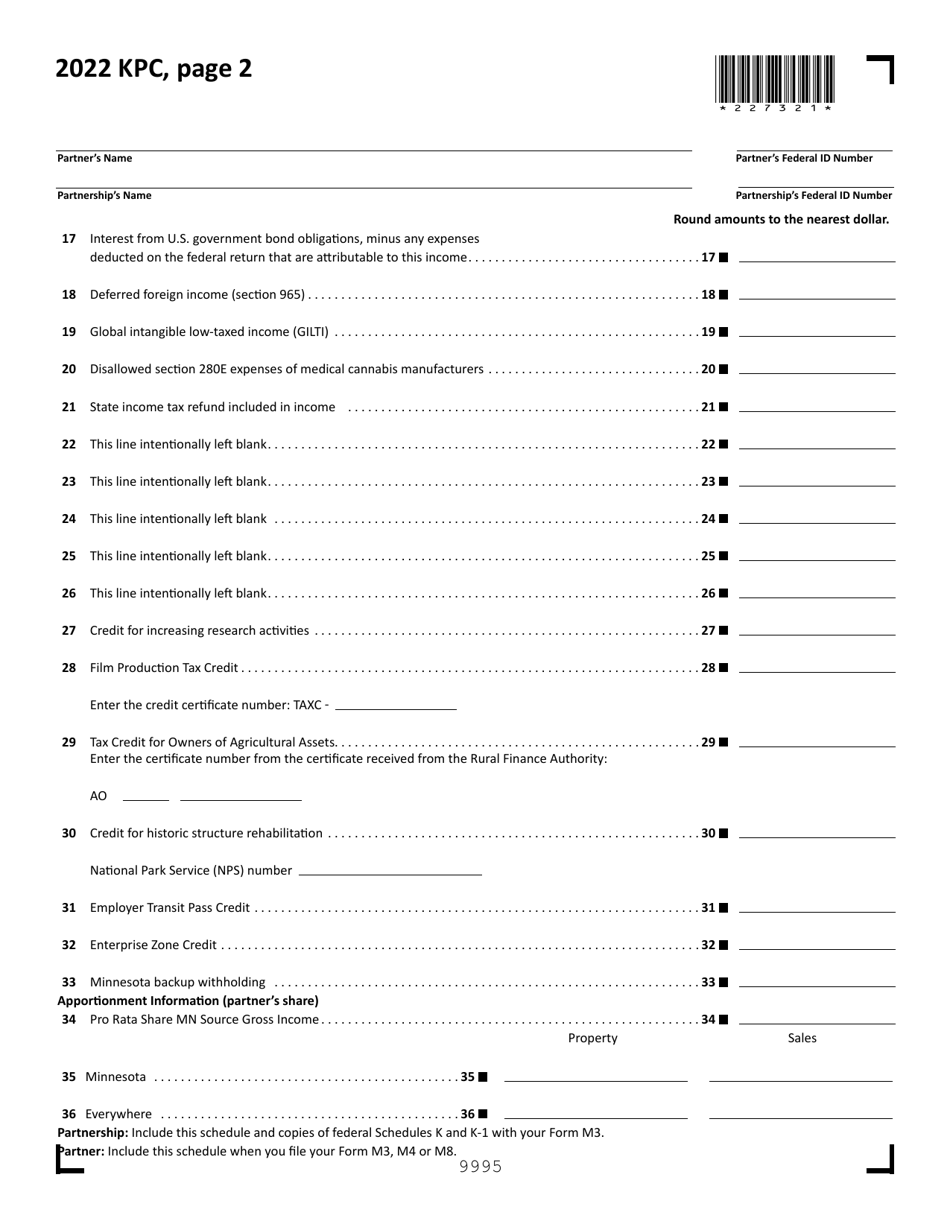

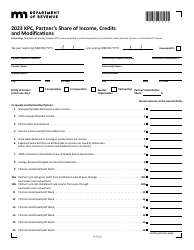

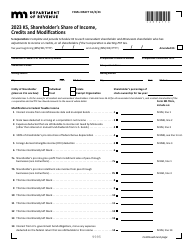

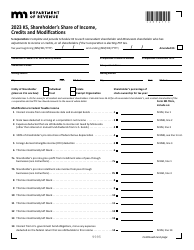

Form KPC Partner's Share of Income, Credits and Modifications - Minnesota

What Is Form KPC?

