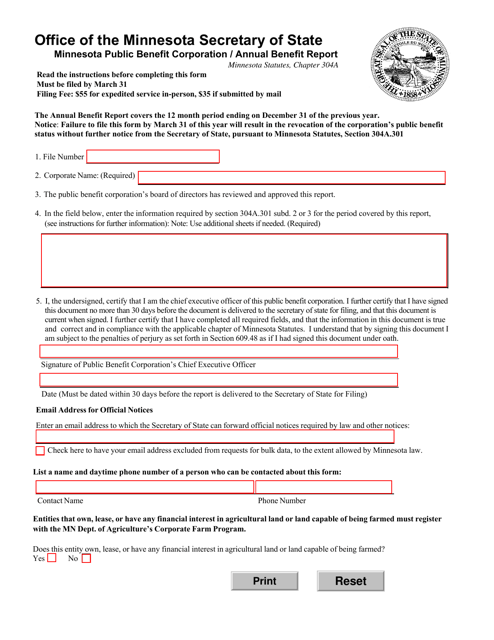

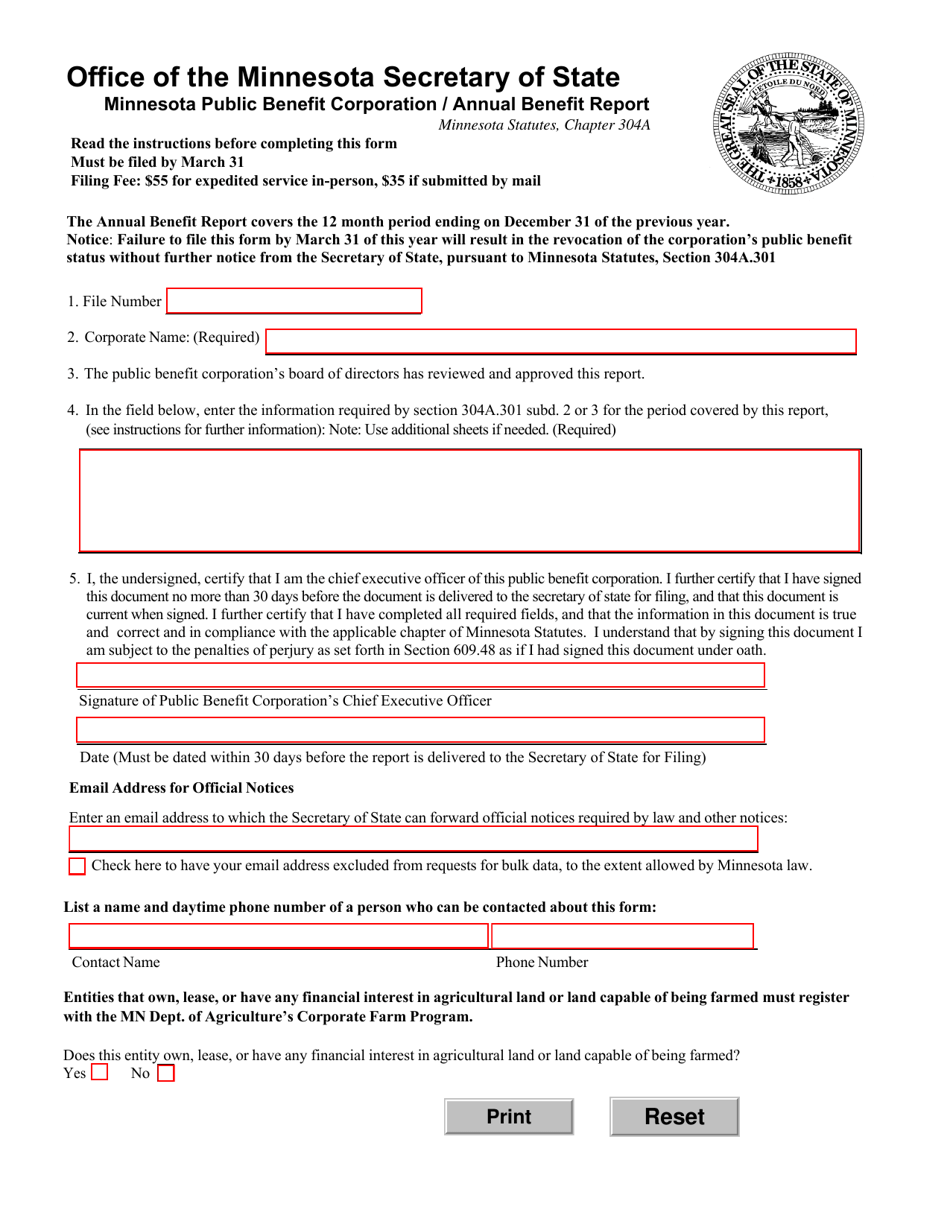

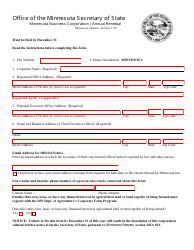

Minnesota Public Benefit Corporation Annual Benefit Report - Minnesota

Minnesota Public Benefit Corporation Annual Benefit Report is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Public Benefit Corporation in Minnesota?

