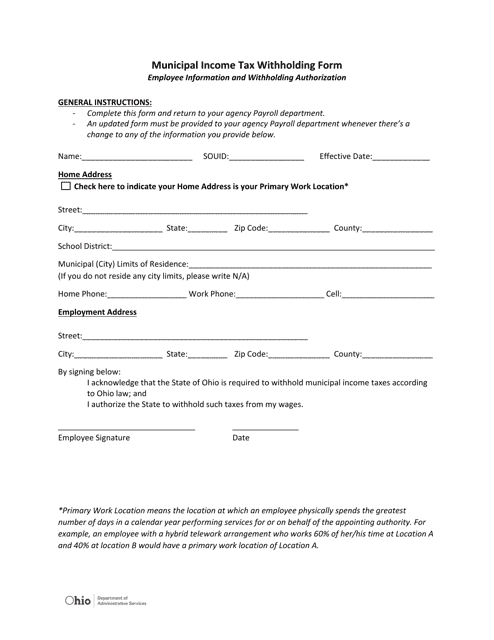

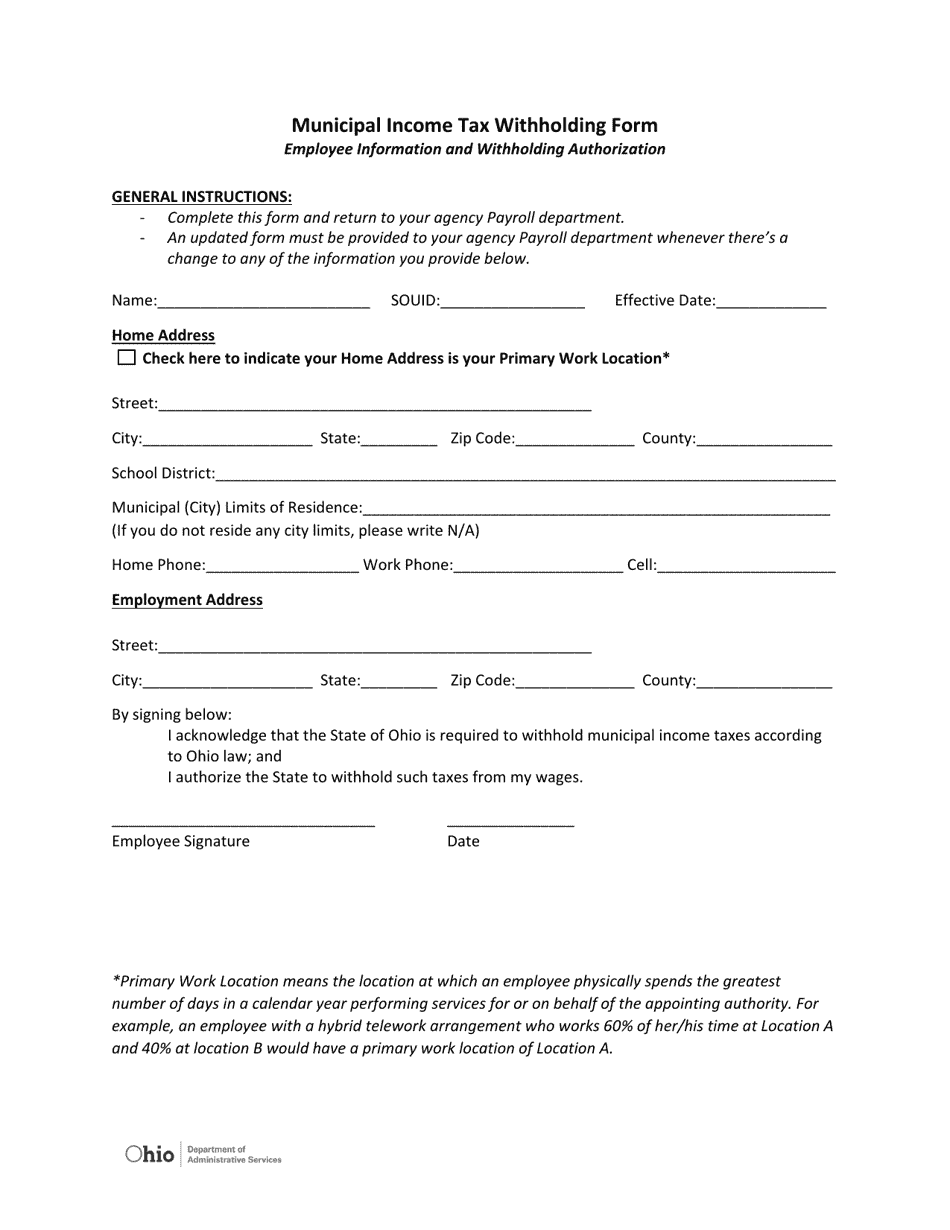

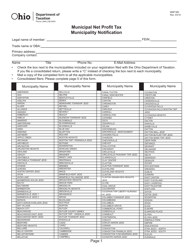

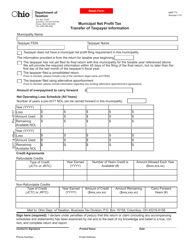

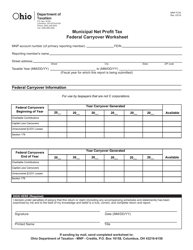

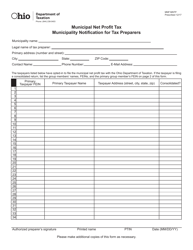

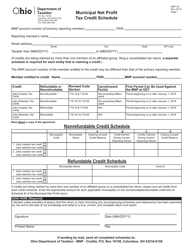

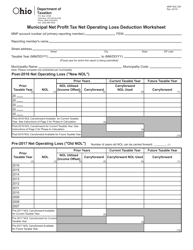

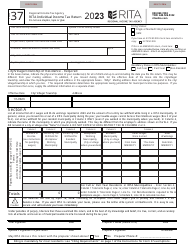

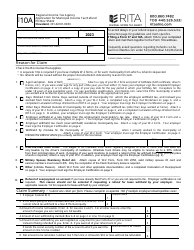

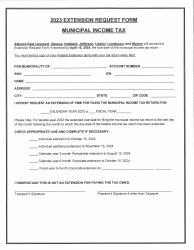

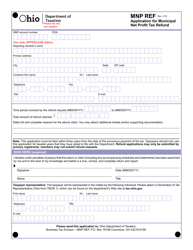

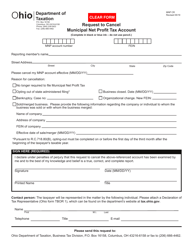

Municipal Income Tax Withholding Form - Ohio

Municipal Income Tax Withholding Form is a legal document that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio.

FAQ

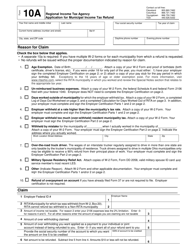

Q: What is the Municipal Income Tax Withholding Form?

A: The Municipal Income Tax Withholding Form is a document used by employers in Ohio to withhold municipal income taxes from their employees' paychecks.

Q: Who needs to fill out the Municipal Income Tax Withholding Form?

A: Employers in Ohio are required to fill out this form for their employees who live or work in a municipality that has an income tax.

Q: What information is required on the form?

A: The form typically requires the employer to provide the employee's personal information, including their name, address, Social Security number, and the municipality where they live or work.

Q: How often do employers need to submit the form?

A: Employers need to submit the form quarterly, along with the withheld taxes, to the appropriate municipality's tax office.

Q: Is there a penalty for not submitting the form?

A: Yes, there may be penalties for failure to submit the form or withholding the taxes correctly, including interest and potential legal consequences.

Form Details:

- The latest edition currently provided by the Ohio Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.