This version of the form is not currently in use and is provided for reference only. Download this version of

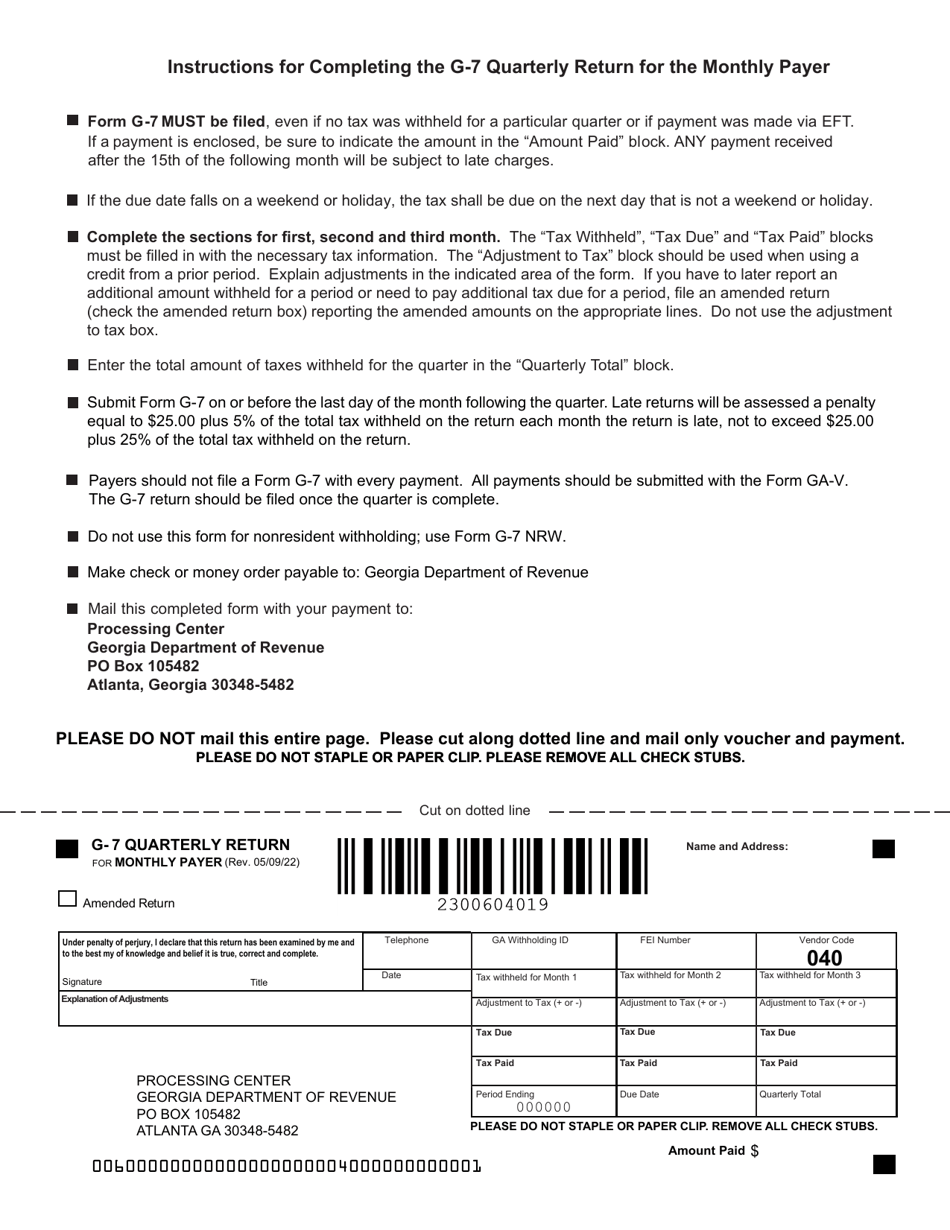

Form G-7

for the current year.

