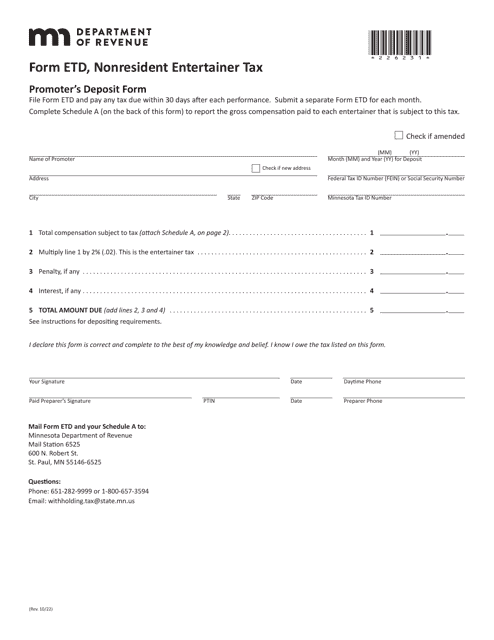

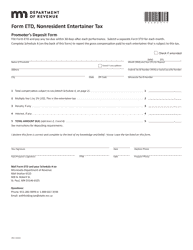

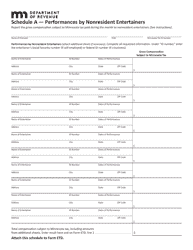

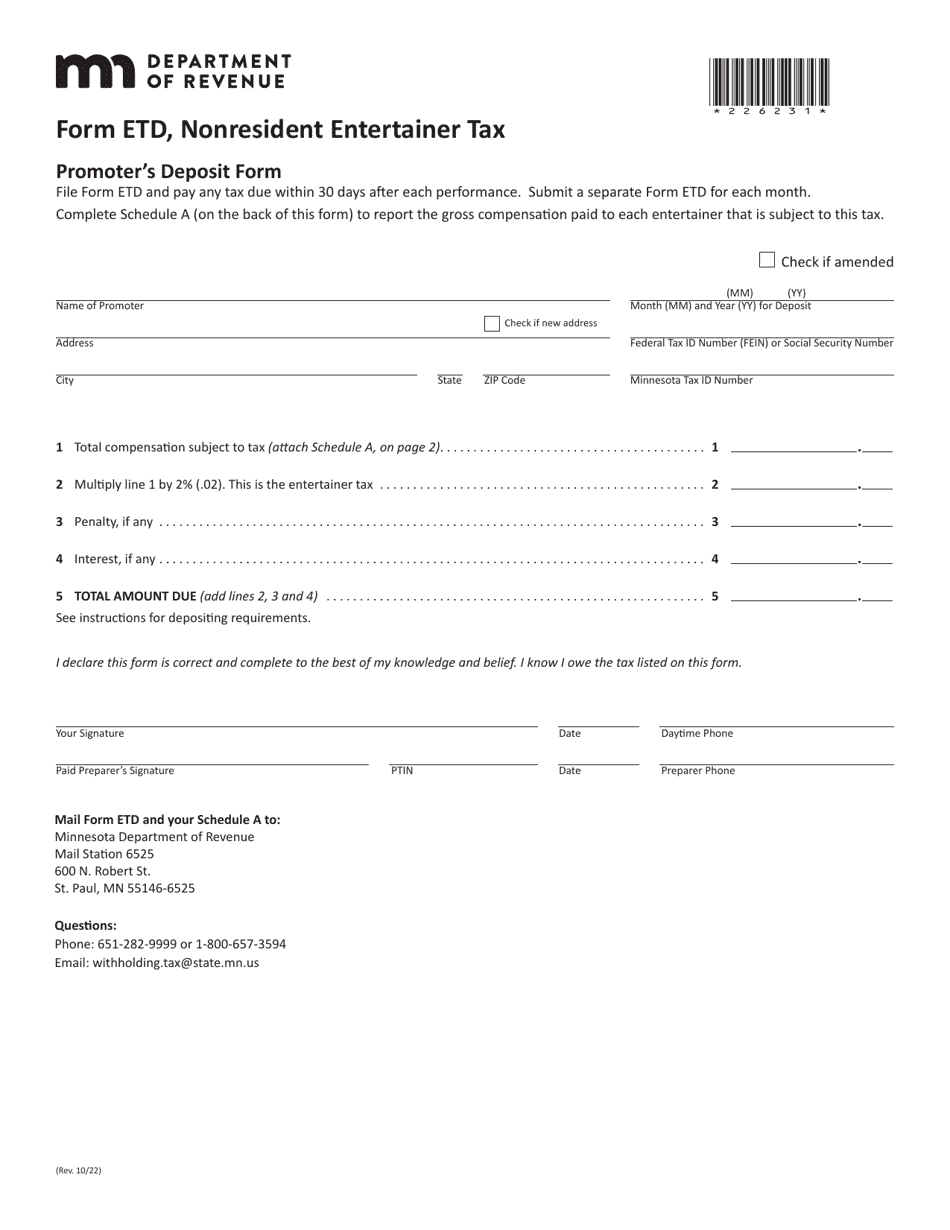

