This version of the form is not currently in use and is provided for reference only. Download this version of

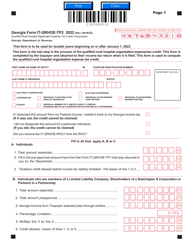

Form IT-QEE-TP2

for the current year.

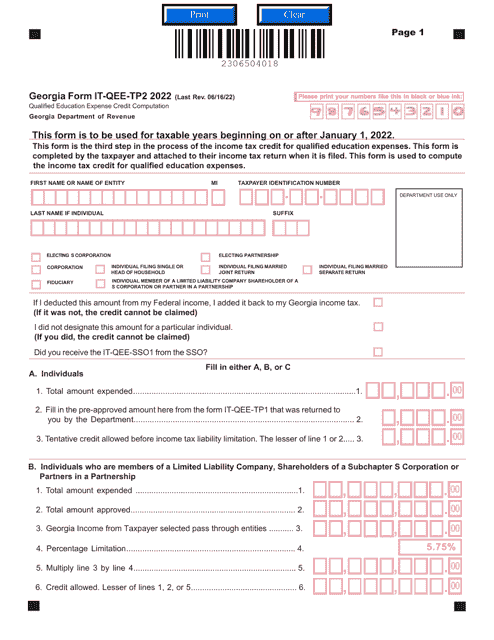

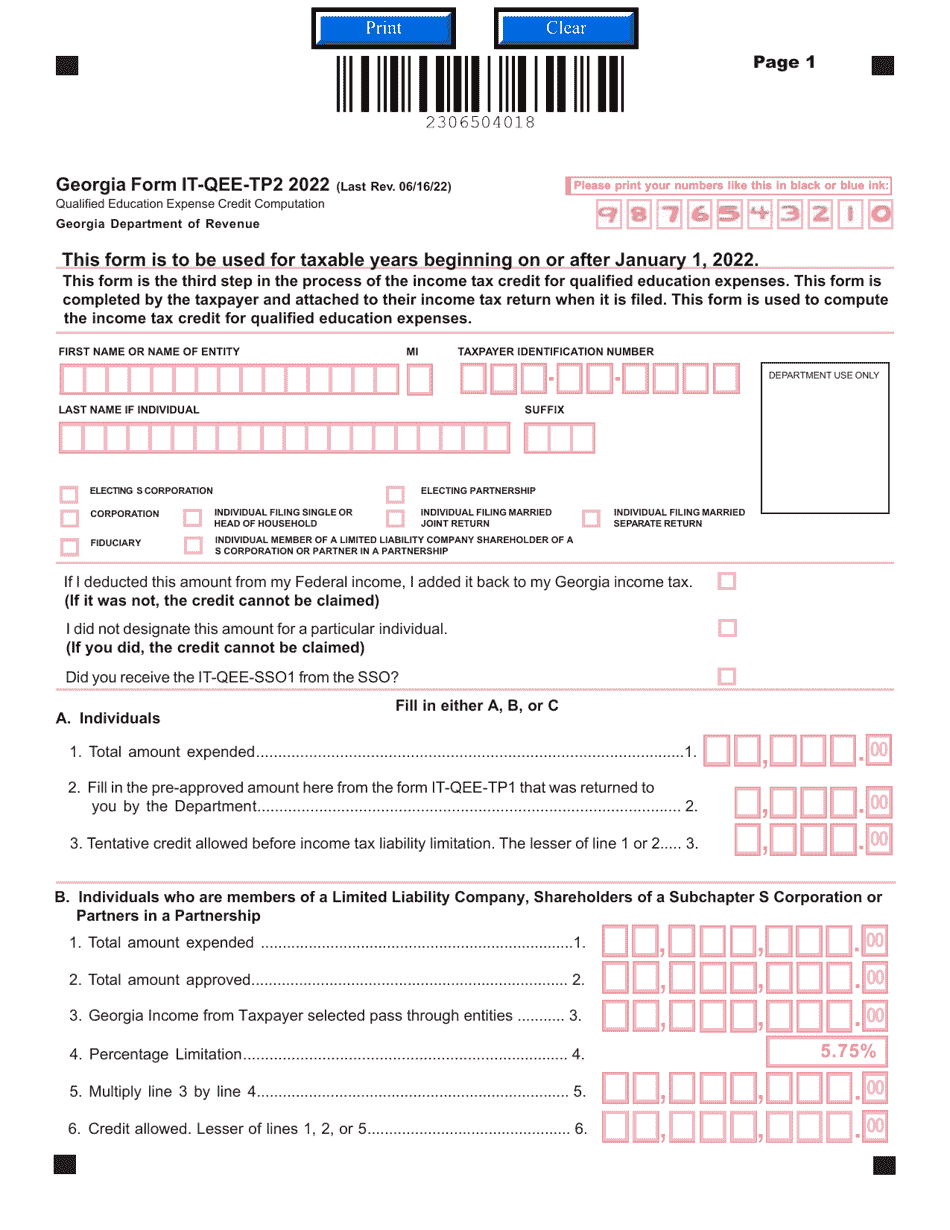

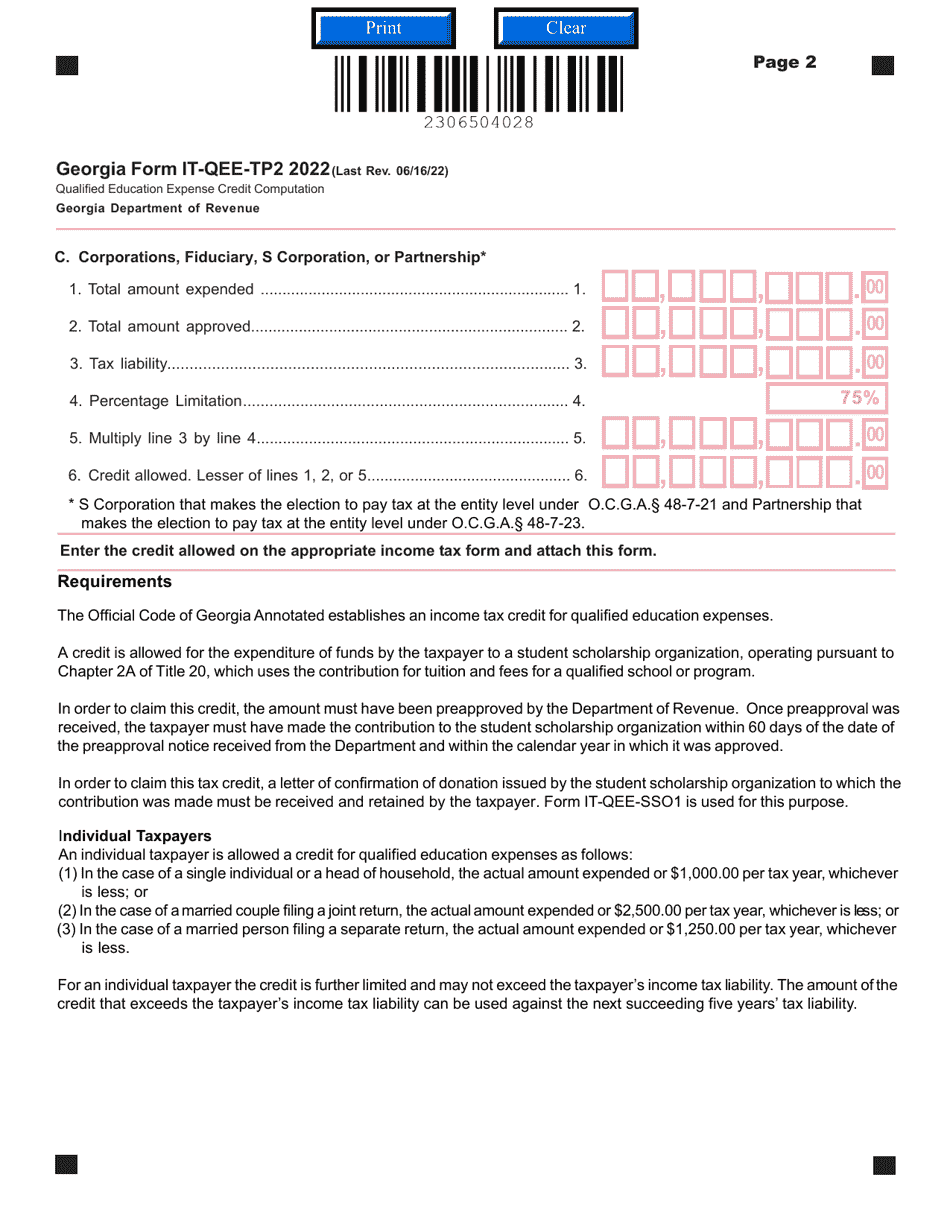

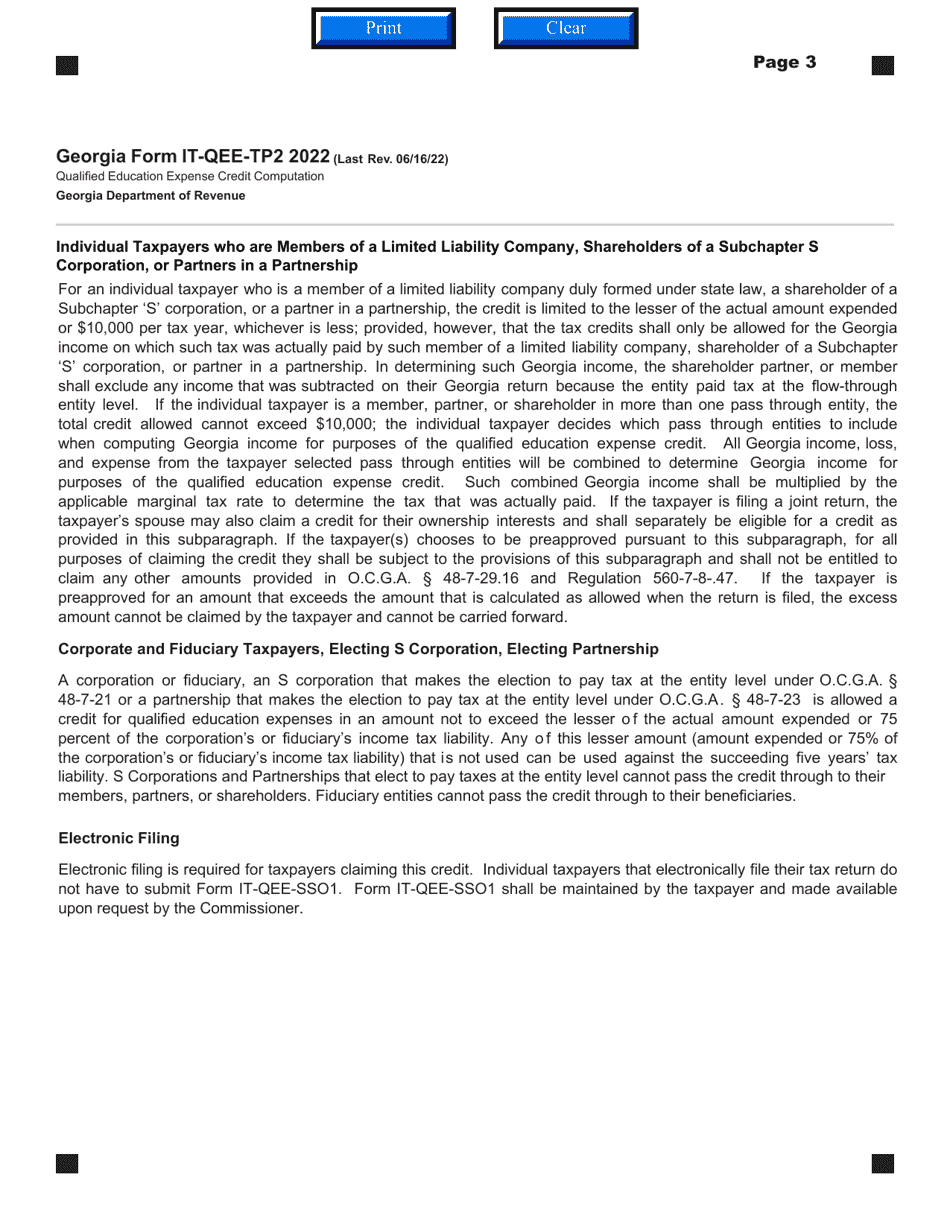

Form IT-QEE-TP2 Qualified Education Expense Credit Computation - Georgia (United States)

What Is Form IT-QEE-TP2?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-QEE-TP2?

A: Form IT-QEE-TP2 is the Qualified Education Expense Credit Computation form for Georgia (United States).

Q: What is the purpose of Form IT-QEE-TP2?

A: The purpose of Form IT-QEE-TP2 is to calculate the Qualified Education Expense Credit in Georgia.

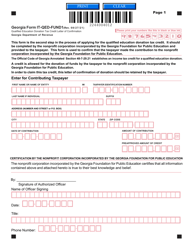