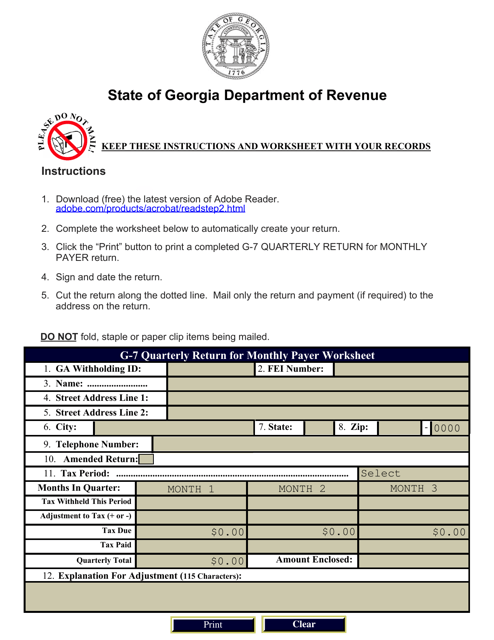

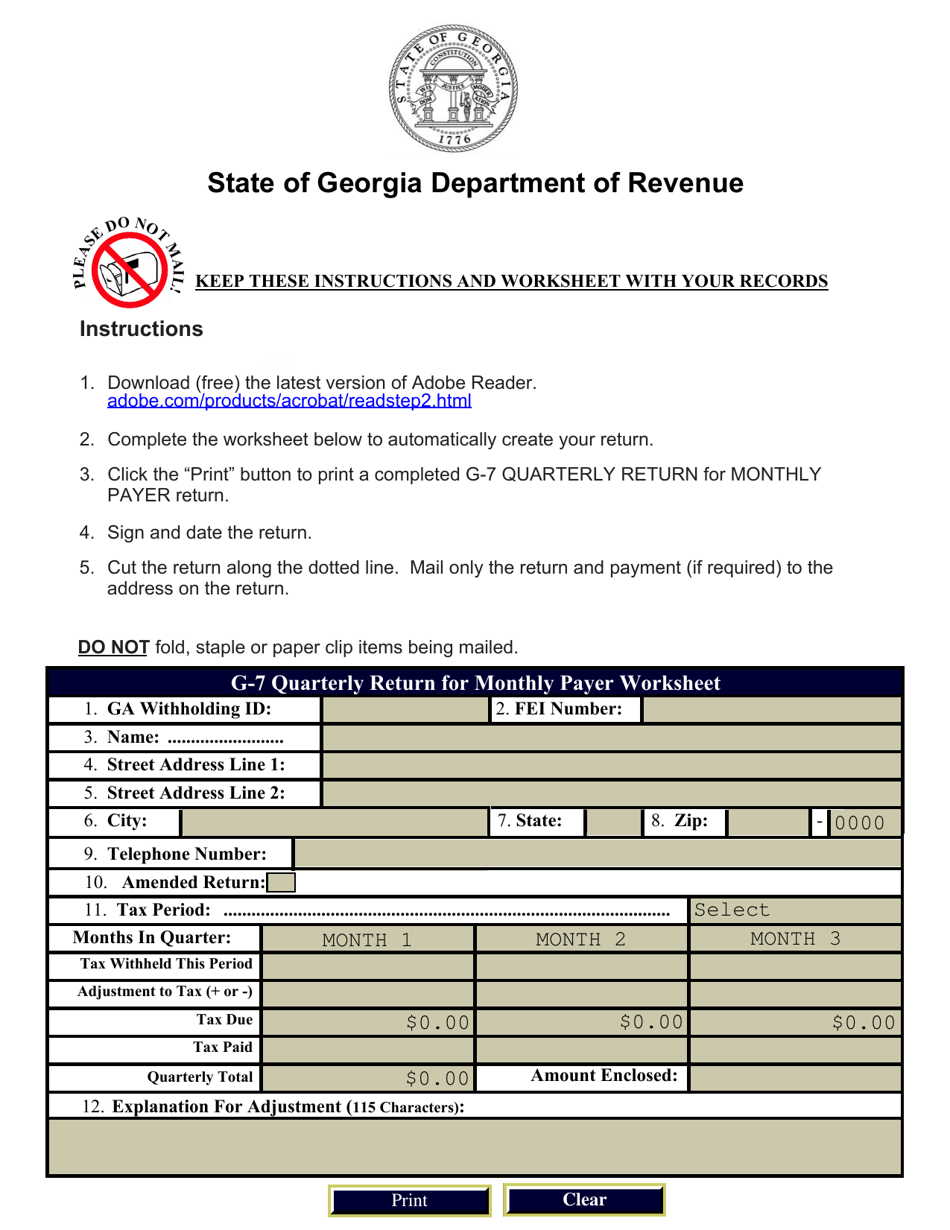

Form G-7 Quarterly Return for Monthly Payer Worksheet - Georgia (United States)

What Is Form G-7?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-7?

A: Form G-7 is a quarterly return for monthly payers in Georgia, United States.

Q: Who needs to file Form G-7?

A: Monthly payers in Georgia are required to file Form G-7.

Q: What is the purpose of Form G-7?

A: Form G-7 is used to report and remit state income tax withheld from employees' wages.

Q: When is Form G-7 due?

A: Form G-7 is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

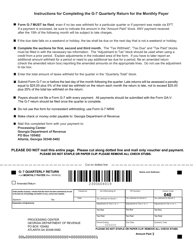

Q: What information do I need to fill out Form G-7?

A: You will need to provide the employer's identification number, the total wages paid, the amount of state income tax withheld, and other pertinent information.

Q: Are there any penalties for not filing Form G-7?

A: Yes, failure to file or late filing of Form G-7 may result in penalties and interest charges.

Q: Can Form G-7 be filed electronically?

A: Yes, Form G-7 can be filed electronically through the Georgia Tax Center.

Q: Is Form G-7 required for all employees?

A: No, Form G-7 is only required for employees who are subject to Georgia income tax withholding.

Form Details:

- Released on May 9, 2022;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-7 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.