This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-QJ

for the current year.

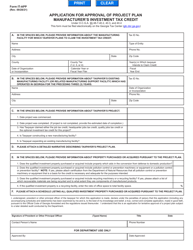

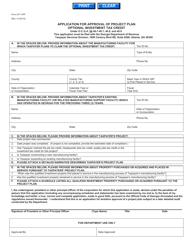

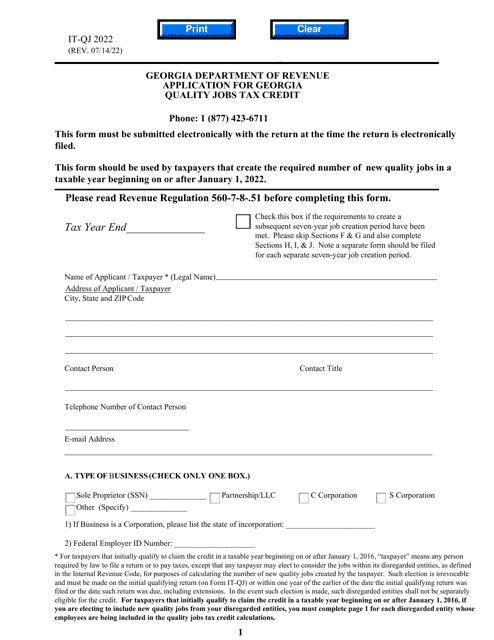

Form IT-QJ Application for Georgia Quality Jobs Tax Credit - Georgia (United States)

