This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0106EP

for the current year.

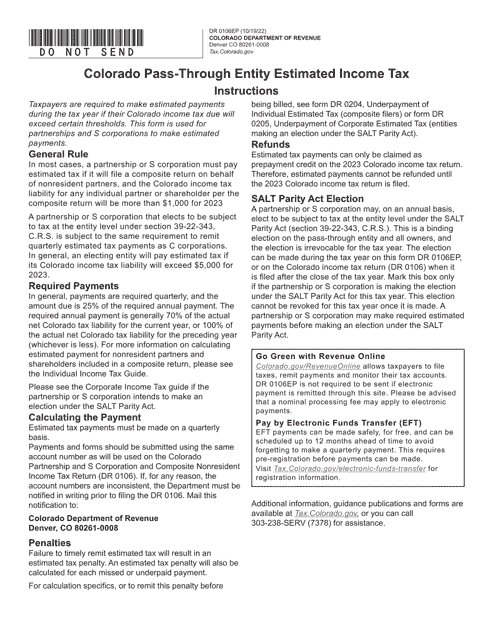

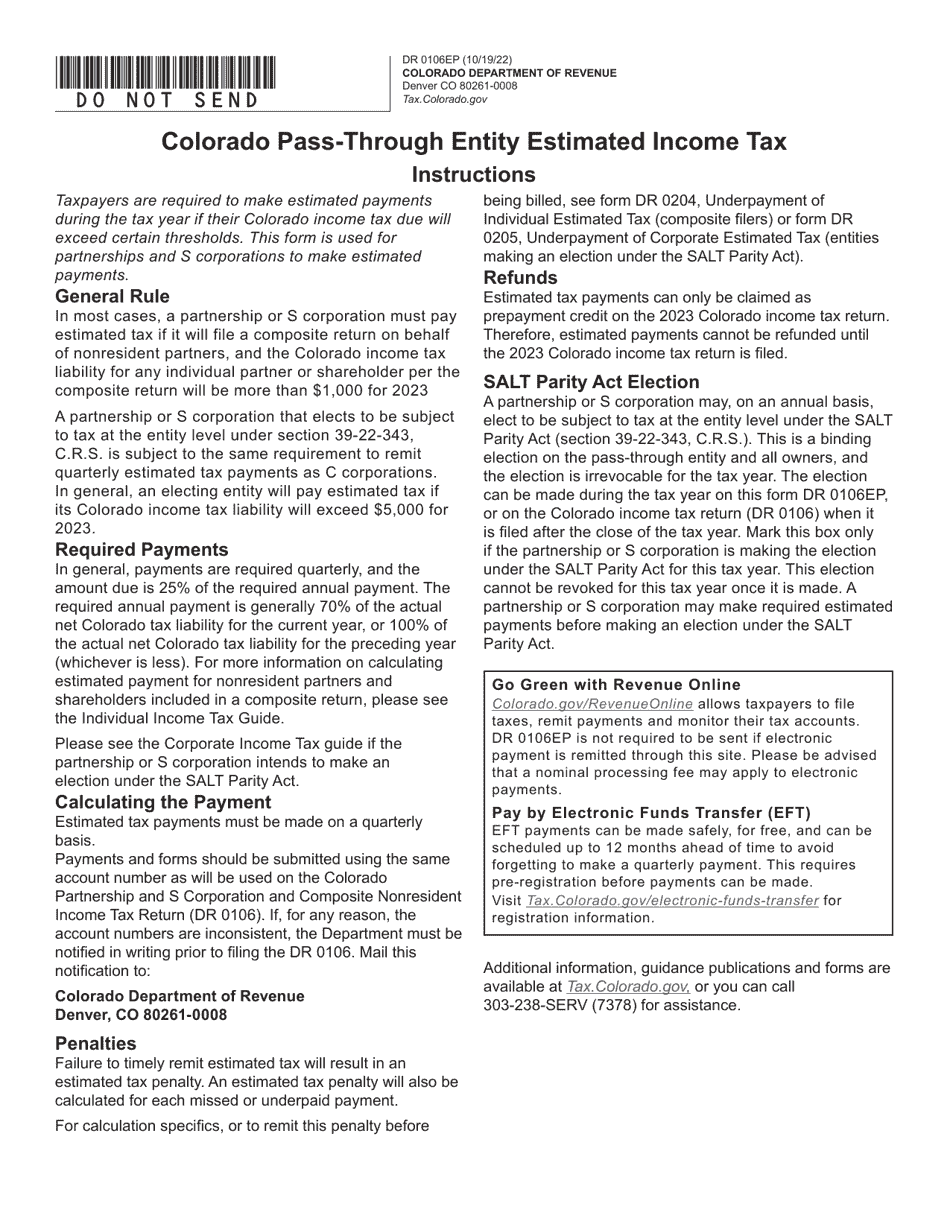

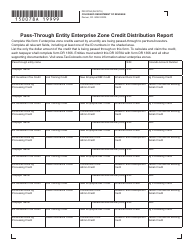

Form DR0106EP Colorado Pass-Through Entity Estimated Income Tax - Colorado

What Is Form DR0106EP?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0106EP?