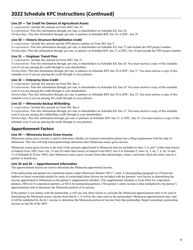

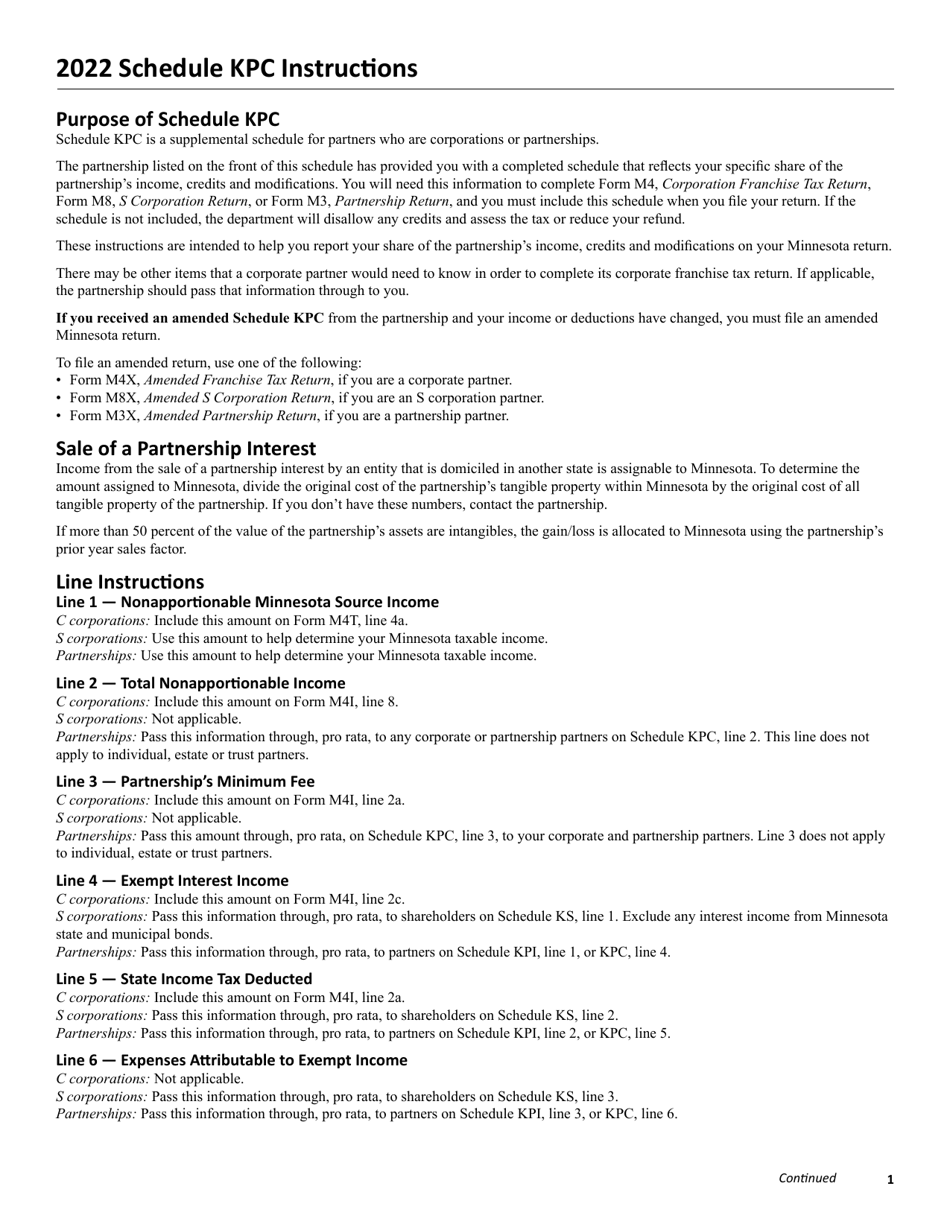

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KPC?

