This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0106K

for the current year.

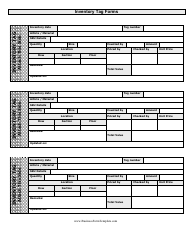

Form DR0106K Colorado K-1 - Colorado

What Is Form DR0106K?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

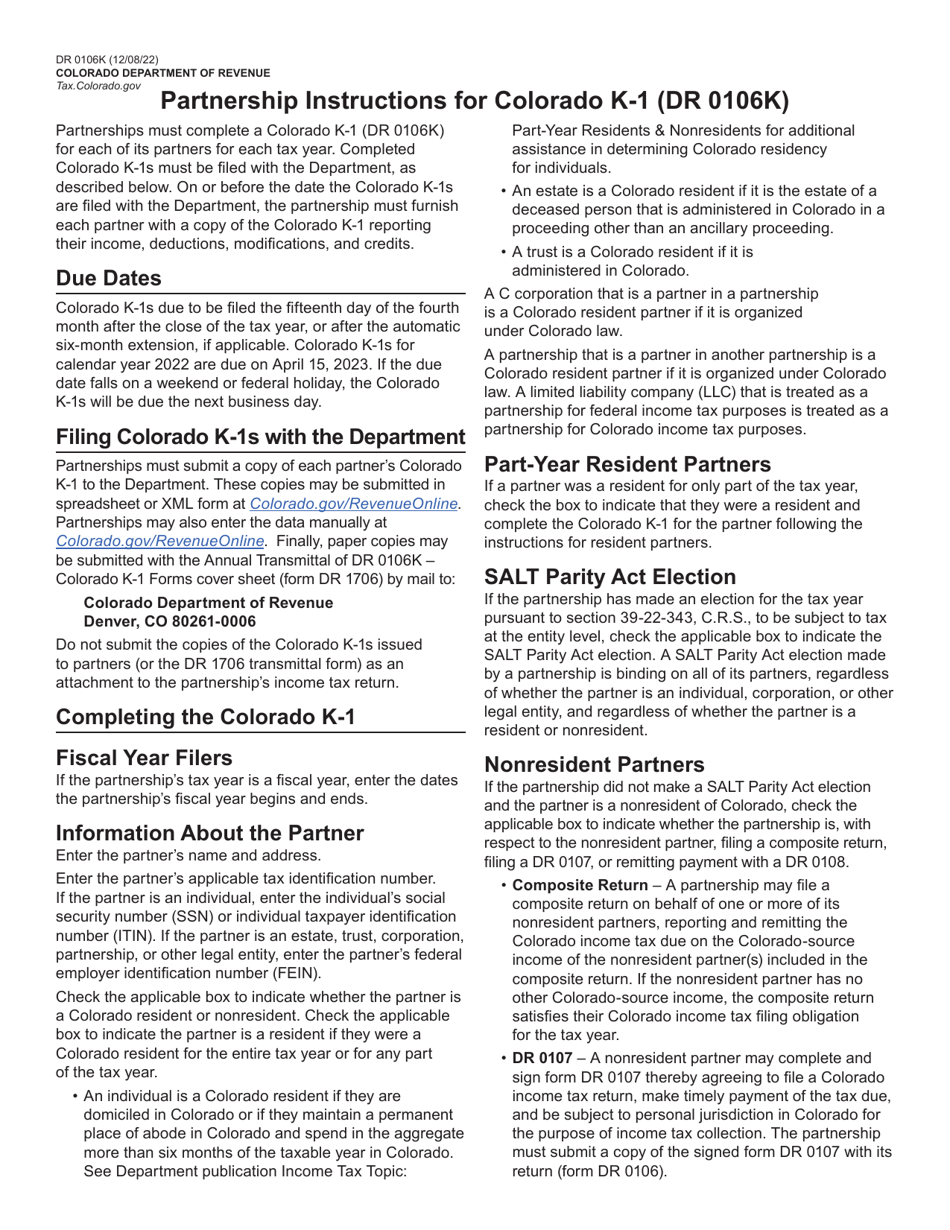

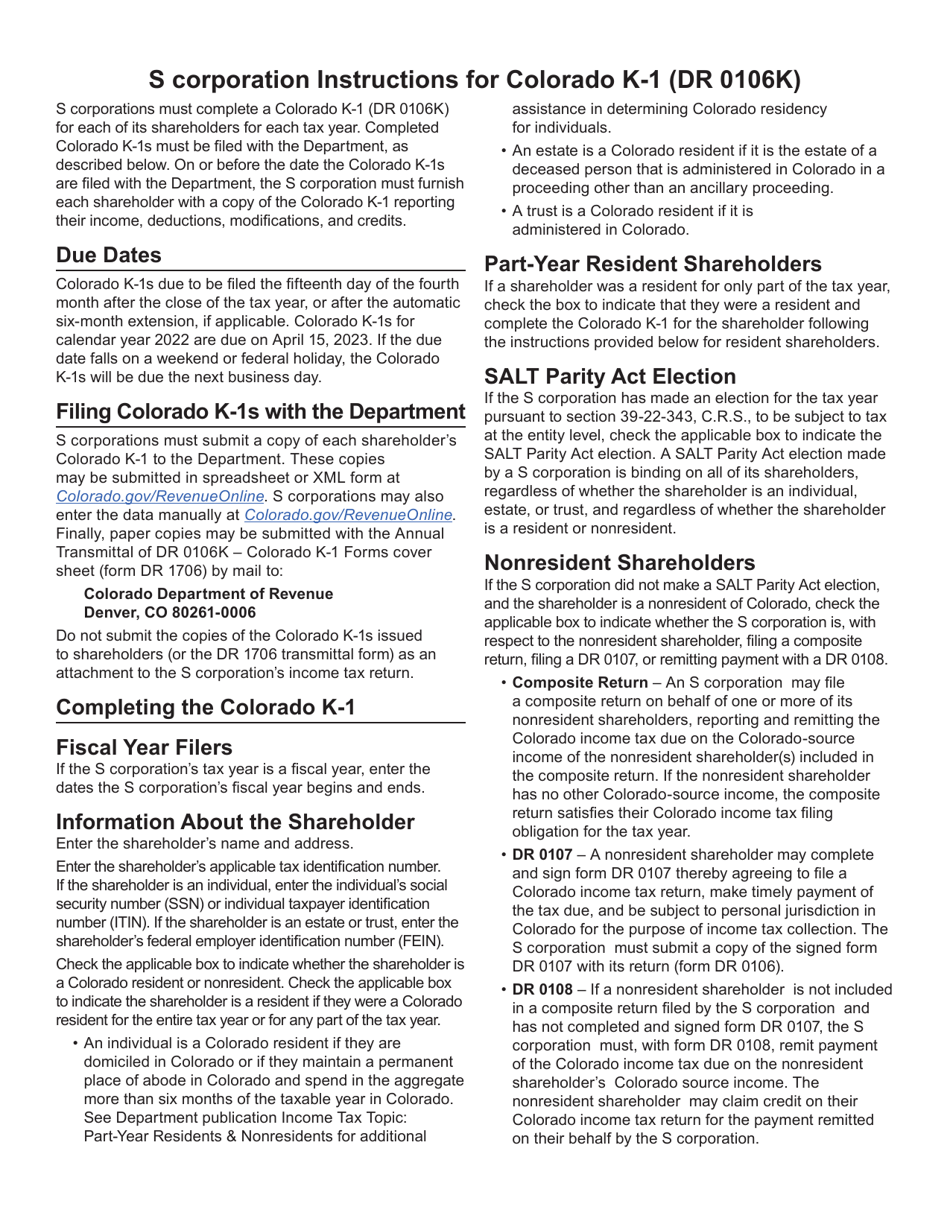

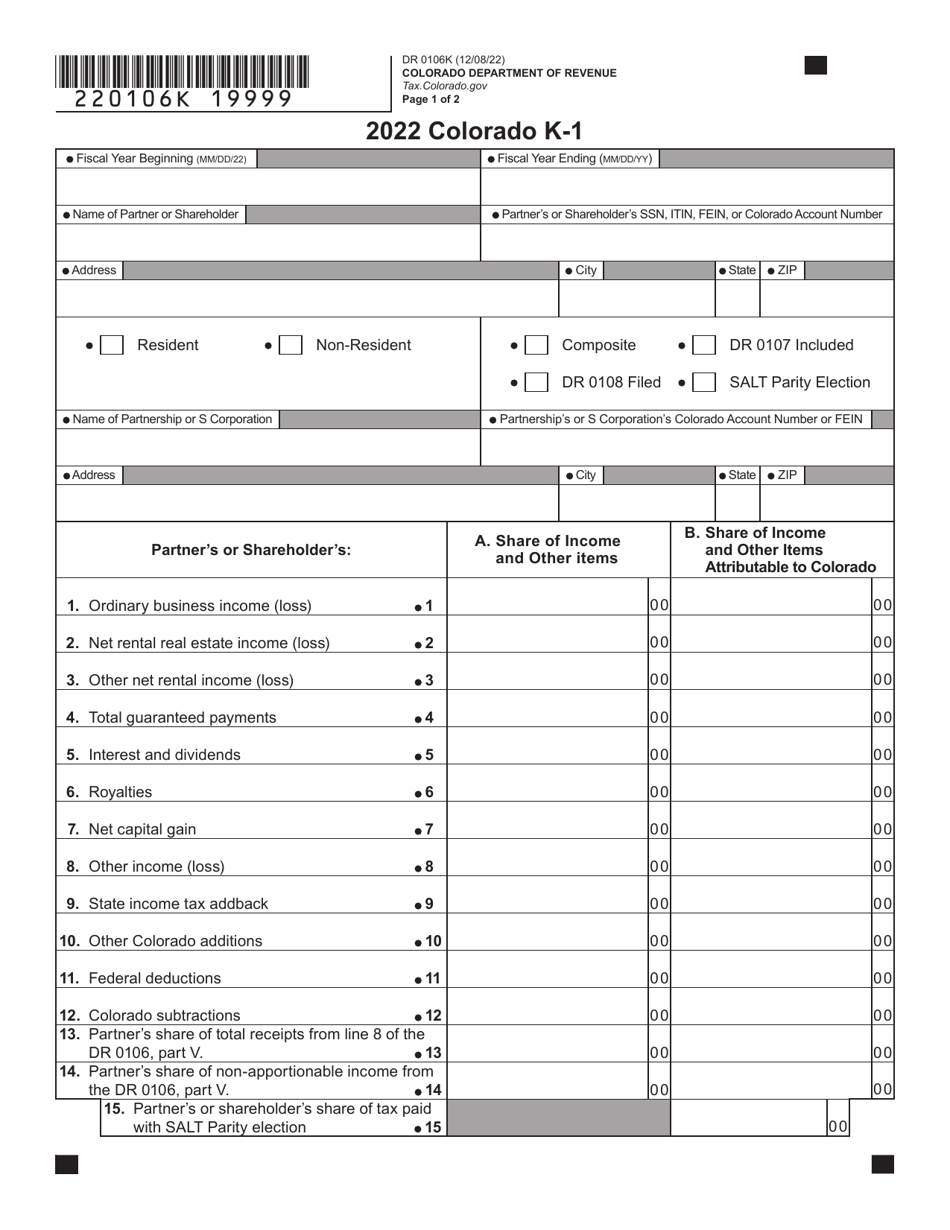

Q: What is the DR0106K form?

A: The DR0106K form is also known as the Colorado K-1 form.

Q: Who needs to file the DR0106K form?

A: The DR0106K form is used by Colorado residents who have income from a partnership, S corporation, estate, or trust.

