This version of the form is not currently in use and is provided for reference only. Download this version of

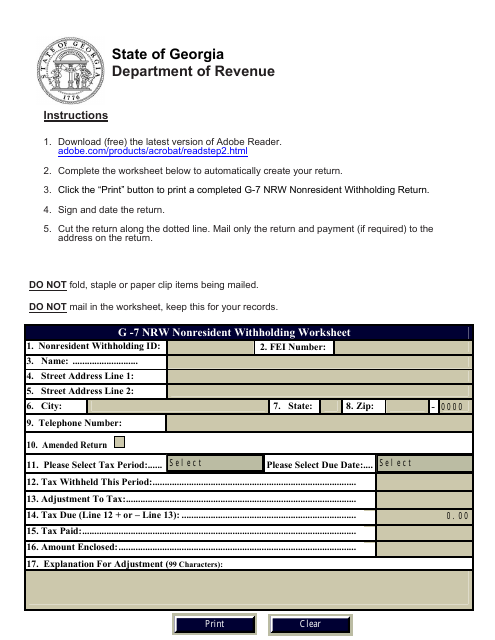

Form G-7 NRW

for the current year.

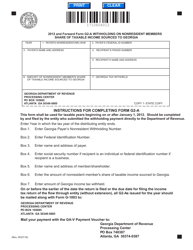

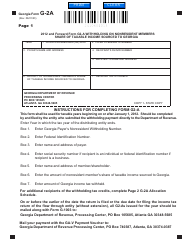

Form G-7 NRW Nonresident Withholding Return - Georgia (United States)

What Is Form G-7 NRW?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-7 NRW?

A: Form G-7 NRW is the Nonresident Withholding Return form for the state of Georgia in the United States.

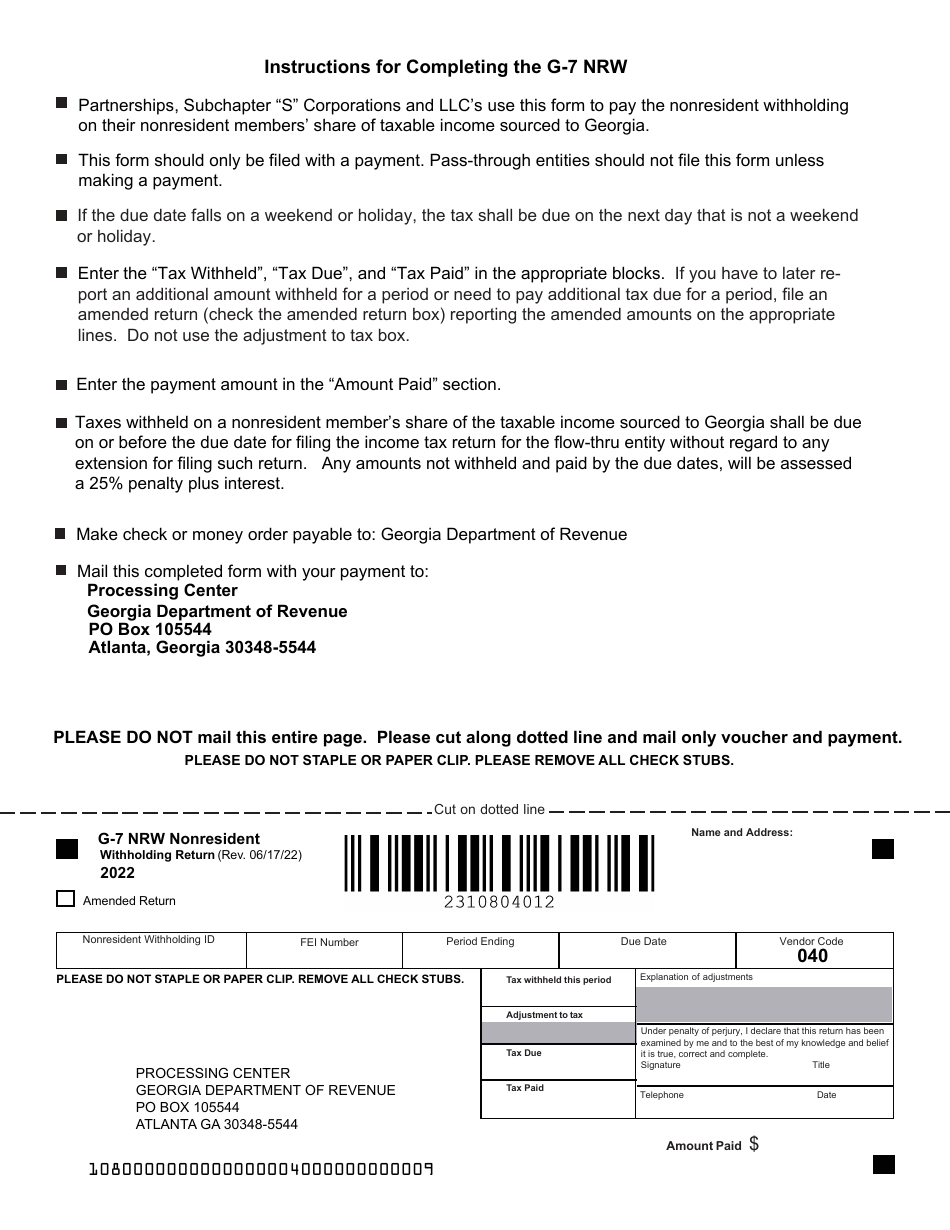

Q: Who should file Form G-7 NRW?

A: Nonresident individuals or entities who have Georgia source income are required to file Form G-7 NRW.

Q: What is Georgia source income?

A: Georgia source income includes income derived from sources within Georgia, such as wages, salaries, rents, royalties, and other types of income.

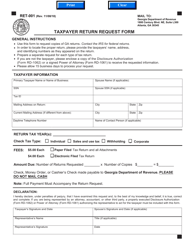

Q: When is Form G-7 NRW due?

A: Form G-7 NRW is due on or before the 20th day of the following month.

Q: Is there any penalty for late or non-filing?

A: Yes, there are penalties for late or non-filing of Form G-7 NRW. It is important to file the form on time to avoid penalties and interest charges.

Form Details:

- Released on June 17, 2022;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-7 NRW by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.