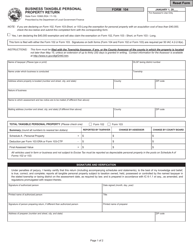

This version of the form is not currently in use and is provided for reference only. Download this version of

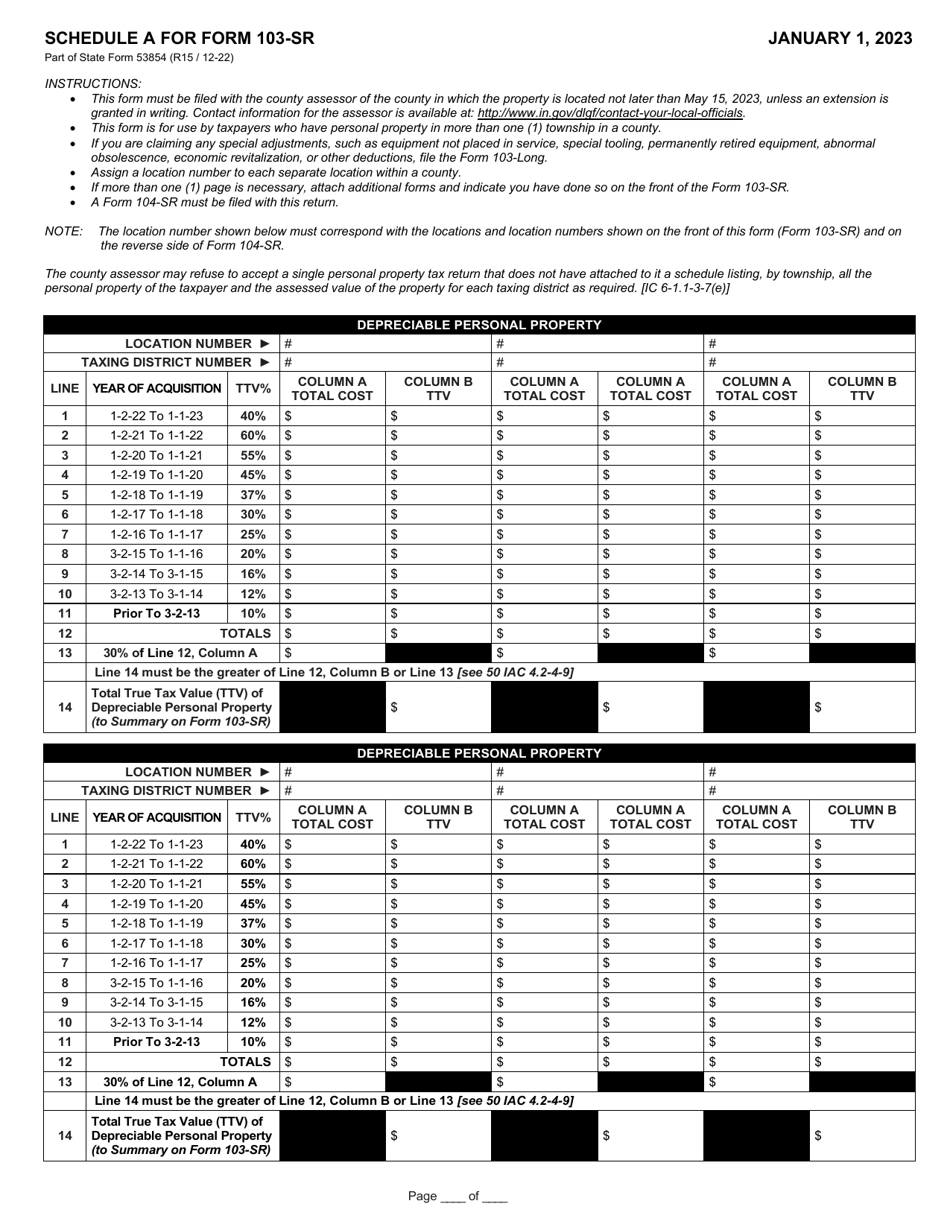

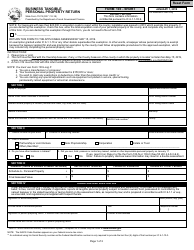

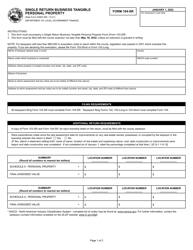

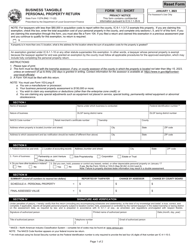

State Form 53854 (103-SR)

for the current year.