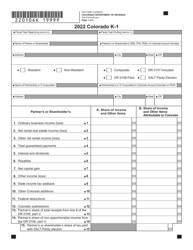

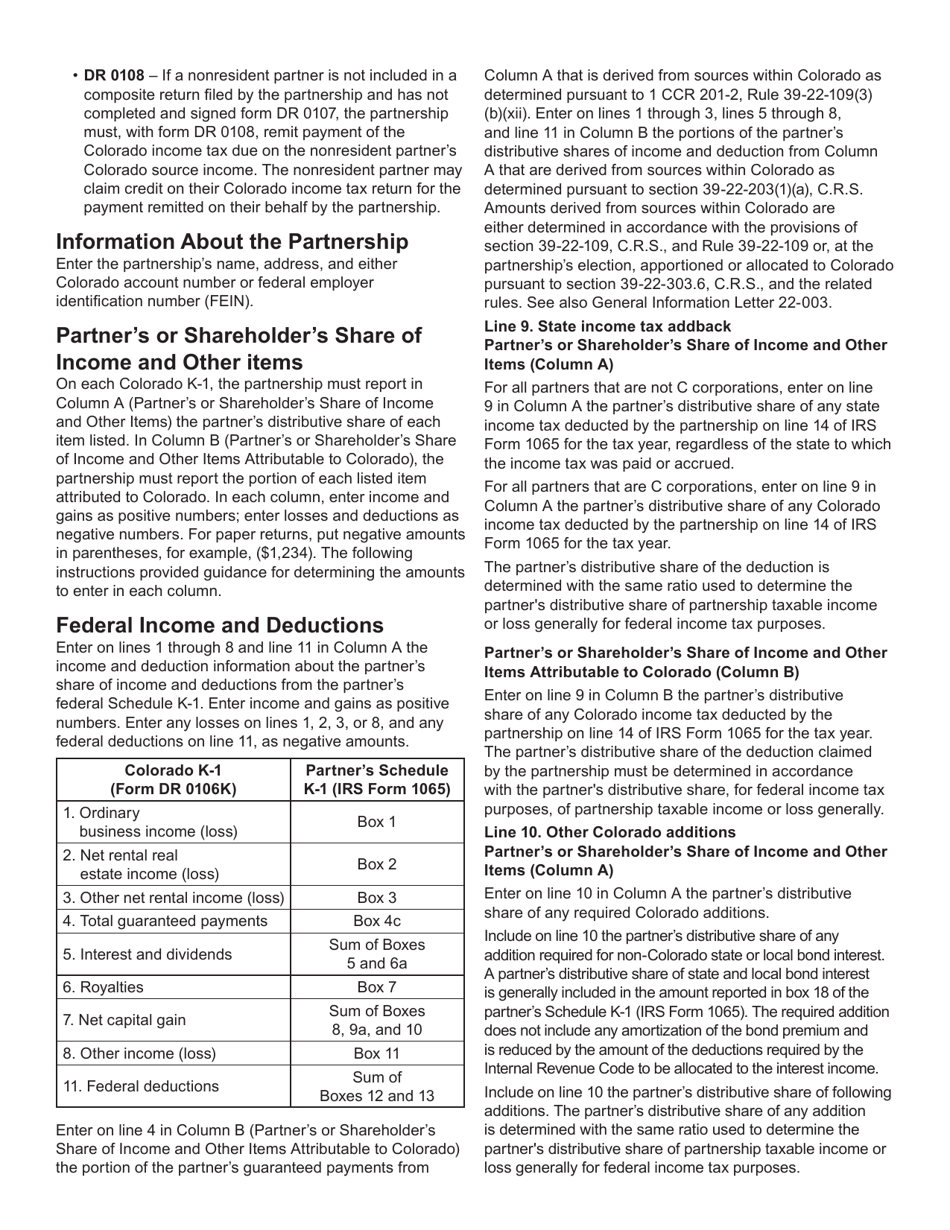

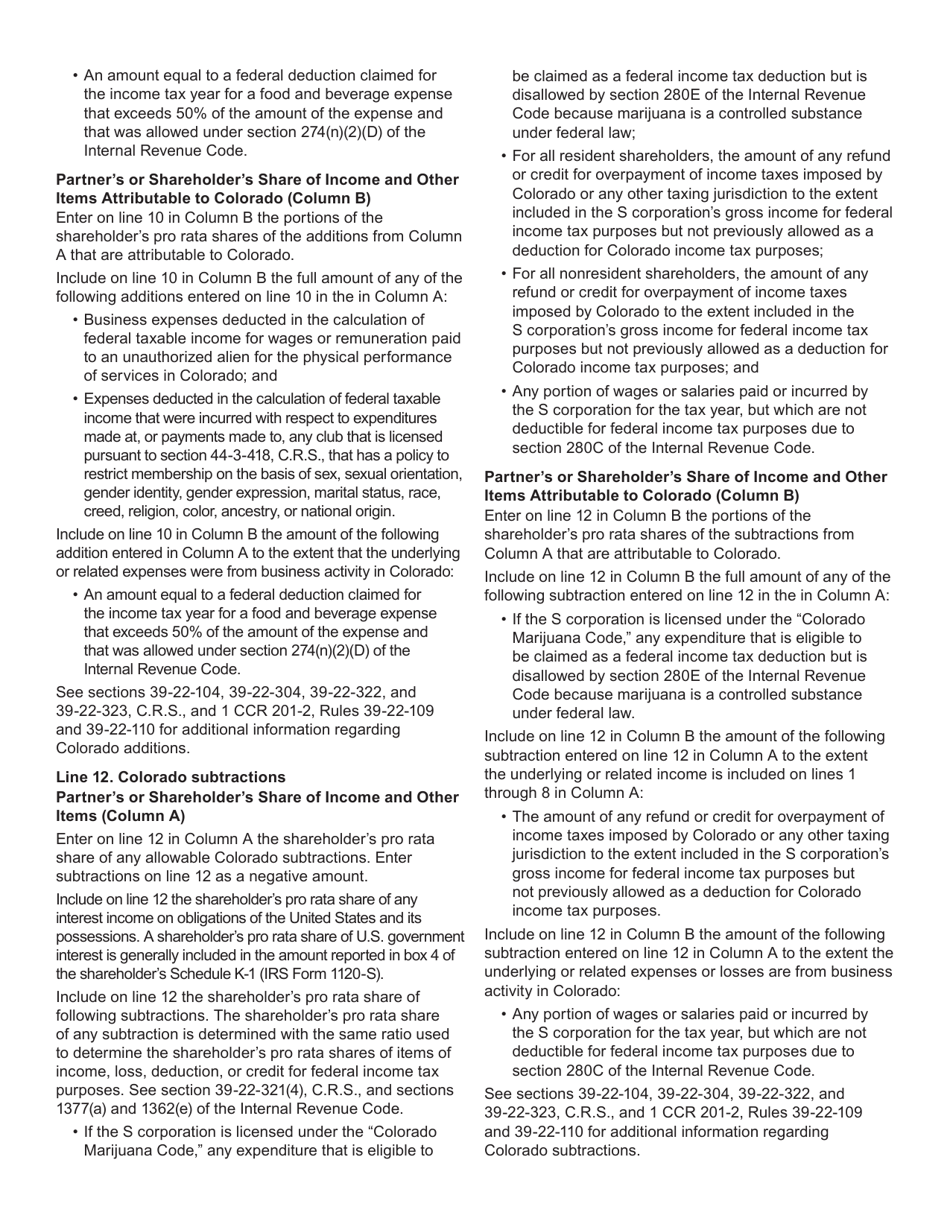

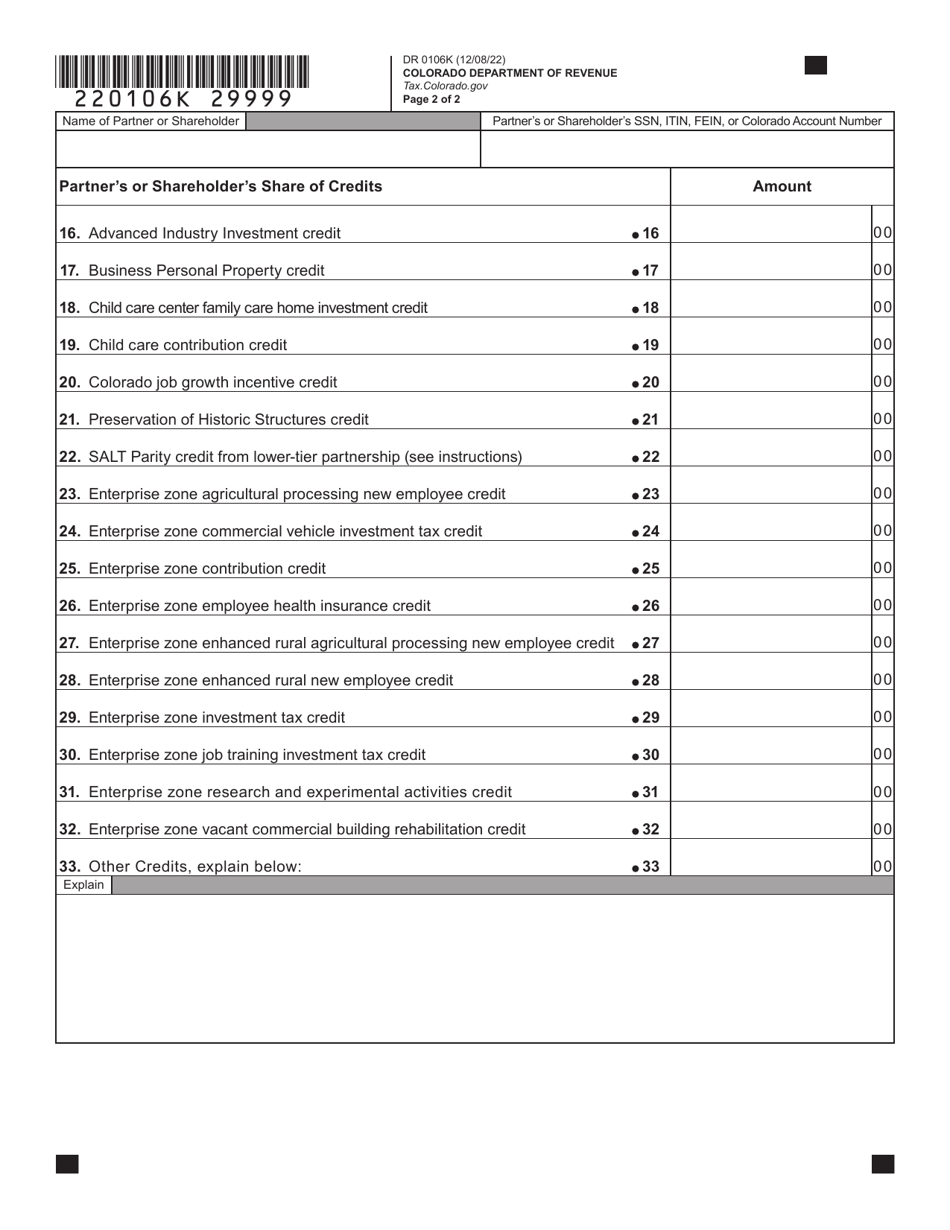

Q: What information is required on the DR0106K form?

A: The form requires information about the partnership, S corporation, estate, or trust, as well as details about the taxpayer's share of the income, deductions, and credits.

Q: When is the deadline to file the DR0106K form?

A: The deadline to file the DR0106K form is the same as the individual incometax deadline, which is typically April 15th.

Q: Are there any additional forms or schedules that need to be filed with the DR0106K form?

A: Depending on the taxpayer's situation, additional forms or schedules may need to be filed, such as Schedule CO K-1.

Q: What should I do if I have questions or need help completing the DR0106K form?

A: If you have questions or need assistance, you can contact the Colorado Department of Revenue or consult a tax professional.

Form Details:

- Released on December 8, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0106K by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.