This version of the form is not currently in use and is provided for reference only. Download this version of

Form G-7Q

for the current year.

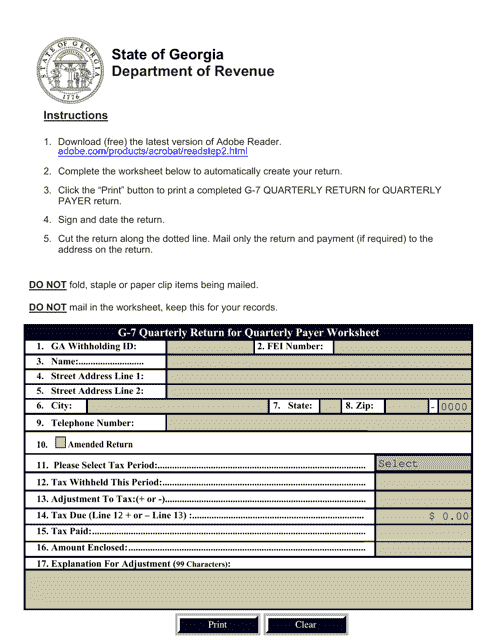

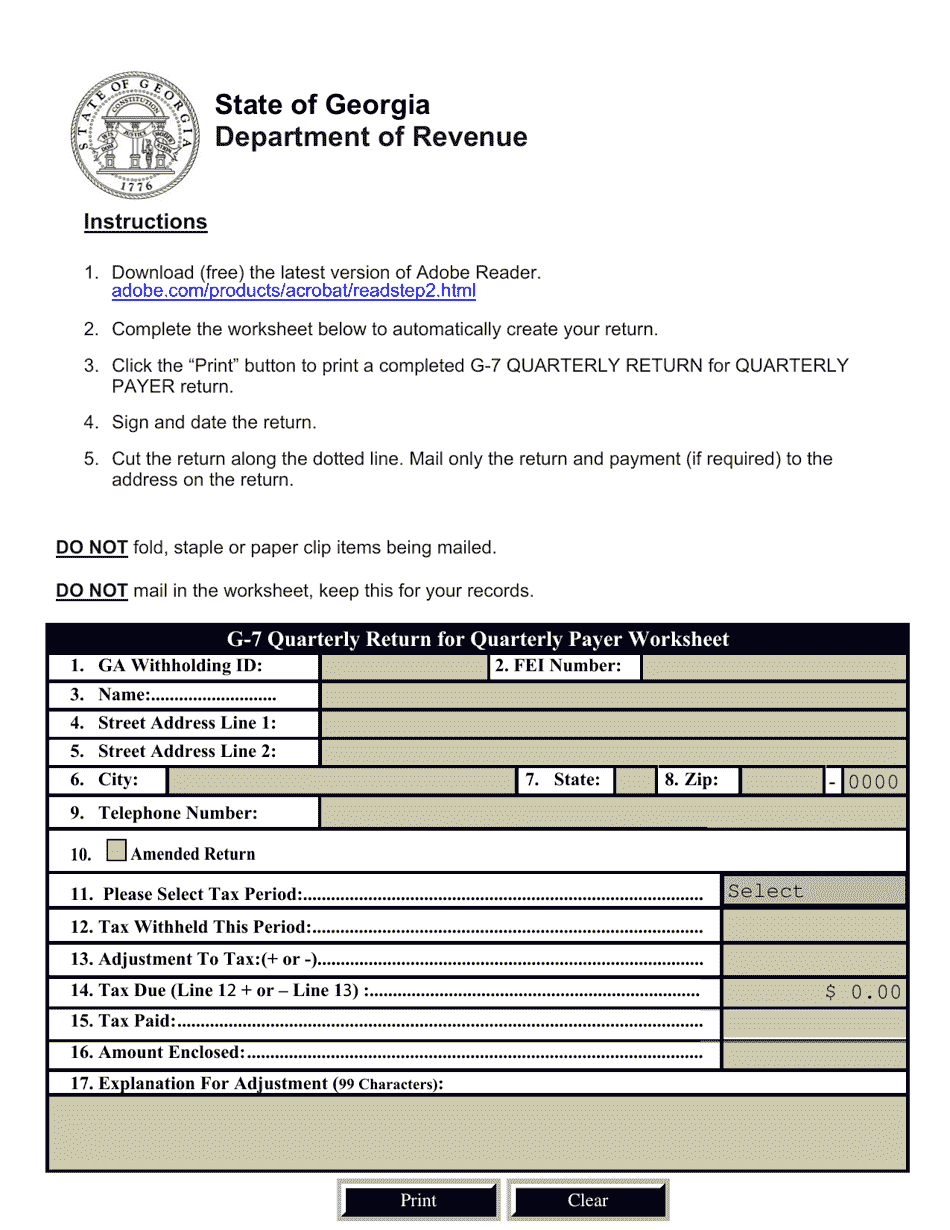

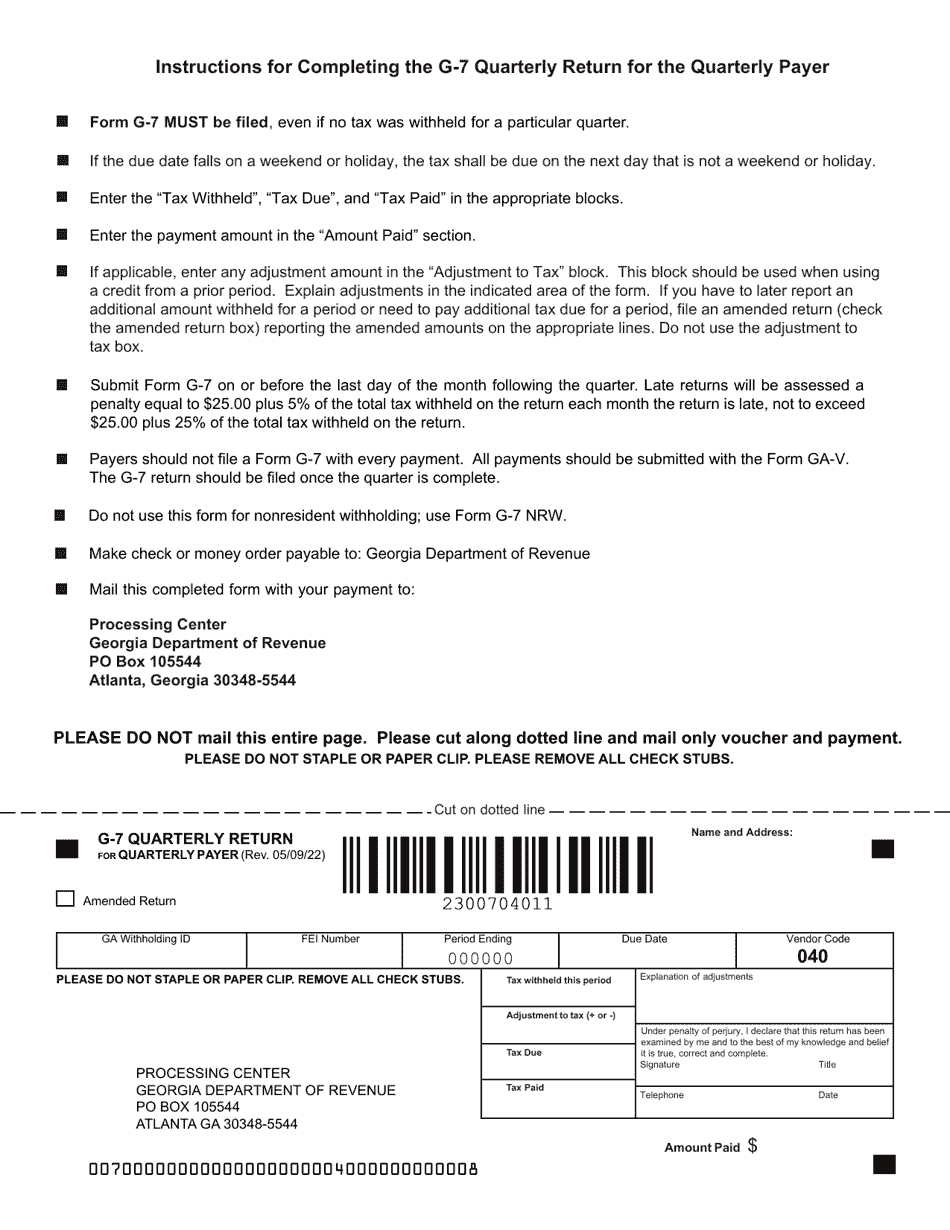

Form G-7Q Withholding Quarterly Return for Quarterly Payer - Georgia (United States)

What Is Form G-7Q?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-7Q?

A: Form G-7Q is the Withholding Quarterly Return for Quarterly Payer in Georgia.

Q: Who needs to file Form G-7Q?

A: Form G-7Q needs to be filed by quarterly payers in Georgia.

Q: What is a quarterly payer?

A: A quarterly payer is an employer or withholding agent who remits withholding taxes on a quarterly basis.

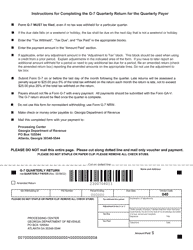

Q: What information is required on Form G-7Q?

A: Form G-7Q requires information such as the employer's name, address, taxpayer identification number, and withholding amounts.

Q: When is Form G-7Q due?

A: Form G-7Q is due on a quarterly basis, with the due dates falling on the last day of the month following the end of each quarter.

Form Details:

- Released on May 9, 2022;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-7Q by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.