A: A Public Benefit Corporation in Minnesota is a type of corporation that is legally required to pursue a public benefit in addition to making profits for its shareholders.

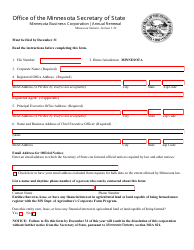

Q: What is an Annual Benefit Report?

A: An Annual Benefit Report is a document that Public Benefit Corporations in Minnesota are required to submit annually to report on their efforts to create a public benefit.

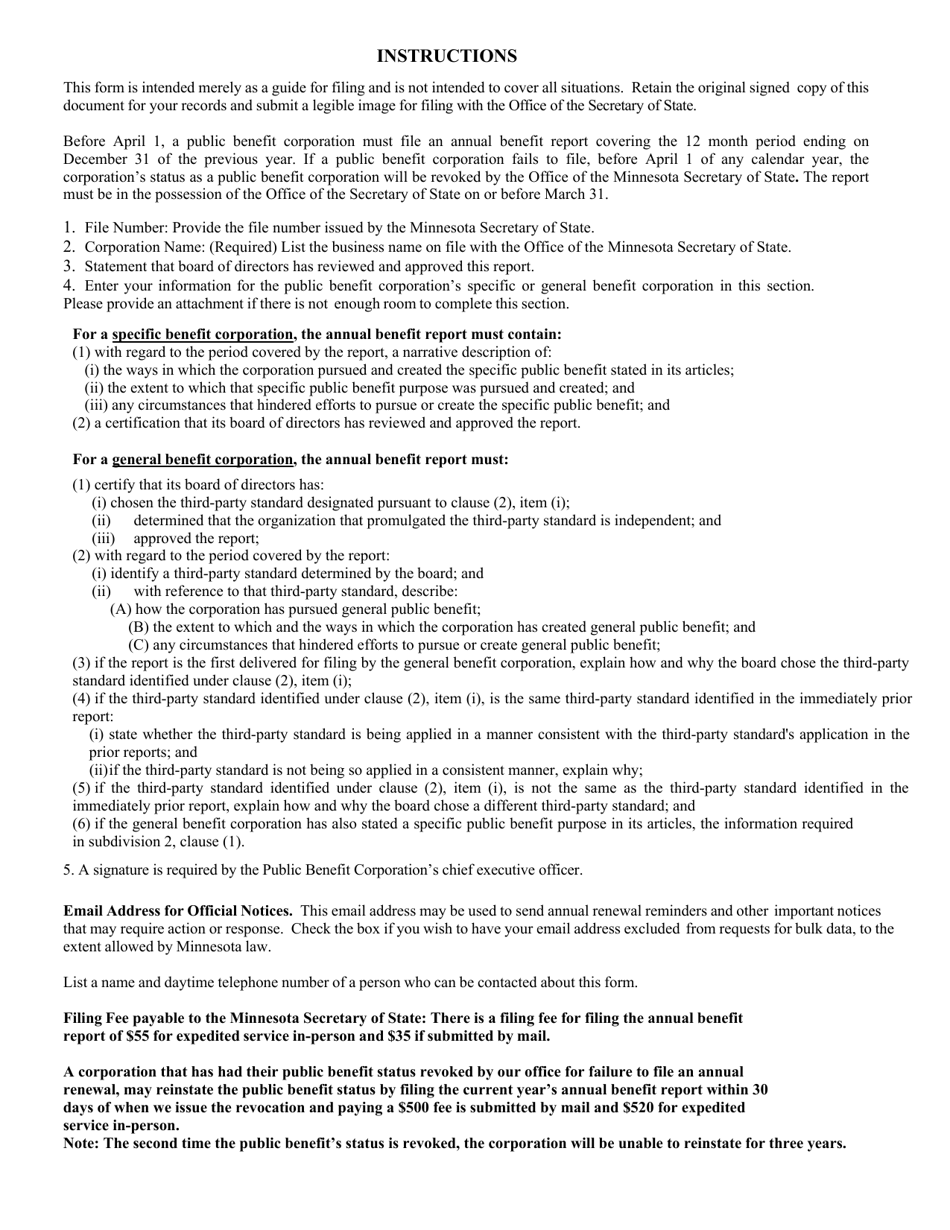

Q: What should be included in the Annual Benefit Report?

A: The Annual Benefit Report should include information about the specific public benefit the corporation aims to create, the actions taken to achieve that benefit, and the overall impact of those actions.

Q: Who is responsible for reviewing the Annual Benefit Report?

A: The Minnesota Secretary of State is responsible for reviewing the Annual Benefit Reports submitted by Public Benefit Corporations in Minnesota.

