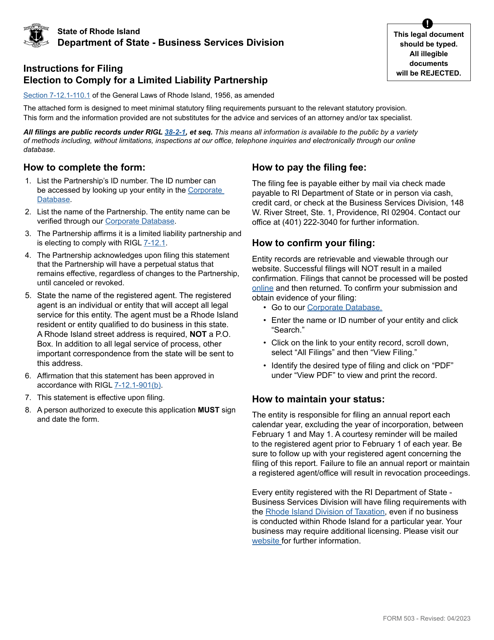

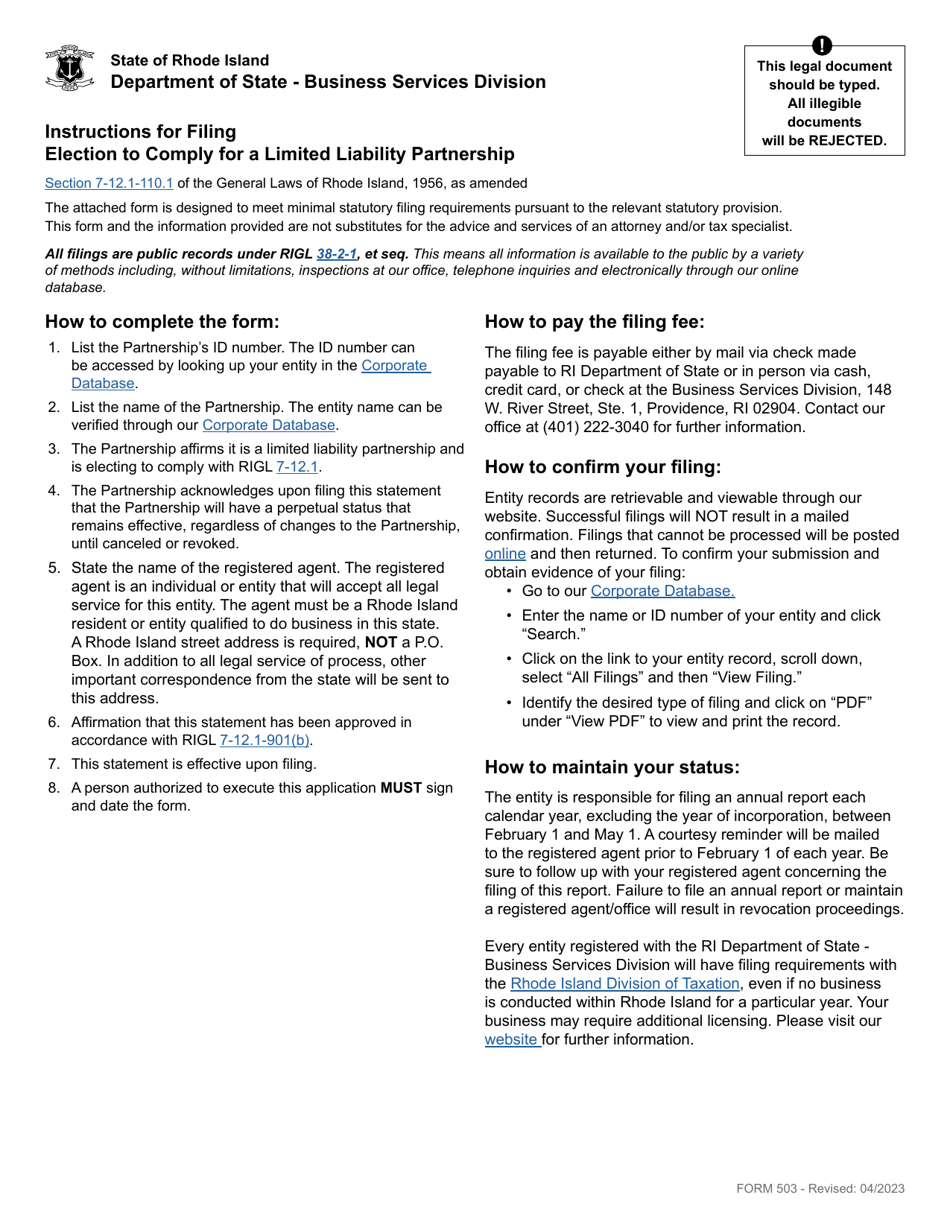

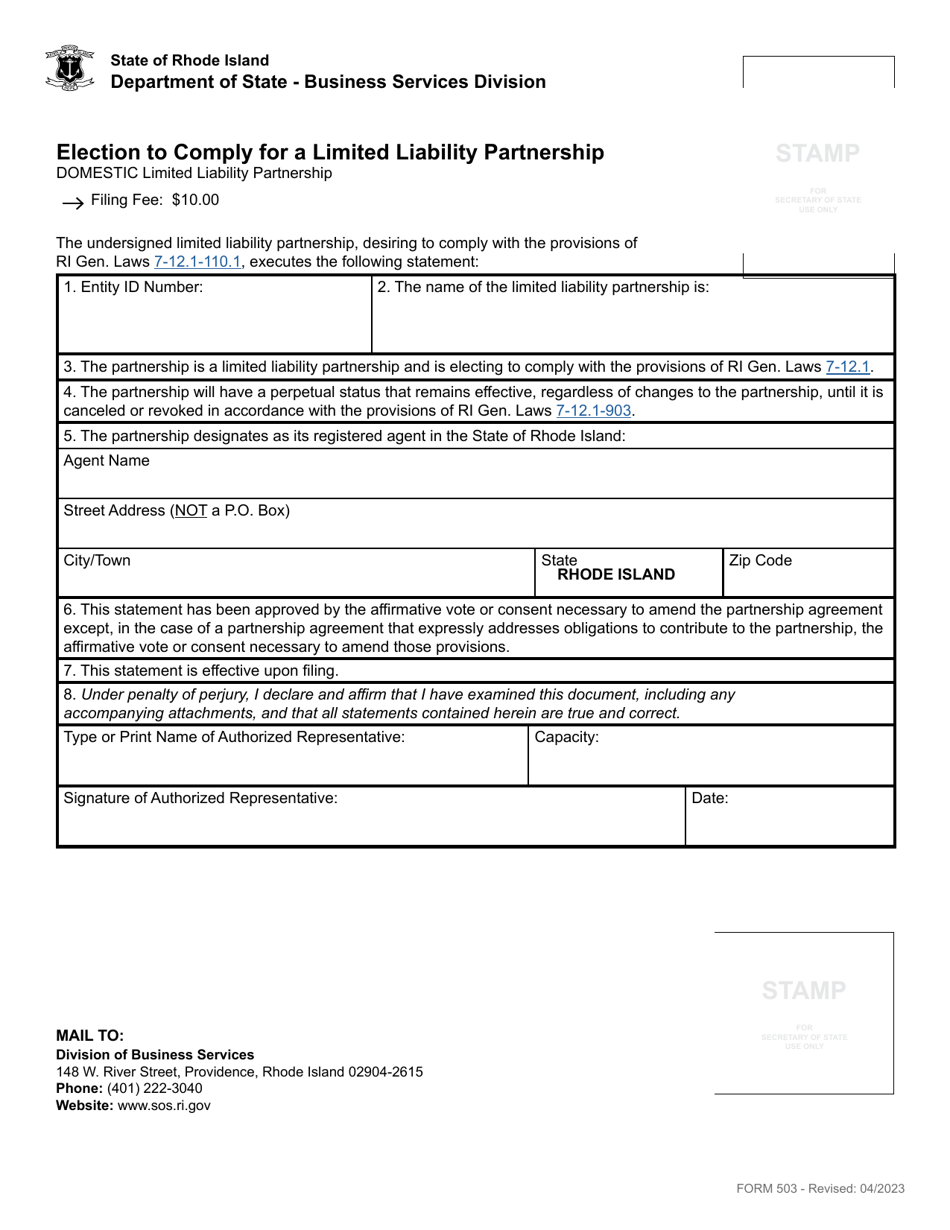

Form 503 Election to Comply for a Limited Liability Partnership - Rhode Island

What Is Form 503?

This is a legal form that was released by the Rhode Island Department of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 503?

A: Form 503 is the Election to Comply form for a Limited Liability Partnership in Rhode Island.

Q: What is a Limited Liability Partnership?

A: A Limited Liability Partnership (LLP) is a type of business structure where partners have limited personal liability for the actions of other partners.

Q: What is the purpose of Form 503?

A: The purpose of Form 503 is to elect for a Limited Liability Partnership to comply with the laws and regulations in Rhode Island.