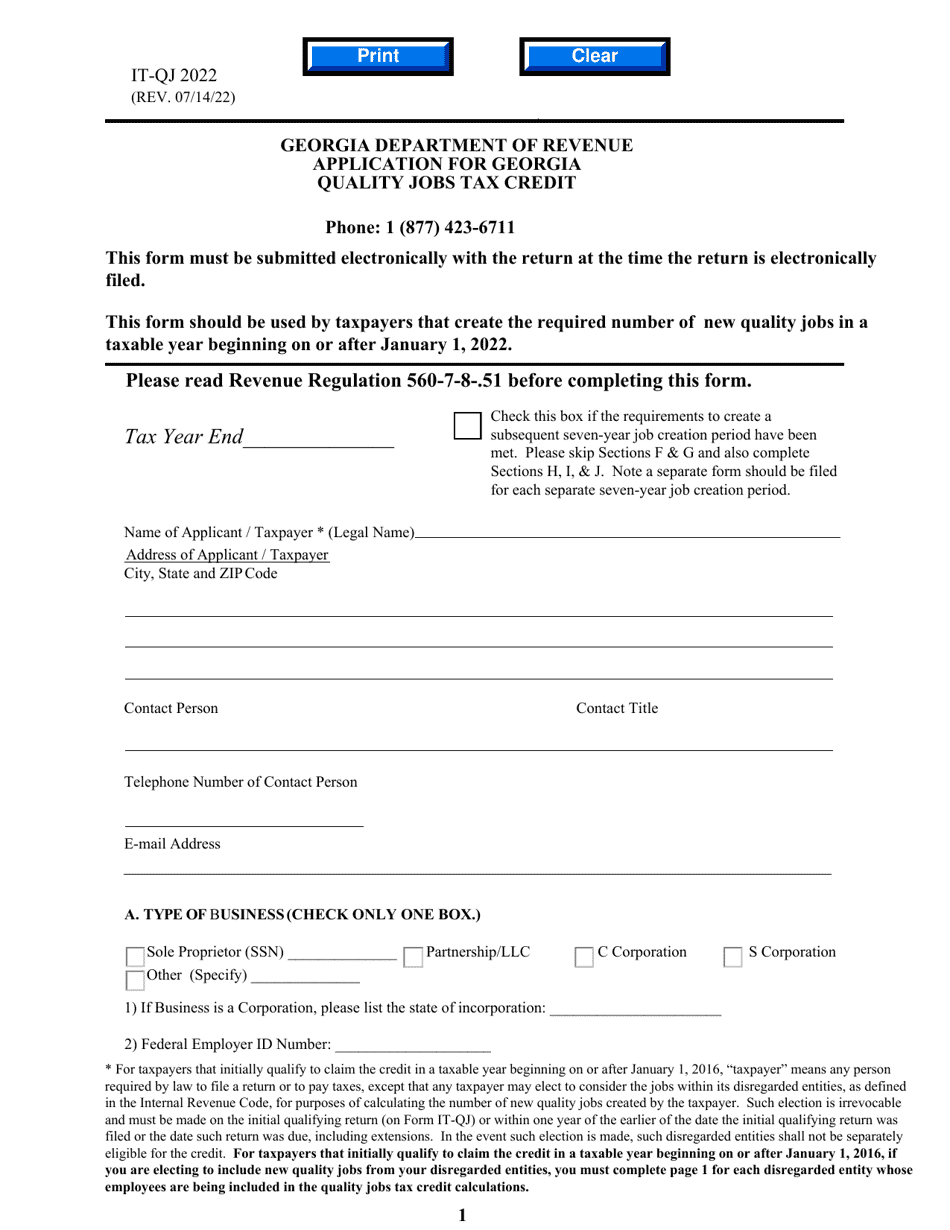

What Is Form IT-QJ?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-QJ Application?

A: The IT-QJ Application is a form used to apply for the Georgia Quality Jobs Tax Credit.

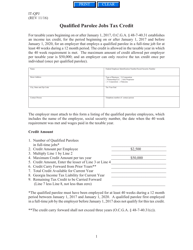

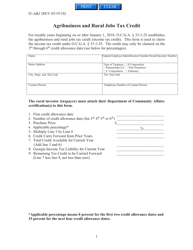

Q: What is the Georgia Quality Jobs Tax Credit?

A: The Georgia Quality Jobs Tax Credit is a tax incentive program aimed at encouraging job creation and investment in Georgia.

Q: Who can apply for the Georgia Quality Jobs Tax Credit?

A: Companies that create new jobs and make qualifying investments in Georgia may be eligible to apply.

