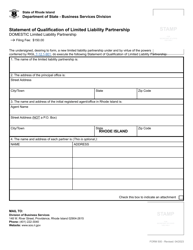

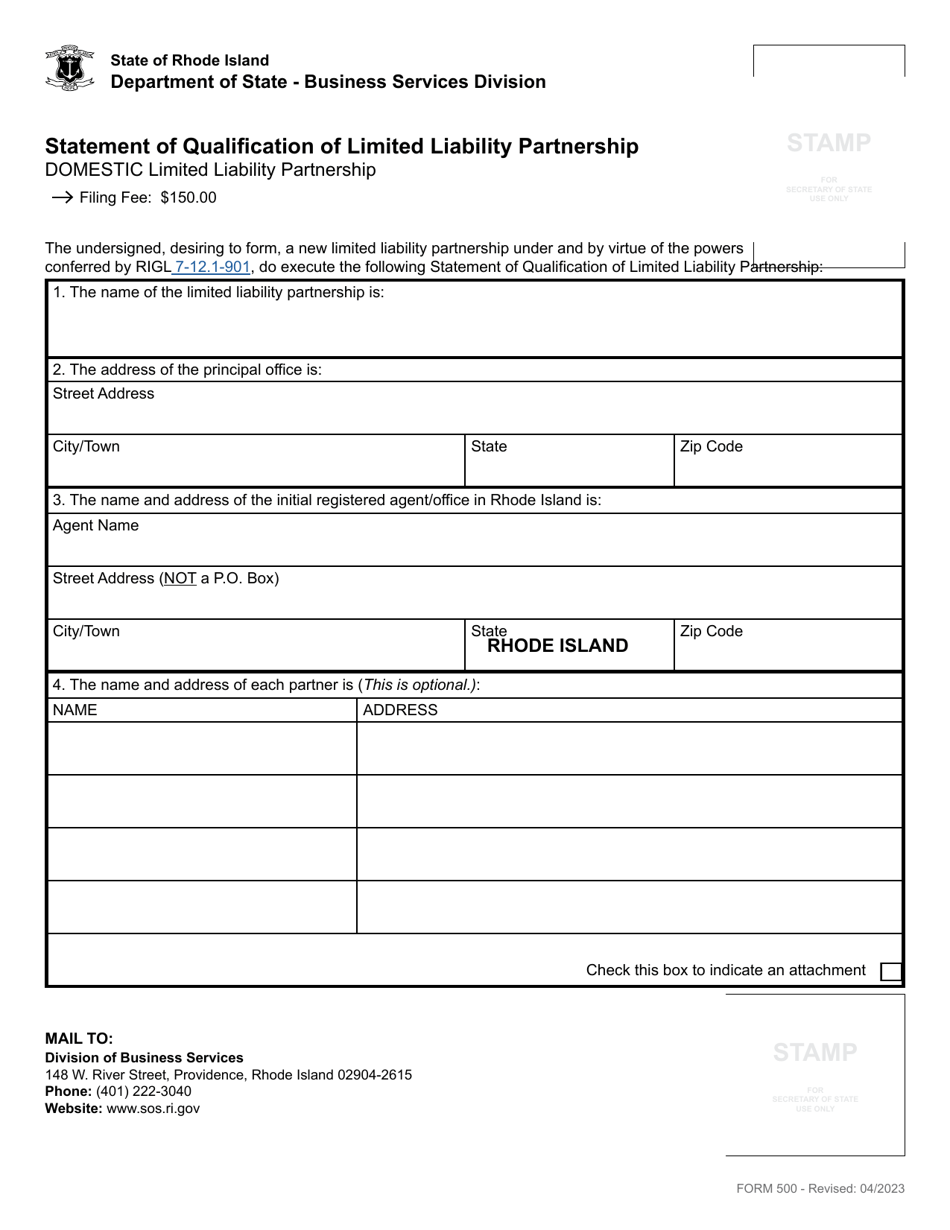

Form 500 Statement of Qualification of Limited Liability Partnership - Domestic Limited Liability Partnership - Rhode Island

