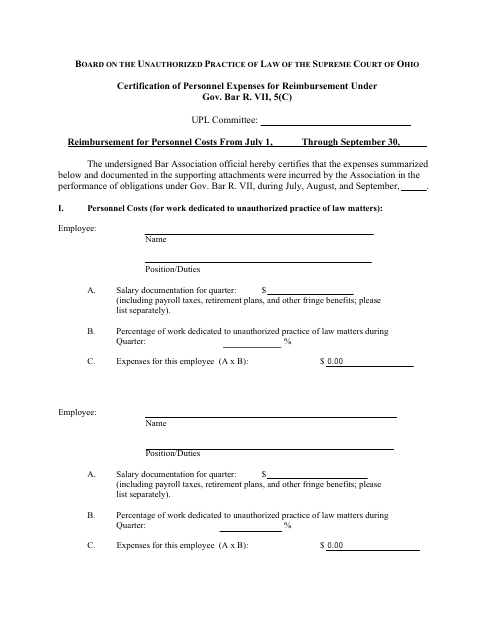

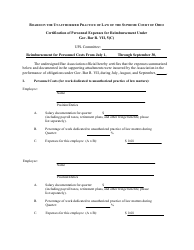

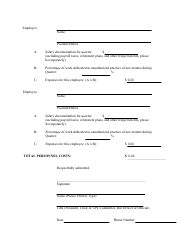

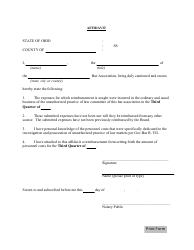

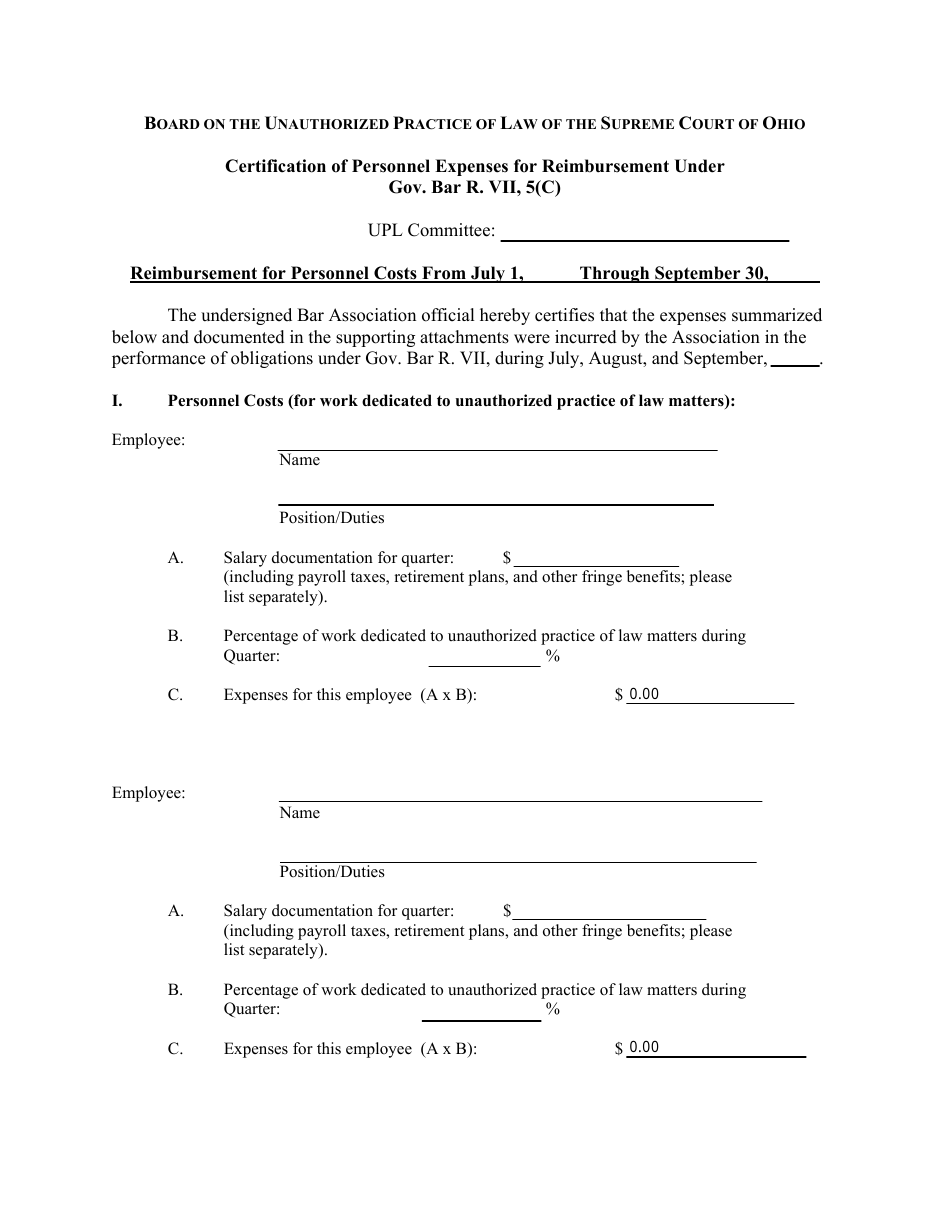

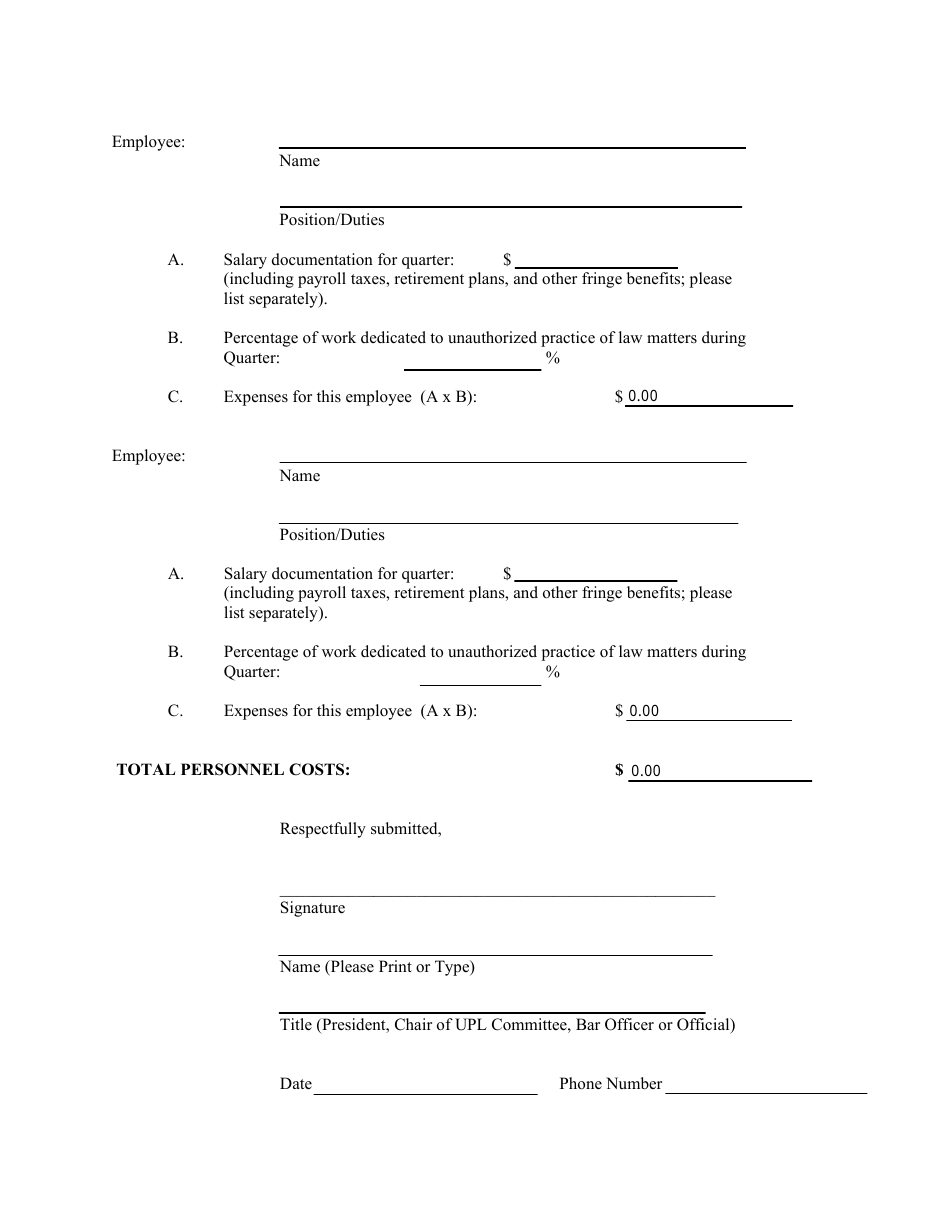

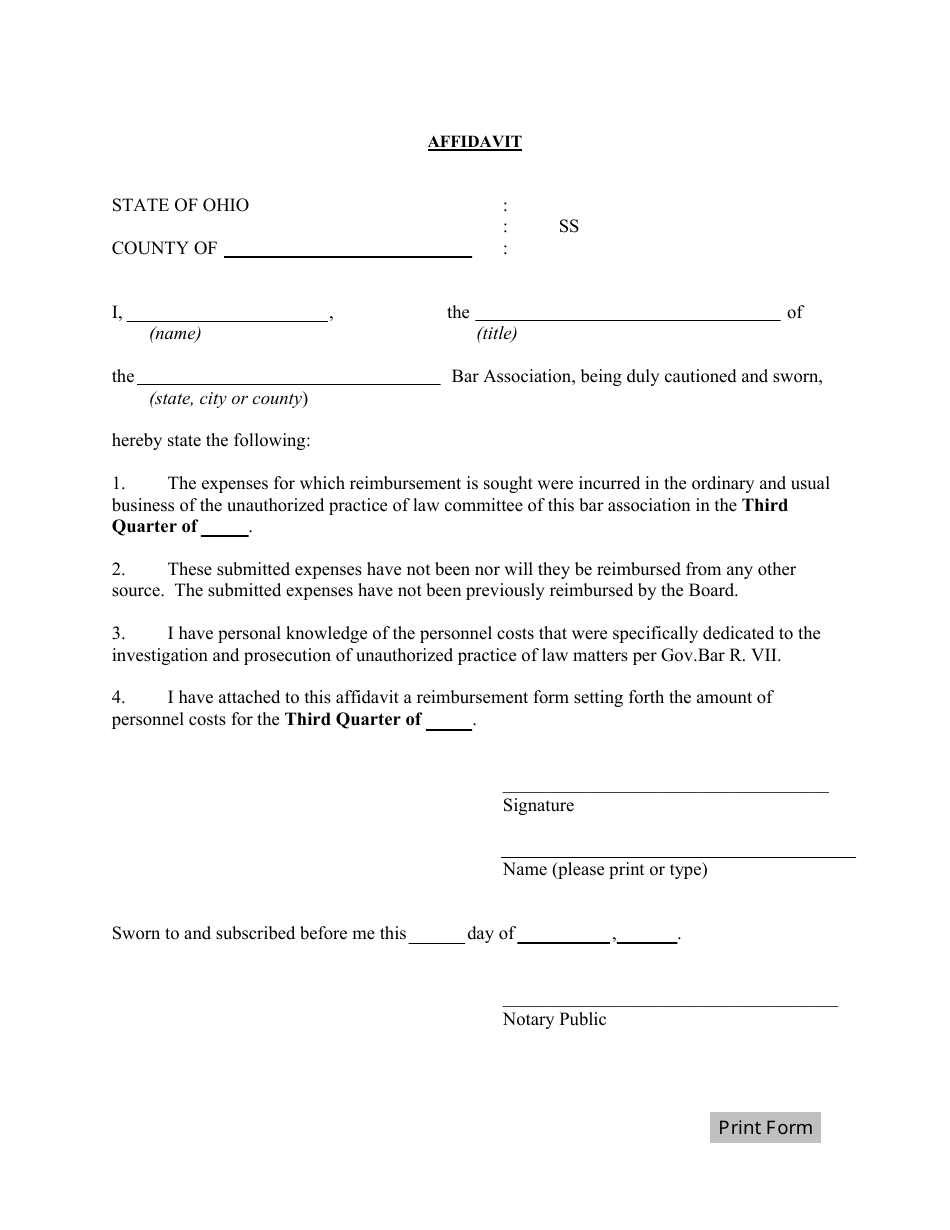

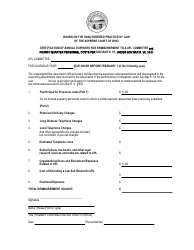

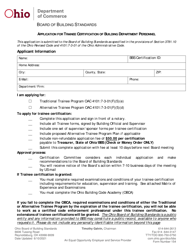

Certification of Personnel Expenses for Reimbursement Under Gov. Bar R. VII, 5(C) - Third Quarter - Ohio

Certification of Personnel Expenses for Reimbursement Under Gov. Bar R. VII, 5(C) - Third Quarter - Ohio pertains to an official procedure in which expenses related to personnel or staff within a legal organization or entity are certifiably recorded and submitted for reimbursement.

The mentioned rule, Gov. Bar R. VII, 5(C), references the regulations in place under the Ohio Government Bar Association. The "Third Quarter" likely indicates this particular document is for the third financial quarter of the year.