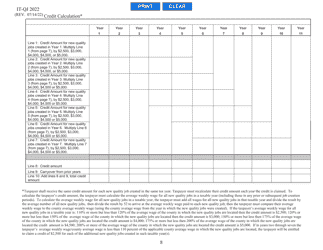

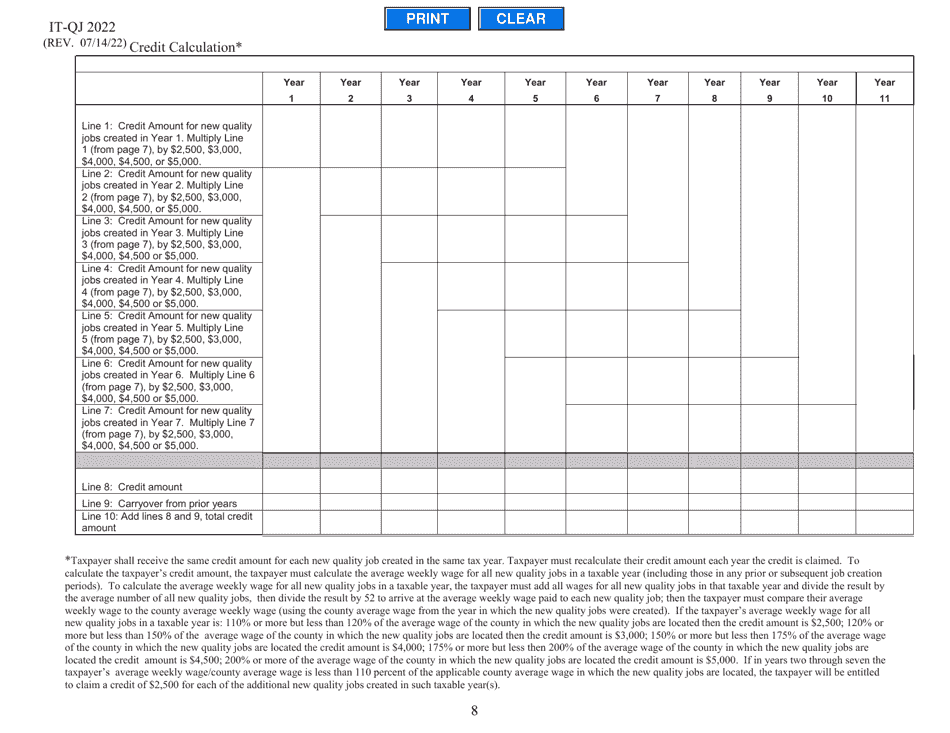

Q: What are the benefits of the Georgia Quality Jobs Tax Credit?

A: The tax credit can provide significant savings on state income taxes for eligible companies.

Q: Are there any deadlines for submitting the IT-QJ Application?

A: Yes, there are deadlines for submitting the application which vary depending on the tax year. It's important to check the specific deadlines to ensure timely submission.