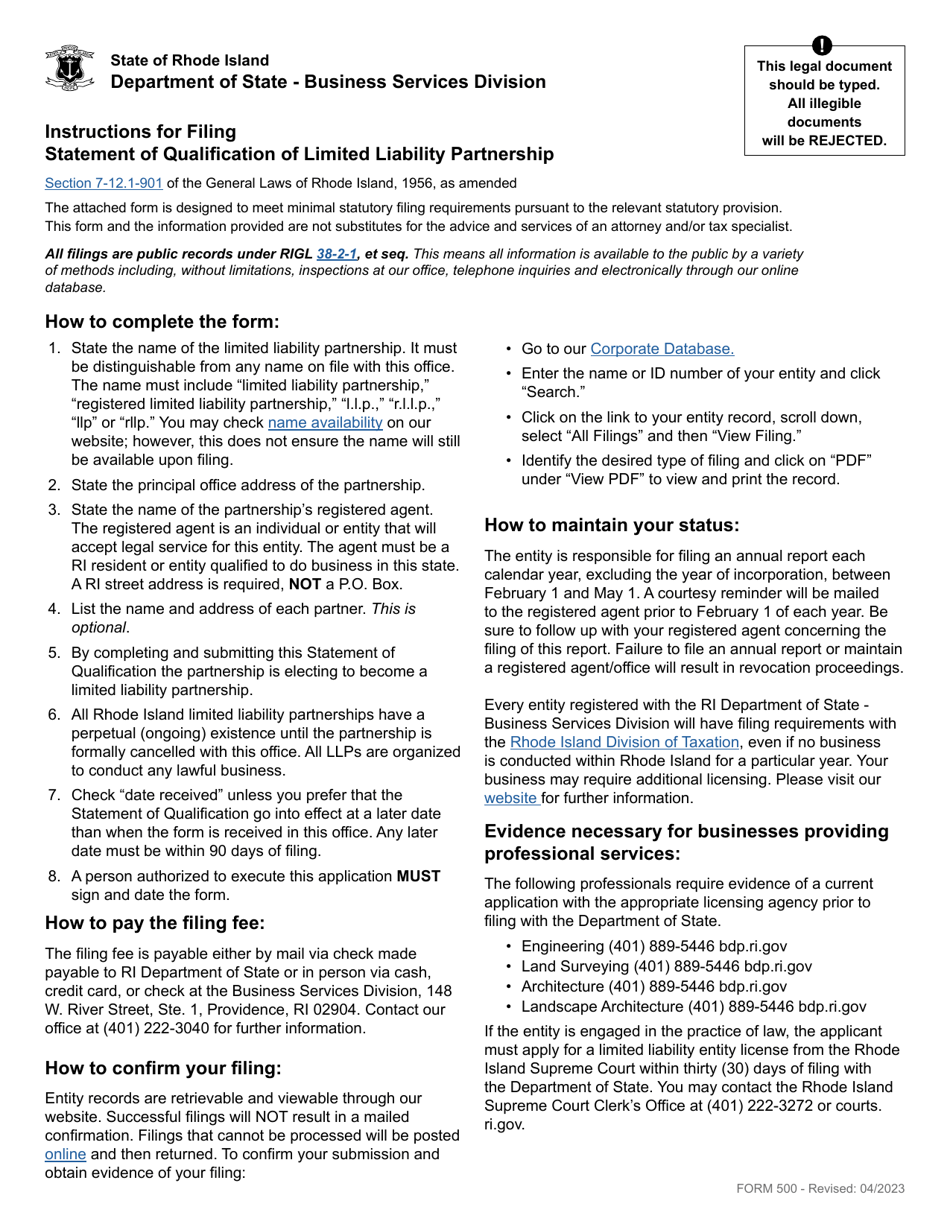

What Is Form 500?

