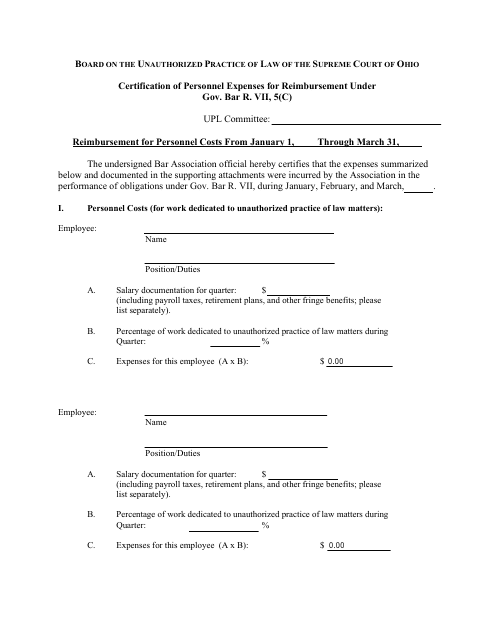

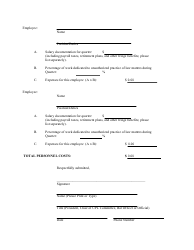

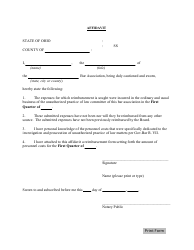

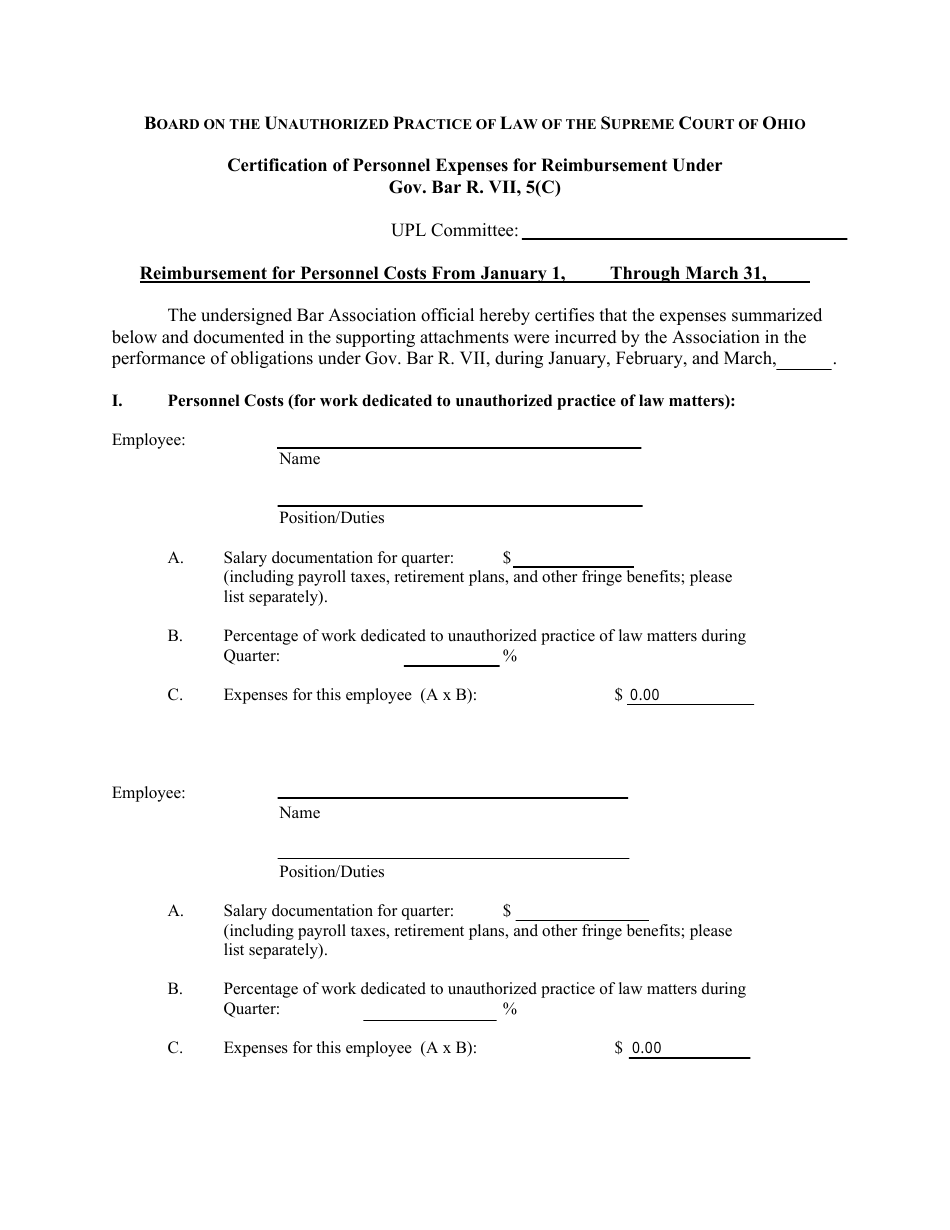

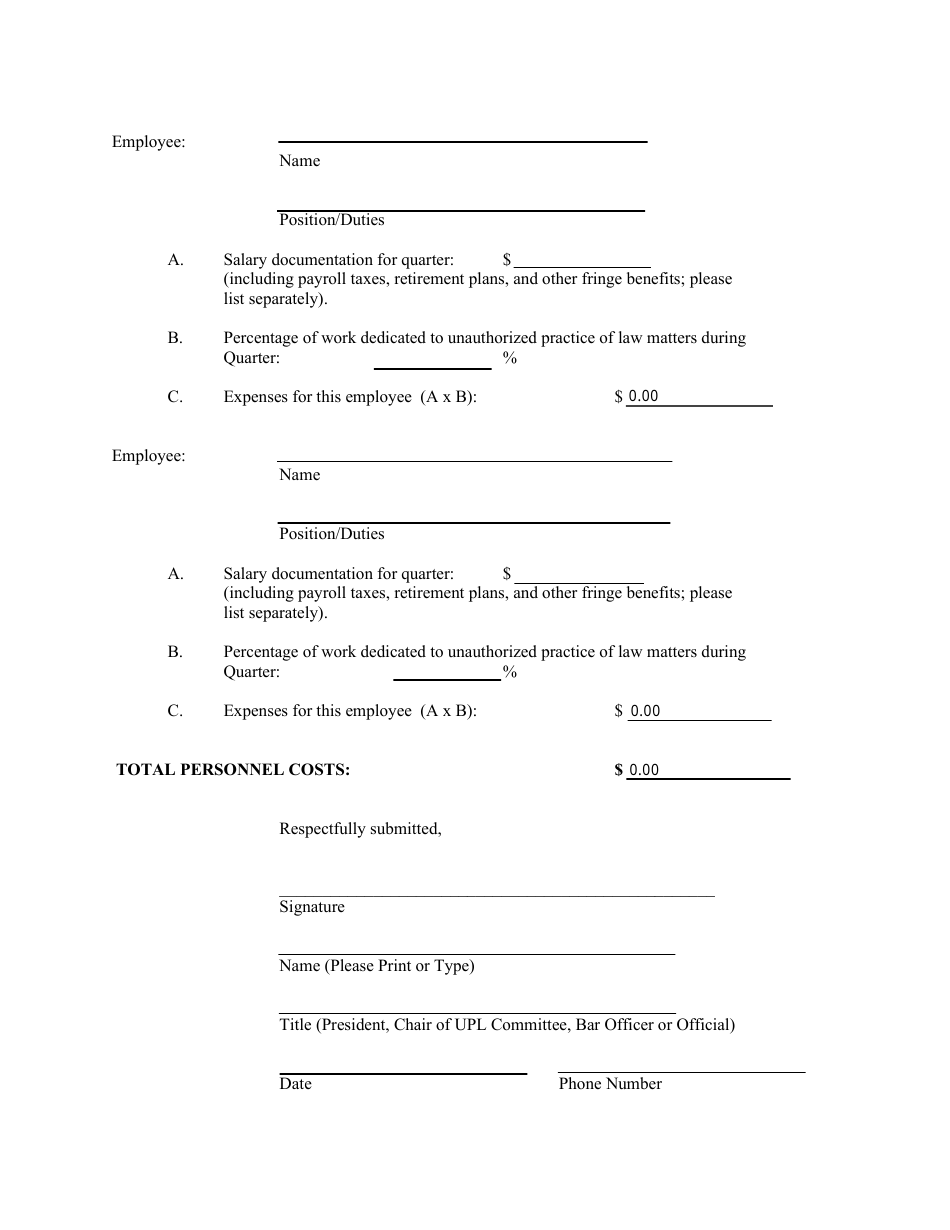

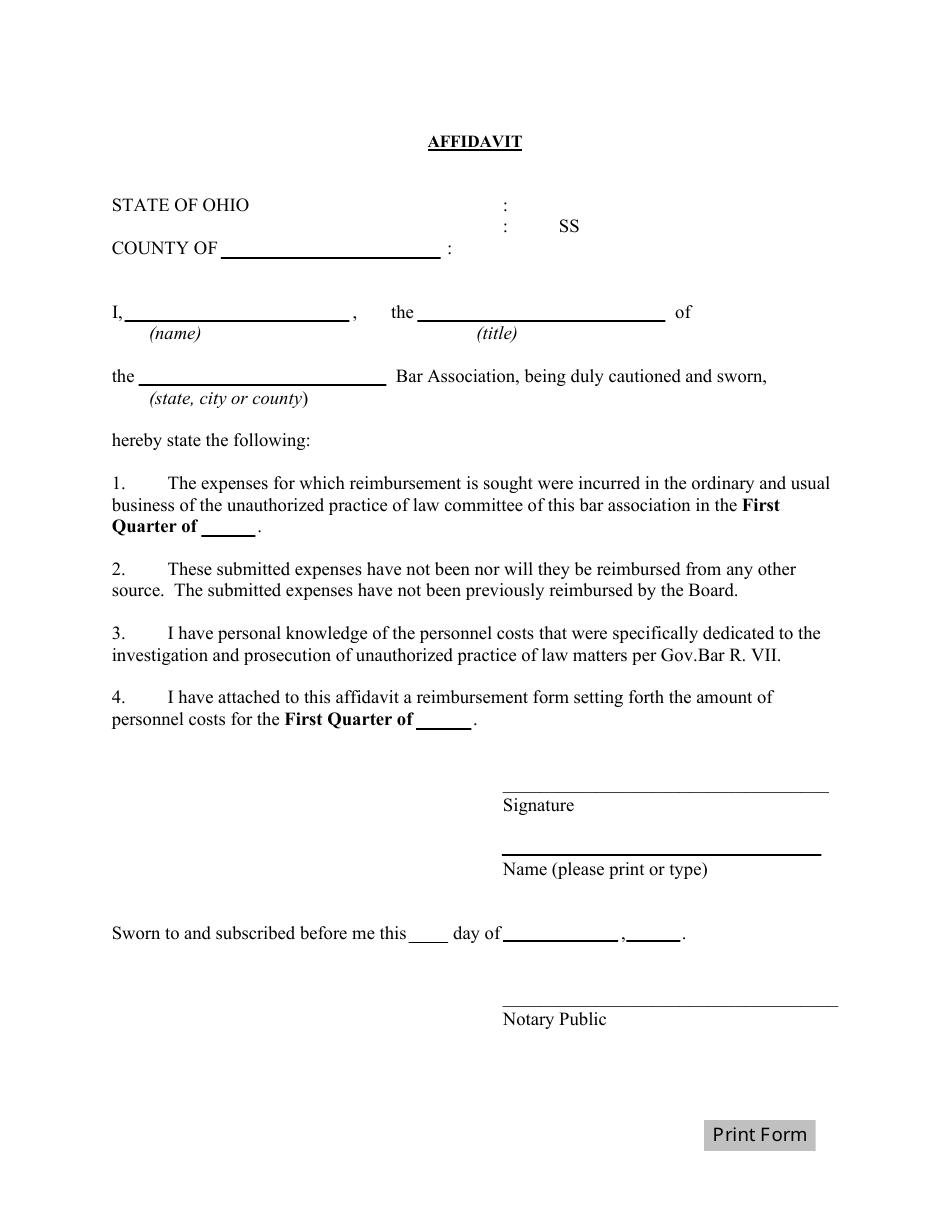

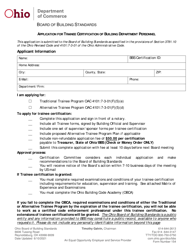

Certification of Personnel Expenses for Reimbursement Under Gov. Bar R. VII, 5(C) - First Quarter - Ohio

The Certification of Personnel Expenses for Reimbursement Under Gov. Bar R. VII, 5(C) - First Quarter for the state of Ohio is filed by the Office of the Public Defender or other equivalent authority responsible for providing legal aid and advice. It is their responsibility to track and report personnel expenses and request reimbursement as per the rules governing such matters. Please contact the local government agency responsible in Ohio for specific details as the person or department handling these might vary.

FAQ

Q: What is the Certification of Personnel Expenses for Reimbursement under Gov. Bar R. VII, 5(C) in Ohio?

