This version of the form is not currently in use and is provided for reference only. Download this version of

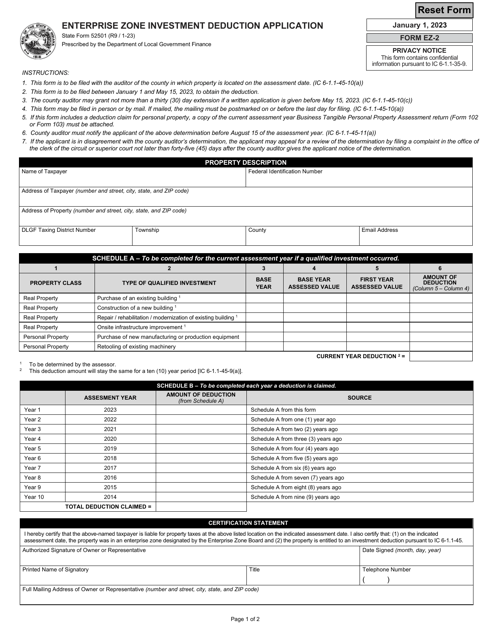

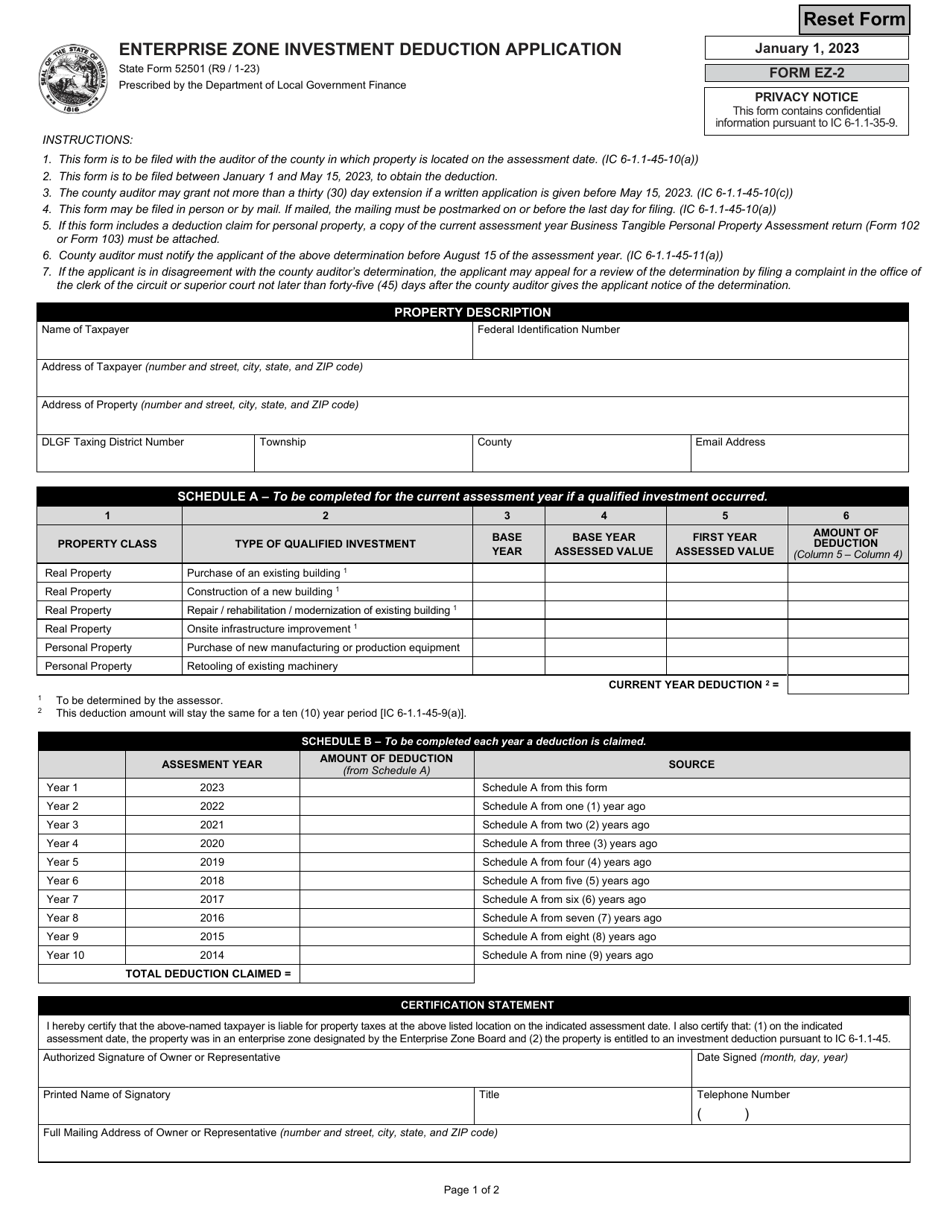

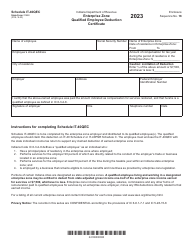

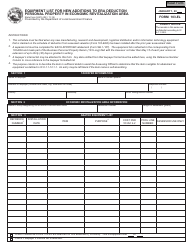

State Form 52501 (EZ-2)

for the current year.

