This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

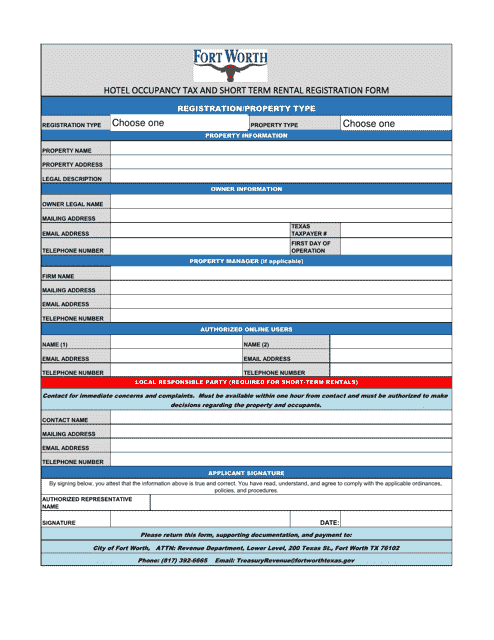

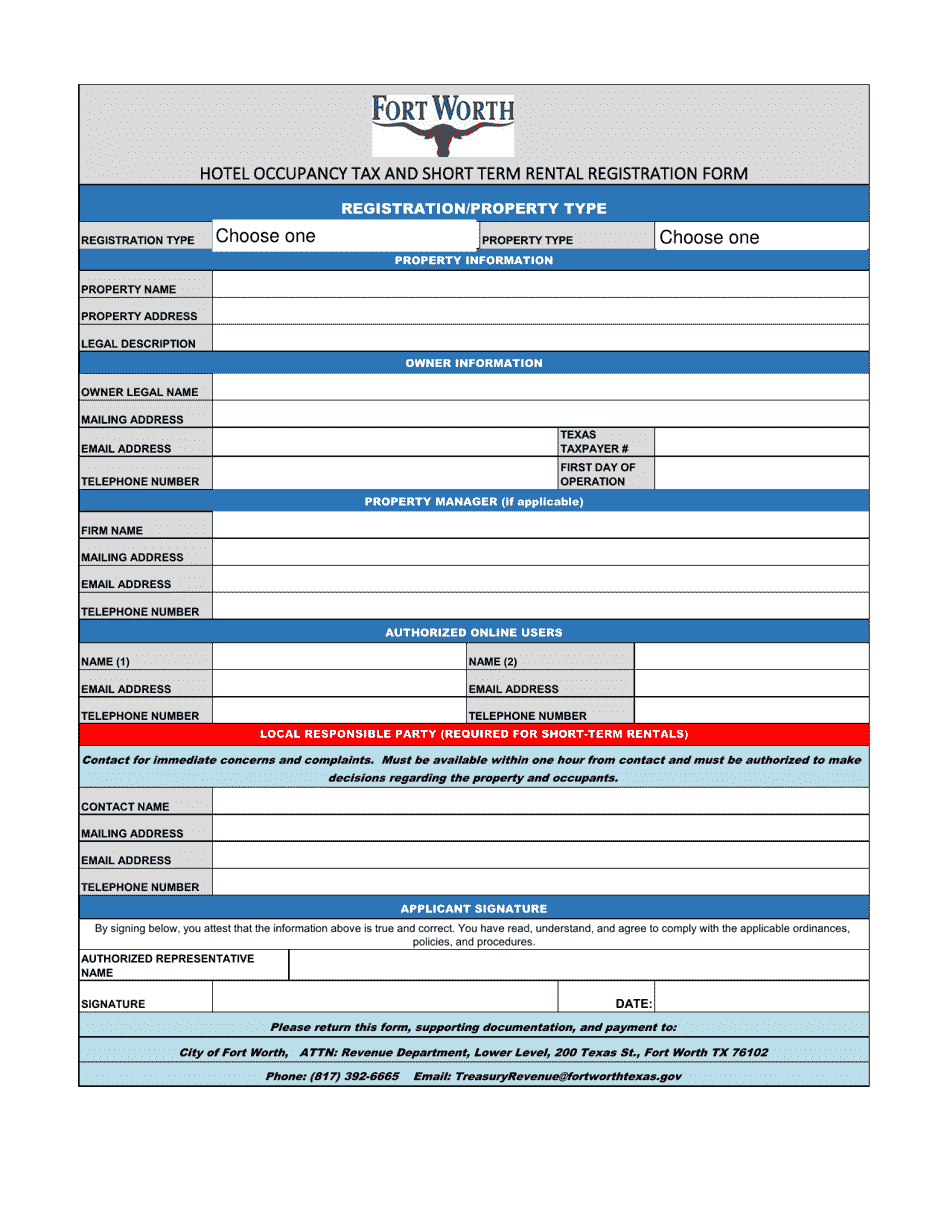

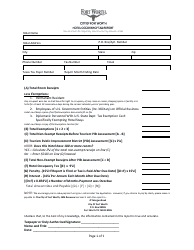

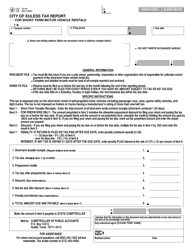

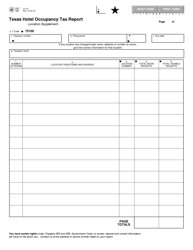

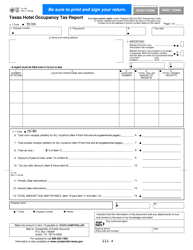

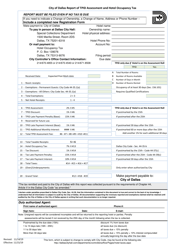

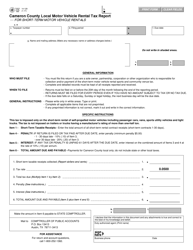

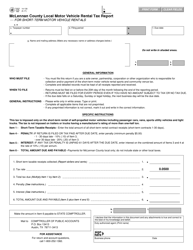

Hotel Occupancy Tax and Short Term Rental Registration Form - City of Fort Worth, Texas

Hotel Short Term Rental Registration Form is a legal document that was released by the Financial Management Services Department - City of Fort Worth, Texas - a government authority operating within Texas. The form may be used strictly within City of Fort Worth.

FAQ

Q: What is the hotel occupancy tax?

A: The hotel occupancy tax is a tax imposed on guests for renting a hotel room in the City of Fort Worth, Texas.

Q: What is the short-term rental registration form?

A: The short-term rental registration form is a form required for individuals or businesses operating a short-term rental property, such as Airbnb, in the City of Fort Worth, Texas.

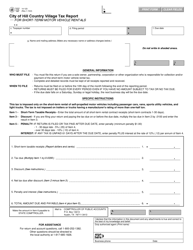

Q: Who needs to pay the hotel occupancy tax?

A: Guests who rent a hotel room in the City of Fort Worth, Texas are required to pay the hotel occupancy tax.

Q: Who needs to fill out the short-term rental registration form?

A: Individuals or businesses operating a short-term rental property, such as Airbnb, in the City of Fort Worth, Texas need to fill out the short-term rental registration form.

