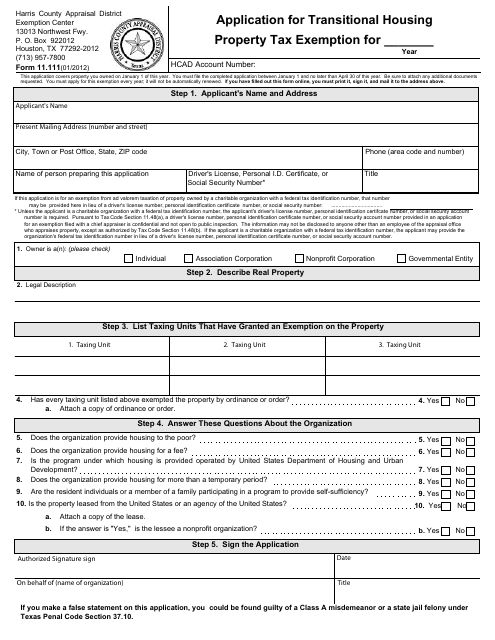

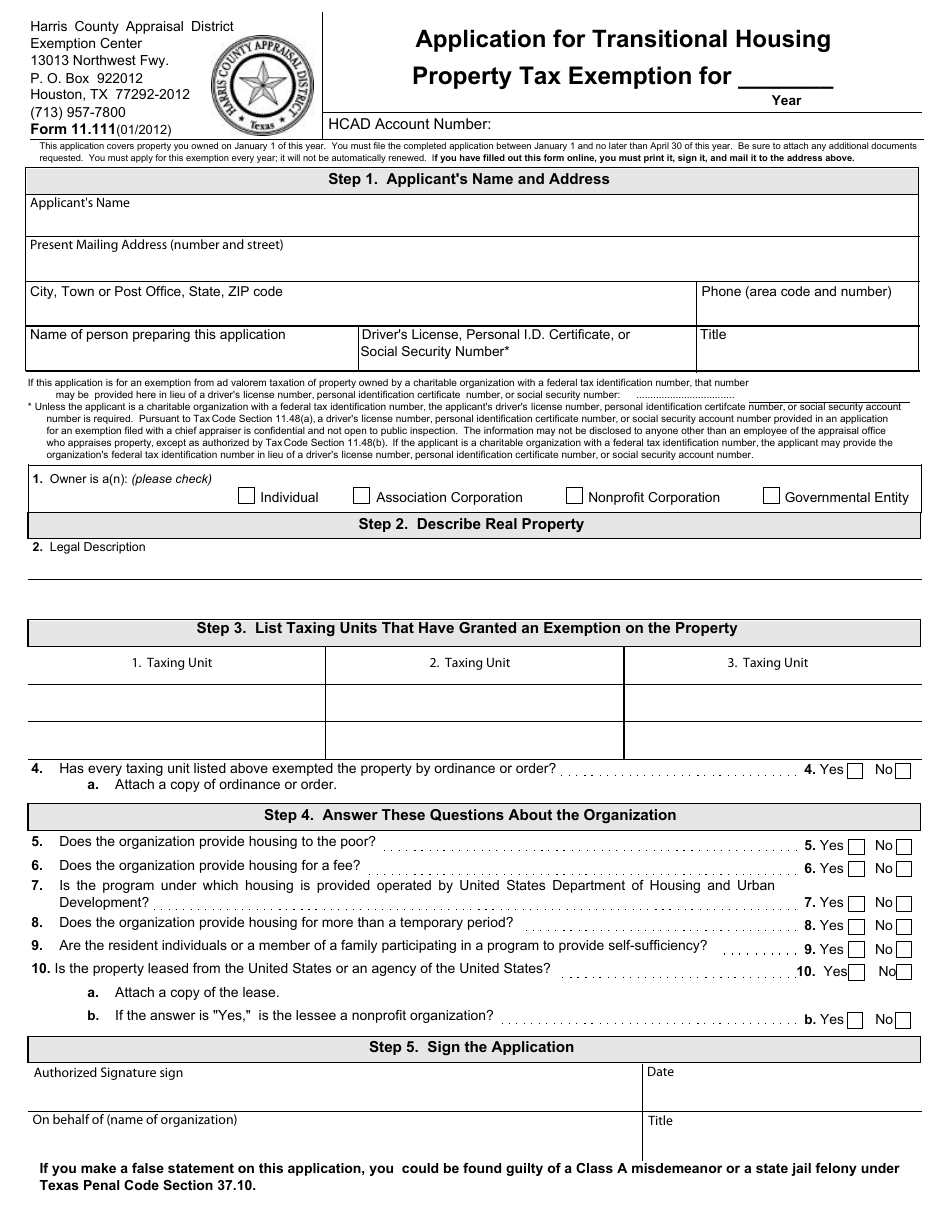

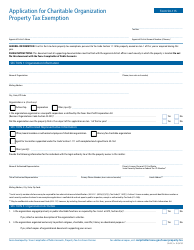

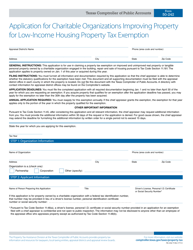

Form 11.111 Application for Transitional Housing Property Tax Exemption - Harris County, Texas

What Is Form 11.111?

This is a legal form that was released by the Appraisal District - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 11.111?

A: Form 11.111 is the Application for Transitional Housing Property Tax Exemption.

Q: What is the purpose of Form 11.111?

A: The purpose of Form 11.111 is to apply for a transitional housing property tax exemption in Harris County, Texas.

Q: Who is eligible to use Form 11.111?

A: Individuals or organizations that operate or plan to operate transitional housing facilities in Harris County, Texas may use Form 11.111.

Q: Do I have to pay a fee to file Form 11.111?

A: No, there is no fee to file Form 11.111.

Q: What information is required on Form 11.111?

A: Form 11.111 requires information about the applicant, the transitional housing facility, and the property for which exemption is sought.

Q: What is the deadline to file Form 11.111?

A: Form 11.111 must be filed on or before April 30 of the tax year for which the exemption is sought.

Q: How long does the transitional housing property tax exemption last?

A: The transitional housing property tax exemption lasts for 10 years from the date of approval.

Q: Is the transitional housing property tax exemption transferable?

A: No, the transitional housing property tax exemption is not transferable.

Q: Can I appeal if my application for the transitional housing property tax exemption is denied?

A: Yes, if your application is denied, you can appeal the decision.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Appraisal District - Harris County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 11.111 by clicking the link below or browse more documents and templates provided by the Appraisal District - Harris County, Texas.