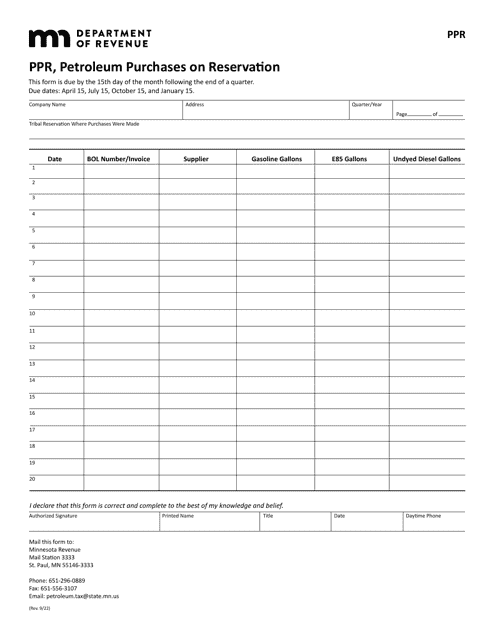

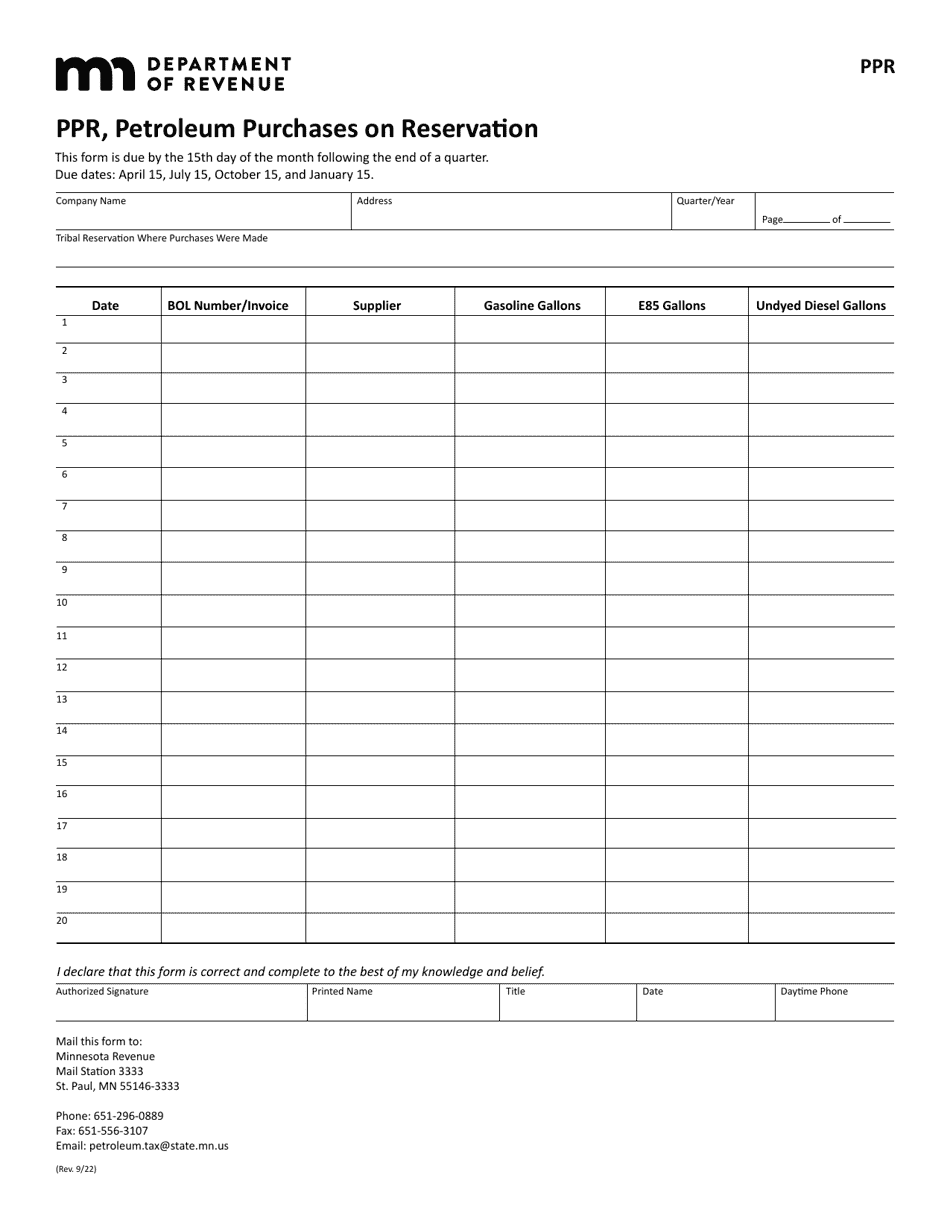

Form PPR Petroleum Purchases on Reservation - Minnesota

What Is Form PPR?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PPR Petroleum Purchases on Reservation form?

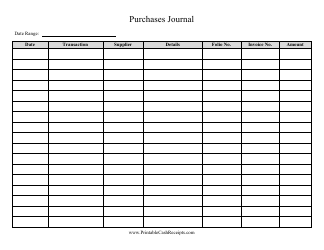

A: The PPR Petroleum Purchases on Reservation form is a document used in Minnesota for reporting petroleum purchases made on Native American reservations.

Q: Who needs to use the PPR Petroleum Purchases on Reservation form?

A: Any individual or business that purchases petroleum products on Native American reservations in Minnesota needs to use the PPR Petroleum Purchases on Reservation form.

Q: What is the purpose of the PPR Petroleum Purchases on Reservation form?

A: The purpose of this form is to report petroleum purchases made on Native American reservations in Minnesota to ensure compliance with state laws and regulations.

Q: How often do I need to submit the PPR Petroleum Purchases on Reservation form?

A: The form must be submitted on a monthly basis, with the reporting period ending on the last day of the month.

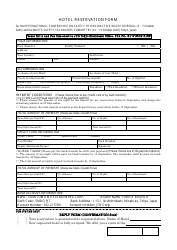

Q: What information do I need to provide on the PPR Petroleum Purchases on Reservation form?

A: You will need to provide information such as the quantity and type of petroleum products purchased, the name of the Native American reservation, and the total purchase price.

Q: Are there any penalties for not filing the PPR Petroleum Purchases on Reservation form?

A: Yes, failure to file the form or filing false or incomplete information may result in penalties, including fines and imprisonment.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPR by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.