This version of the form is not currently in use and is provided for reference only. Download this version of

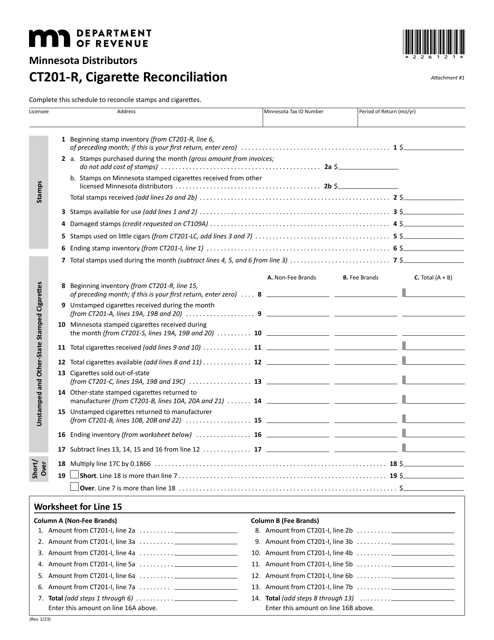

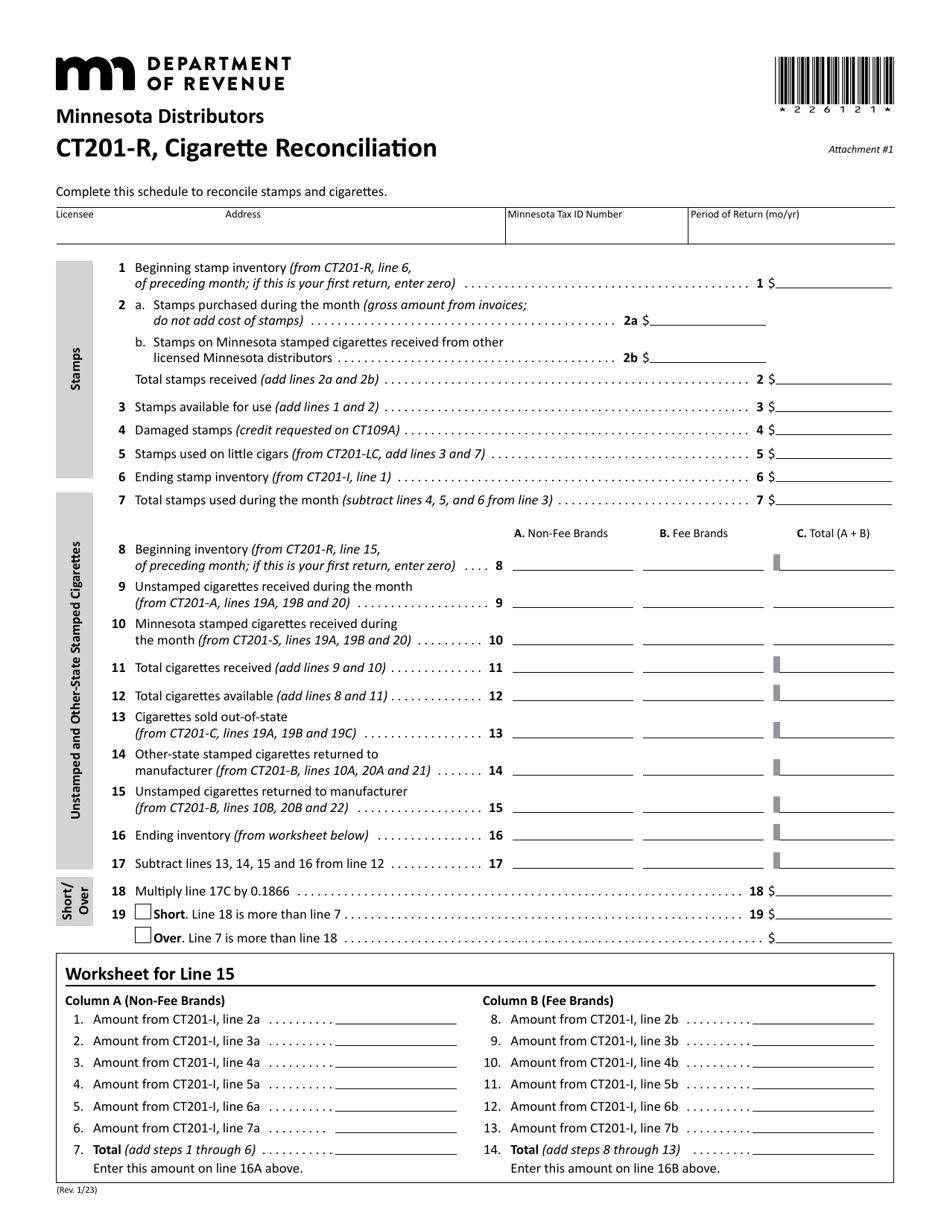

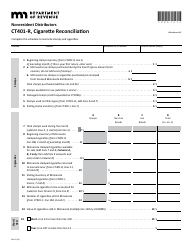

Form CT201-R Attachment 1

for the current year.

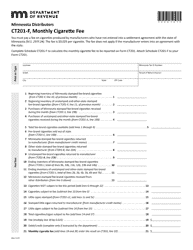

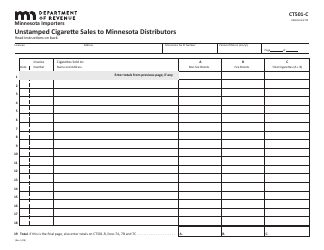

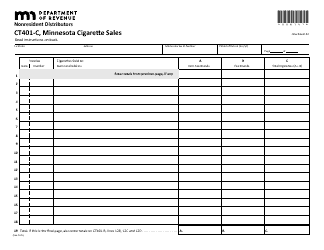

Form CT201-R Attachment 1 Cigarette Reconciliation - Minnesota Distributors - Minnesota

What Is Form CT201-R Attachment 1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT201-R Attachment 1?

A: Form CT201-R Attachment 1 is a document used for cigarette reconciliation.

Q: Who uses Form CT201-R Attachment 1?

A: Minnesota distributors in Minnesota use Form CT201-R Attachment 1.

Q: What is the purpose of Form CT201-R Attachment 1?

A: The purpose of Form CT201-R Attachment 1 is to reconcile cigarette sales with cigarette tax liabilities.

Q: What does the document contain?

A: Form CT201-R Attachment 1 contains information about cigarette sales and tax liabilities of Minnesota distributors.

Q: Is Form CT201-R Attachment 1 specific to Minnesota?

A: Yes, Form CT201-R Attachment 1 is specific to Minnesota and used by distributors in the state.

Q: Are there any other attachments or forms related to CT201-R?

A: Yes, there may be additional attachments or forms related to CT201-R depending on the specific requirements of the state.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT201-R Attachment 1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.