Q: What is the Qualified Education Expense Credit?

A: The Qualified Education Expense Credit is a tax credit in Georgia that can be claimed for certain education expenses.

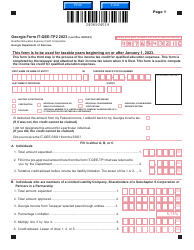

Q: Who is eligible to claim the Qualified Education Expense Credit?

A: Georgia residents who have eligible education expenses for themselves, their spouses, or their dependent(s) may be eligible to claim the credit.

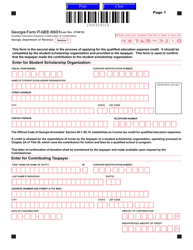

Q: What are eligible education expenses?

A: Eligible education expenses include tuition, fees, and certain other expenses paid to attend a qualified educational institution.

Q: How is the Qualified Education Expense Credit calculated?

A: The credit is calculated based on the total eligible education expenses paid during the tax year.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the credit, including income limits and maximum credit amounts.

Q: When is Form IT-QEE-TP2 due?

A: Form IT-QEE-TP2 is generally due on the same date as the taxpayer's Georgia income tax return.

Q: Can the Qualified Education Expense Credit be carried forward?

A: No, the credit cannot be carried forward or back.

Q: Can I claim the credit for expenses paid for K-12 education?

A: No, the credit is only available for eligible higher education expenses.

Q: Is the Qualified Education Expense Credit refundable?

A: No, the credit is non-refundable and can only be used to offset Georgia income tax liability.

Form Details:

- Released on June 16, 2022;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QEE-TP2 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.