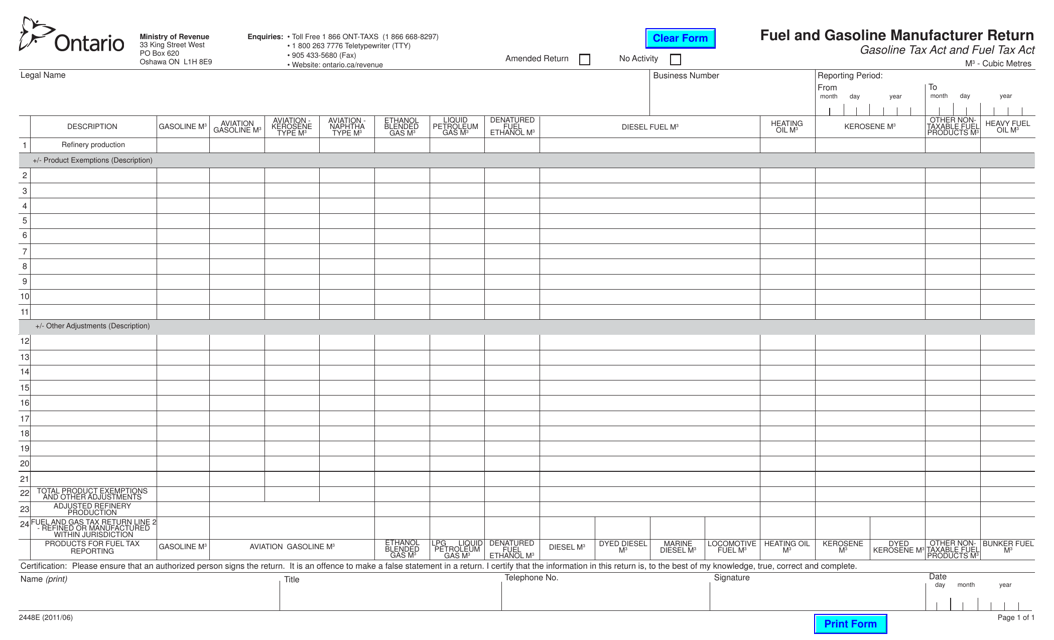

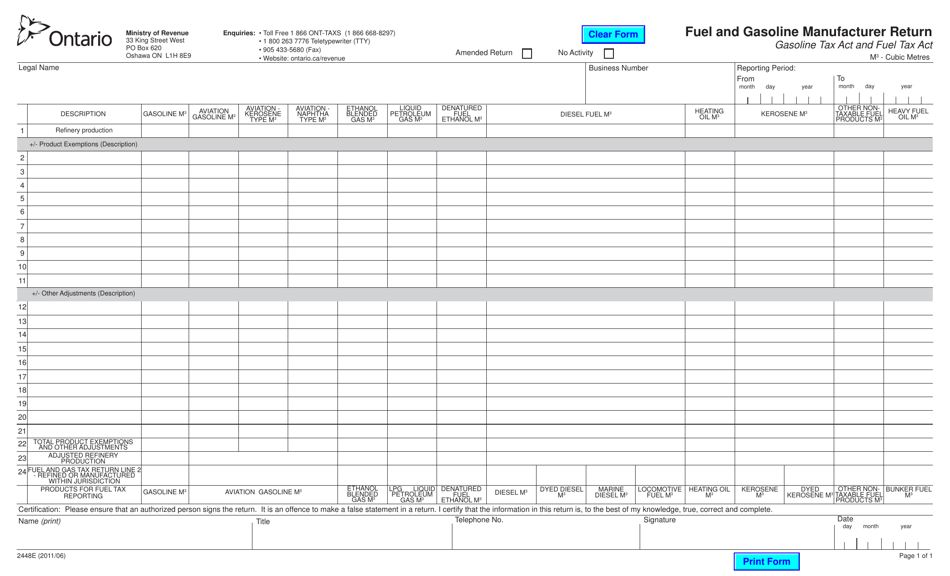

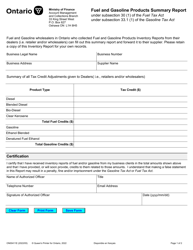

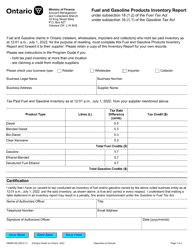

Form 2448E Fuel and Gasoline Manufacturer Return - Ontario, Canada

Form 2448E Fuel and Gasoline Manufacturer Return is used in Ontario, Canada for tax reporting purposes by manufacturers of fuel and gasoline.

FAQ

Q: What is Form 2448E?

A: Form 2448E is a fuel and gasoline manufacturer return for reporting and remitting taxes in Ontario, Canada.

Q: Who needs to file Form 2448E?

A: Fuel and gasoline manufacturers in Ontario, Canada are required to file Form 2448E.

Q: What is the purpose of Form 2448E?

A: The purpose of Form 2448E is to report and remit taxes on fuel and gasoline produced or imported in Ontario, Canada.

Q: What are the filing deadlines for Form 2448E?

A: Form 2448E must be filed on or before the 25th day of the month following the end of the reporting period.

Q: What taxes are reported on Form 2448E?

A: Form 2448E is used to report the Fuel Tax and the Carbon Charge on gasoline and other fuel products.

Q: Are there any penalties for late filing of Form 2448E?

A: Yes, penalties may apply for late filing of Form 2448E. It is important to file on time to avoid any penalties or interest charges.

Q: What supporting documents should be attached to Form 2448E?

A: Supporting documents may include sales and purchase invoices, inventory records, and any other relevant records related to fuel and gasoline production or importation.