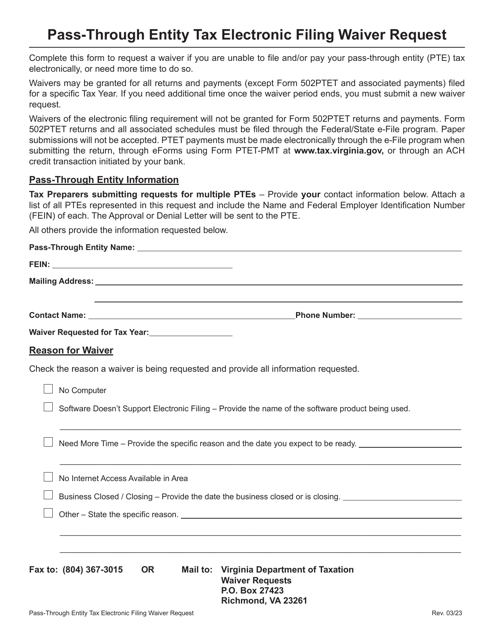

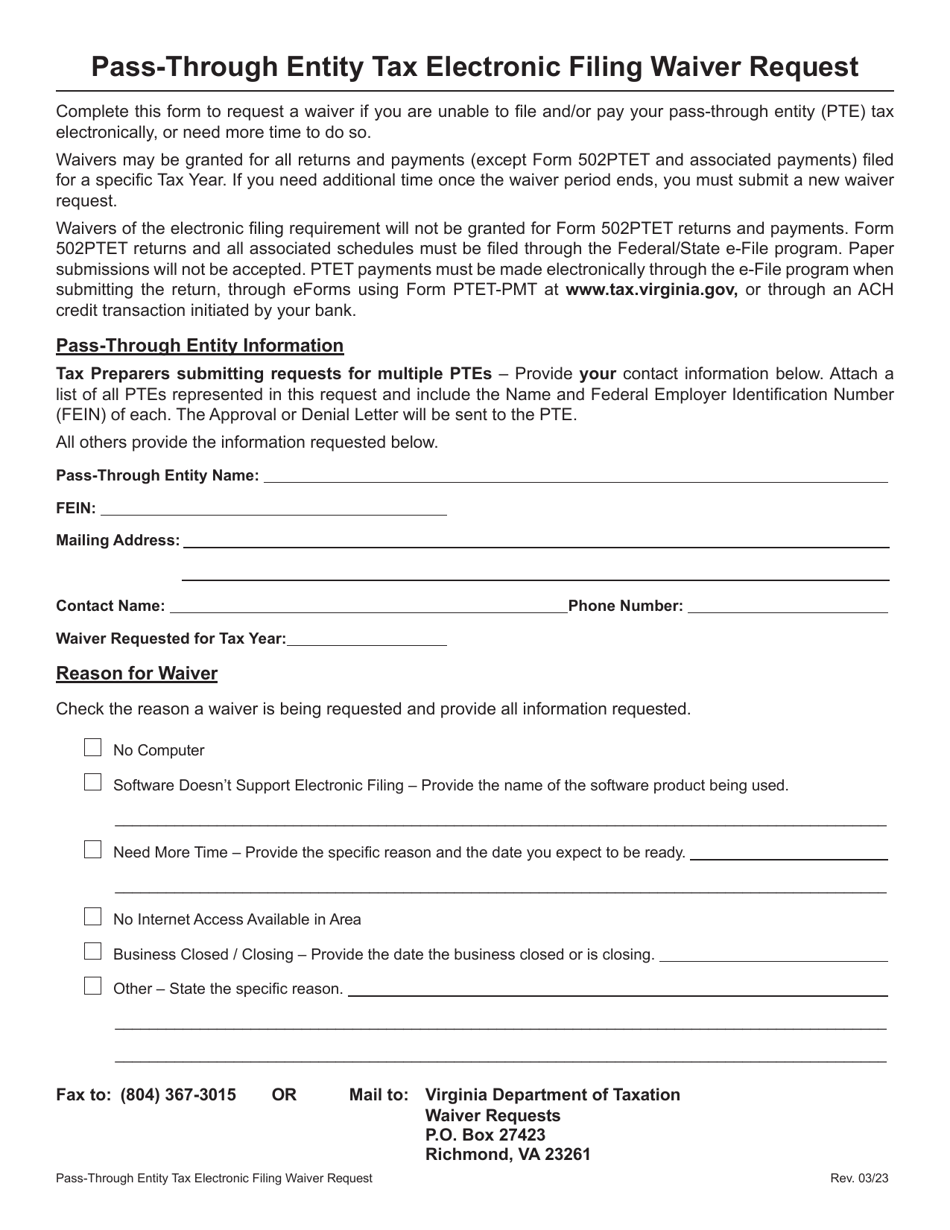

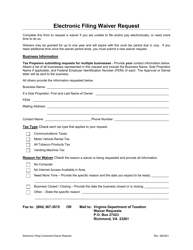

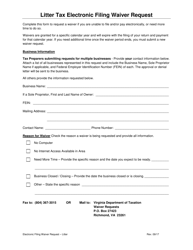

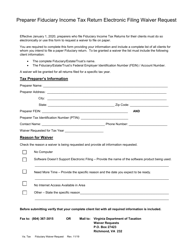

Pass-Through Entity Tax Electronic Filing Waiver Request - Virginia

Pass-Through Entity Tax Electronic Filing Waiver Request is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

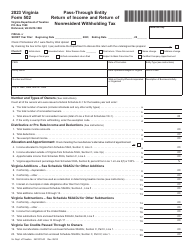

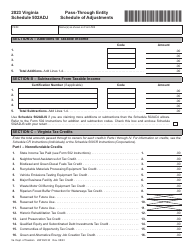

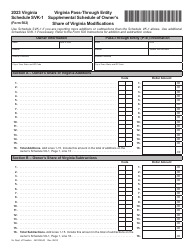

Q: What is a pass-through entity?

A: A pass-through entity is a business structure that does not pay federal income tax. Instead, the income and deductions are passed through to the owners who report it on their individual tax returns.

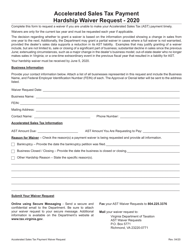

Q: What is an electronic filing waiver request?

A: An electronic filing waiver request is a request to the state of Virginia to allow a pass-through entity to request an exemption from electronic filing requirements for their tax return.

Q: How can I request an electronic filing waiver?

A: To request an electronic filing waiver, you will need to complete and submit the Pass-Through Entity Tax Electronic Filing Waiver Request form to the Virginia Department of Taxation.

Q: Who is eligible to request an electronic filing waiver?

A: Pass-through entities that meet certain criteria, such as technical limitations or undue hardship, may be eligible to request an electronic filing waiver.

Q: What are the benefits of electronic filing?

A: Electronic filing offers benefits such as faster processing, reduced errors, and quicker receipt of any tax refund. However, some pass-through entities may have valid reasons for requesting a waiver from electronic filing requirements.

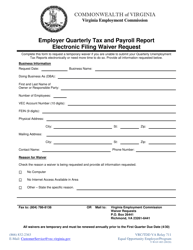

Form Details:

- Released on March 1, 0202;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.