This version of the form is not currently in use and is provided for reference only. Download this version of

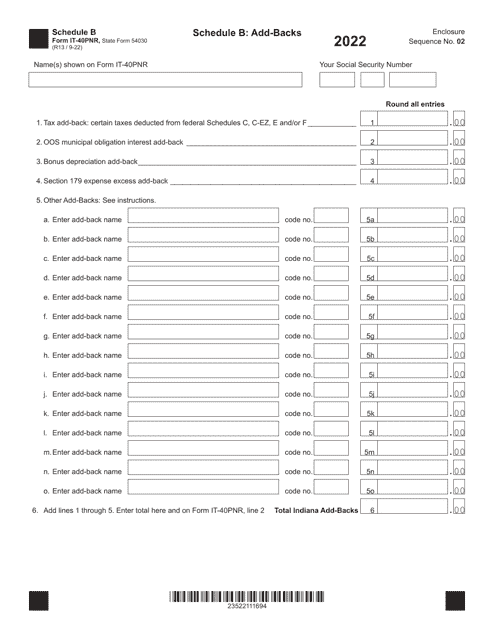

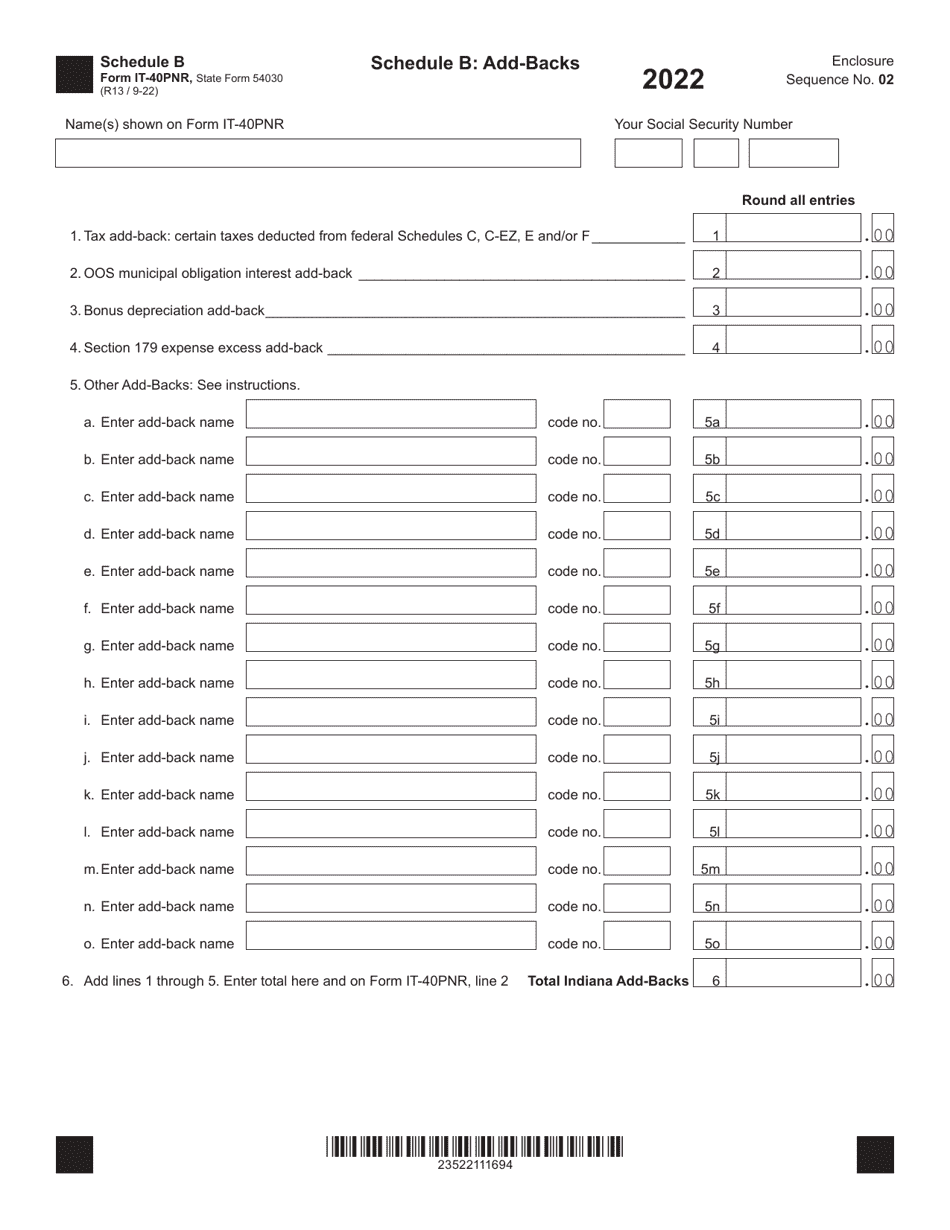

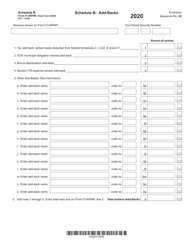

Form IT-40PNR (State Form 54030) Schedule B

for the current year.

Form IT-40PNR (State Form 54030) Schedule B Add-Backs - Indiana

What Is Form IT-40PNR (State Form 54030) Schedule B?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is a tax form used by non-residents of Indiana to report their income and calculate their state taxes.

Q: What is Schedule B Add-Backs?

A: Schedule B Add-Backs is a part of Form IT-40PNR where certain deductions or exemptions are added back to your income.

Q: What does 'Add-Backs' mean?

A: 'Add-Backs' refers to certain deductions or exemptions that are normally allowed on federal tax returns but need to be added back to your income on the state tax return.

Q: Why are add-backs required?

A: Add-backs are required to ensure that non-residents are not claiming deductions or exemptions that are not allowed under Indiana's tax laws.

Q: What are some examples of items that may need to be added back?

A: Some examples include federal installment sales income, net operating losses, and certain deductions related to education or retirement savings.

Q: Do all non-residents need to complete Schedule B Add-Backs?

A: Not all non-residents need to complete Schedule B Add-Backs. It depends on their specific income and deductions.

Q: What happens if I don't include the required add-backs?

A: If you fail to include the required add-backs, you may be subject to penalties or audits by the Indiana Department of Revenue.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54030) Schedule B by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.