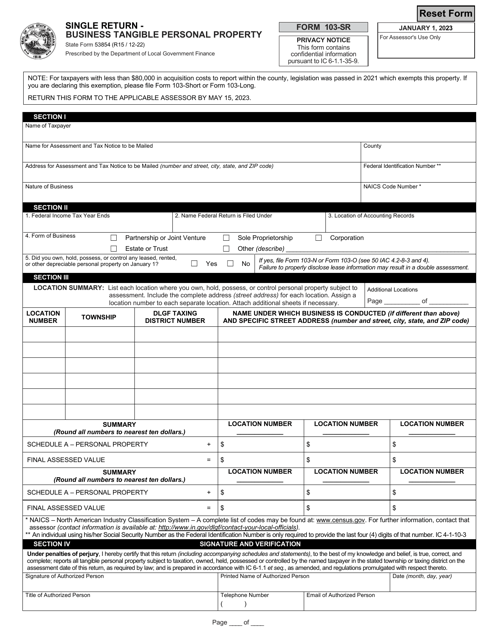

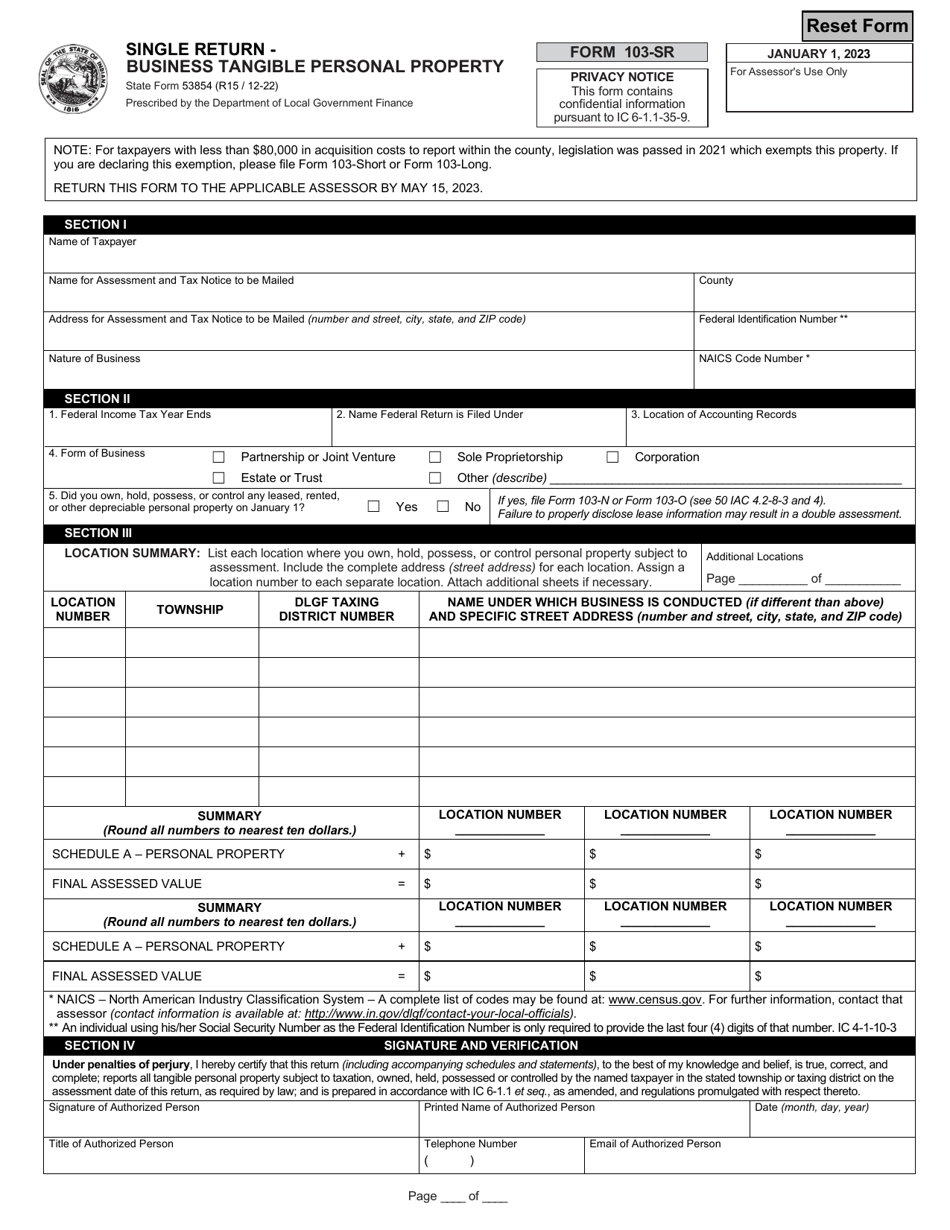

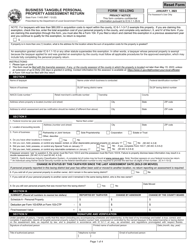

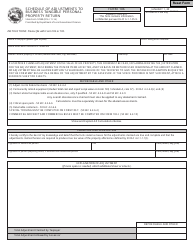

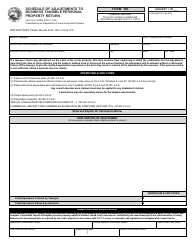

State Form 53854 (103-SR) Single Return - Business Tangible Personal Property - Indiana

What Is State Form 53854 (103-SR)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 53854 (103-SR)?

A: State Form 53854 (103-SR) is a tax return form for reporting business tangible personal property in Indiana.

Q: Who needs to file State Form 53854 (103-SR)?

A: Businesses in Indiana that own tangible personal property used in their operations need to file State Form 53854 (103-SR).

Q: What is considered business tangible personal property?

A: Business tangible personal property refers to physical assets owned by a business, such as equipment, furniture, and inventory.

Q: What is the purpose of filing State Form 53854 (103-SR)?

A: The purpose of filing State Form 53854 (103-SR) is to report the value of business tangible personal property for taxation purposes.

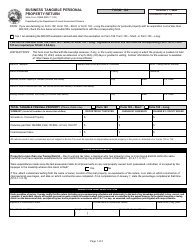

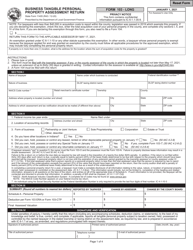

Q: When is the deadline for filing State Form 53854 (103-SR)?

A: The deadline for filing State Form 53854 (103-SR) is determined by the county assessor and varies from county to county in Indiana.

Q: Is there a fee for filing State Form 53854 (103-SR)?

A: There may be a fee associated with filing State Form 53854 (103-SR), depending on the county in Indiana. Contact your county assessor's office for more information.

Q: What happens if I don't file State Form 53854 (103-SR)?

A: Failure to file State Form 53854 (103-SR) may result in penalties and interest on unpaid taxes. It is important to comply with the filing requirements.

Q: Can I e-file State Form 53854 (103-SR)?

A: E-filing options for State Form 53854 (103-SR) may be available in some counties in Indiana. Contact your county assessor's office for more information.

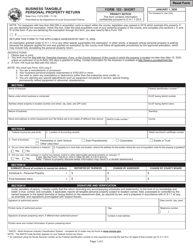

Q: Is State Form 53854 (103-SR) the only tax form I need to file for my business?

A: State Form 53854 (103-SR) is specifically for reporting business tangible personal property. Depending on your business activities, you may need to file other tax forms as well. Consult with a tax professional or the Indiana Department of Revenue for guidance.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53854 (103-SR) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.