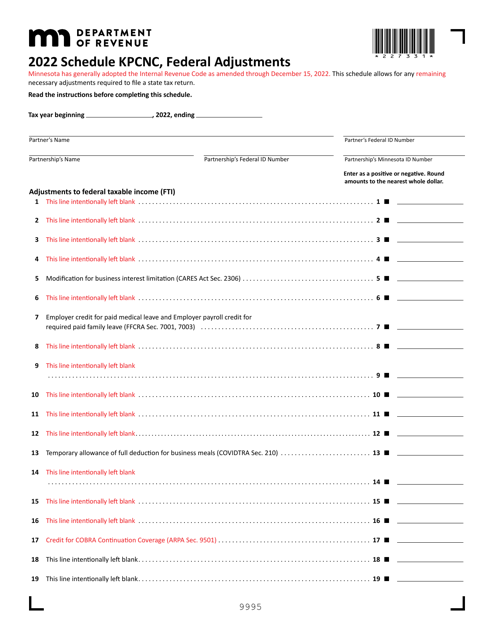

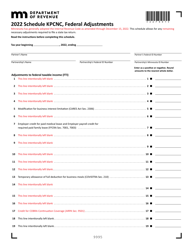

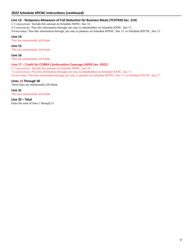

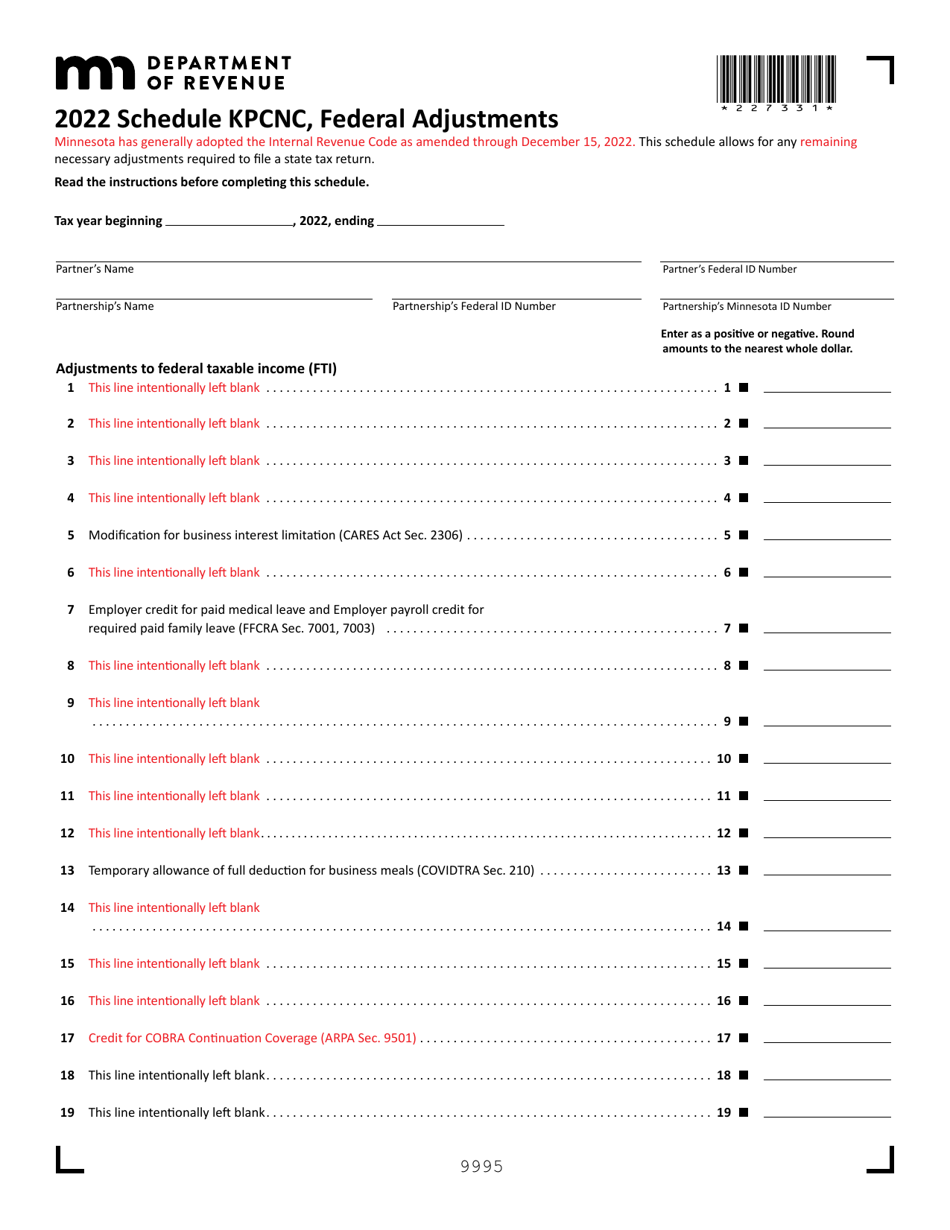

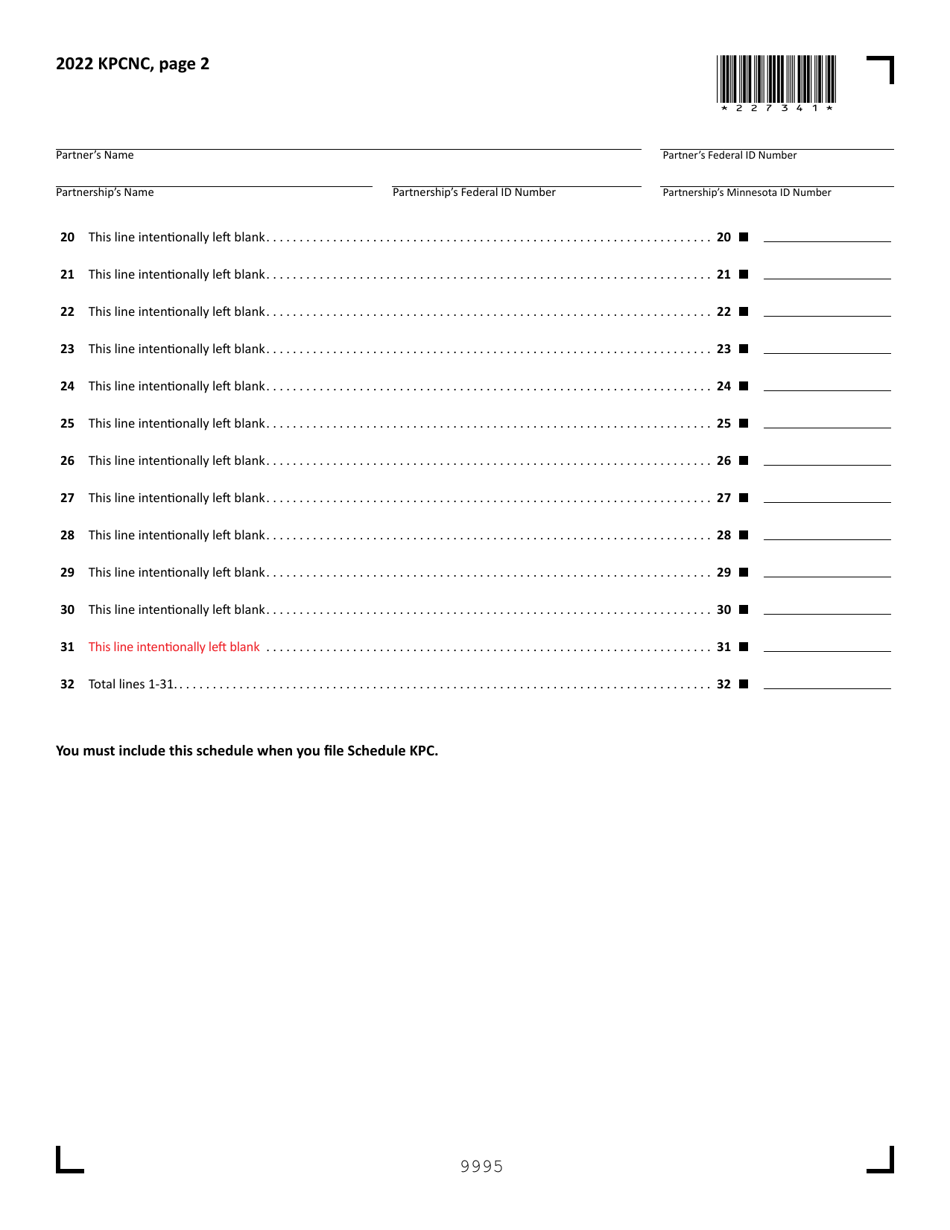

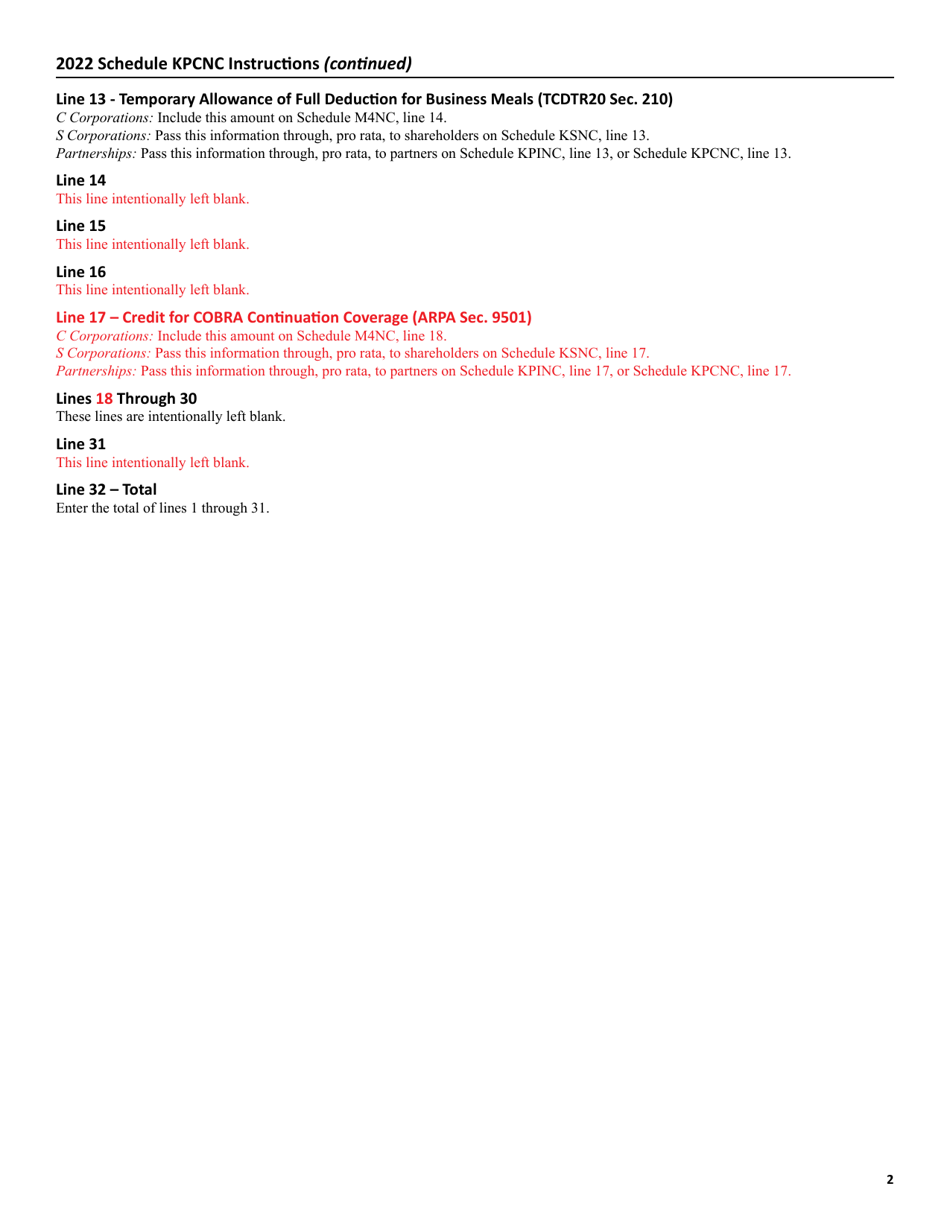

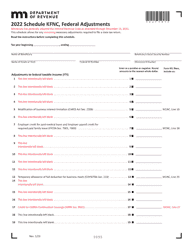

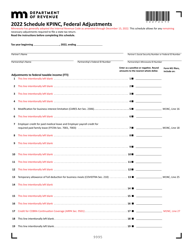

Schedule KPCNC Federal Adjustments - Minnesota

What Is Schedule KPCNC?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule KPCNC?

A: Schedule KPCNC is a form used in Minnesota to report federal adjustments made on your federal income tax return.

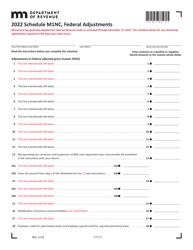

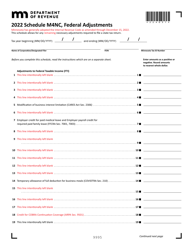