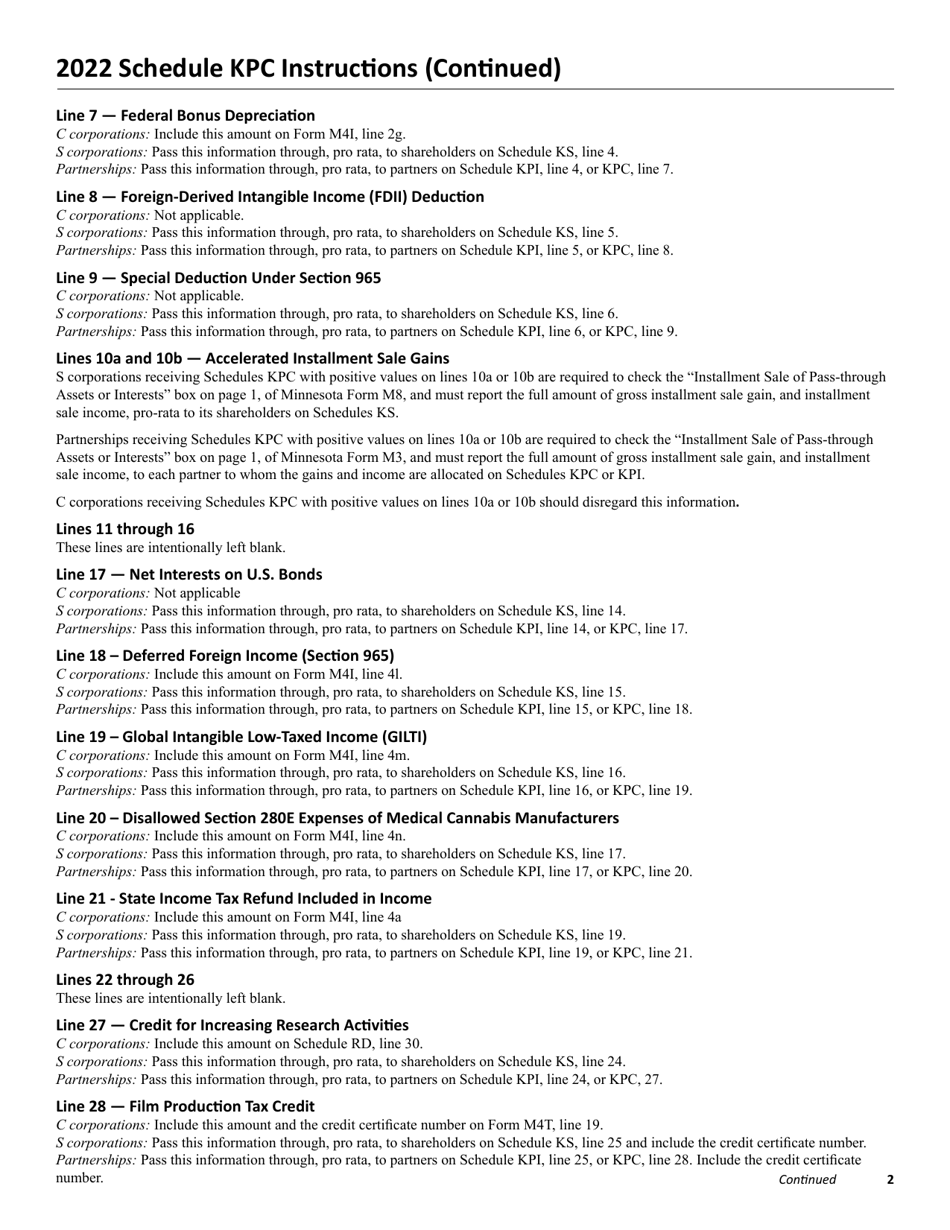

A: Form KPC is used to report a partner's share of income, credits, and modifications in Minnesota.

Q: Who needs to file Form KPC?

A: Partnerships or limited liability companies (LLCs) that are treated as partnerships for tax purposes need to file Form KPC.

Q: What information is reported on Form KPC?

A: Form KPC reports the partner's share of income, credits, and modifications, including Minnesota additions and subtractions.

Q: When is Form KPC due?

A: Form KPC is generally due on the same date as the partnership or LLC tax return, which is the 15th day of the fourth month after the end of the tax year.

Q: Are there any penalties for late filing of Form KPC?

A: Yes, there may be penalties for late filing of Form KPC. It is important to file the form on time to avoid these penalties.

Q: How can I get help with completing Form KPC?

A: You can seek assistance from a tax professional or consult the instructions provided by the Minnesota Department of Revenue.

Q: Can I file Form KPC electronically?

A: Yes, Form KPC can be filed electronically through the Minnesota Department of Revenue's e-Services platform.

Q: What should I do with copies of Form KPC?

A: You should keep copies of Form KPC with your tax records for at least three years in case of future audits or inquiries.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KPC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.