Hence, this document would be utilised by entities, commonly law firms or departments, to secure reimbursement for their personnel expenses from the relevant Ohio state authorities. It serves as an official, legal proof of personnel expenses incurred during a specified period (third quarter, in this case) that merit monetary reimbursement as per the established regulations.

Please contact a local Ohio attorney or accounting professional for more specific information related to your circumstances.

The Certification of Personnel Expenses for Reimbursement Under Gov. Bar R. VII, 5(C) - Third Quarter is typically filed by the government agency or organization that is seeking reimbursement for expenses related to personnel. In this case, it would be filed by the relevant government agency in Ohio that has accrued staff expenses for carrying out duties under Gov. Bar R. VII, 5(C). It is important to note that the exact department or agency could vary depending on the specific circumstances and objectives associated with this rule. For detailed information, referring to government and official sources in Ohio would be beneficial.

FAQ

Q: What is Gov. Bar R. VII, 5(C) in Ohio?

A: Gov. Bar R. VII, 5(C) in Ohio refers to a Regulation under the Ohio government rules that pertains to reimbursement procedures for those practicing law in the state of Ohio.

Q: What does the third quarter mean in context of reimbursement?

A: The third quarter in a fiscal year commonly refers to the months of July, August, and September. Hence, a document mentioning third quarter would be referring to expenses incurred during these months.

Q: What is certification of personnel expenses mean?

A: Certification of personnel expenses refers to the official validation of expenses incurred by employees during official duties. This includes salaries, bonuses, benefits, and other employee costs.

Q: Who can claim reimbursement under Gov. Bar R. VII, 5(C) in Ohio?

A: Reimbursement under Gov. Bar R. VII, 5(C) in Ohio can typically be claimed by practicing attorneys who have incurred certain authorized expenses in carrying out their official duties.

Q: How is the reimbursement process under Gov. Bar R. VII, 5(C) conducted in Ohio?

A: The specific process can vary, but generally, the individual would need to submit documentation of their personnel expenses to the appropriate governing body for approval, and upon approval, they would receive reimbursement.

Q: What kind of expenses include in personnel expenses for reimbursement under Gov. Bar R. VII, 5(C)?

A: Personnel expenses for reimbursement under Gov. Bar R. VII, 5(C) can include all costs related to employment, such as wages, salaries, benefits, learning and development costs, and welfare expenses.