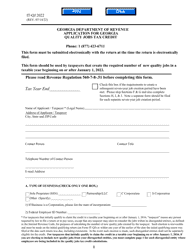

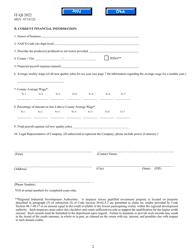

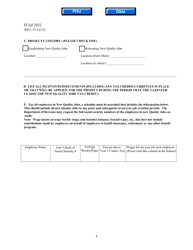

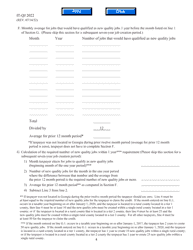

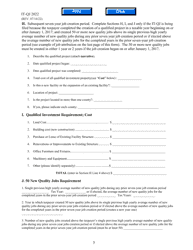

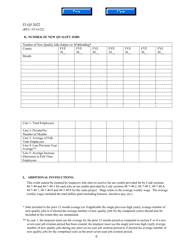

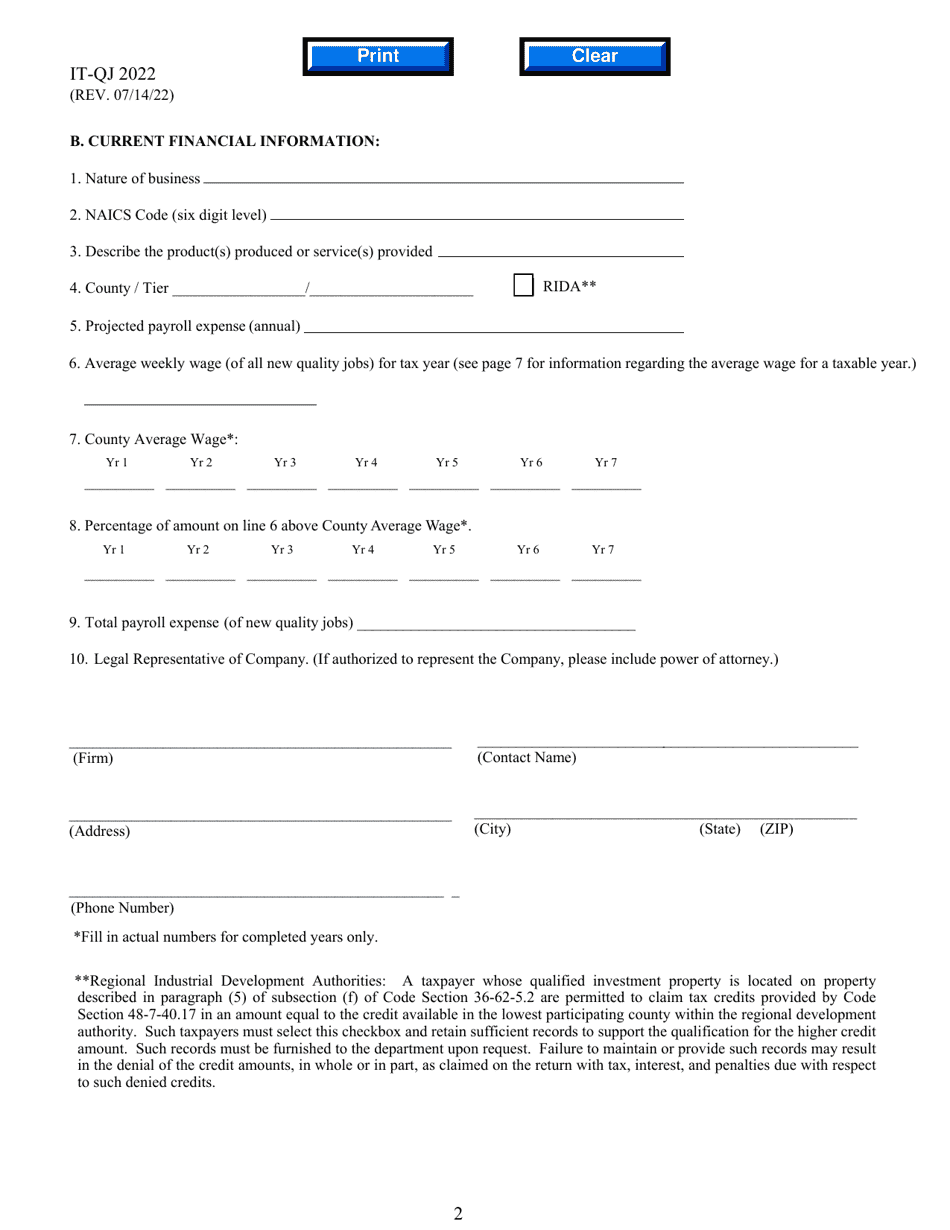

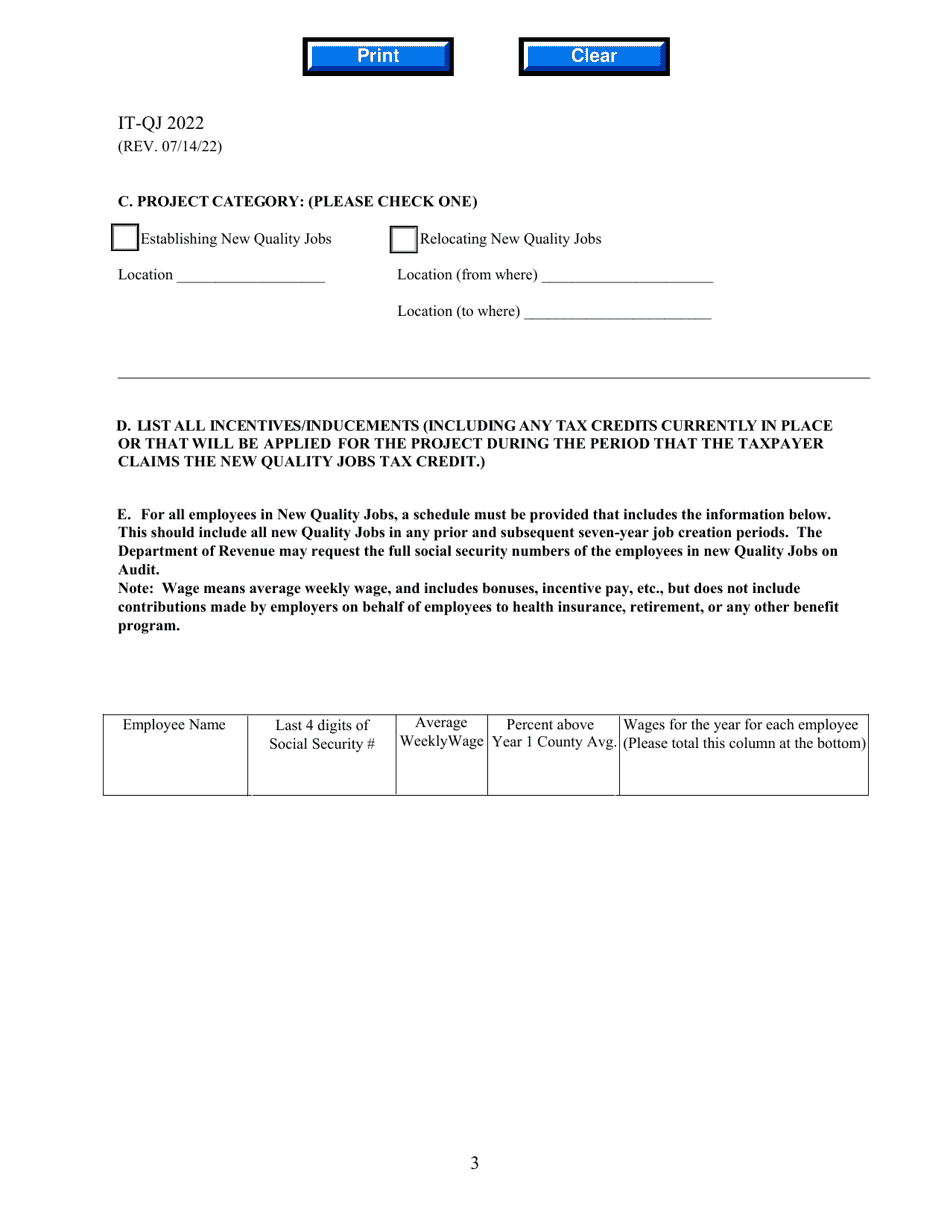

