This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0375

for the current year.

Form DR0375 Credit for Employer Paid Leave of Absence for Live Organ Donation - Colorado

What Is Form DR0375?

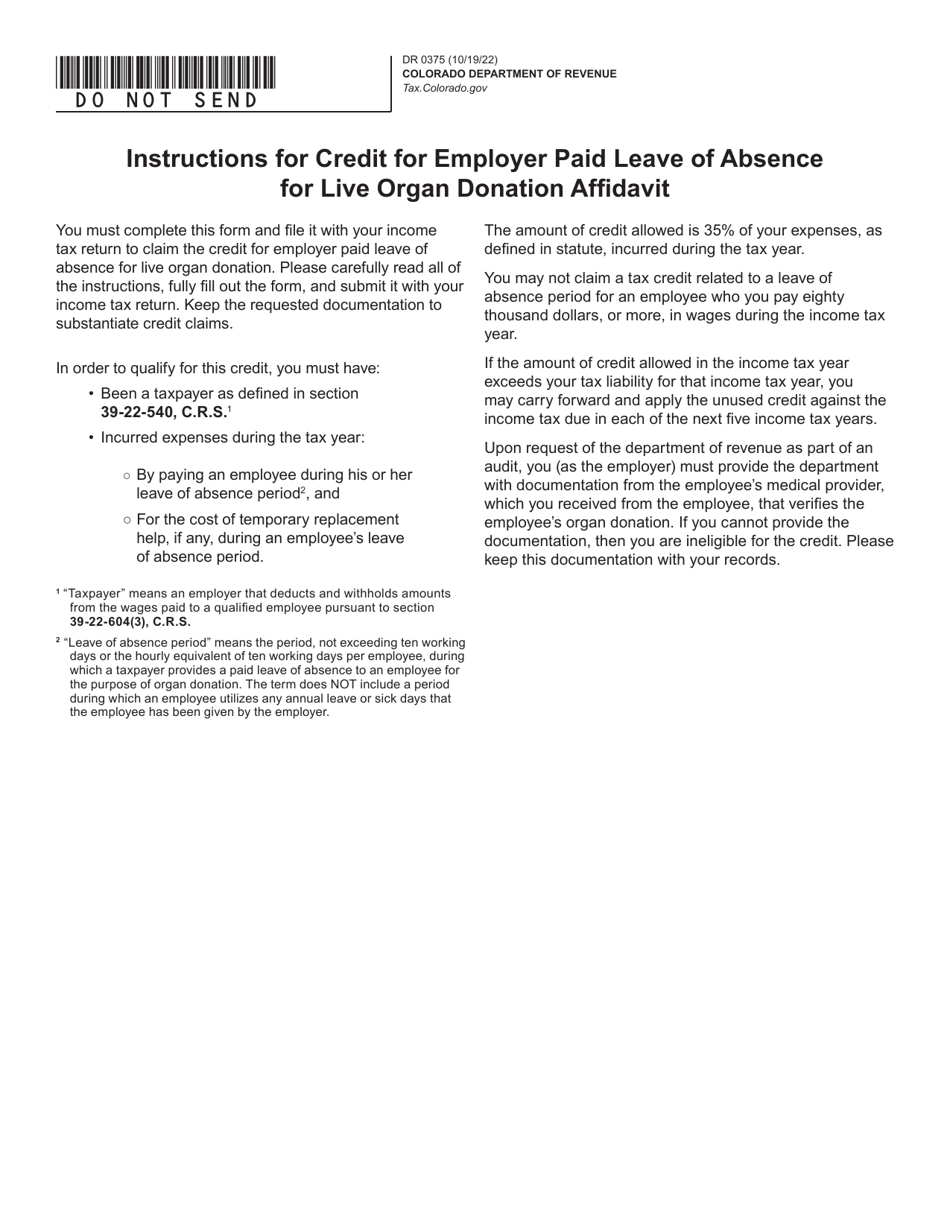

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

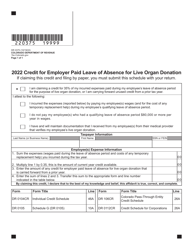

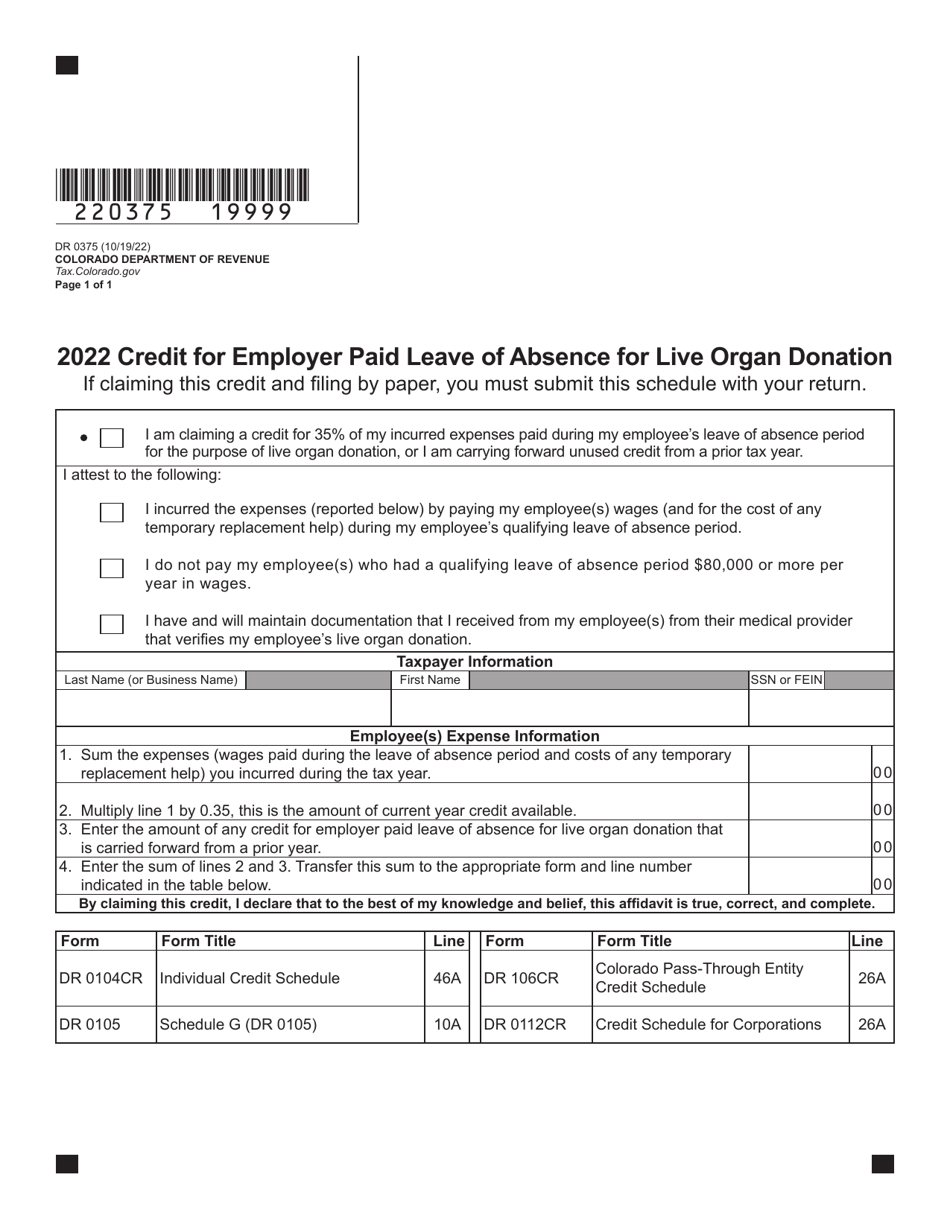

Q: What is Form DR0375?

A: Form DR0375 is the form used in Colorado to claim the credit for employer-paid leave of absence for live organ donation.

Q: What is the purpose of Form DR0375?

A: The purpose of Form DR0375 is to claim a tax credit for employers who provide paid leave of absence to an employee who serves as a live organ donor.

Q: Who can use Form DR0375?

A: Employers in Colorado can use Form DR0375 to claim the credit for employer-paid leave of absence for live organ donation.

Q: What is the credit for employer-paid leave of absence for live organ donation?

A: The credit is equal to 35% of the employee's regular wages paid during the leave of absence period.

Q: What are the requirements to claim the credit?

A: To claim the credit, the employer must have a written policy that provides for at least 10 consecutive workdays of paid leave of absence for live organ donation.

Q: When should Form DR0375 be filed?

A: Form DR0375 should be filed with the Colorado Department of Revenue by the last day of the month following the end of the calendar year in which the leave of absence occurred.

Q: Are there any other forms or documents that need to be submitted with Form DR0375?

A: No, Form DR0375 does not require any additional forms or documents to be submitted.

Form Details:

- Released on October 19, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0375 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.