This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0105EP

for the current year.

Form DR0105EP Estate / Trust Estimated Tax Payment Form - Colorado

What Is Form DR0105EP?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

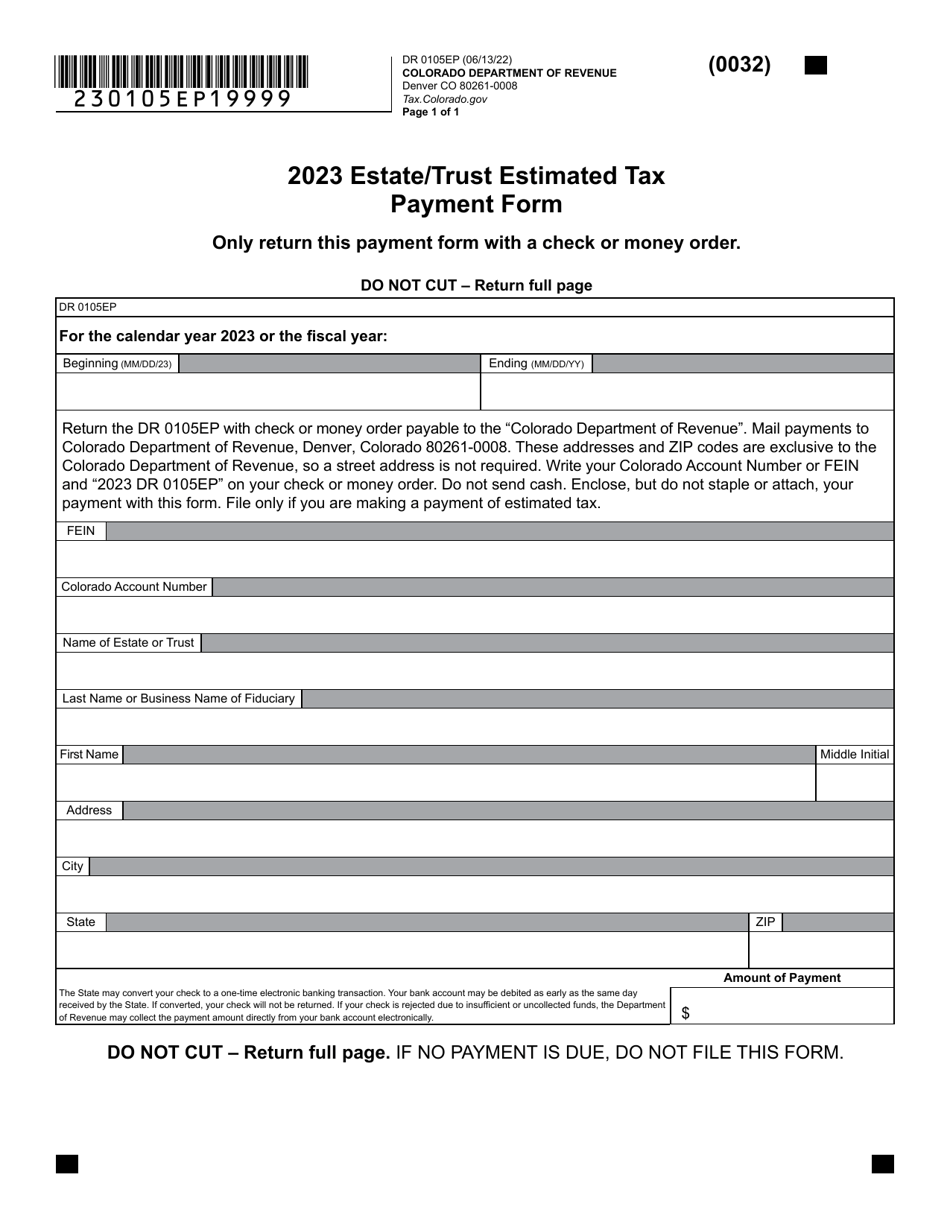

Q: What is Form DR0105EP?

A: Form DR0105EP is the Estate/Trust Estimated Tax Payment Form for Colorado.

Q: Who is required to use Form DR0105EP?

A: Estate and trust filers in Colorado are required to use Form DR0105EP.

Q: What is the purpose of Form DR0105EP?

A: Form DR0105EP is used to make estimated tax payments for estates and trusts in Colorado.

Q: When is Form DR0105EP due?

A: Form DR0105EP is due on or before the 15th day of the 4th month following the close of the tax year.

Q: Are there any penalties for late or insufficient payments?

A: Yes, there may be penalties for late or insufficient payments. It is important to accurately calculate and timely submit your estimated tax payments to avoid penalties.

Q: Is Form DR0105EP for federal or state taxes?

A: Form DR0105EP is specifically for Colorado state taxes.

Q: Do I need to attach any additional forms or documentation to Form DR0105EP?

A: Generally, you do not need to attach additional forms or documentation to Form DR0105EP. However, it is always a good idea to consult the instructions or seek professional tax advice to ensure compliance with the filing requirements.

Form Details:

- Released on June 13, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0105EP by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.