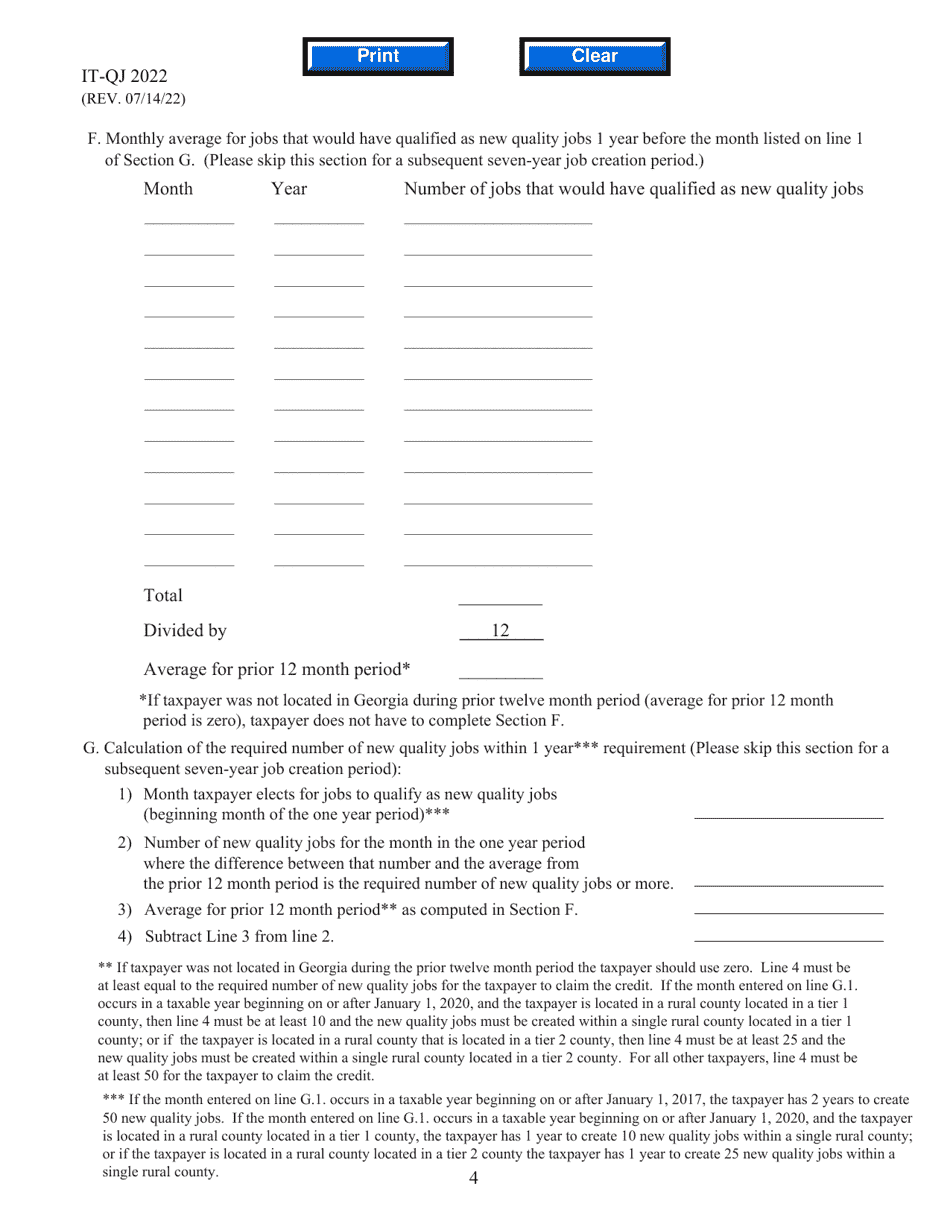

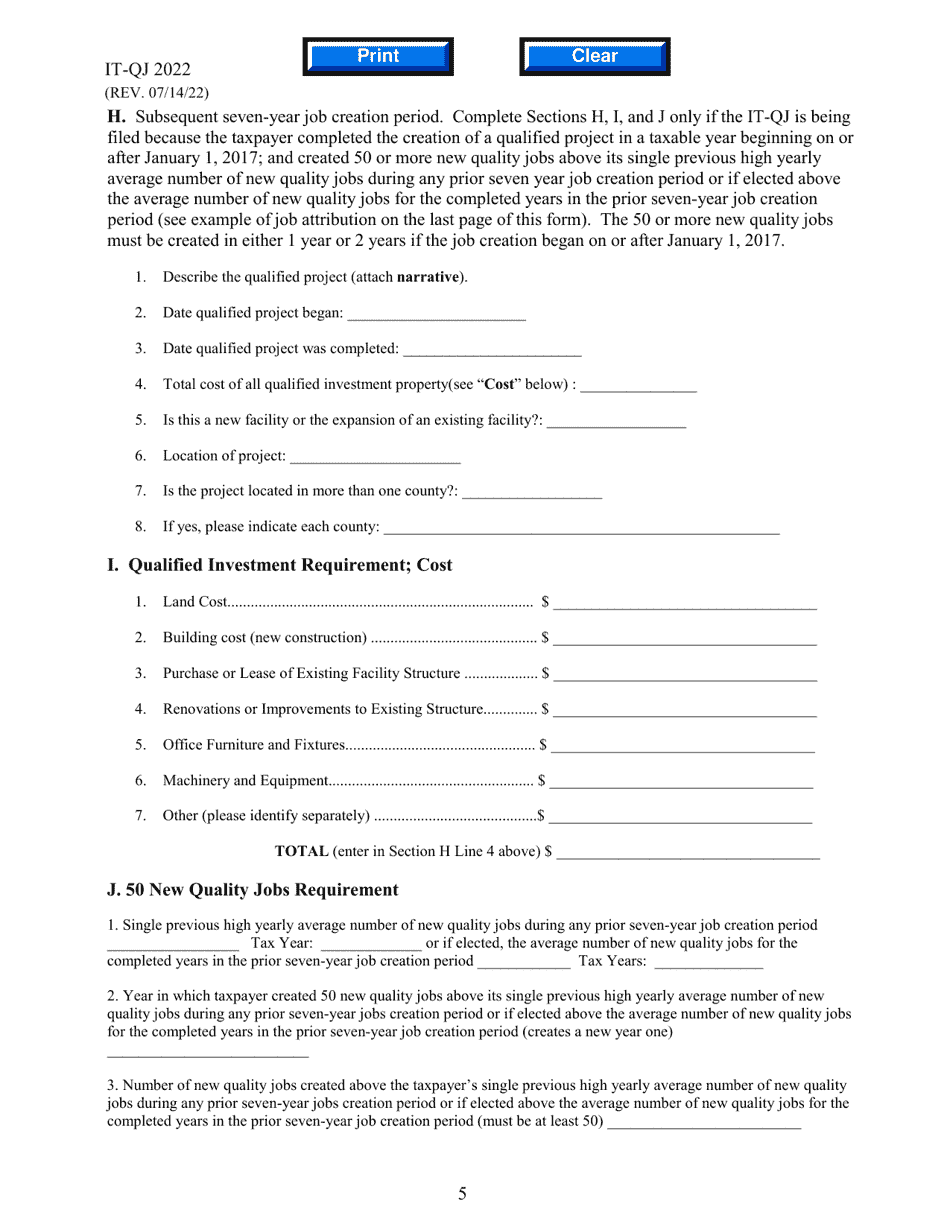

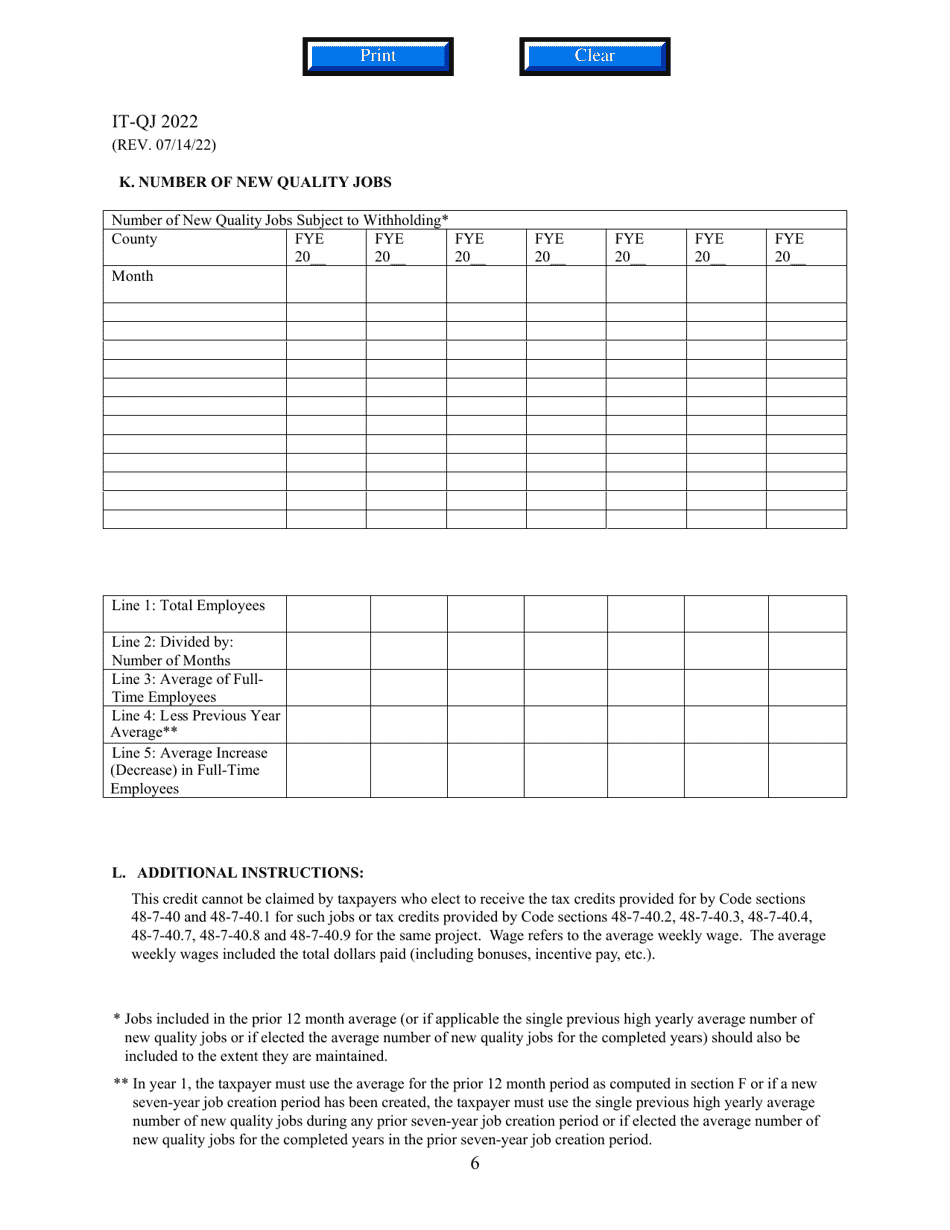

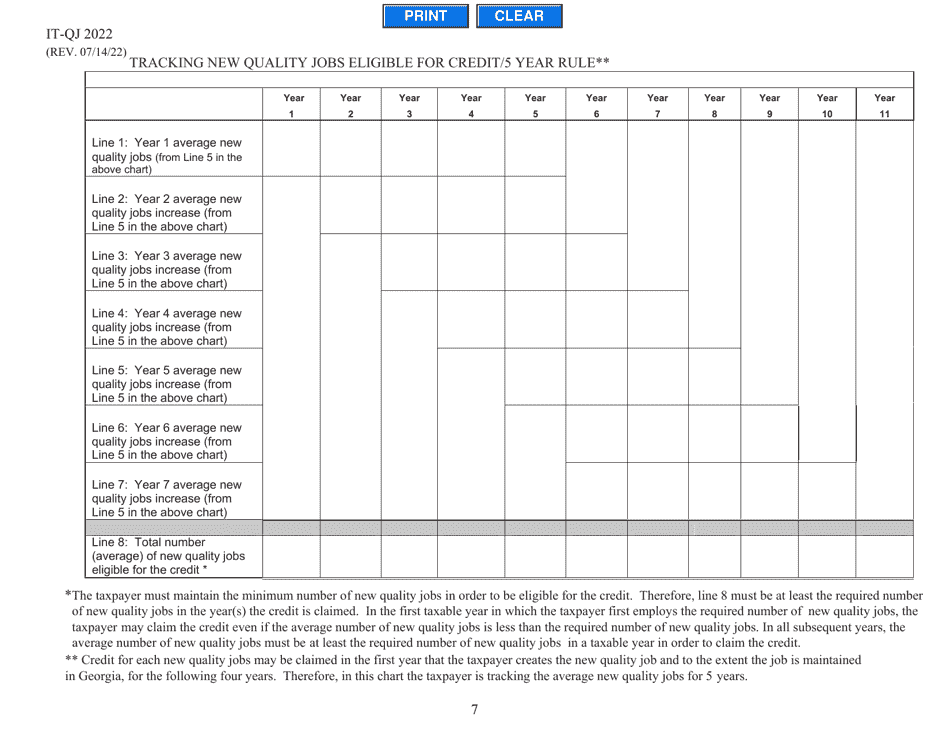

Q: What information is required on the IT-QJ Application?

A: The application requires information about the applicant company, the projected number of jobs to be created, and details about the qualifying investment.

Q: Is there a fee to submit the IT-QJ Application?

A: There is no fee to submit the IT-QJ Application.

Q: How long does it take to process the IT-QJ Application?

A: The processing time for the application can vary, but it generally takes several weeks to receive a decision.

Q: What happens after the IT-QJ Application is approved?

A: If the application is approved, the company can claim the Georgia Quality Jobs Tax Credit on their state income tax return for the eligible tax years.

Form Details:

- Released on July 14, 2022;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QJ by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.

![Document preview: Form ERC-1 Application to Certify and Bank Emission Reduction Credits [georgia Rules for Air Quality Control Chapter 391-3-1-.03(13)] - Georgia (United States)](https://data.templateroller.com/pdf_docs_html/1801/18019/1801950/form-erc-1-application-to-certify-and-bank-emission-reduction-credits-georgia-rules-air-quality-control-chapter-391-3-1-03-13-georgia-united-states.png)