Q: Who needs to file Form 503?

A: Any Limited Liability Partnership operating in Rhode Island must file Form 503.

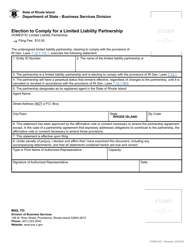

Q: What information is required on Form 503?

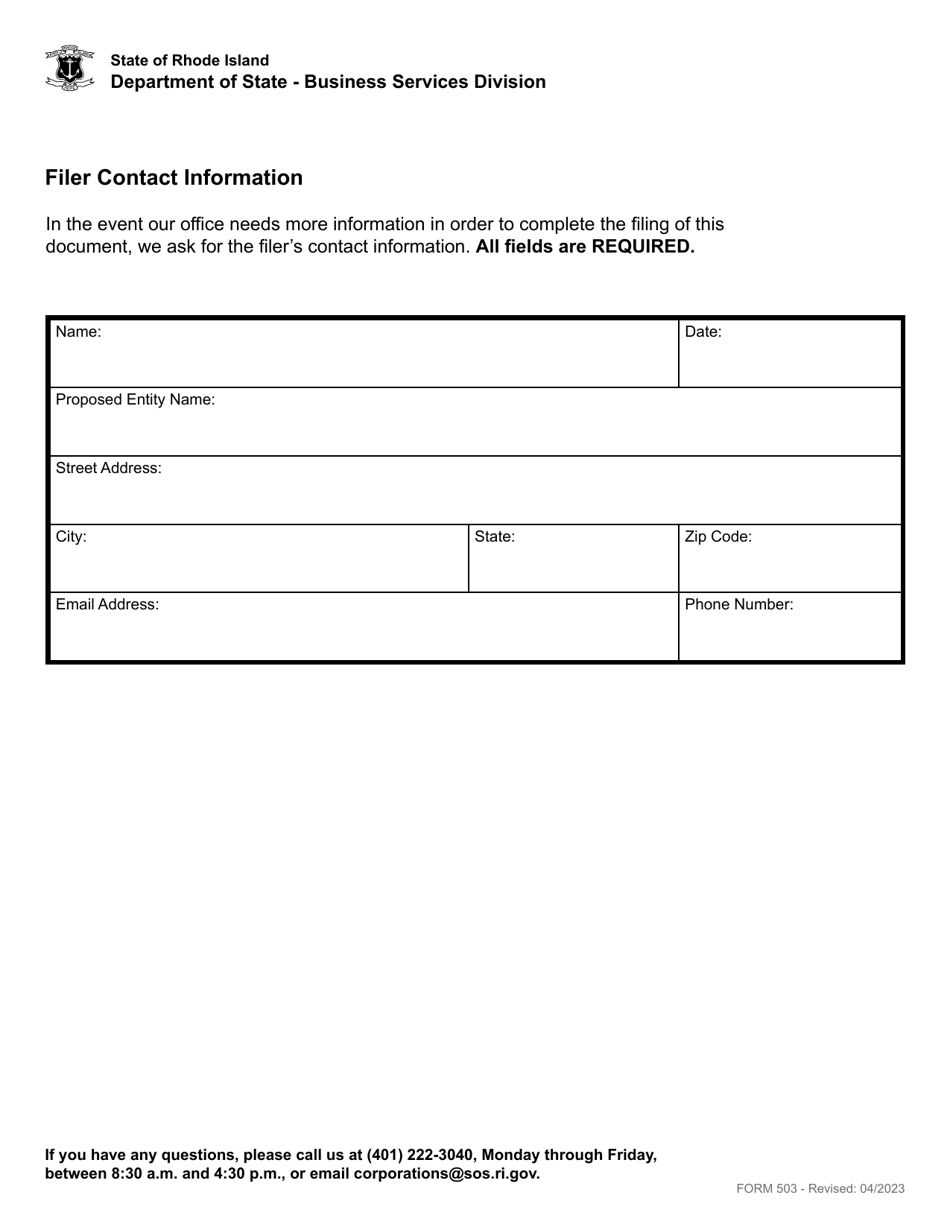

A: Form 503 requires information such as the name of the Limited Liability Partnership, its principal office address, and the names and addresses of partners.

Q: When should Form 503 be filed?

A: Form 503 should be filed within 60 days of commencing business operations as a Limited Liability Partnership in Rhode Island.

Q: What happens after filing Form 503?

A: After filing Form 503, the Limited Liability Partnership will be considered compliant with Rhode Island laws and regulations.

Form Details:

- Released on April 1, 2023;

- The latest edition provided by the Rhode Island Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 503 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of State.