This version of the form is not currently in use and is provided for reference only. Download this version of

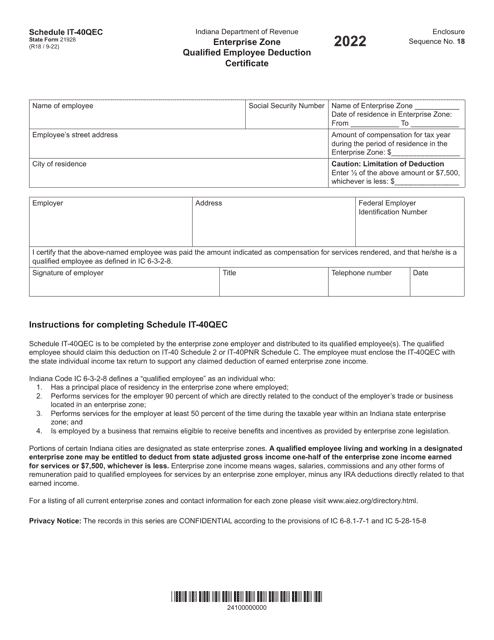

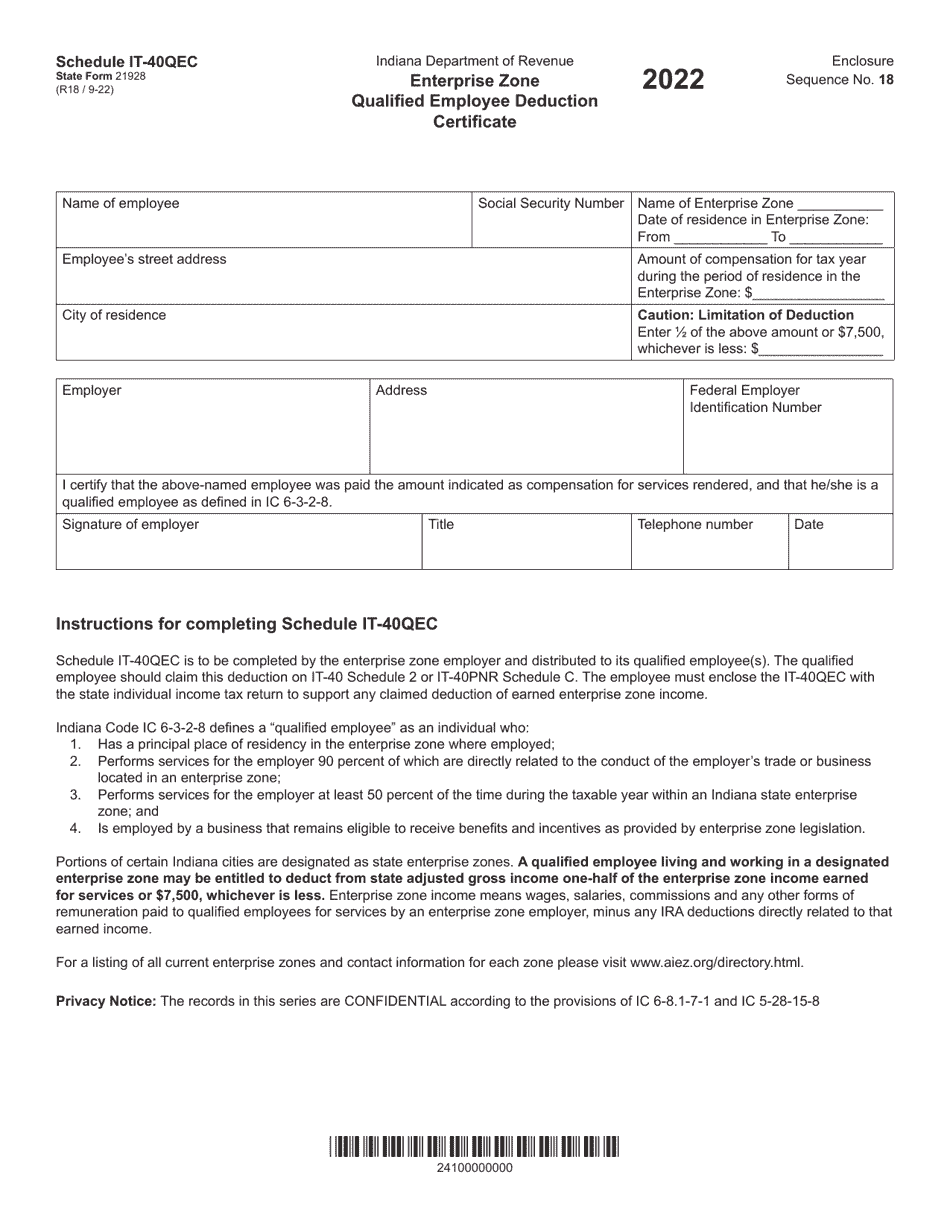

State Form 21928 Schedule IT-40QEC

for the current year.

State Form 21928 Schedule IT-40QEC Enterprise Zone Qualified Employee Deduction Certificate - Indiana

What Is State Form 21928 Schedule IT-40QEC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21928 Schedule IT-40QEC?

A: Form 21928 Schedule IT-40QEC is a document used in Indiana to claim the Enterprise Zone Qualified Employee Deduction.

Q: What is the Enterprise Zone Qualified Employee Deduction?

A: The Enterprise Zone Qualified Employee Deduction is a tax deduction available in Indiana for employees working in designated enterprise zones.

Q: Who can claim the Enterprise Zone Qualified Employee Deduction?

A: Employers in Indiana who have employees working in designated enterprise zones can claim this deduction.

Q: What information is required on Form 21928 Schedule IT-40QEC?

A: Form 21928 Schedule IT-40QEC requires information about the qualified employees, including their names, social security numbers, and the number of days they worked in the enterprise zone.

Q: When is the deadline to file Form 21928 Schedule IT-40QEC?

A: The deadline to file Form 21928 Schedule IT-40QEC is typically the same as the deadline for filing your annual state tax return in Indiana.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 21928 Schedule IT-40QEC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.