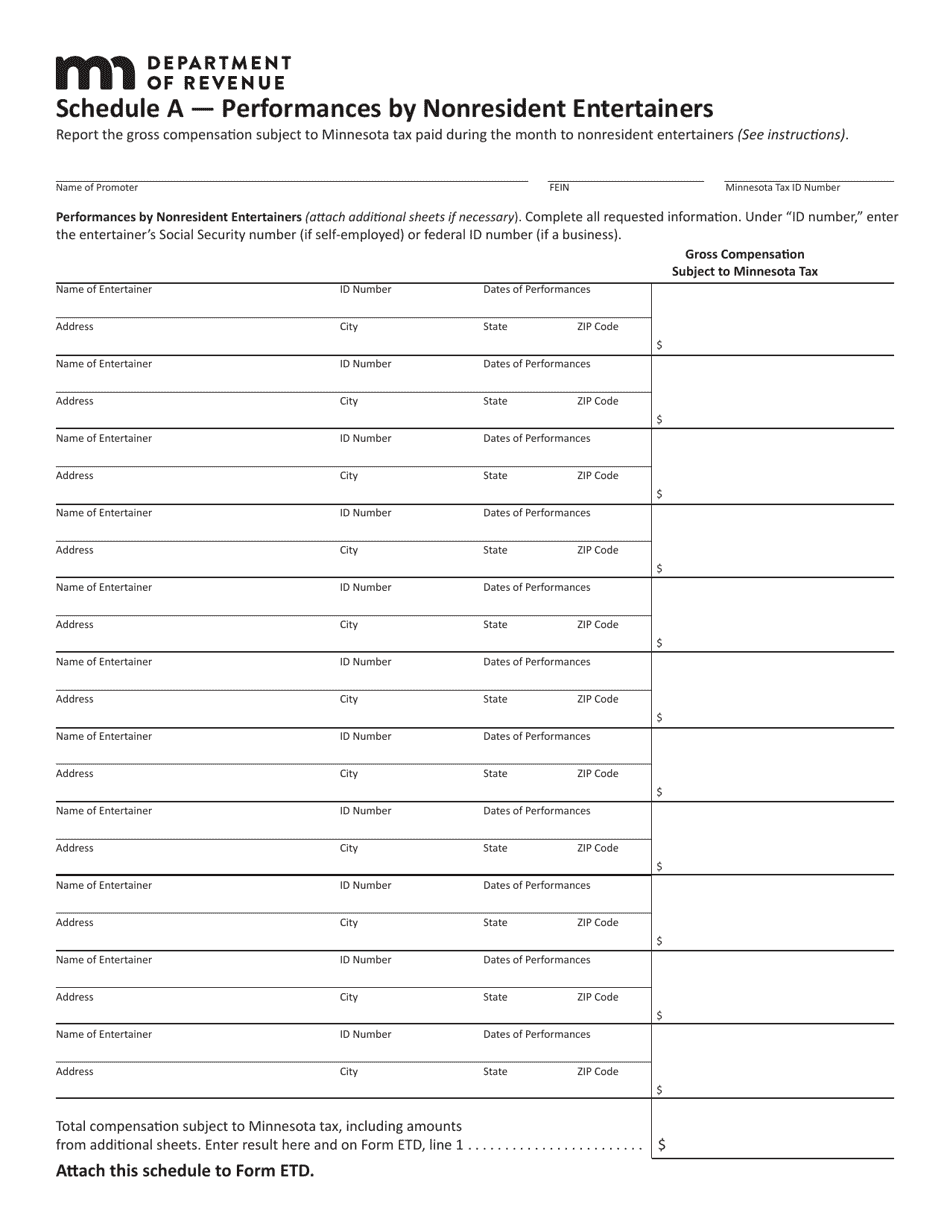

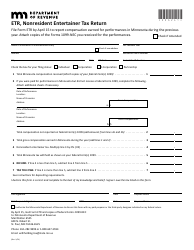

Form ETD Nonresident Entertainer Tax - Minnesota

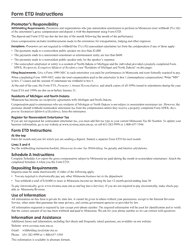

What Is Form ETD?