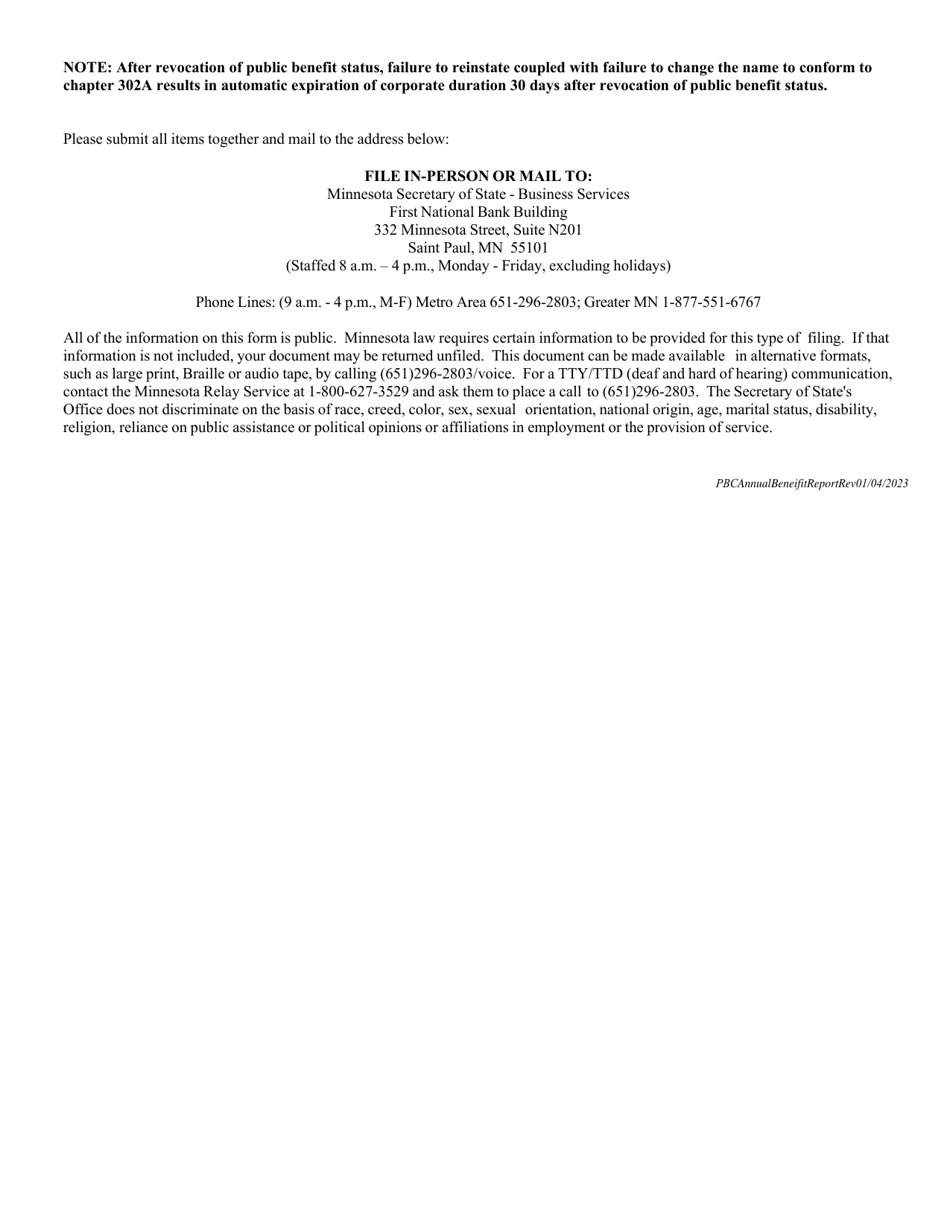

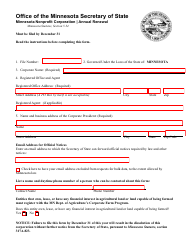

Q: What happens if a Public Benefit Corporation fails to submit the Annual Benefit Report?

A: If a Public Benefit Corporation fails to submit the Annual Benefit Report, it may face legal consequences, such as fines or the potential loss of its status as a Public Benefit Corporation.

Q: Are Annual Benefit Reports publicly available?

A: Yes, Annual Benefit Reports submitted by Public Benefit Corporations in Minnesota are typically available to the public for review.

Q: How are Public Benefit Corporations different from traditional corporations?

A: Public Benefit Corporations are different from traditional corporations because they have a legal obligation to consider the public benefit in addition to maximizing shareholder value.

Q: What is the purpose of requiring Annual Benefit Reports?

A: Requiring Annual Benefit Reports helps ensure transparency and accountability for Public Benefit Corporations, allowing stakeholders to evaluate whether they are fulfilling their public benefit obligations.

Q: Can a Public Benefit Corporation change its designated public benefit?

A: Yes, a Public Benefit Corporation can change its designated public benefit, but such a change must be approved by the shareholders and filed with the Minnesota Secretary of State.

Q: Are there any tax benefits for Public Benefit Corporations in Minnesota?

A: There are currently no specific tax benefits provided exclusively to Public Benefit Corporations in Minnesota. However, they may still be eligible for certain tax deductions or incentives available to all corporations.

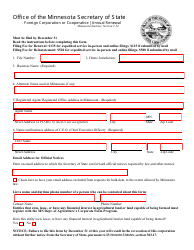

Form Details:

- Released on January 4, 2023;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.