This version of the form is not currently in use and is provided for reference only. Download this version of

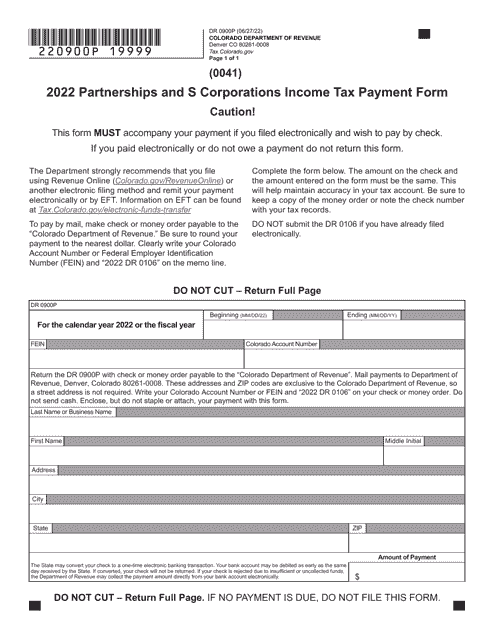

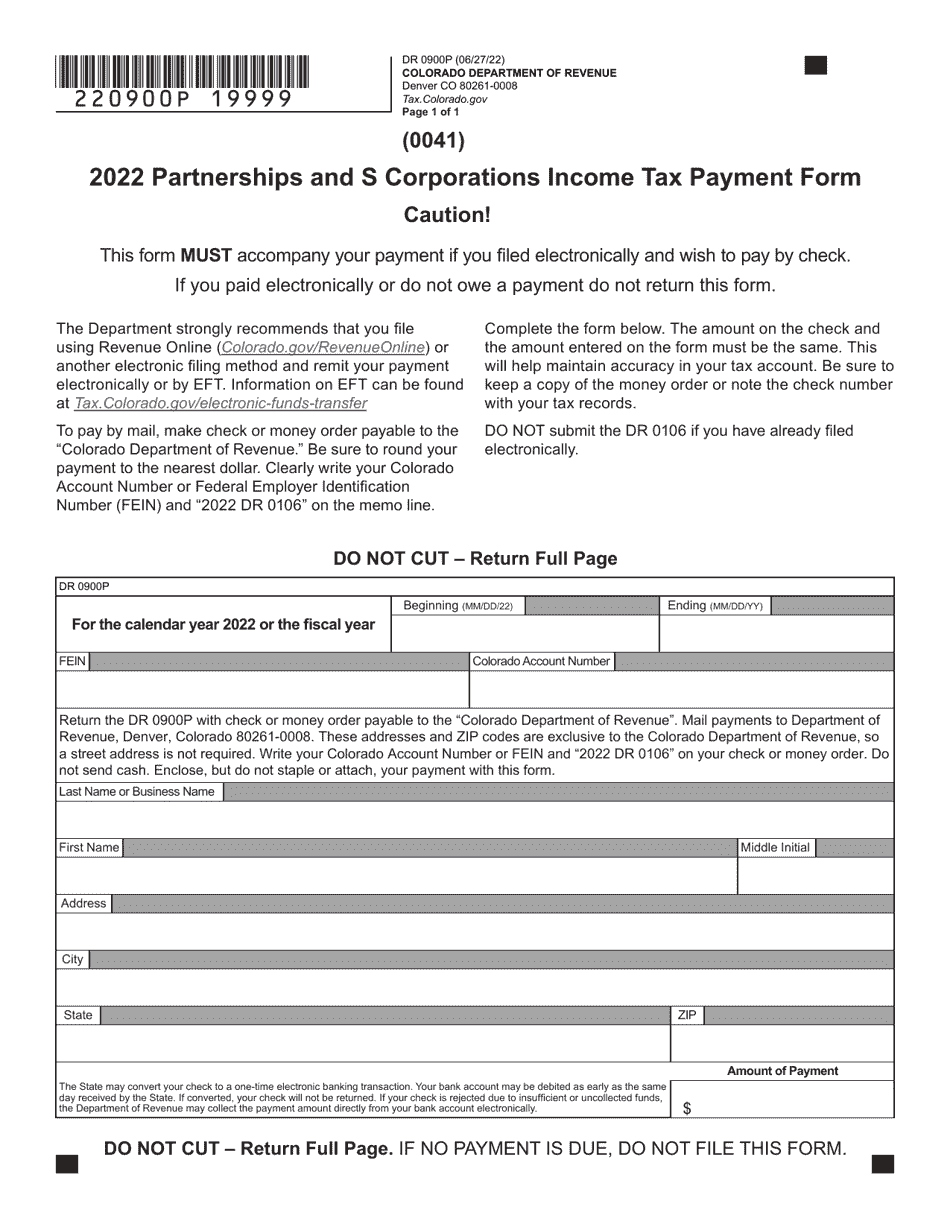

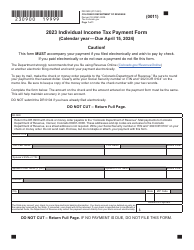

Form DR0900P

for the current year.

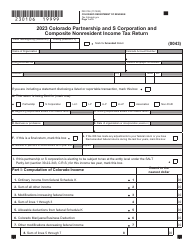

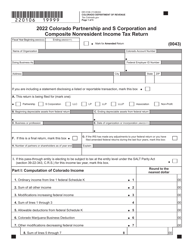

Form DR0900P Partnerships and S Corporations Income Tax Payment Form - Colorado

What Is Form DR0900P?

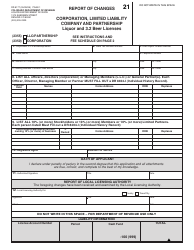

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR0900P?

A: Form DR0900P is the Partnerships and S Corporations Income Tax Payment Form in Colorado.

Q: Who needs to use Form DR0900P?

A: Partnerships and S Corporations in Colorado need to use Form DR0900P.

Q: What is the purpose of Form DR0900P?

A: The purpose of Form DR0900P is to make income tax payments for partnerships and S corporations in Colorado.

Q: When is Form DR0900P due?

A: Form DR0900P is due on the 15th day of the 4th month following the close of the tax year for partnerships and S corporations.

Q: Are there any penalties for late payment of income tax using Form DR0900P?

A: Yes, there may be penalties for late payment of income tax. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on June 27, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0900P by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.