A: This Certification is a legal form that is used to request reimbursement for personnel expenses from the government under rule 5(C) of the Ohio State Bar Association's governance rule VII.

Q: What is the purpose of Ohio's Gov. Bar R. VII, 5(C)?

A: Rule VII, 5(C) of the Ohio Government Bar pertains to the regulation of funds provided by the Ohio Attorney Services Fund. It provides necessary guidelines for lawyers to ensure proper auditing and accounting practices while handling client funds and/or expenses.

Q: Who can apply for the reimbursement under Gov. Bar R. VII, 5(C) in Ohio?

A: Individuals and organizations who have incurred personnel expenses in Ohio related to legal practice and are governed by the rule can apply for the reimbursement by filling out the Certification form.

Q: When can one submit the 'Certification of Personnel Expenses for Reimbursement' under Gov. Bar R. VII, 5(C) in Ohio?

A: If the form cites a specific 'first quarter', this suggests a quarterly system is in place. Therefore, one should ideally submit the form within the first three months of the fiscal year. Specific deadlines may vary and should be clarified with the relevant governmental entity in Ohio in charge of processing these forms.

Q: Why should one submit the Certification of Personnel Expenses for Reimbursement under Gov. Bar R. VII, 5(C) in Ohio?

A: Submitting this form allows legal professionals and organizations in Ohio to recover some of their personnel expenses from the government, providing essential financial relief.

Q: How does the Gov. Bar R. VII, 5(C) impact the work of legal professionals in Ohio?

A: Ohio's Gov. Bar R. VII, 5(C) has a direct impact on legal professionals' accounting practices as they must ensure transparency and propriety, especially related to client funds. Seeking reimbursement for personnel expenses may also necessitate meticulous record-keeping of these costs.