This version of the form is not currently in use and is provided for reference only. Download this version of

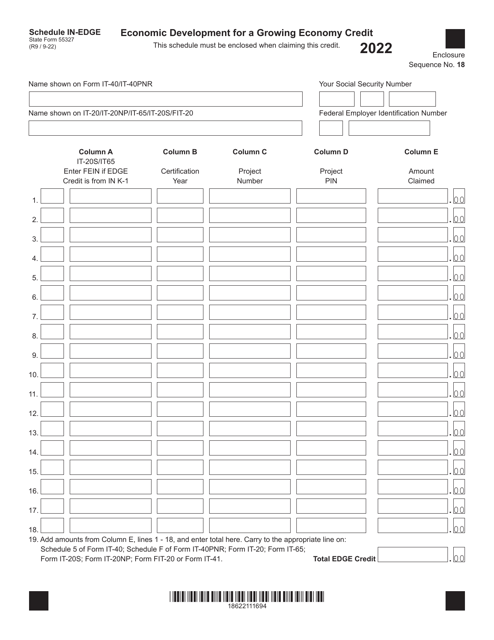

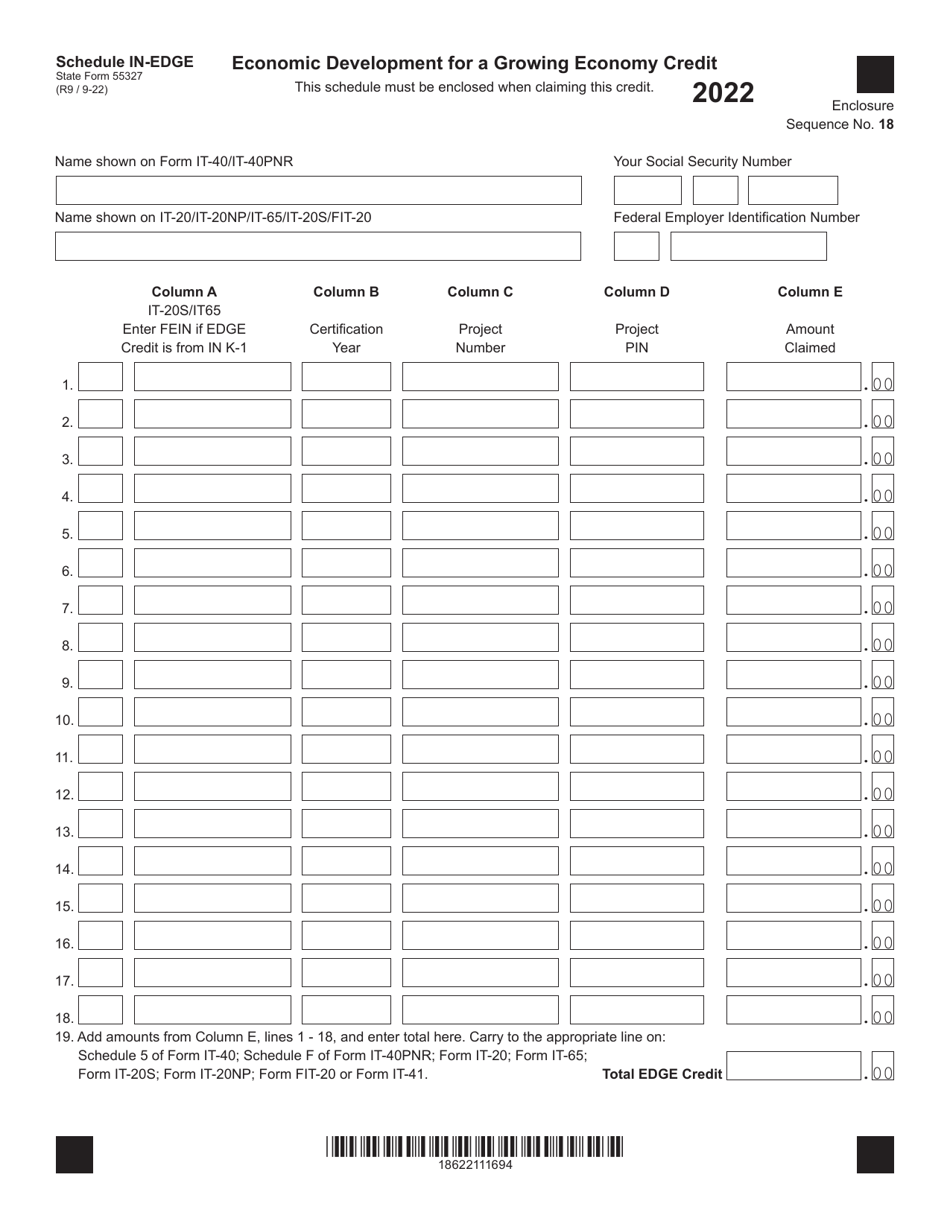

State Form 55327 Schedule IN-EDGE

for the current year.

State Form 55327 Schedule IN-EDGE Economic Development for a Growing Economy Credit - Indiana

What Is State Form 55327 Schedule IN-EDGE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55327?

A: State Form 55327 is a schedule used for claiming the Economic Development for a Growing Economy Credit in Indiana.

Q: What is the purpose of Schedule IN-EDGE?

A: Schedule IN-EDGE is used to claim the Economic Development for a Growing Economy Credit, which is aimed at promoting economic development in Indiana.

Q: Who can claim the Economic Development for a Growing Economy Credit?

A: Businesses that qualify under the guidelines set by the Indiana Department of Revenue can claim this credit.

Q: What is the Economic Development for a Growing Economy Credit?

A: The Economic Development for a Growing Economy (EDGE) Credit is a tax credit offered in Indiana to encourage businesses to create jobs and invest in the state.

Q: How can businesses qualify for the Economic Development for a Growing Economy Credit?

A: Businesses must meet certain requirements, such as job creation and capital investment goals, as specified by the Indiana Department of Revenue.

Q: Are there any deadlines for filing Schedule IN-EDGE?

A: Yes, businesses must file Schedule IN-EDGE by the due date specified by the Indiana Department of Revenue.

Q: What are the benefits of claiming the Economic Development for a Growing Economy Credit?

A: By claiming this credit, businesses can receive tax incentives that can help them expand, create jobs, and contribute to the economic growth of Indiana.

Q: Is there any additional documentation required when filing Schedule IN-EDGE?

A: Yes, businesses may need to provide supporting documentation, such as proof of job creation and capital investment, to substantiate their claim for the credit.

Q: Can individuals claim the Economic Development for a Growing Economy Credit?

A: No, the Economic Development for a Growing Economy Credit is only available to businesses that meet the qualifying criteria set by the Indiana Department of Revenue.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55327 Schedule IN-EDGE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.