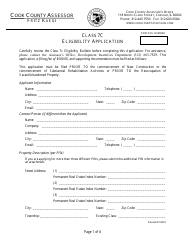

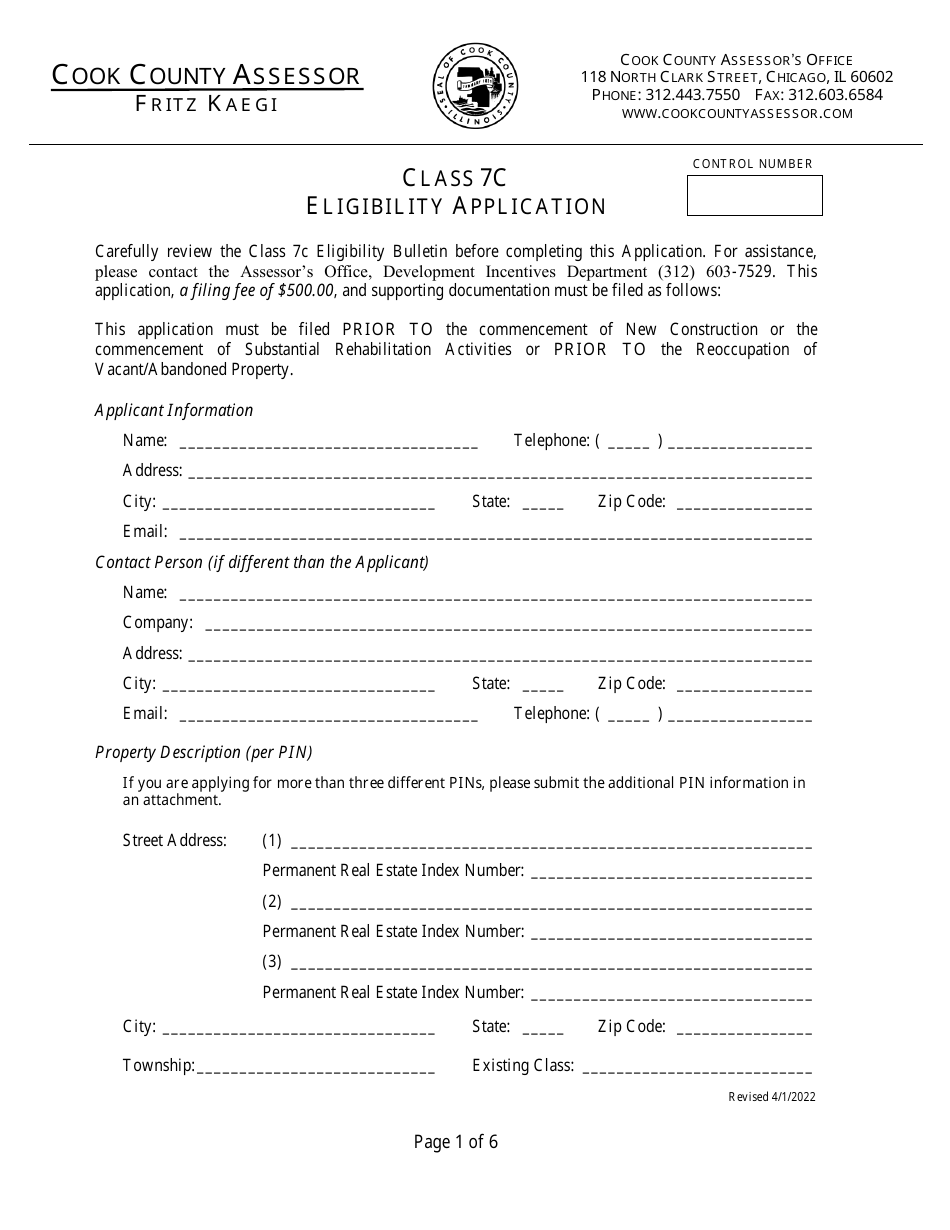

Class 7c Eligibility Application - Cook County, Illinois

Class 7c Eligibility Application is a legal document that was released by the Assessor's Office - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County.

FAQ

Q: What is a Class 7c eligibility application?

A: A Class 7c eligibility application is a process to receive a property tax reduction for certain types of properties in Cook County, Illinois.

Q: Who is eligible to apply for Class 7c eligibility?

A: Property owners of certain types of properties in Cook County, Illinois are eligible to apply for Class 7c eligibility.

Q: What types of properties are eligible for Class 7c eligibility?

A: Industrial properties and commercial properties that are vacant or requiring substantial rehabilitation may be eligible for Class 7c eligibility.

Q: What are the benefits of Class 7c eligibility?

A: Class 7c eligibility provides a property tax reduction for eligible properties in Cook County, Illinois.

Q: How can I apply for Class 7c eligibility?

A: You can apply for Class 7c eligibility by completing and submitting the Class 7c eligibility application to the Cook County Assessor's Office.

Q: Are there any fees for applying for Class 7c eligibility?

A: There is no fee to apply for Class 7c eligibility in Cook County, Illinois.

Q: What is the deadline to submit the Class 7c eligibility application?

A: The deadline to submit the Class 7c eligibility application is typically July 1st of the assessment year.

Q: How long does it take to process the Class 7c eligibility application?

A: The processing time for the Class 7c eligibility application can vary, but it typically takes a few months.

Q: Is Class 7c eligibility renewable?

A: No, once you receive Class 7c eligibility, it does not need to be renewed as long as the property continues to meet the eligibility requirements.

Form Details:

- Released on April 1, 2022;

- The latest edition currently provided by the Assessor's Office - Cook County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - Cook County, Illinois.