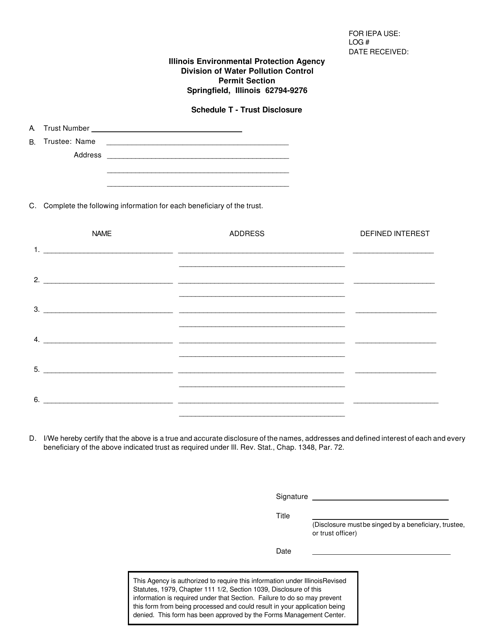

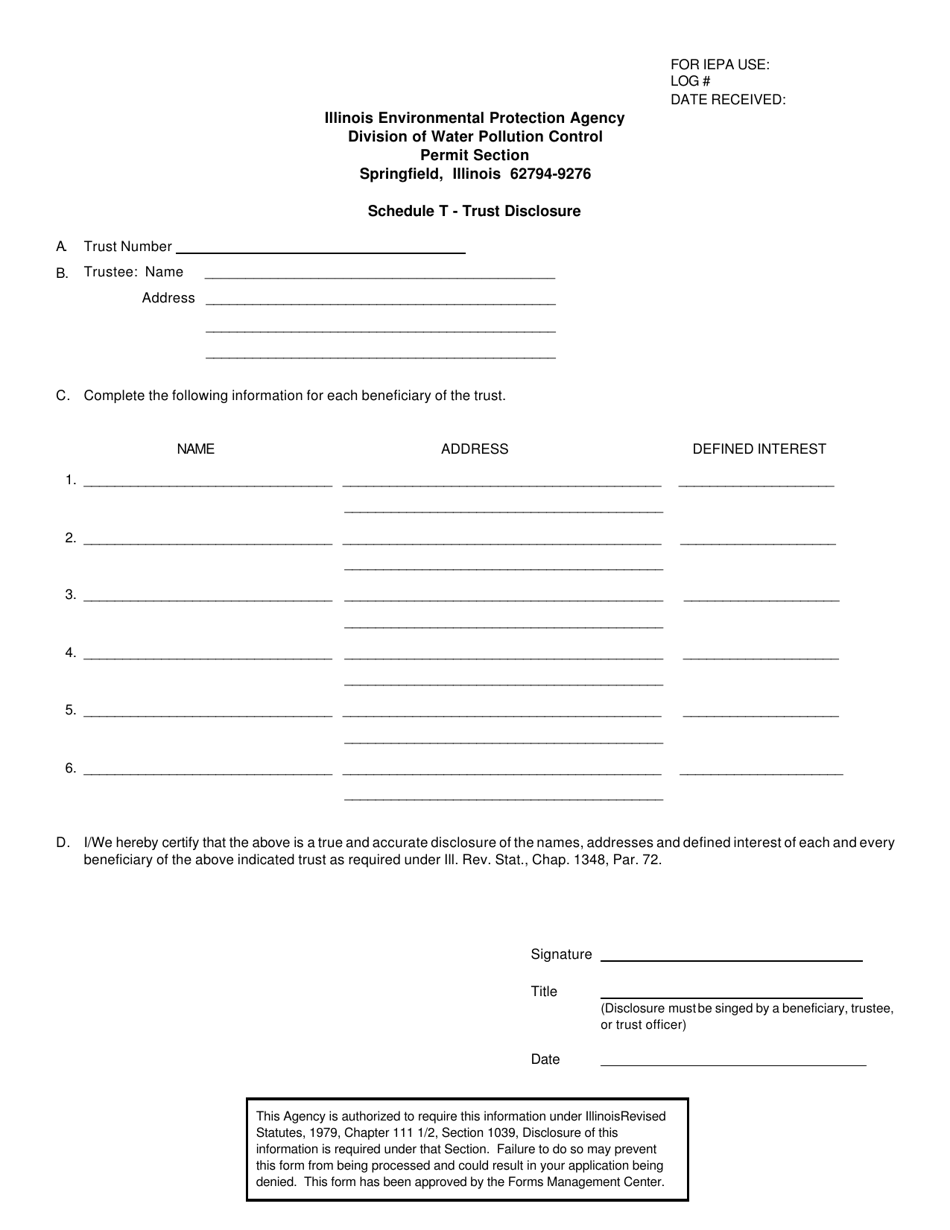

Schedule T Trust Disclosure - Illinois

What Is Schedule T?

This is a legal form that was released by the Illinois Environmental Protection Agency - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule T Trust Disclosure?

A: Schedule T Trust Disclosure is a form used in Illinois to report relevant information about a trust.

Q: Who needs to file Schedule T Trust Disclosure?

A: Anyone who is required to file a federal trust return and has a beneficiary or fiduciary who is an Illinois resident needs to file Schedule T Trust Disclosure.

Q: What information is required on Schedule T Trust Disclosure?

A: Schedule T Trust Disclosure requires information about the trust, the beneficiaries, and the fiduciary.

Q: When is Schedule T Trust Disclosure due?

A: Schedule T Trust Disclosure is due on the same date as the federal trust return, which is typically April 15th.

Form Details:

- The latest edition provided by the Illinois Environmental Protection Agency;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule T by clicking the link below or browse more documents and templates provided by the Illinois Environmental Protection Agency.