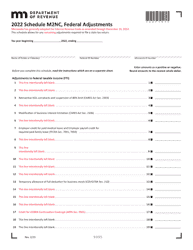

Q: What are federal adjustments?

A: Federal adjustments refer to changes or modifications made to your federal income tax return that affect your state taxes.

Q: Why do I need to file Schedule KPCNC?

A: You need to file Schedule KPCNC to report any federal income tax adjustments that impact your Minnesota state tax liability.

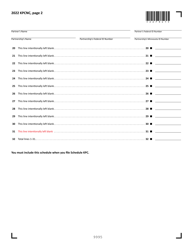

Q: How do I complete Schedule KPCNC?

A: You need to consult the instructions provided with the form to accurately complete Schedule KPCNC.

Q: Is there a deadline for filing Schedule KPCNC?

A: Yes, the deadline for filing Schedule KPCNC is the same as the deadline for filing your Minnesota state income tax return.

Q: Do I need to include a copy of my federal tax return with Schedule KPCNC?

A: No, you do not need to include a copy of your federal tax return with Schedule KPCNC. However, you may be required to provide documentation supporting the federal adjustments reported on the form.

Q: What happens if I don't file Schedule KPCNC?

A: If you have federal adjustments that impact your Minnesota state tax liability and you fail to file Schedule KPCNC, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule KPCNC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.