Q: What is the purpose of the hotel occupancy tax?

A: The purpose of the hotel occupancy tax is to generate revenue for the City of Fort Worth, Texas and to promote tourism and the local economy.

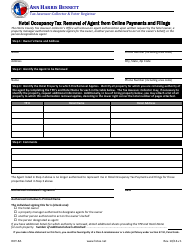

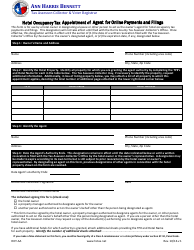

Q: What information is required on the short-term rental registration form?

A: The short-term rental registration form may require information such as the property address, owner's contact information, and details about the rental operation.

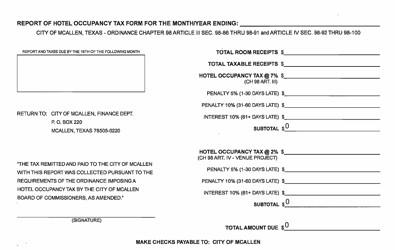

Q: How much is the hotel occupancy tax in the City of Fort Worth, Texas?

A: The hotel occupancy tax rate in the City of Fort Worth, Texas is currently 9% of the cost of the hotel room.

Q: What are the consequences of not paying the hotel occupancy tax or not registering a short-term rental property?

A: Failure to pay the hotel occupancy tax or register a short-term rental property can result in penalties, fines, or legal action.

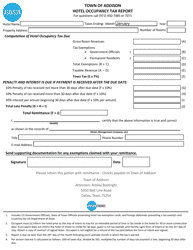

Q: Are there any exemptions or discounts for the hotel occupancy tax?

A: There may be exemptions or discounts available for certain individuals or types of lodging, such as government employees or long-term rentals. It is best to consult the City of Fort Worth, Texas for more information.

Form Details:

- The latest edition currently provided by the Financial Management Services Department - City of Fort Worth, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Financial Management Services Department - City of Fort Worth, Texas.