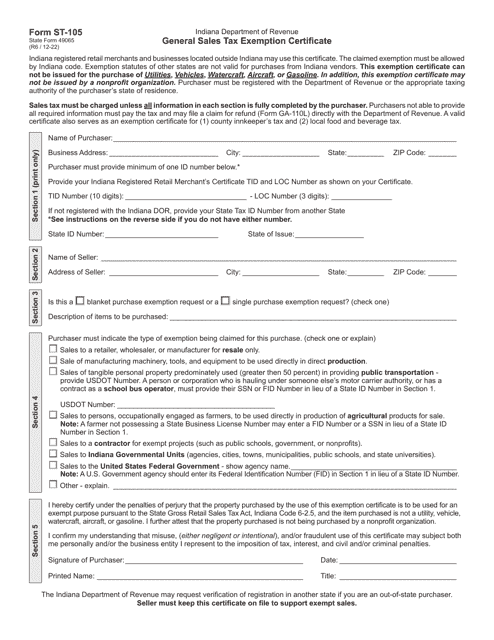

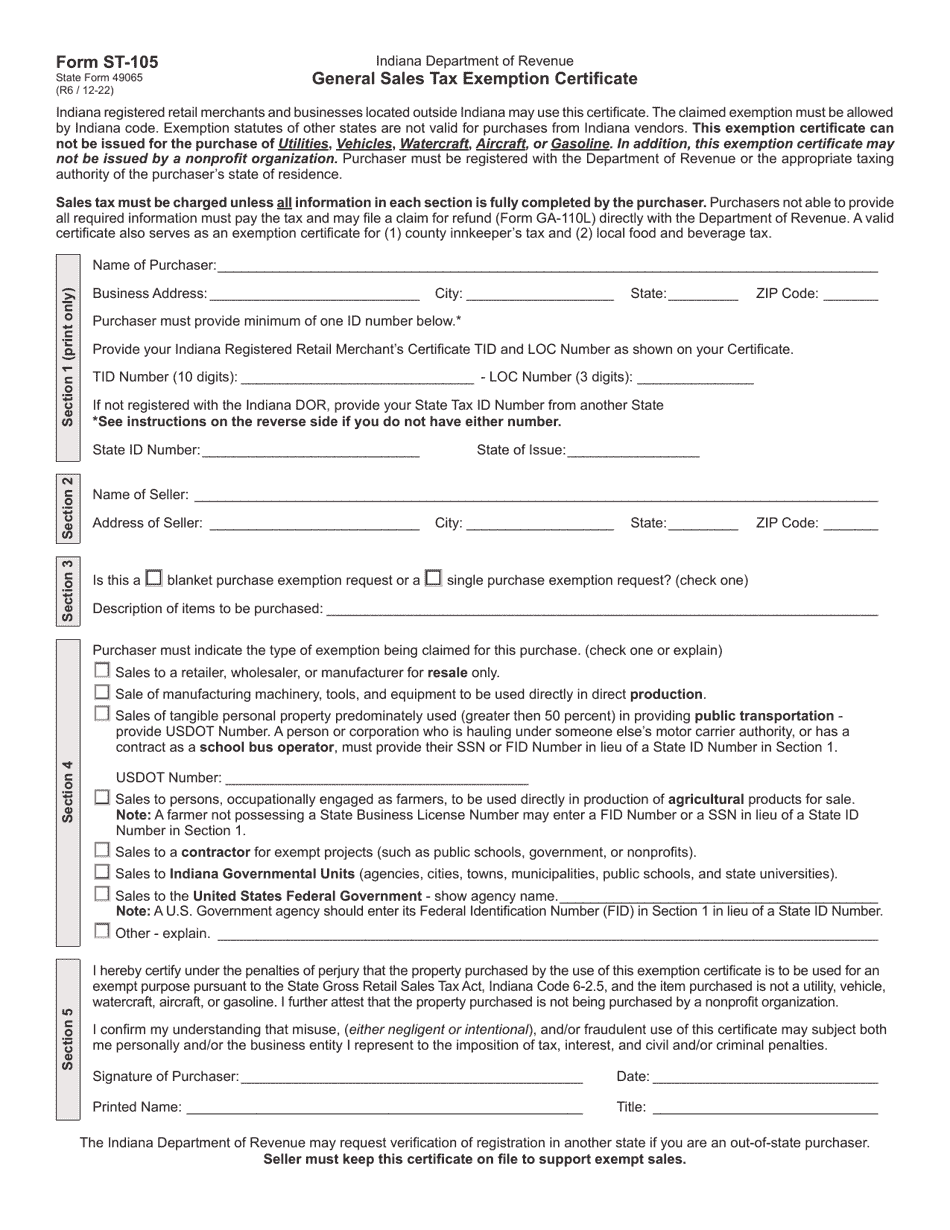

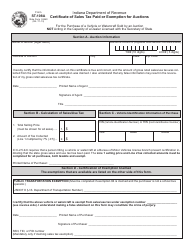

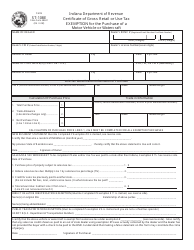

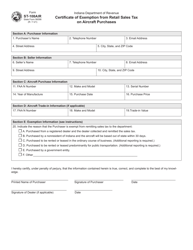

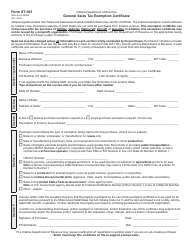

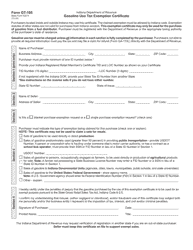

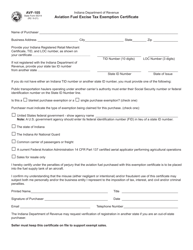

Form ST-105 (State Form 49065) General Sales Tax Exemption Certificate - Indiana

What Is Form ST-105 (State Form 49065)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-105?

A: Form ST-105 is a General Sales Tax Exemption Certificate specific to the state of Indiana.

Q: What is the purpose of Form ST-105?

A: The purpose of Form ST-105 is to claim exemption from sales tax on qualifying purchases in Indiana.

Q: Who can use Form ST-105?

A: Form ST-105 can be used by individuals and businesses who are eligible for sales tax exemptions in Indiana.

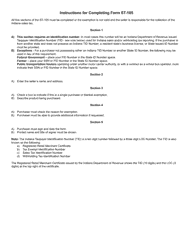

Q: How do I fill out Form ST-105?

A: You must provide your name, address, and tax identification number, along with details of the exempt purchase and the reason for exemption.

Q: Can I use Form ST-105 for all types of purchases?

A: No, Form ST-105 can only be used for qualifying purchases that are eligible for sales tax exemption in Indiana.

Q: How long is Form ST-105 valid for?

A: Form ST-105 is typically valid for one year from the date of issue, unless otherwise stated.

Q: Do I need to keep a copy of Form ST-105?

A: Yes, it is recommended to keep a copy of Form ST-105 for your records in case of future audits or inquiries.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-105 (State Form 49065) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.