This version of the form is not currently in use and is provided for reference only. Download this version of

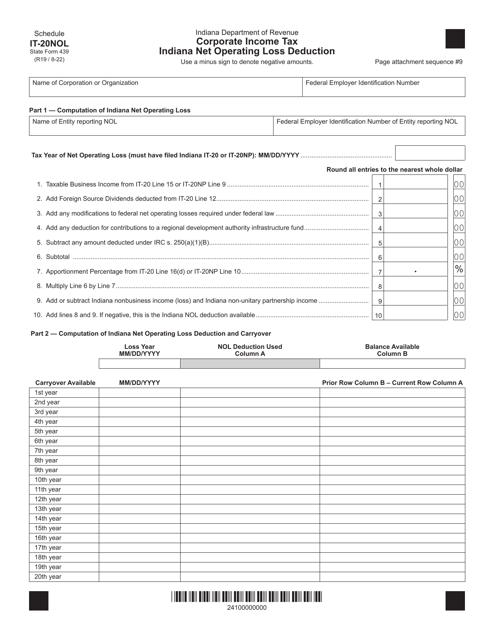

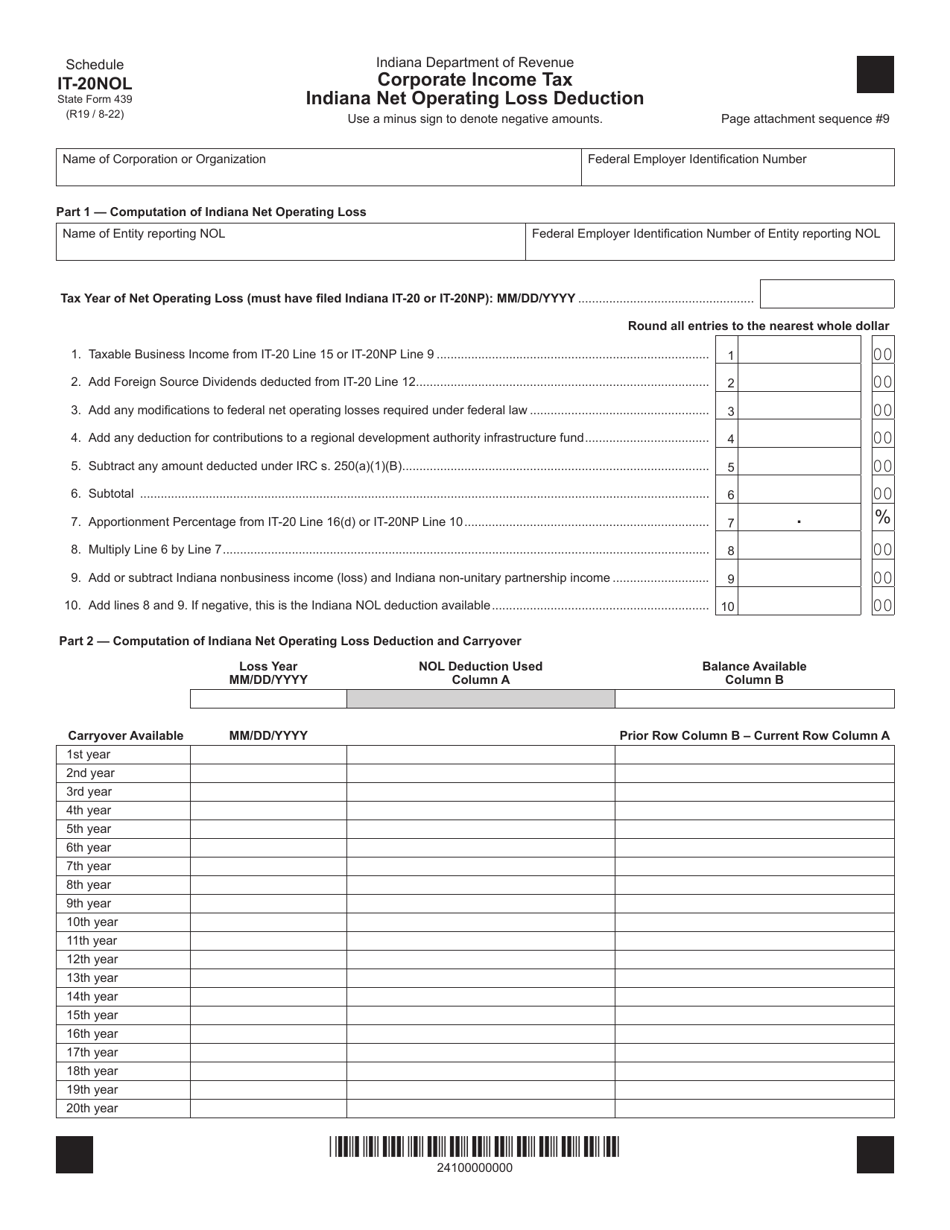

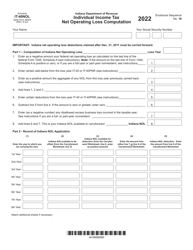

State Form 439 Schedule IT-20NOL

for the current year.

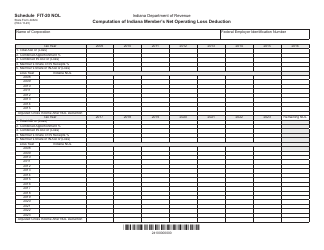

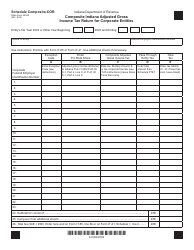

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

What Is State Form 439 Schedule IT-20NOL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 439 Schedule IT-20NOL?

A: Form 439 Schedule IT-20NOL is a specific form used for corporate incometax filing in Indiana.

Q: What does IT-20NOL stand for?

A: IT-20NOL stands for Indiana Net Operating Loss.

Q: What is the purpose of Form 439 Schedule IT-20NOL?

A: The purpose of Form 439 Schedule IT-20NOL is to calculate and claim the net operating loss deduction for corporate income tax filing in Indiana.

Q: Who is required to file Form 439 Schedule IT-20NOL?

A: Corporations in Indiana that have incurred a net operating loss during the tax year are required to file Form 439 Schedule IT-20NOL.

Q: What is a net operating loss?

A: A net operating loss occurs when a company's deductible expenses exceed its taxable income.

Q: How does the net operating loss deduction work?

A: The net operating loss deduction allows corporations to offset their current year's taxable income by deducting their net operating losses from previous years.

Q: Are there any limitations to the net operating loss deduction?

A: Yes, there are certain limitations and restrictions on the net operating loss deduction, including carryback and carryforward periods.

Q: Is Form 439 Schedule IT-20NOL the only form required for corporate income tax filing in Indiana?

A: No, besides Form 439 Schedule IT-20NOL, corporations in Indiana are also required to file Form IT-20 to report their income and calculate their tax liability.

Q: Are there any specific instructions for filling out Form 439 Schedule IT-20NOL?

A: Yes, the form comes with detailed instructions that provide guidance on how to complete each section accurately.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 439 Schedule IT-20NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.