A: Form DR0106EP is the Colorado Pass-Through Entity Estimated Income Tax form.

Q: Who needs to file Form DR0106EP?

A: Pass-through entities in Colorado, such as partnerships, S corporations, and limited liability companies, need to file Form DR0106EP if they have estimated income tax liability.

Q: What is the purpose of Form DR0106EP?

A: The purpose of Form DR0106EP is to report and pay estimated income tax for pass-through entities in Colorado.

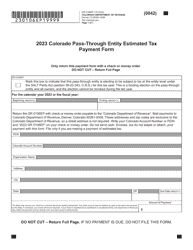

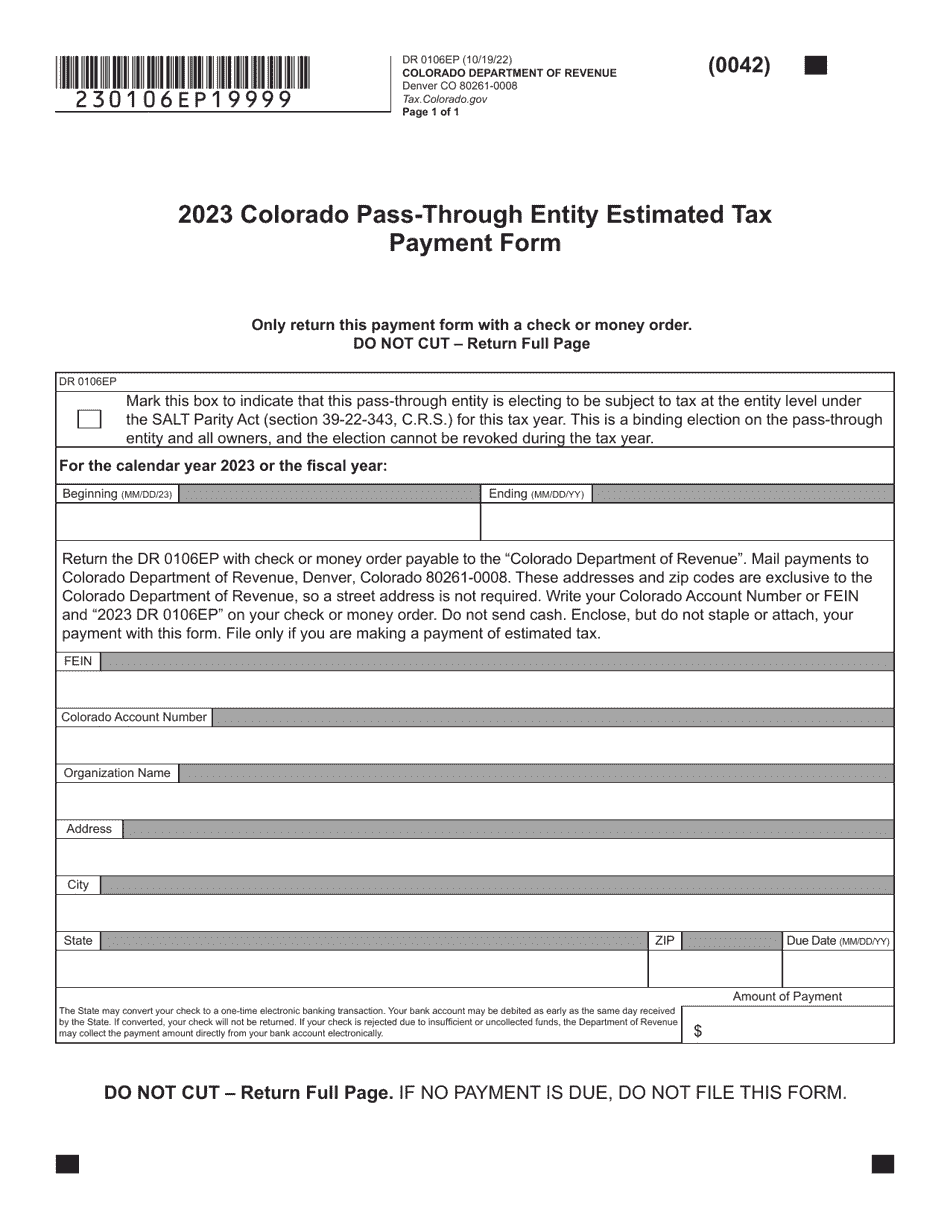

Q: When is the deadline to file Form DR0106EP?

A: The deadline to file Form DR0106EP is on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing Form DR0106EP?

A: Yes, failure to file Form DR0106EP or pay the estimated income tax by the due date may result in penalties and interest.

Form Details:

- Released on October 19, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0106EP by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.