This version of the form is not currently in use and is provided for reference only. Download this version of

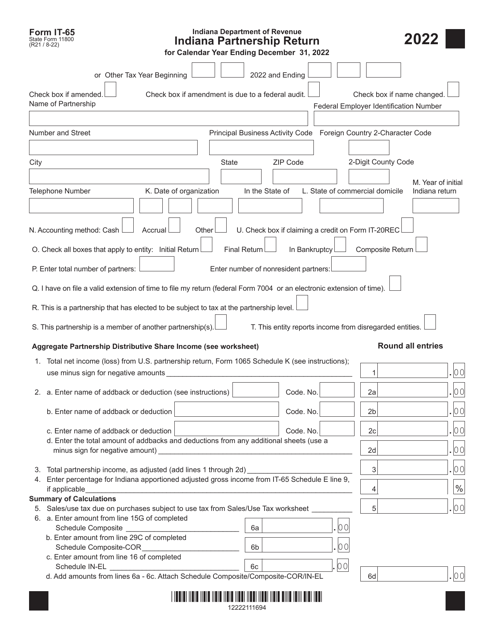

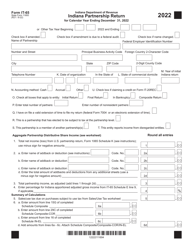

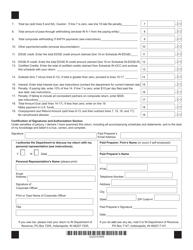

Form IT-65 (State Form 11800)

for the current year.

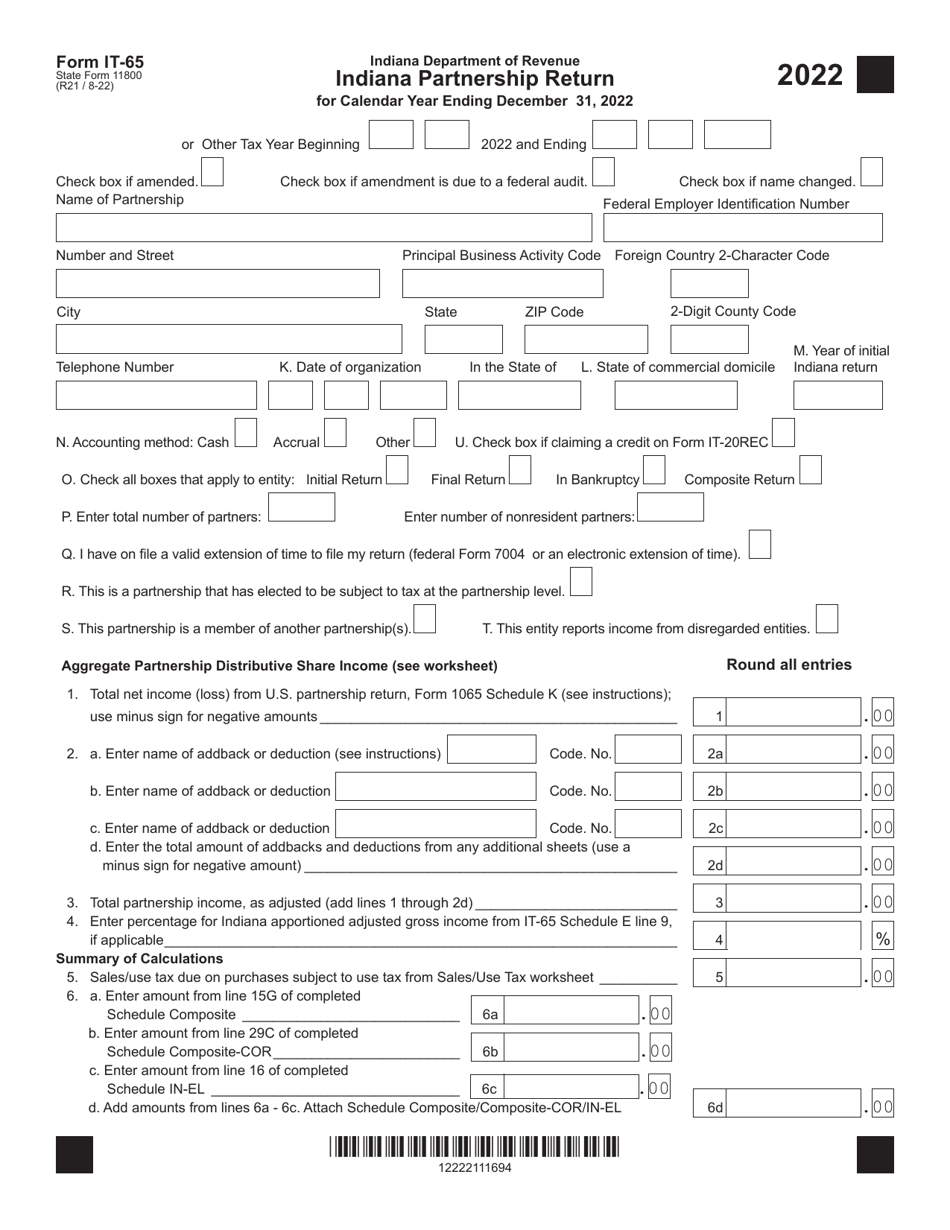

Form IT-65 (State Form 11800) Indiana Partnership Return - Indiana

What Is Form IT-65 (State Form 11800)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-65 (State Form 11800)?

