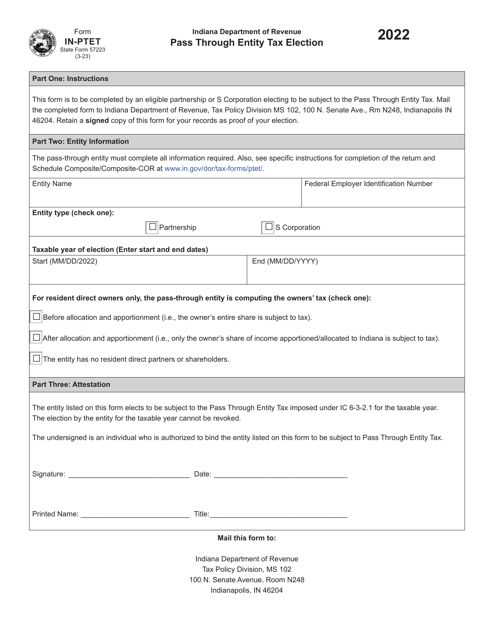

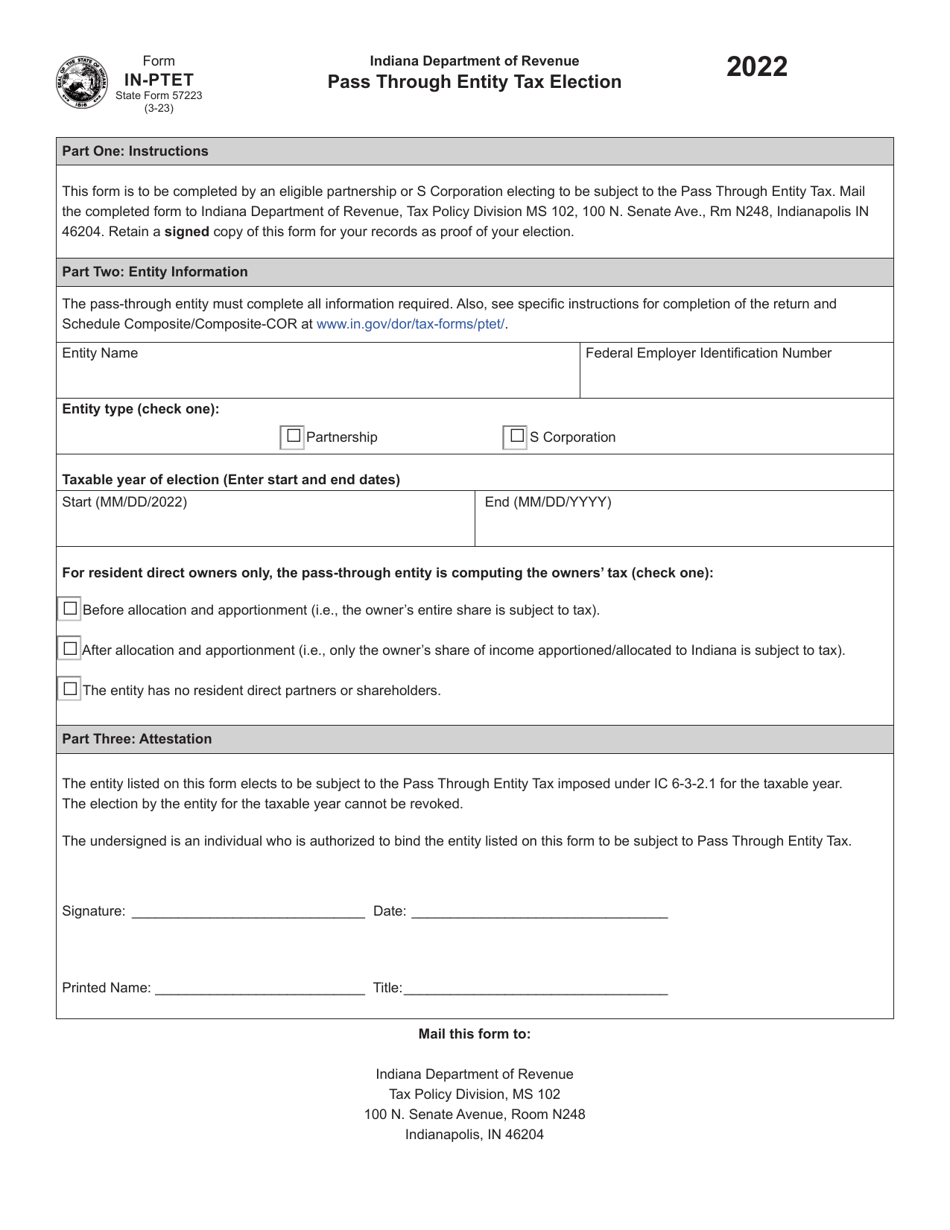

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IN-PTET (State Form 57223)

for the current year.

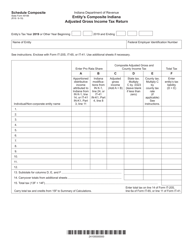

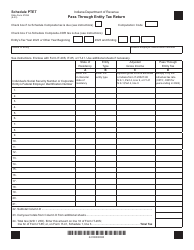

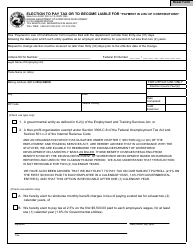

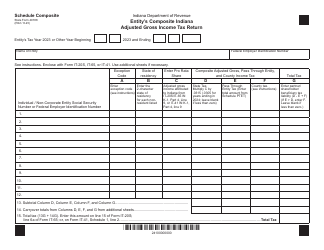

Form IN-PTET (State Form 57223) Pass Through Entity Tax Election - Indiana

What Is Form IN-PTET (State Form 57223)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IN-PTET form?

A: The IN-PTET form is the Pass Through Entity Tax Election form in Indiana.

Q: What is the purpose of the IN-PTET form?

A: The purpose of the IN-PTET form is to elect to pay the Pass Through Entity Tax.

Q: What is the Pass Through Entity Tax?

A: The Pass Through Entity Tax is a tax paid by certain business entities in Indiana.

Q: Who needs to file the IN-PTET form?

A: Business entities that qualify as pass-through entities in Indiana need to file the IN-PTET form.

Q: Is the IN-PTET form mandatory?

A: No, the IN-PTET form is not mandatory. It is an optional election to pay the Pass Through Entity Tax.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-PTET (State Form 57223) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.