This version of the form is not currently in use and is provided for reference only. Download this version of

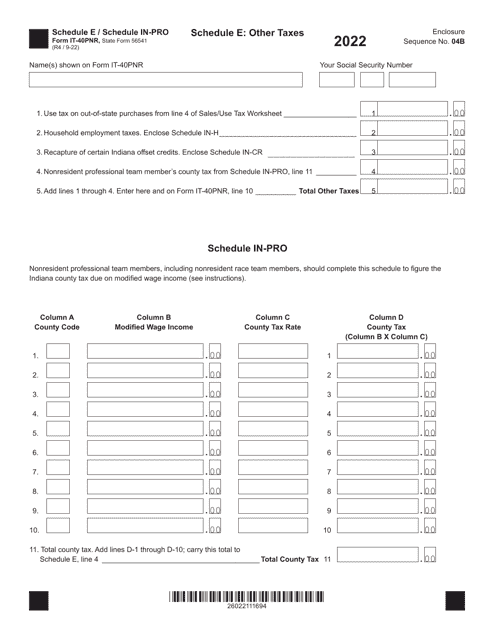

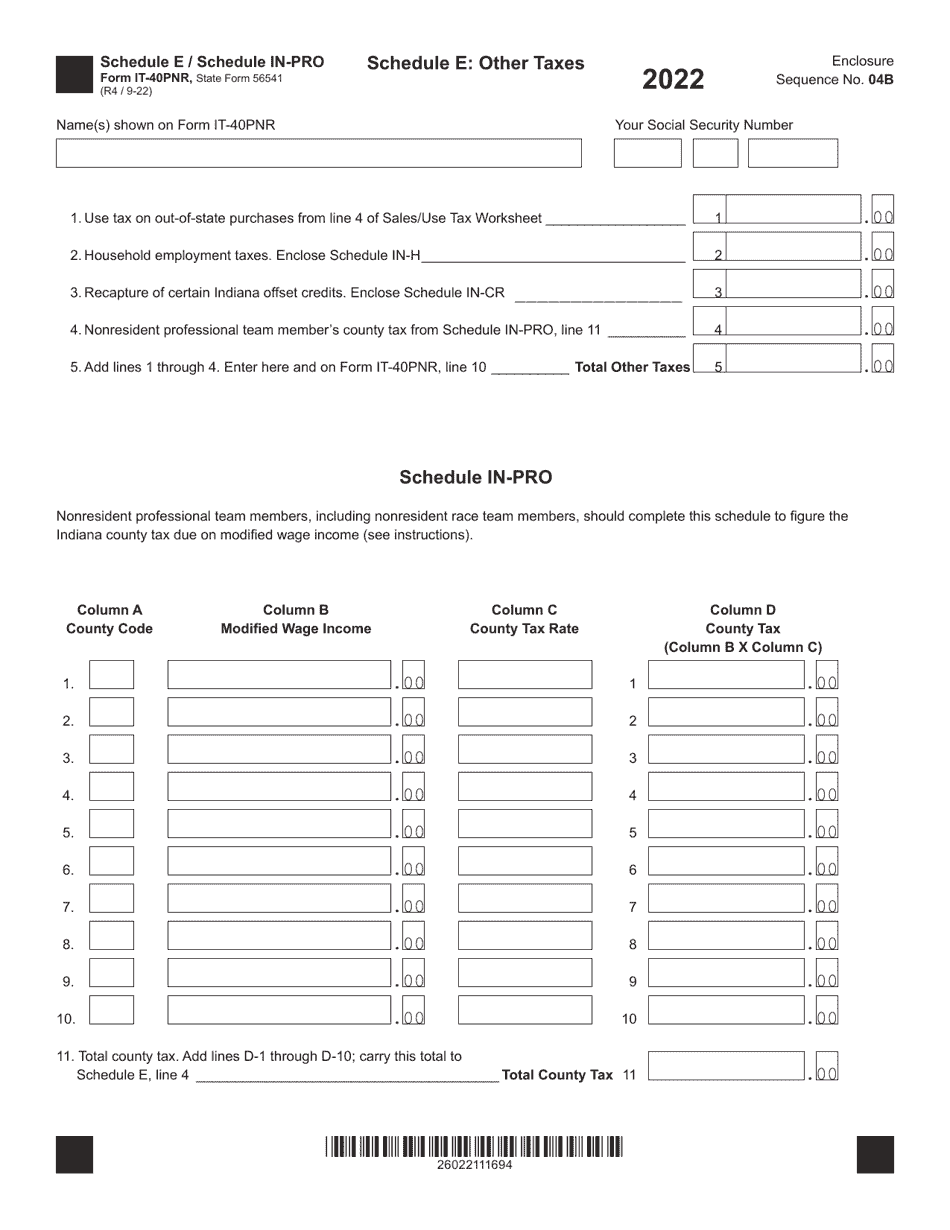

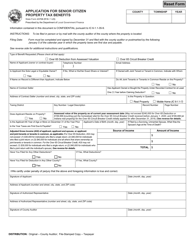

Form IT-40PNR (State Form 56541) Schedule E, IN-PRO

for the current year.

Form IT-40PNR (State Form 56541) Schedule E, IN-PRO Other Taxes / Nonresident Professional Team Members - Indiana

What Is Form IT-40PNR (State Form 56541) Schedule E, IN-PRO?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is the Indiana Nonresident/Part-Year Resident Individual Income Tax Return.

Q: What is Schedule E?

A: Schedule E is a section of Form IT-40PNR used to report other taxes and nonresident professional team member income in Indiana.

Q: Who needs to file Schedule E?

A: Nonresident individuals who have income from nonresident professional team member activities in Indiana need to file Schedule E.

Q: What are examples of other taxes reported on Schedule E?

A: Examples of other taxes reported on Schedule E include county innkeeper's tax, county food and beverage tax, and county auto rental excise tax.

Q: What is a nonresident professional team member?

A: A nonresident professional team member is an individual who is employed by a professional team based in Indiana but is not a resident of Indiana.

Q: How do I complete Schedule E?

A: You will need to provide information about the specific taxes you owe and include the amounts paid on Schedule E, along with any other required documentation.

Q: Do I need to file Schedule E if I am a resident of Indiana?

A: No, Schedule E is specifically for nonresident individuals who have income from nonresident professional team member activities in Indiana.

Q: What happens if I don't file Schedule E?

A: If you are required to file Schedule E but fail to do so, you may be subject to penalties and interest on the taxes owed.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 56541) Schedule E, IN-PRO by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.