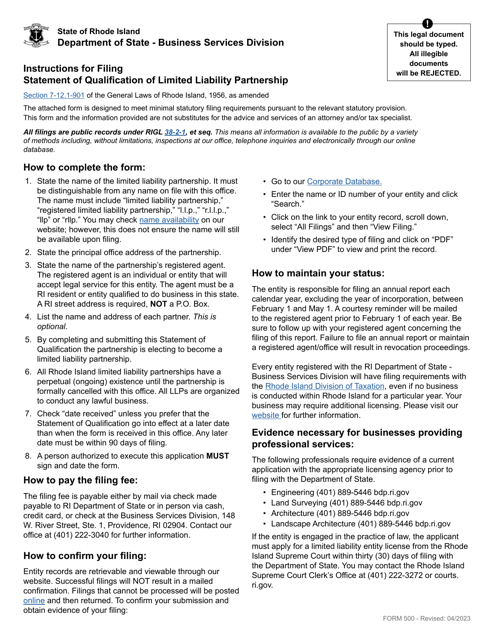

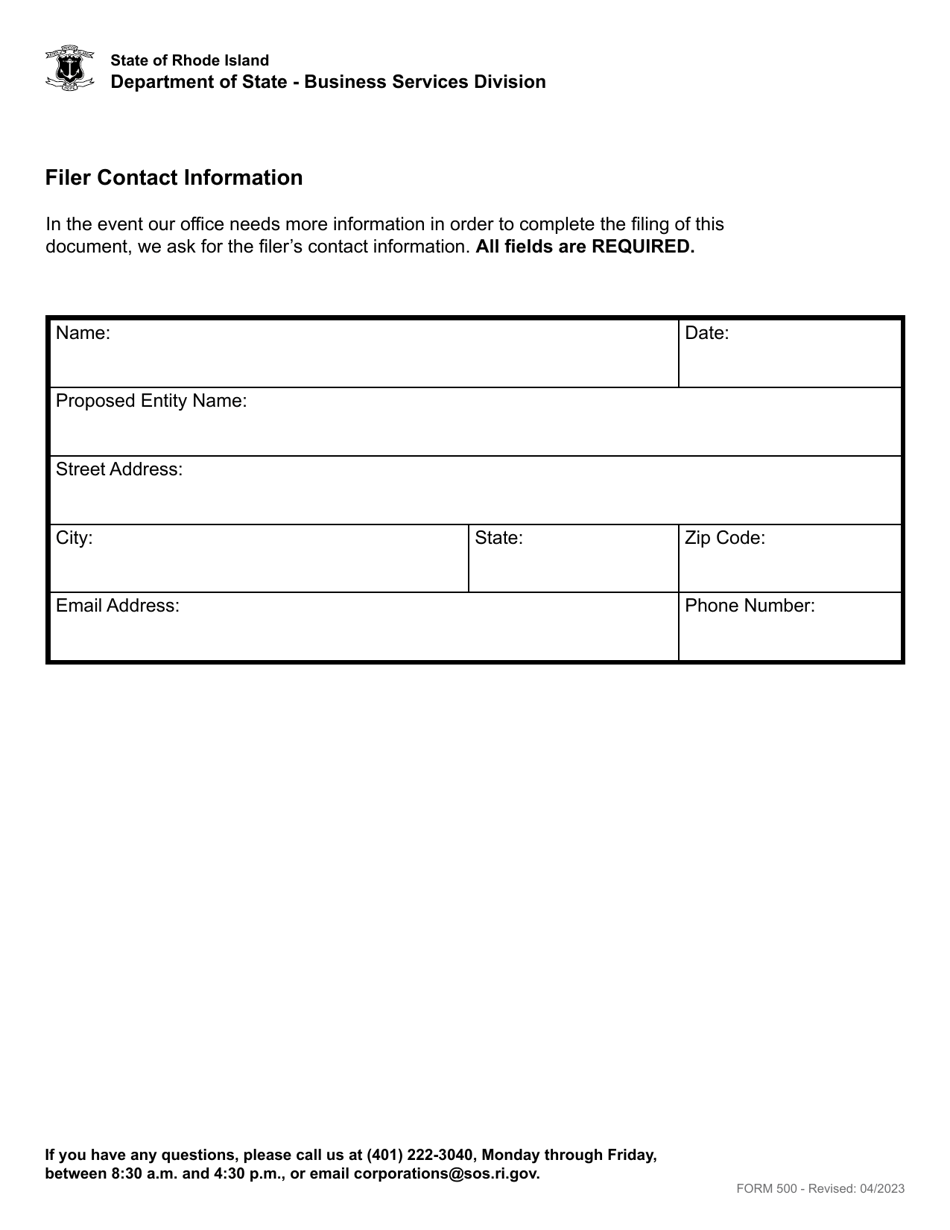

This is a legal form that was released by the Rhode Island Department of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 500?

A: Form 500 is the Statement of Qualification of Limited Liability Partnership - Domestic Limited Liability Partnership in Rhode Island.

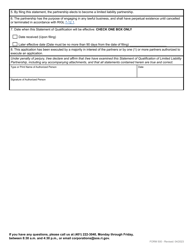

Q: Who needs to file Form 500?

A: Limited Liability Partnerships (LLPs) formed in Rhode Island need to file Form 500.

Q: What is the purpose of Form 500?

A: Form 500 is used to officially register a Limited Liability Partnership in the state of Rhode Island.

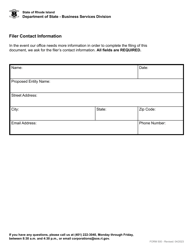

Q: What information is required on Form 500?

A: Form 500 requires details such as the name and address of the LLP, the names and addresses of partners, and the registered agent information.

