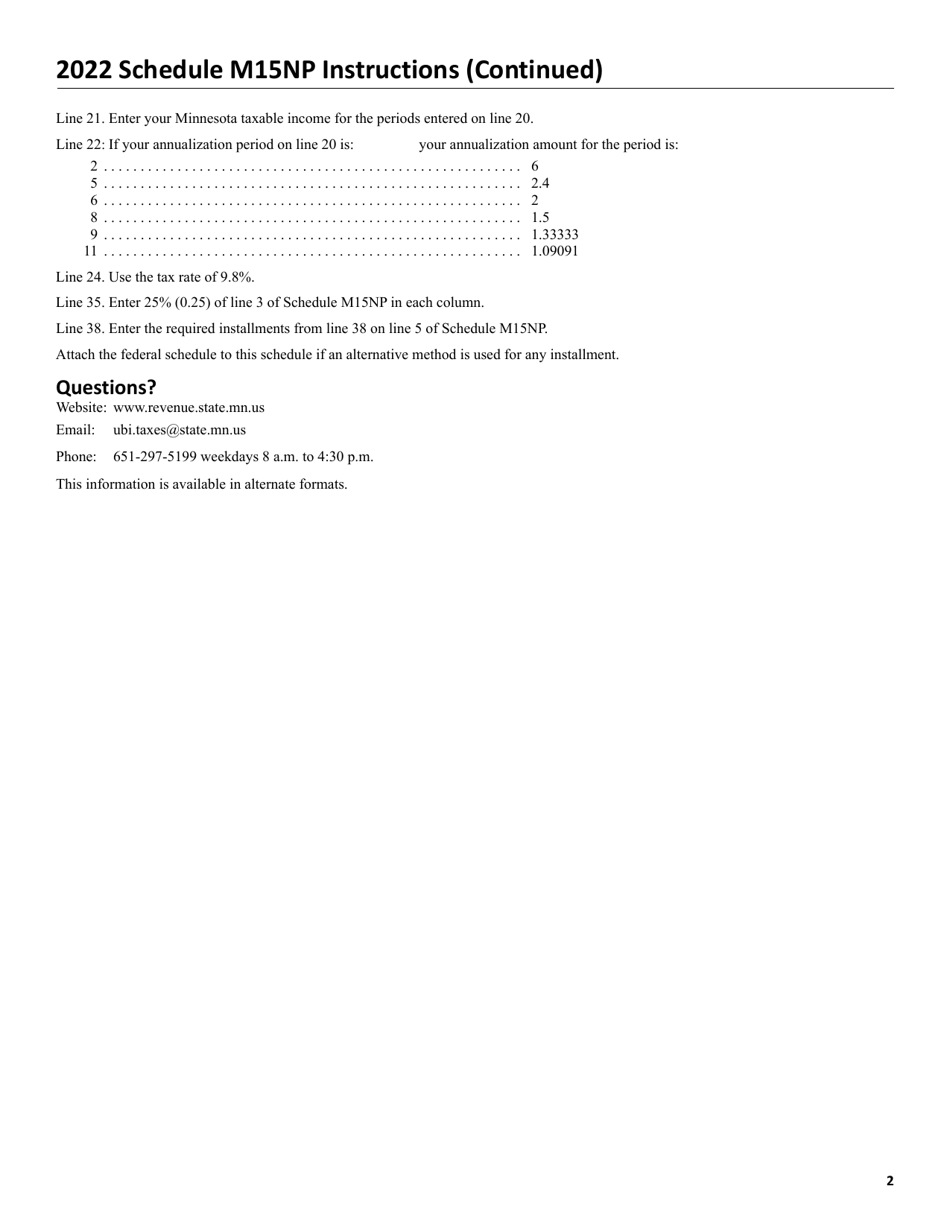

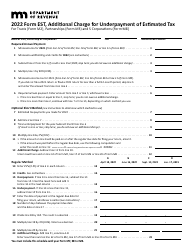

Form M15NP Additional Charge for Underpayment of Estimated Tax - Minnesota

What Is Form M15NP?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

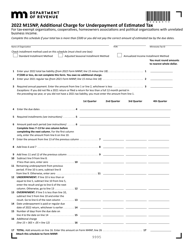

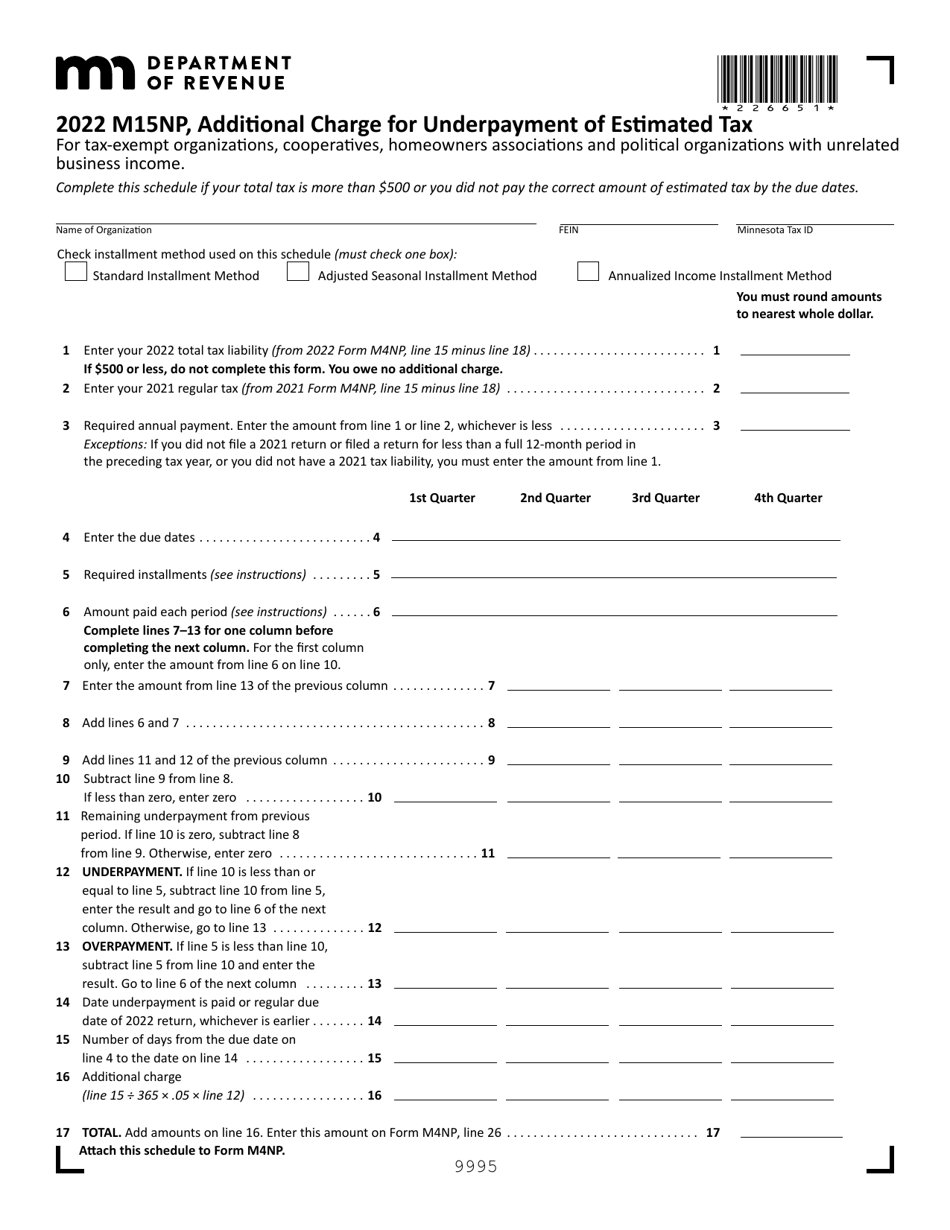

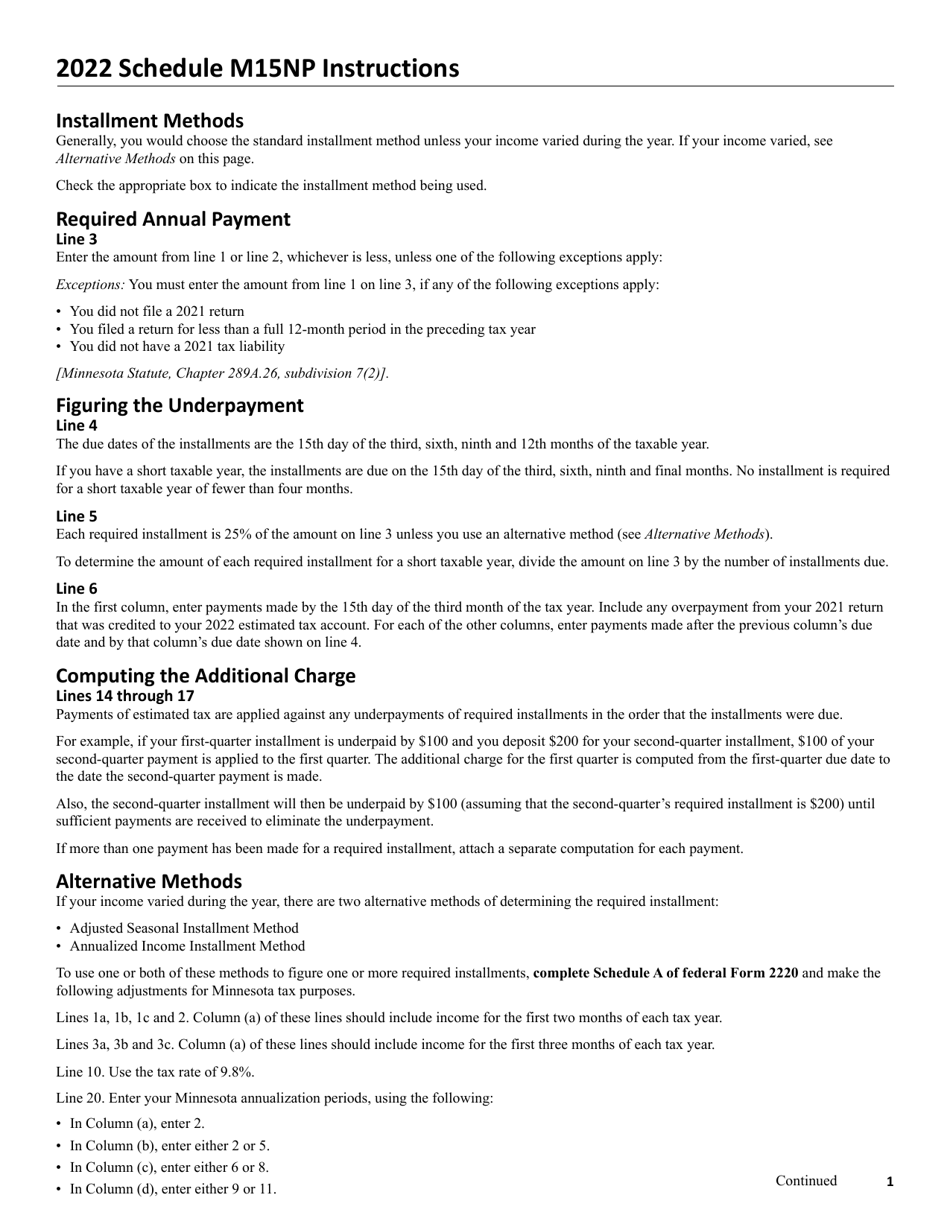

Q: What is Form M15NP?

A: Form M15NP is used to report and pay any additional charges for underpayment of estimated tax in Minnesota.

Q: Who needs to file Form M15NP?

A: Taxpayers who did not pay enough estimated tax throughout the year are required to file Form M15NP.

Q: What is the purpose of Form M15NP?

A: The purpose of Form M15NP is to calculate the amount of additional charges for underpayment of estimated tax and remit it to the state of Minnesota.

Q: When is Form M15NP due?

A: Form M15NP is generally due on the same date as your Minnesota income tax return, which is April 15th, or the next business day if it falls on a weekend or holiday.

Q: Are there any penalties for not filing Form M15NP?

A: Yes, if you fail to file Form M15NP or pay the additional charges for underpayment of estimated tax, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M15NP by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.