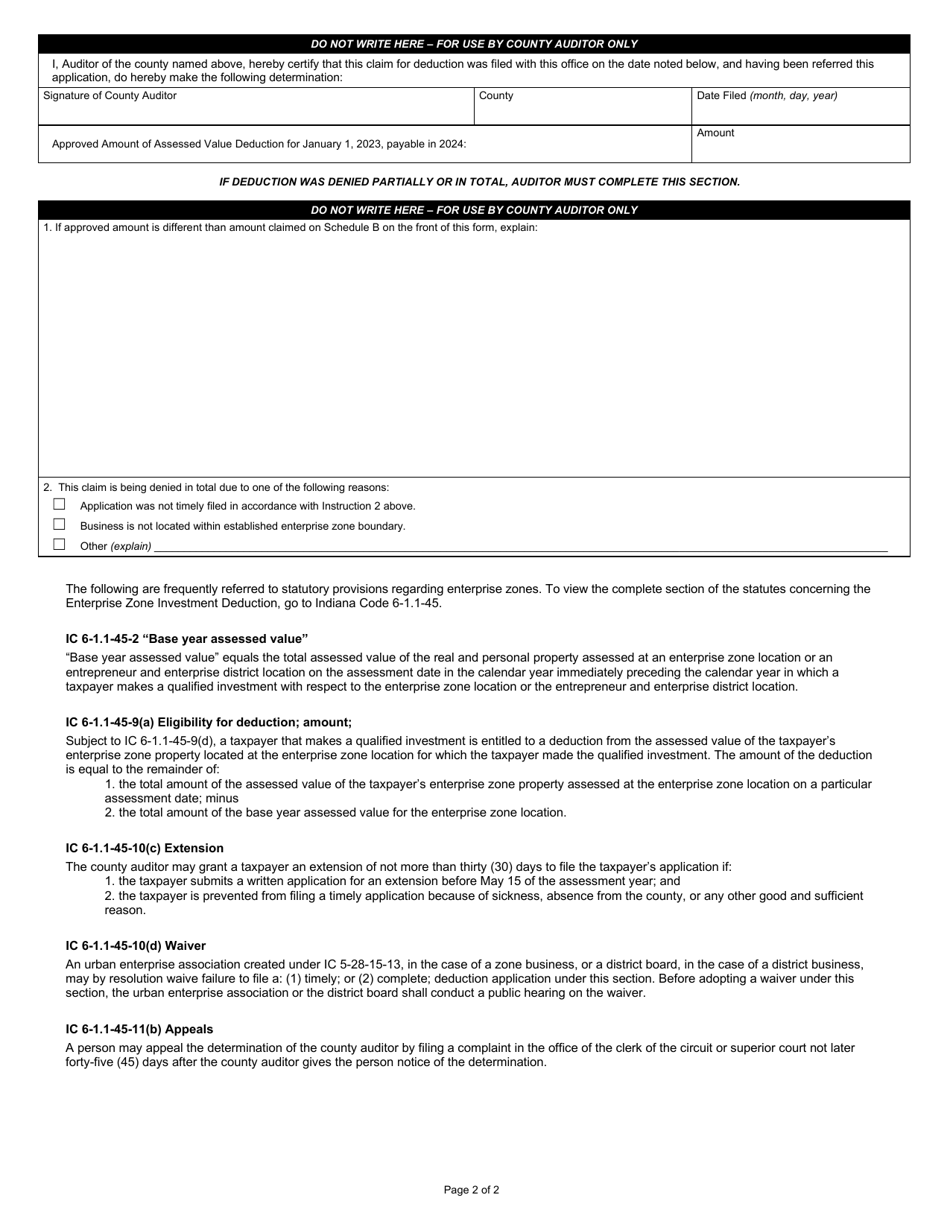

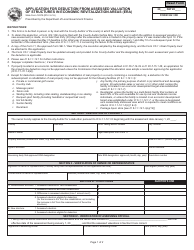

State Form 52501 (EZ-2) Enterprise Zone Investment Deduction Application - Indiana

What Is State Form 52501 (EZ-2)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52501 (EZ-2)?

A: State Form 52501 (EZ-2) is the Enterprise Zone Investment Deduction Application for the state of Indiana.

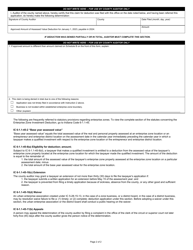

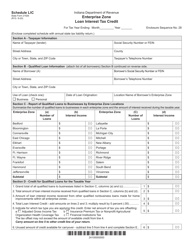

Q: What is the Enterprise Zone Investment Deduction?

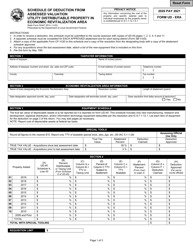

A: The Enterprise Zone Investment Deduction is a tax incentive program offered by the state of Indiana to encourage business development and investment in designated enterprise zones.

Q: Who is eligible for the Enterprise Zone Investment Deduction?

A: Businesses that make qualifying investments within designated enterprise zones in Indiana may be eligible for the deduction.

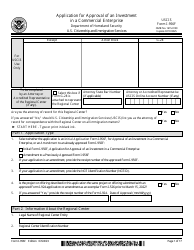

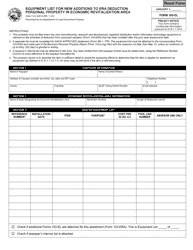

Q: How do I apply for the Enterprise Zone Investment Deduction?

A: To apply for the deduction, you need to complete and submit State Form 52501 (EZ-2), also known as the Enterprise Zone Investment Deduction Application.

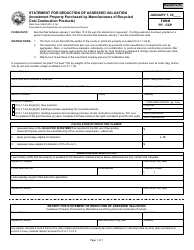

Q: What information do I need to provide in the application?

A: The application will require you to provide details about your business, the investment made in the enterprise zone, and any other necessary supporting documentation.

Q: Are there any deadlines for submitting the application?

A: The deadline for submitting the Enterprise Zone Investment Deduction Application may vary, so it is important to check the specific requirements and deadlines set by the Indiana Department of Revenue.

Q: What are the benefits of the Enterprise Zone Investment Deduction?

A: The deduction allows eligible businesses to reduce their state tax liability by a certain percentage of the investment made in the enterprise zone.

Q: Are there any limitations or conditions for the deduction?

A: Yes, there are certain limitations and conditions that may apply, such as a minimum investment threshold and specific requirements for the enterprise zone designation.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52501 (EZ-2) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.