A: Form IT-65 is the Indiana Partnership Return, also known as State Form 11800.

Q: Who needs to file Form IT-65?

A: Partnerships in Indiana are required to file Form IT-65.

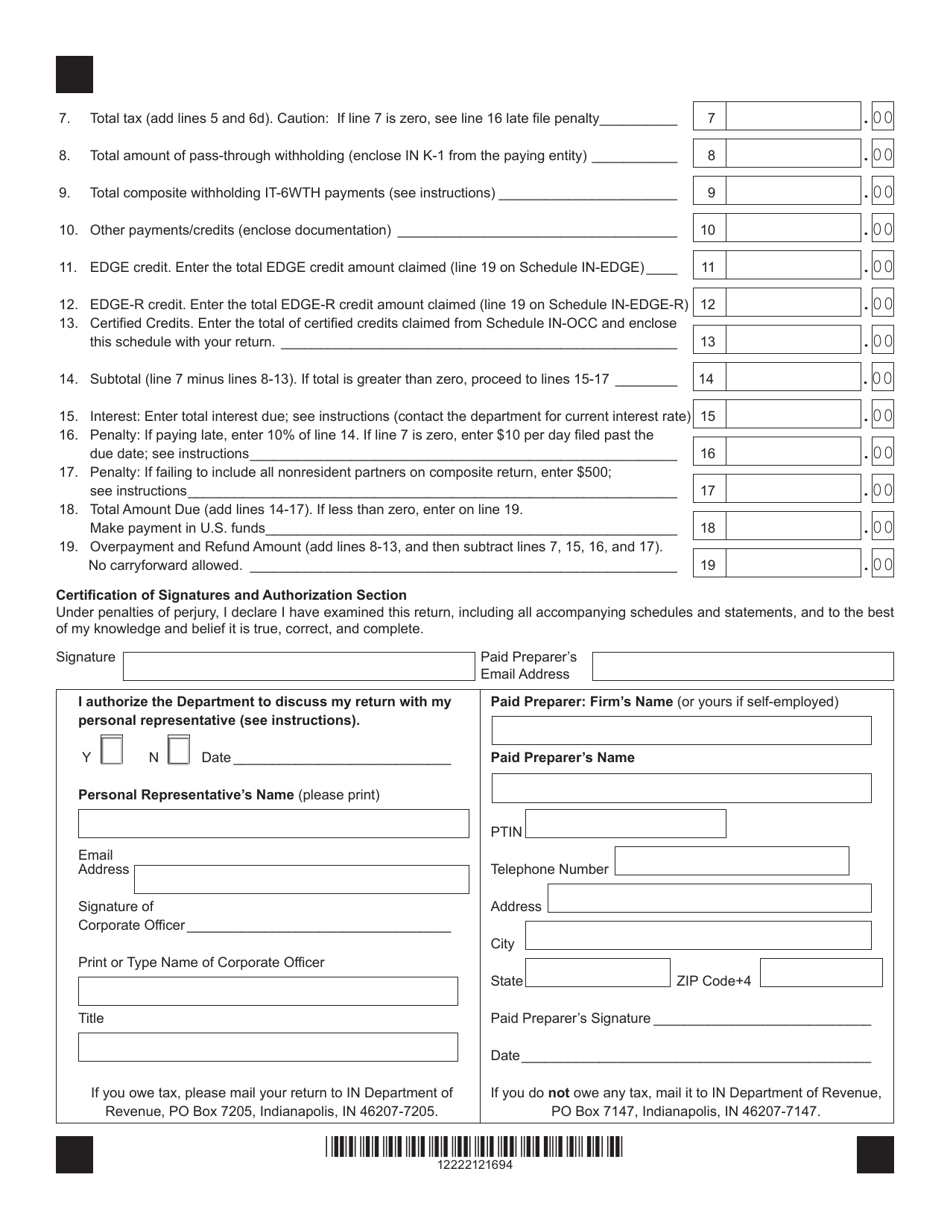

Q: What information is required on Form IT-65?

A: Form IT-65 requires information about the partnership's income, expenses, deductions, and credits.

Q: When is Form IT-65 due?

A: Form IT-65 is due on the 15th day of the 4th month after the close of the partnership's taxable year.

Q: Are there any penalties for late filing of Form IT-65?

A: Yes, there are penalties for late filing of Form IT-65. It is important to file the return on time to avoid penalties and interest charges.

Q: What if I need more time to file Form IT-65?

A: If you need more time to file Form IT-65, you can request a filing extension. However, any tax due must still be paid by the original due date.

Q: Do I need to include any supporting documents with Form IT-65?

A: You may be required to include supporting documents, such as Schedule K-1s, with Form IT-65. Check the instructions for the specific requirements.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-65 (State Form 11800) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.