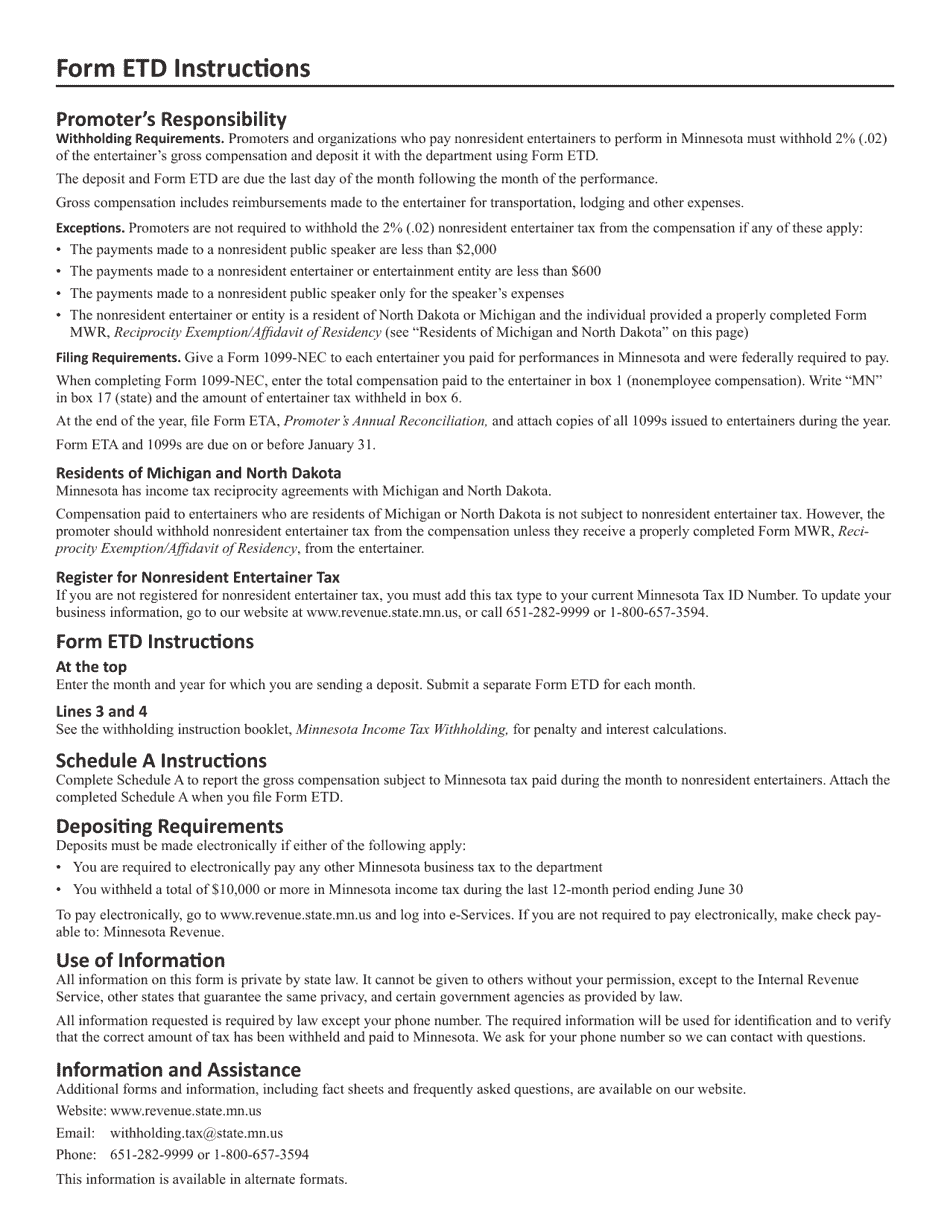

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ETD Nonresident Entertainer Tax?

A: The Form ETD Nonresident Entertainer Tax is a tax form specific to Minnesota that must be filed by nonresident entertainers who have performed in the state.

Q: Who needs to file the Form ETD Nonresident Entertainer Tax?

A: Nonresident entertainers who have performed in Minnesota need to file the Form ETD Nonresident Entertainer Tax.

Q: What is the purpose of the Form ETD Nonresident Entertainer Tax?

A: The purpose of the Form ETD Nonresident Entertainer Tax is to report and pay taxes on income earned by nonresident entertainers in Minnesota.

Q: When is the Form ETD Nonresident Entertainer Tax due?

A: The Form ETD Nonresident Entertainer Tax is due on or before the 15th day of the fourth month following the close of the entertainer's fiscal year.

Q: Are there any penalties for late or non-filing of the Form ETD Nonresident Entertainer Tax?

A: Yes, there are penalties for late or non-filing of the Form ETD Nonresident Entertainer Tax. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ETD by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.