Q: What is the filing fee for Form 500?

A: The filing fee for Form 500 is $50.

Q: When should Form 500 be filed?

A: Form 500 should be filed within 30 days of forming the Limited Liability Partnership in Rhode Island.

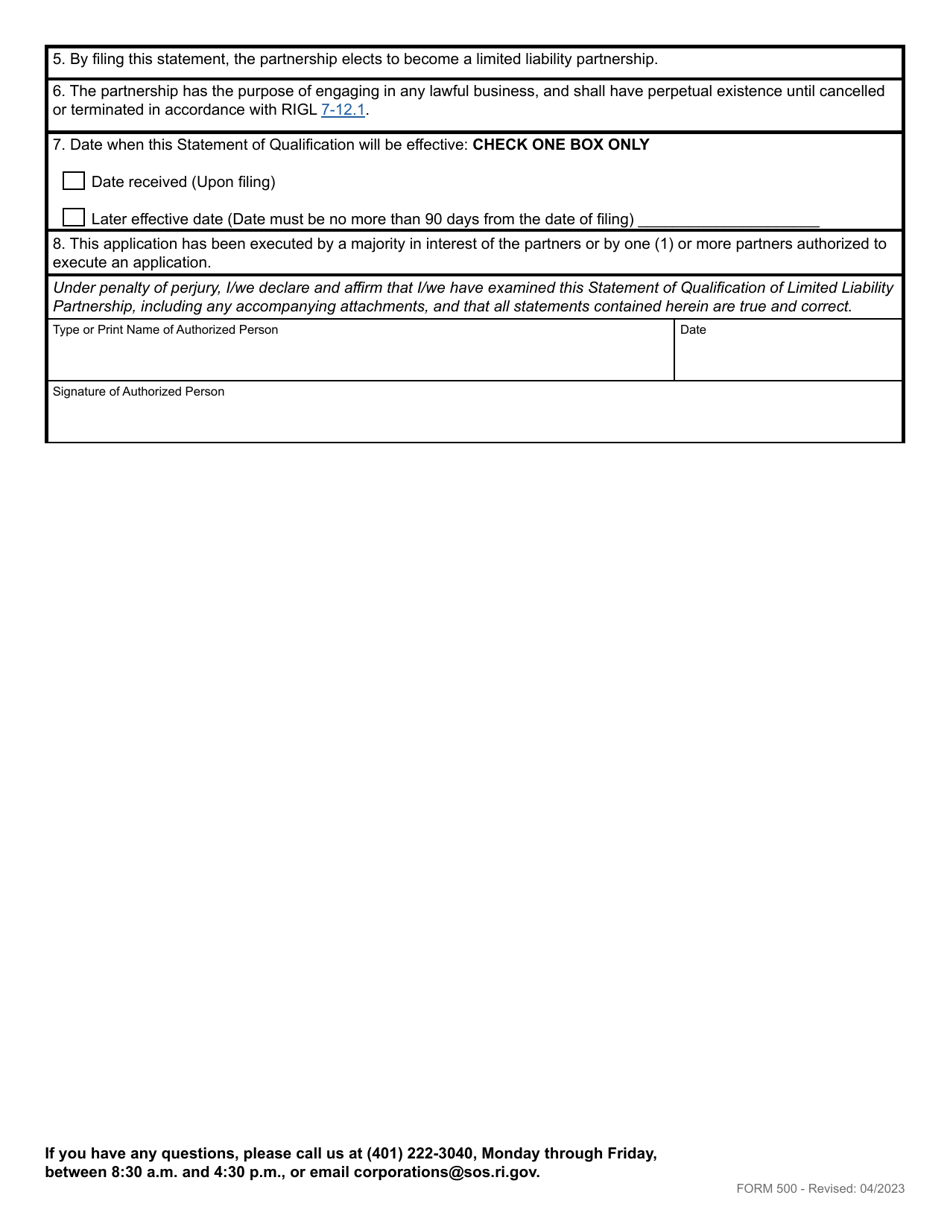

Q: Is it mandatory to file Form 500 annually?

A: Yes, LLPs in Rhode Island are required to file Form 500 annually by November 1st.

Q: Are there any additional requirements for LLPs in Rhode Island?

A: LLPs in Rhode Island are required to maintain a registered agent and file an annual report.

Q: What happens if Form 500 is not filed?

A: Failure to file Form 500 may result in penalties or the loss of good standing for the Limited Liability Partnership.

Form Details:

- Released on April 1, 2023;

- The latest edition provided by the Rhode Island Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 500 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of State.