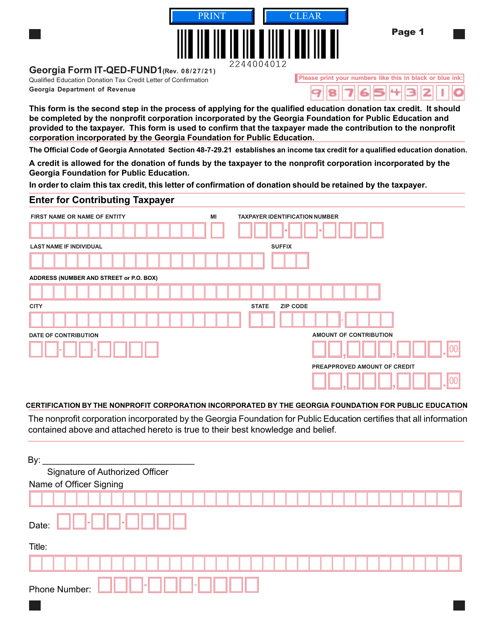

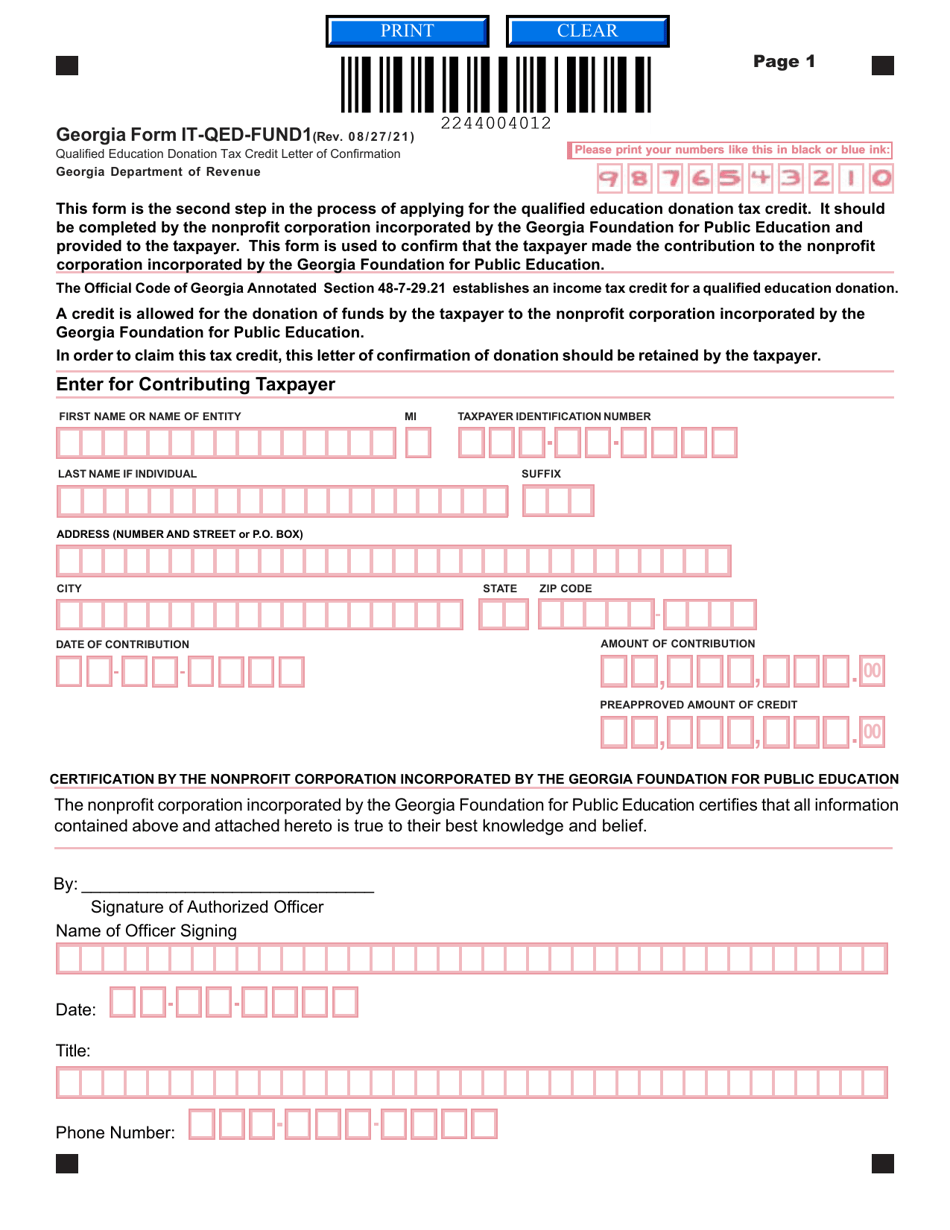

Form IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation - Georgia (United States)

What Is Form IT-QED-FUND1?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation?

A: The IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation is a letter provided in Georgia (United States) that confirms a donation made towards qualified education expenses.

Q: What is the purpose of the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation?

A: The purpose of the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation is to support individuals or businesses in claiming a tax credit for qualified education expenses they have donated towards.

Q: Who can receive the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation?

A: Individuals or businesses who have made a qualified education donation in Georgia (United States) can receive the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation.

Q: What qualifies as a qualified education donation?

A: Qualified education donations include contributions to authorized entities such as public schools, student scholarship organizations, and qualified education expense organizations.

Q: How can I obtain the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation?

A: To obtain the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation, you should contact the authorized entity or organization to which you made the qualified education donation.

Q: What should I do with the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation?

A: You should keep the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation for your records as it may be required when filing your tax returns and claiming the tax credit.

Q: Is the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation specific to Georgia only?

A: Yes, the IT-QED-FUND1 Qualified Education Donation Tax Credit Letter of Confirmation is specific to Georgia (United States) and the tax credit program available in the state.

Form Details:

- Released on August 27, 2021;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QED-FUND1 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.