This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0102

for the current year.

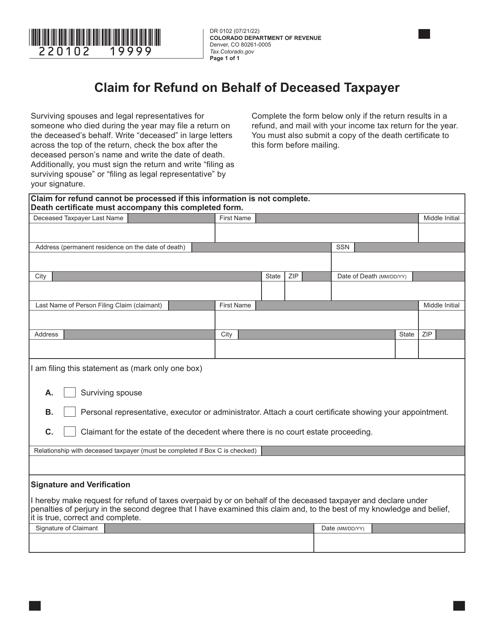

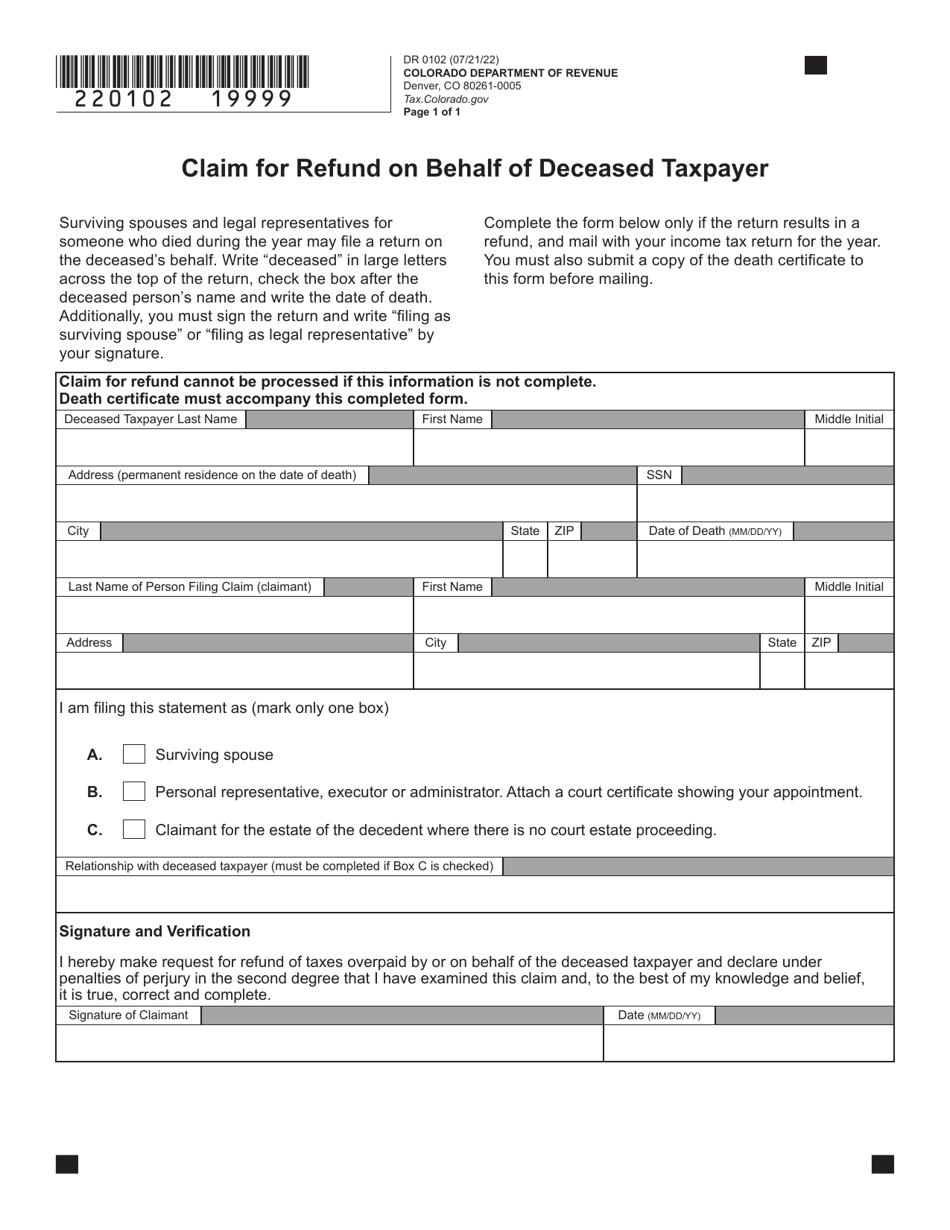

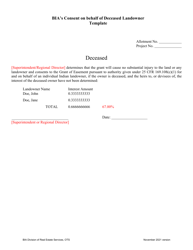

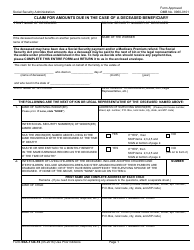

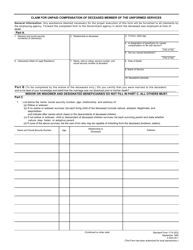

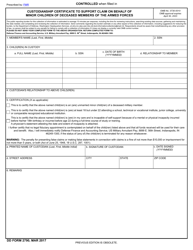

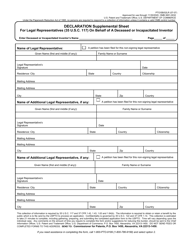

Form DR0102 Claim for Refund on Behalf of Deceased Taxpayer - Colorado

What Is Form DR0102?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0102?

A: Form DR0102 is a claim for refund on behalf of a deceased taxpayer in Colorado.

Q: Who can file Form DR0102?

A: The personal representative, surviving spouse, or legal representative can file Form DR0102 on behalf of a deceased taxpayer.

Q: What is the purpose of Form DR0102?

A: The purpose of Form DR0102 is to claim a refund for any overpaid taxes on behalf of a deceased taxpayer.

Q: What information is required to fill out Form DR0102?

A: The form requires information about the deceased taxpayer, the personal representative, and the tax year for which the refund is being claimed.

Q: Is there a deadline to file Form DR0102?

A: Yes, Form DR0102 must be filed within 3 years from the due date of the original tax return or within 1 year of the final determination of the estate, whichever is later.

Q: Can I e-file Form DR0102?

A: No, Form DR0102 cannot be e-filed. It must be printed, signed, and mailed to the Colorado Department of Revenue.

Q: Is there a fee to file Form DR0102?

A: No, there is no fee to file Form DR0102.

Q: How long does it take to process Form DR0102?

A: It may take several weeks for the Colorado Department of Revenue to process Form DR0102 and issue a refund.

Form Details:

- Released on July 21, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0102 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.