This version of the form is not currently in use and is provided for reference only. Download this version of

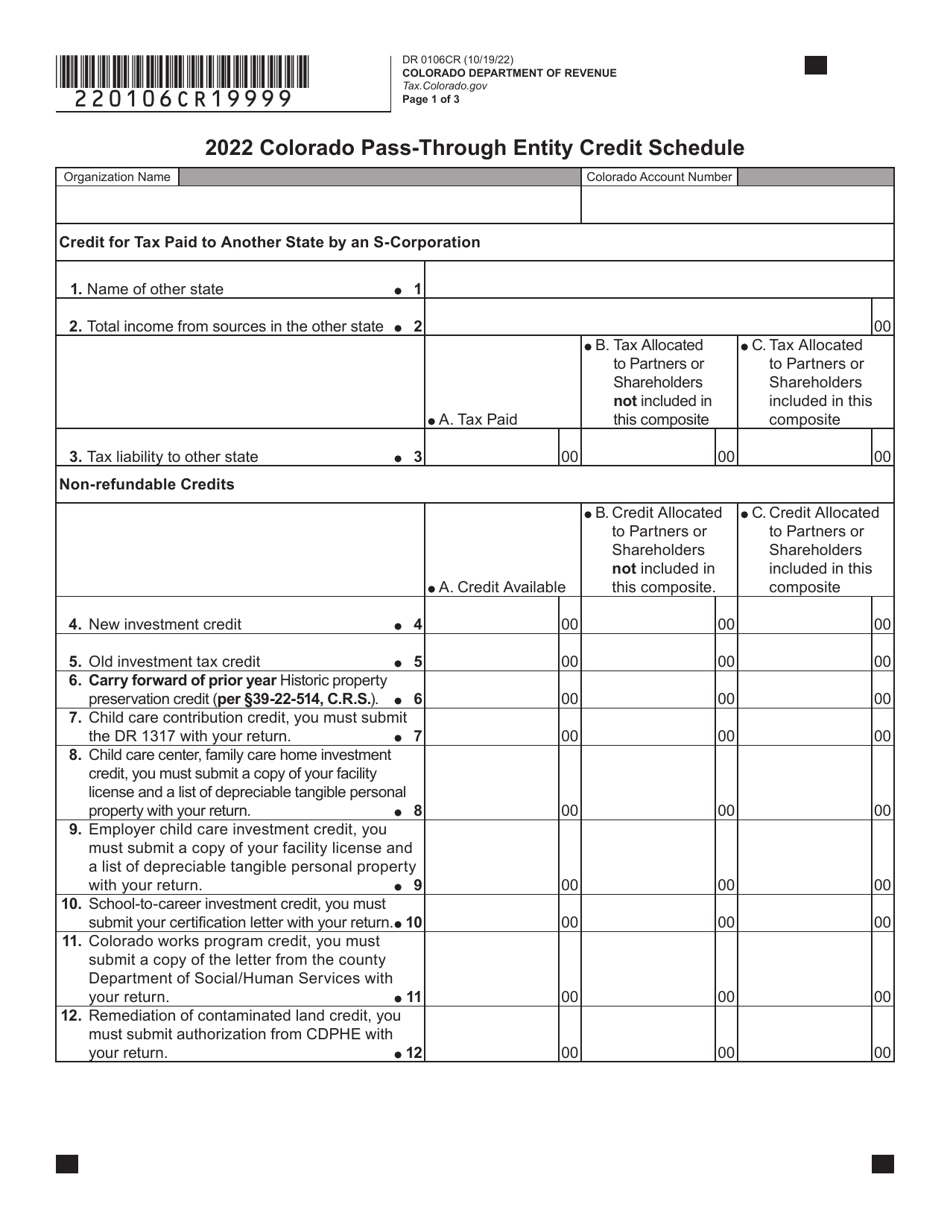

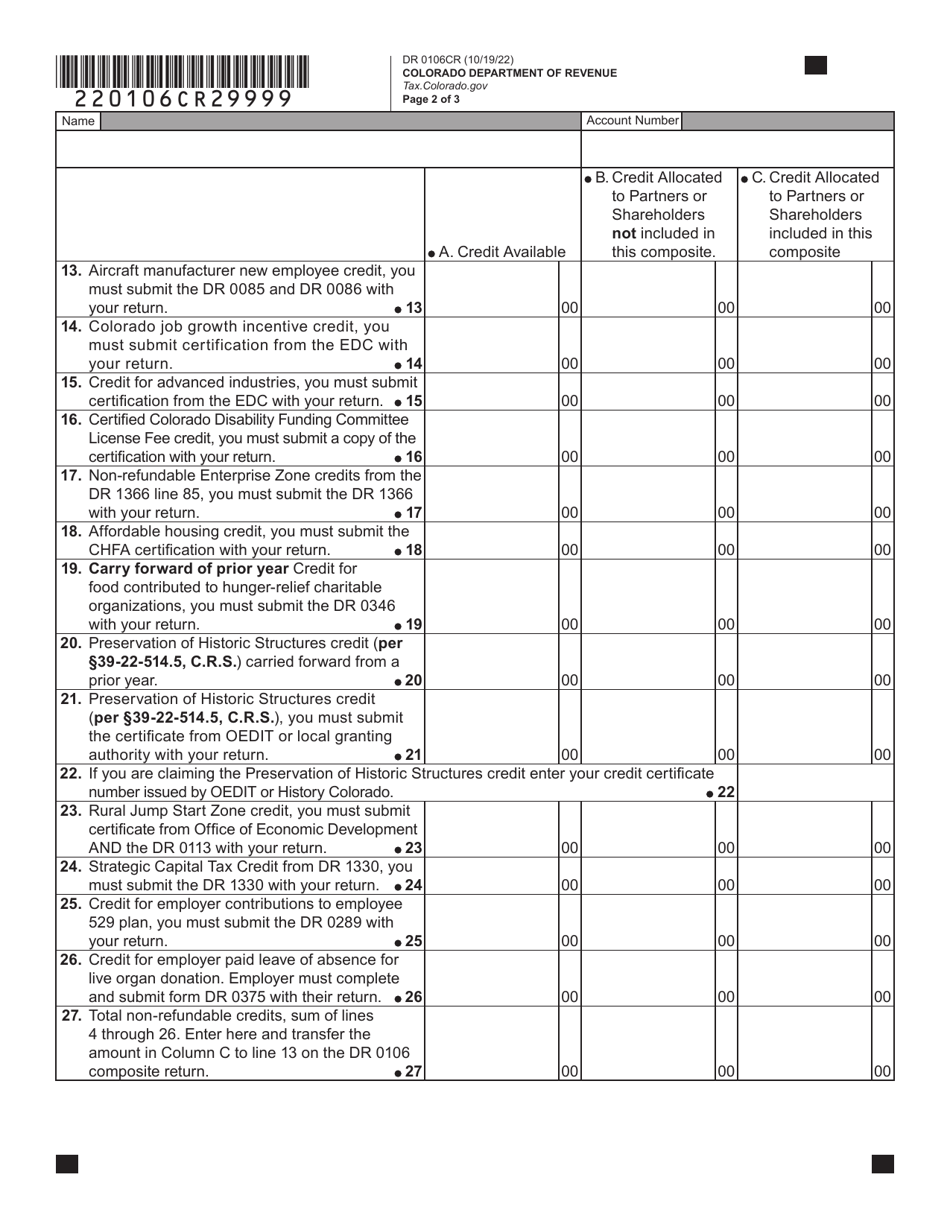

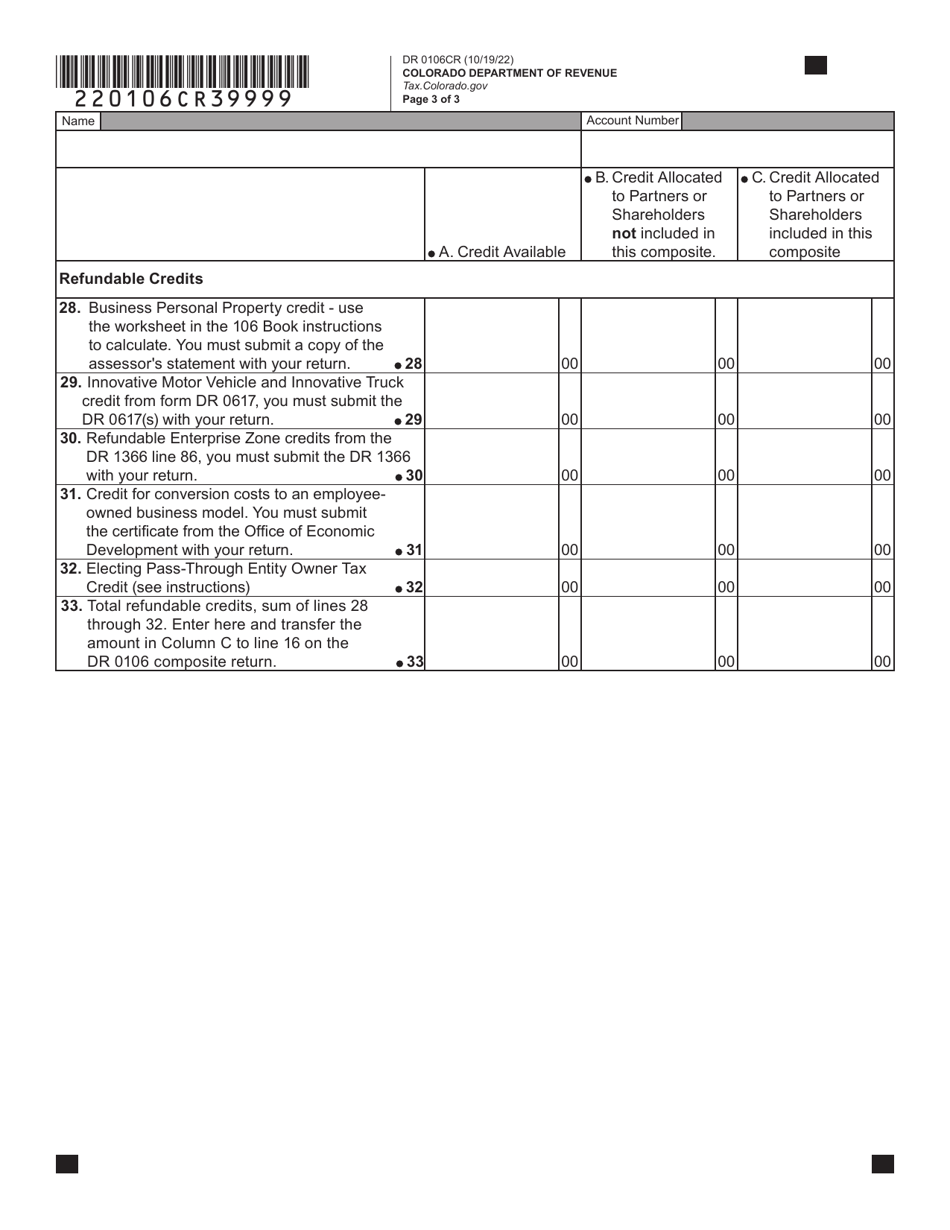

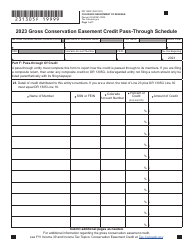

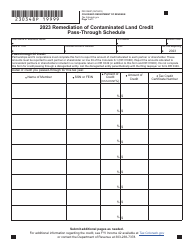

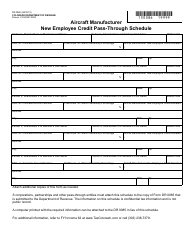

Form DR0106CR

for the current year.

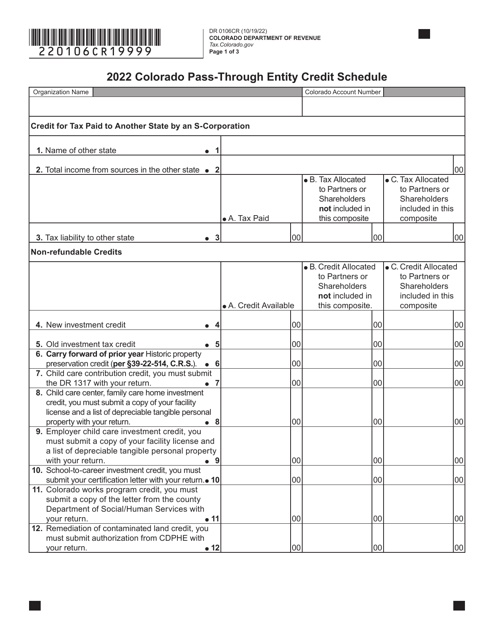

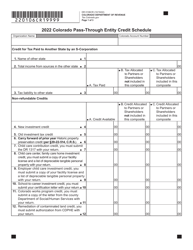

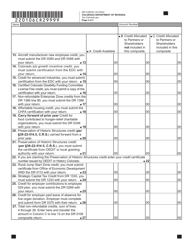

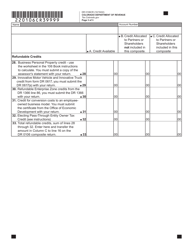

Form DR0106CR Colorado Pass-Through Entity Credit Schedule - Colorado

What Is Form DR0106CR?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0106CR?

A: Form DR0106CR is the Colorado Pass-Through Entity Credit Schedule.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income tax directly, but passes income and deductions to its owners or shareholders who report them on their individual tax returns.

Q: What is the purpose of Form DR0106CR?

A: Form DR0106CR is used by pass-through entities in Colorado to claim various tax credits.

Q: Who needs to file Form DR0106CR?

A: Pass-through entities in Colorado that are eligible for tax credits need to file Form DR0106CR.

Q: When is the deadline to file Form DR0106CR?

A: The deadline to file Form DR0106CR is the same as the deadline for filing the pass-through entity's Colorado income tax return.

Q: Are there any penalties for not filing Form DR0106CR?

A: Yes, failing to file Form DR0106CR or claiming incorrect credits may result in penalties and interest.

Q: What credits can be claimed on Form DR0106CR?

A: Form DR0106CR allows pass-through entities to claim credits such as enterprise zone, conservation easement, and earned income tax credits.

Q: Is Form DR0106CR for individuals or businesses?

A: Form DR0106CR is for businesses, specifically pass-through entities in Colorado.

Form Details:

- Released on October 19, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0106CR by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.